Segregation, Profiling, and Opportunism: 20 Books on Real Estate and Racism

- Published on

- 5 min read

-

Melissa Holtje Contributing AuthorClose

Melissa Holtje Contributing AuthorClose Melissa Holtje Contributing Author

Melissa Holtje Contributing AuthorMelissa enjoys using her experience as a house flipper, investment buyer, and waterfront home owner to help buyers and sellers thrive in the housing market. When not scouting real estate, you’ll most likely find her at the beach.

We’re only as good as the information we have, and in an era when both good and bad reports are available online, in some ways it’s more difficult than ever to be sure that you really do know what you think you know. And when we started digging into the information available around real estate policies and systemic racism, we realized that there wasn’t a good repository of books on racism in real estate for readers (or writers) to consult.

In an ongoing effort to provide accurate and relevant information, our HomeLight team compiled this reference guide around racism and housing. We vetted these books and studies as both professional and reliable – two of our core communication values.

Homebuyers, home sellers, and real estate agents who wish to remain up-to-date on the current housing issues within our nation will likely find these resources enlightening. In fact, the topic of race within the realm of real estate is so important that we recommend these books and studies to every reader!

Books on racism in real estate

The following books provide a foundation for understanding the issues of racism within the housing market, especially systemic segregation. Topics include redlining, socioeconomic profiling, and corruption within mortgage lending.

American Apartheid: Segregation and the Making of the Underclass

By Douglas Massey and Nancy Denton

American Apartheid examines the hyper-segregation of urban America despite the efforts of the Fair Housing Act of 1968; it also analyzes poverty as a function and consequence of systemic racism. Originally published in 1993, this book has received textbook status due to its extensive journalistic research and the connections it draws to economic systems.

Race for Profit: How Banks and the Real Estate Industry Undermined Black Homeownership

By Keeanga-Yamahtta Taylor

Longlisted for the 2019 National Book Award, Taylor’s book uncovers how the push of the Department of Housing and Urban Development’s HUD Act of 1968, which was intended to uplift Black homeownership, backfired into a cyclical system of foreclosure and perpetual poverty.

Based on Taylor’s Princeton dissertation, this book follows research regarding government guarantees of Black mortgages and the subsequent fallout for Black individuals when numerous institutions took advantage of the program.

Stuck in Place: Urban Neighborhoods and the End of Progress Toward Racial Equality

By Patrick Sharkey

Sharkey, a sociologist at New York University, examines how race intersects with neighborhood conditions in Stuck in Place, examining income gaps, test scores, and the racial composition of different neighborhoods.

Among his findings, Sharkey noted that Black Americans between the ages of 13 and 28 are 10 times as likely to reside in an impoverished neighborhood than white Americans — 66% compared to 6% — and that Black Americans tend to experience multigenerational neighborhood poverty, whereas white Americans tend to experience more episodic neighborhood poverty.

The Color of Law: A Forgotten History of How Our Government Segregated America

By Richard Rothstein

Lauded by Publisher’s Weekly as one of the best books of 2017, The Color of Law looks into historical segregation based on the creation of different planned city zones by local governments as early as the 1920s. Rothstein also examines the limitations of Fair Housing Act efforts to reverse discriminatory practices that were previously embedded in urban areas, resulting in neighborhoods that still remain segregated even today.

The Color of Money: Black Banks and the Racial Wealth Gap

By Mehrsa Baradaran

Baradaran looks deeply into the wealth gap between races and the institutional factors supporting it — specifically, the creation of black banks, which relates to the availability of mortgage loans. The Color of Money was publicly praised by The Atlantic and was a finalist for the Georgia Author of the Year Award in 2019.

The Warmth of Other Suns: The Epic Story of America’s Great Migration

By Isabel Wilkerson

This multi-award winning 2010 book looks into the movement of Black families from the south to the north and the subsequent housing segregation that resulted. In dramatic fashion, Wilkerson incorporates the testimony of more than a thousand interviews to compare this change in American demographics to other epic migrations throughout history.

The South Side: A Portrait of Chicago and American Segregation

By Natalie Y. Moore

Moore examines previous and ongoing practices of redlining and racism in the South Side of Chicago as a microcosm of the nation. Written in a style that blends memoir with journalism, The South Side was named one of the best nonfiction books of 2016.

Studies on housing and racism

At the university level, real estate and housing experts have published numerous data-driven articles based on specific areas of study, which provide deeper insight into the issues at hand. The following list categorizes research by the universities that published the findings. Though this list is by no means entirely comprehensive, these studies are some of the top papers available for the general public to read and analyze.

Lusk Center for Real Estate at USC

Race, Immigrant Status, and Homeownership (LA)

Authored by Assistant Professor Gary Painter in 2000, this study shows that homeownership in general increased during the previous decades, but people of color lagged significantly in attaining homeownership. His data shows that the homeownership gap between minority and white households began to grow in the 1980s in Los Angeles. At the same time, Black households experienced income and education deficits.

Household Location and Race: A Twenty-Year Retrospective (DC)

This 2011 study by Gary Painter and Stuart Gabriel sought to analyze the claims of a previous study conducted twenty years earlier, which examined tendencies toward racial segregation in the Washington, D.C. area. According to the authors, “As in our prior analysis, large simulated gains in Black economic and educational status had little effect on prevailing racial segregation.”

The paper posits that Black households continue to experience limited opportunities based on “traditional areas of settlement.” However, other minority groups seemed “more sensitive to improvements in socioeconomic status.”

Homeownership, Race, and the American Dream

This study, conducted by Stuart Gabriel and Stuart Rosenthal and published in 2003, examines data from the Survey of Consumer Finances regarding homeownership gains within the context of race.

“Findings indicate that household socioeconomic characteristics explain nearly all of the gain in homeownership in the 1990s.”

The authors urge policy-makers to focus their efforts outside the mortgage market in order to remedy homeownership disparities by race.

A Test of Cultural Affinity in Home Mortgage Lending

In 2002, Raphael Bostic looked into two theories regarding how race affects mortgage approval and rejection rates.

“The taste-based cultural affinity hypothesis asserts that lenders have a blanket preference for members of the same race, while the common bond hypothesis asserts that cultural affinity allows lenders to better assess the credit quality of members of the same race,” he wrote. His study found weak support for the first hypothesis while contradicting the second.

Do Households Move to Obtain Higher Benefits? A “Natural Experiment” Approach (Ontario and LA)

This 1999 study by Gary Painter observed whether or not people would move to a different locale in order to take part in greater welfare benefits — a notion called “race to the bottom.”

He found: “While the notion that households move to achieve greater benefits is pervasive in the popular press, research suggests that the number of households who move to obtain higher benefits is small.”

Forced Sale Risk: Class, Race, and The ‘Double Discount’

In 2009, Thomas Mitchell, Stephen Malpezzi, and Richard Green looked into the impact of a forced sale upon a property owner’s wealth. They also questioned whether characteristics of a property owner (such as race and economic status) affect the ultimate price of a forced sale.

They write: “The article also raises the possibility for the first time that the race or ethnicity of a property owner may affect the sales price for property sold at a forced sale, resulting in a ‘double discount,’ i.e. a discount from market value for the forced sale and a further discount attributable to the race of the property owner.”

Basically, the data suggests that people of color encounter an unfair disadvantage when faced with a forced sale. Forced sales already decrease the price of a home; racial profiling decreases the price even more.

Ziman Center for Real Estate at UCLA

Race, Ethnicity, and Income Segregation in Los Angeles

This 2016 paper by Paul Ong, Chhandara Pech, Jenny Chhea, and C. Aujean Lee examines demographic and socioeconomic data within Los Angeles from 1960 and onward, recognizing a geographic transformation based on race and ethnicity.

It also looks at “whether racial segregation could be explained by systematic differences in income across racial/ethnic groups.” Their findings indicate that income differences are not the only indicator of residential segregation.

Escape from the City? The Role of Income, Race, and Local Public Goods in Post-War Suburbanization

Leah Platt Boustan compares demographics of inner city and suburban housing along with the public goods (such as police and education) that accompany various metropolitan strata. Published in 2008, Boustan looks into housing prices, income levels, tax rates, and racial composition in regards to an area’s distance from the city center. Her findings reflect both consumer and political behavior and address the gap in quality of life between urban and suburban communities. In general, downtown areas tend to be poorer than outlying suburban areas, and suburban residents seem willing to pay a housing premium for perceived isolation from social problems along with lower tax rates.

Furman Center for Real Estate and Urban Policy

Differences in Neighborhood Conditions among Immigrant and Native-born Children in New York City

Emily Rosenbaum, Samantha Friedman, and Michael Schill look at racial segregation within neighborhoods of New York City in this research published in 1999.

The researchers used four indicators to rank how advantaged different neighborhoods were, then looked at who had access to which neighborhoods. “We find evidence of a hierarchy of access to advantageous neighborhoods, whereby native- and foreign-born white children have access to the most-advantaged neighborhoods while native-born black children consistently live in the least-advantaged neighborhoods,” they wrote.

Welcome to the Neighborhood: What Can Regional Science Contribute to the Study of Neighborhoods?

Ingrid Gould Ellen and Katherine O’Regan published this paper in 2009 in order to raise unanswered questions that could use further examination at a local and regional level.

They acknowledge that U.S. metropolitan areas are segregated by race and income levels, and they posit ideas of what that segregation could lead to in terms of education and labor markets decades down the road. The authors also examine location choices along with travel and commuting behaviors and call on regional scientists to conduct further research based on their findings.

The Samuel Zell and Robert Lurie Real Estate Center at Wharton School (University of Pennsylvania)

Status Caste Exchange: Preferences for Race and Poverty Status of Neighbors in Large U.S. Metropolitan Areas, 1970-2000

This 2007 paper by Janice Fanning Madden examines census tract data for 36 large metropolitan areas between 1970 and 2000. Her findings indicate that racial segregation seems to persist for people of color across economic and poverty status: “racial integration occurs consistent with status caste exchange: non poor African Americans and poor non African Americans are shifting to the same neighborhoods,” especially in Midwestern and Northeastern cities, where racial segregation is highest.

What Drives Racial and Ethnic Differences in High Cost Mortgages? The Role of High Risk Lenders

In this 2017 study, Patrick Bayer, Fernando Ferreira, and Stephen Ross examined high-cost mortgages stemming from seven diverse metropolitan areas between 2004 and 2007, and they found that Black and Hispanic homebuyers were disproportionately affected by these mortgages.

“Even after controlling for credit score and other key risk factors, African-American and Hispanic home buyers are 105 and 78 percent more likely to have high cost mortgages for home purchases.”

The authors note that these rates can be attributed both to skewed consumer exposure to high-risk lenders and also to mortgage professionals offering different options to borrowers from different racial backgrounds when it comes to the loan process.

Estimating Racial Price Differentials in the Housing Market

This 2017 paper by Patrick Bayer, Marcus Casey, Fernando Ferreira, and Robert McMillan analyzes panel data from more than two million housing transactions within four metropolitan areas in order to look for trends in home pricing based upon race. “We find that Black and Hispanic homebuyers pay premiums of about three percent on average across the four cities, differences that are not explained by variation in buyer income, wealth or access to credit.”

Taking an active stance against the world’s problems requires understanding what they are and where they came from. These resources should give you a good platform to start learning more about the specific issues in your neighborhood.

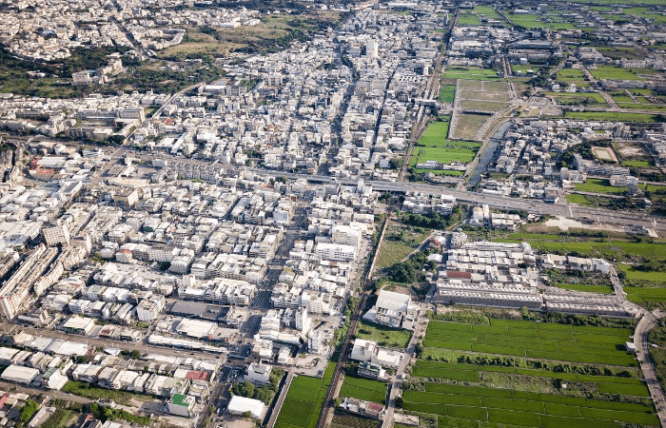

Header Image Source: (Stanislav Kondratiev / Unsplash)