Will the Housing Market Crash in 2022? We Dug Into What the Numbers Say

- Published on

- 9 min read

-

Leslie Osmond, Contributing AuthorClose

Leslie Osmond, Contributing AuthorClose Leslie Osmond Contributing Author

Leslie Osmond Contributing AuthorLeslie is a licensed Realtor in Missouri and freelance writer that’s developed content for several online and offline mediums. While her writing specializes in financial concepts, she loves trending topics, technology, travel, and pop culture and incorporates these subjects into her pieces. Launching her career as a ghostwriter, Leslie has contributed content for articles in US News & World Report, TheStreet, Kiplinger, Fox Business, and is a Finance Writer for Seeking Alpha.

-

Amber Taufen, Former Managing Editor, Buyer Resource CenterClose

Amber Taufen, Former Managing Editor, Buyer Resource CenterClose Amber Taufen Former Managing Editor, Buyer Resource Center

Amber Taufen Former Managing Editor, Buyer Resource CenterAmber was one of HomeLight’s Buyer Center editors and has been a real estate content expert since 2014. The former editor-in-chief at Inman, she was named a “Trendsetter” in the 2017 Swanepoel Power 200 list, which acknowledges “innovators, dealmakers, and movers-and-shakers who made a noteworthy impact over the last year” in real estate, and her assessment of revenue and expenses at the National Association of Realtors won a NAREE Gold Award for “Best Economic Analysis” in 2017.

The housing market continues to run hot at the beginning of 2022, and frantic buyers vie for limited homes up for sale, some paying more than $100,000 over the asking price last year. “All markets are seeing strong conditions, and home sales are the best they have been in 15 years,” said chief economist at the National Association of Realtors®, Lawrence Yun, at NAR’s annual conference in November 2021.

Whether you’re considering a move in 2022 or are simply concerned about whether the soaring prices and pace will continue this year — or whether a housing bubble is imminent — there are many variables to consider when evaluating the likelihood of a market crash. To provide some clarity, we brought in a few experts who shared where they believe the housing market is headed in 2022.

I don’t think we’re going to go on like this forever, or even fully for the next year. I think we will see interest rates start to creep up. I think we will see housing prices slow — maybe not decline, but at least slow.

The Fed, mortgage rates, and inflation

In December 2021, the Federal Reserve announced its intentions to fight inflation by raising interest rates sooner and more aggressively than outlined months prior. How will this change impact the housing market and the various affordability factors driving market activity in 2022?

Mortgage rates are influenced by the Federal Reserve’s interest rates, which means that rates could increase in 2022, also increasing affordability pressure on homebuyers. For homebuyers, two of the most important variables when it comes to housing affordability are:

- Home price: According to the St. Louis Federal Reserve, in 2022, the median home price is up 24% over 2021, bringing median home prices to $416,900. This level of price growth is uncommon, though it is reasonable to expect home prices to increase over time, with an average year-over-year price increase of 5.3% since March of 1992.

- Mortgage interest rates: Interest rates have been at historic lows, making homebuying more affordable and appealing. When interest rates go up, buying a home costs more.

With the changing landscape, there may be some headwinds for homebuyers facing the housing market as we move through 2022.

According to Time, mortgage rates are still below 4% for some buyers, and just this past November, a 30-year fixed rate was 2.98%.

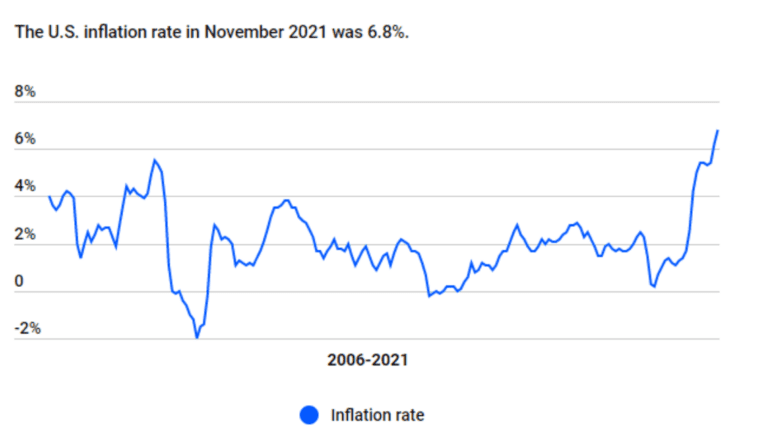

As consumer prices continue to climb, the upward trajectory of inflation as exhibited by the chart below is predicted to also continue, and borrowers will also feel the effects of higher mortgage rates.

Perrin Cornell, a former loan officer and top real estate agent in East Wenatchee, Washington, who works with 84% more single-family homes than the average agent in his area, says, “I don’t think we’re going to go on like this forever, or even fully for the next year. I think we will see interest rates start to creep up. I think we will see housing prices slow — maybe not decline, but at least slow.”

Another topic of headline news is supply and demand. Since the Great Recession, economic expansion has taken place. Still, supply chain disruptions in housing have continued, and with the onset of the pandemic, worsened since March 2020 — and demand sets prices. The current housing supply is failing to meet demand, and so the odds of a housing crash in the immediate term are likely relatively low.

Housing supply and demand

Labor shortages and constraints within the construction industry are causing many skilled jobs to go unfilled post-Great Recession, adding to the supply-chain shortages in all parts of the nation. Limited inventory and a need for building materials affect housing, and homes cannot be built fast enough to keep up with demand — a stark difference compared to 2007, when the masses wanted to sell.

“When you look at today’s market and then look back at the market in 2007 (and) 2008, there are glaring differences. If you remembered in 2007…it was an investment that you’d buy and hold for six months like a stock for a year and then turn around and sell,” says Cornell.

This is not something seen in today’s market. Buyers are vying for homes everywhere, whereas in 2007, sellers saturated the market, and there weren’t enough buyers. Today, there are far more buyers in the market than sellers, and the effects of the housing shortage are even more evident since the pandemic.

According to a Freddie Mac analysis, in 2018, the U.S. economy was approximately 2.5 million housing units short of meeting long-term demand. Urbanization is becoming more common as young adults flock to the cities and urban areas to find work and housing. Developers like Blackstone invest in building vertically for the cost savings versus building horizontally. This means that builders simply aren’t putting their dollars behind the entry-level single-family housing that the market demands.

Another factor affecting the housing shortage is the growing population. A growing population boosts demand for housing. First-time homebuyers, low-interest rates, and young adults wanting to move out of their parents’ homes helps spur the demand. The market craves solutions to replenish the low levels of inventory, and the increased demand for housing and acute supply issues have the effect of increasing home prices.

What causes housing market crashes?

When a housing market “crashes,” it’s typically the result of a “bubble,” or a scenario where housing prices are overinflated vis-a-vis the actual value of the house. Housing bubbles don’t happen overnight; several complex underlying causes prompt a real estate crash.

There are four big contributing factors to a housing market crash.

- Rapid spike in home prices: When home prices rise quickly, especially in an inflationary environment, assets like stocks and houses can go from boom to bust.

- Down payment amounts and home equity levels: When homebuyers don’t have comfortable down payments at the time of purchase, or when homeowners are leveraging their equity through cash-out refinancing, this can lower national home equity levels. And when home equity levels are low or nonexistent, it can place a financial burden on homeowners that can leave them in debt or can increase the likelihood of home loan defaults.

- Lack of loan standards: One of the main contributing factors to the Great Recession was financial institutions loosening lending regulations to the point where many borrowers could not afford to pay back their mortgages. Today, lending standards are much stricter than they were prior to the Great Recession.

- Unemployment and the overall economy: According to the U.S. Department of Labor, the U.S. economy in 2019 set records, with wages rising and unemployment rates near historic lows. The onset of COVID-19 brought employment growth to a halt, as businesses shut their doors and people were in lockdown, prompting global job losses. The unemployment rate is still 3.9% — higher than pre-pandemic levels despite a fast recovering economy and demand for the labor force. The service sector continues to struggle to find employees.

Unlike the Great Recession, however, “consumer net worths are at all-time highs, household debt is lower, and homeowners are currently sitting on far more equity. And while there has been some loosening over the years, by and large, mortgage credit underwriting standards are tighter,” said Chris Osmond, CFA, CAIA®, CFP®, Markets Expert and Managing Director of DLP Capital.

Will there be another housing market crash in 2022?

Many housing economists believe that a crash is unlikely. Here are five reasons why.

Homebuyers are in a much stronger financial position

According to CoreLogic, today’s national average annual equity gain is up 31.1%, a total increase of more than $3.2 trillion since 2020. Compare that to the fourth quarter of 2009, when negative equity peaked at 26%. Having more equity in a home provides a cushion in the unlikely event that home prices plateau or fall.

Stricter lending standards

According to a Federal Reserve Bank of New York Household Debt and Credit Report, the average credit score for mortgage borrowers in the third and fourth quarters of 2021 was a record 786.

We spoke with single-family home expert and top Edmonds, Washington, real estate agent Sam Mansour, who was an active agent during the Great Recession. He explains that the subprime lending crisis was a large driver of the last housing market crash when buyers were getting adjustable-rate loans with, “‘teaser rates,’ where you purchase a home, and your rate is 1% percent, but that rate just a year later or two years later, once that rate adjusted, it then became unaffordable.”

Since the last housing crash, the Dodd-Frank Act was enacted, in response to the Great Recession, creating standards and guidelines that protect buyers and lenders and are designed to prevent a repetition of history.

Mortgage interest rates remain near record lows

As of January 10, the average fixed rate on a mortgage is 3.54%, and lower rates give homebuyers more flexibility in terms of their buying power.

Lack of inventory

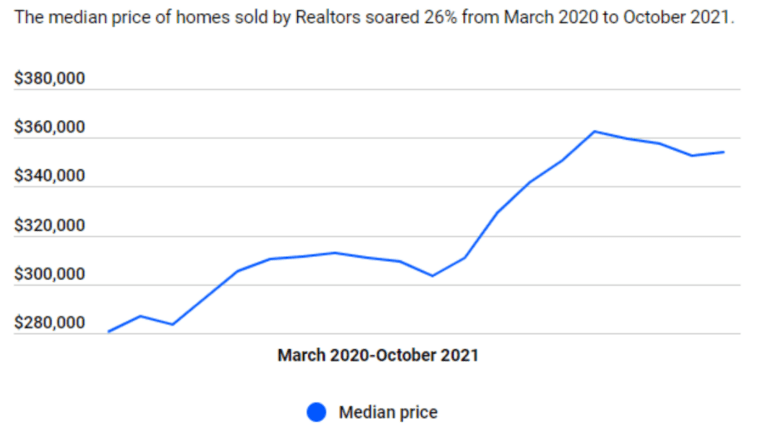

According to NAR, November 2021 brought median home prices up to $353,900, a 13.9% increase since November 2020. They also found housing inventory at 2.1 months, a 13.3% decrease since the year prior.

Builders cannot meet demand

Following the 2008 housing crash, many homebuilders were more cautious about the pace at which they built. There was already a housing shortage, especially in the entry-level segment in most areas, and the pandemic supply chain issues have only further exacerbated the problem. Builders, already trying to reclaim lost ground, have not been able to meet today’s demand.

In addition to the six reasons above, a home affordability crisis is underway. Consumers face difficult decisions because of rent increases that follow a similar growth trajectory as home prices — increasing more than 18% year-over-year through November. To rent, or buy a home within their budgets and lock in historically low rates? Neither may seem like a realistic solution at this point.

“Factoring into the equation and pushing both the price of housing and affordable workforce multi-family housing higher is the relatively new trend of large institutional investors like Blackstone entering both the single-family rental and affordable workforce housing markets,” notes Osmond.

There’s no shortage of prospective buyers in the housing market, and given tighter lending standards and a bustling economy, the odds that 2022 will shift to a buyer’s market are low.

“There’s a certain amount of safety net in [the market] right now. Could it change? Sure,” says Cornell.

In 2022, we should see more normalization of housing price growth closer to the averages between 3.5% to 3.8% per year, and the housing market is likely to slow down — but not stop.

Conclusion: The housing market is probably safe this year

The pandemic has brought about fear and uncertainty, with concerns of a housing bubble. Rapid price increases in housing will always raise concerns, whatever the circumstances. Depending on geographics, as pricey coastal cities like New York and San Francisco experienced an exodus early in the pandemic, people are now moving back in droves. Homebuyers are adjusting to pandemic life, and our experts believe that market normalization will be more achievable in 2022.

Header Image Source: (Matthias Mullie / Unsplash)