How the Stock Market Impacts Real Estate and If Stock Market Crashes What Will Happen

- Published on

- 6-7 min read

-

Christine Bartsch Contributing AuthorClose

Christine Bartsch Contributing AuthorClose Christine Bartsch Contributing Author

Christine Bartsch Contributing AuthorFormer art and design instructor Christine Bartsch holds an MFA in creative writing from Spalding University. Launching her writing career in 2007, Christine has crafted interior design content for companies including USA Today and Houzz.

Once upon a time, in the amusement park that is the financial investment world, the stock market and the housing market were two of the most popular investment roller coaster rides around.

The stock market is a wild, swift, at-your-own-risk ride with thrilling highs, deep dives, fast turns, and free falls.

On the other hand, many regarded the real estate market as more of a “my-first-roller coaster” ride, offering milder, lower-risk rises and dips at a much slower pace—that is, until 2008.

The dramatic drop that was the subprime mortgage crisis left many dizzy, and shaken, and feeling like they’d gotten on the wrong ride.

Even a decade later, some homeowners and investors are still uneasy about giving the housing market another go. But those fears are largely unfounded.

While the housing market crash may have helped trigger the financial crisis of 2008 that threatened the world economy, it was by no means the sole cause.

In fact, the disparity between the slow nature of the housing market’s fluctuations and the faster paced stock market means that they typically have minimal impact on each other—at least under normal conditions. That means if the stock market crashes what happens to real estate may be very little.

But the economic situation in 2008 was far from normal.

The 2008 housing market crash in a nutshell

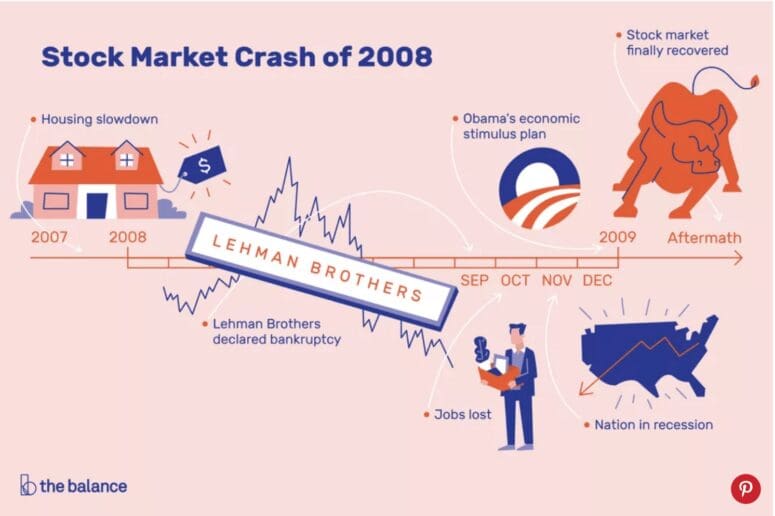

It seems incredible that a downturn in the U.S. housing market could have global implications. But that’s what resulted during the economic disaster that reached its crisis on September 15, 2008: The U.S. government refused to bailout the Wall Street brokerage firm Lehman Brothers. On September 29, the Dow Jones fell 777.68 points, which was at the time the largest point drop in U.S. history.

“With Lehman brothers, we couldn’t even fund our intraday trading. We couldn’t borrow enough money to operate and so Lehman Brothers went bankrupt,” explains Florida real estate agent Brett Keyser, who ranks in the top 1% of all active Realtors in Sarasota and Manatee Counties in total number of sales.

When Lehman Brothers filed the largest bankruptcy in U.S. history, it became the largest victim of the subprime mortgage crisis. The government’s bailout refusal destroyed the publicly held belief that banks were “too big to fail,” and triggered a financial domino effect felt around the globe for years. But the financial crisis didn’t start with the Lehman Brothers.

Experts examining the event after the fact actually believe the first domino fell in early 2007 when Freddie Mac backed away from buying risky subprime mortgages and a leading subprime mortgage lender, New Century Financial Corporation, filed for bankruptcy.

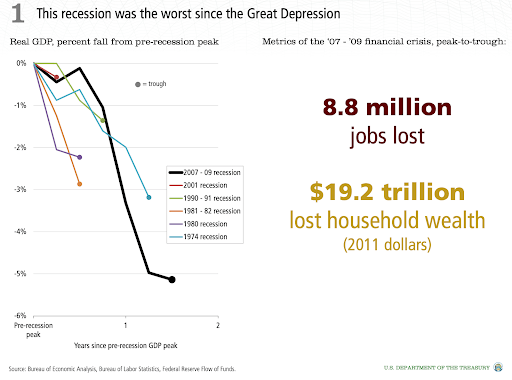

The second-most disastrous chapter (second only to the Great Depression) in the history of the U.S. economy officially came to an end on April 13, 2011 when the U.S. Senate Permanent Subcommittee on Investigations released its final report on its inquiry into key causes of the financial crisis.

Looking back at the timeline of events can tell us what happened, but it doesn’t fully explain why it happened. That answer is so complex that Harvard Law School has conducted an in-depth study of the implications of the crisis and the resulting financial regulatory reform.

In order to simplify matters, let’s focus in on the role that housing played.

The housing market’s role in the financial crisis

In the early 2000s, the global financial situation had shifted so that the housing market was driving the world economy.

This housing boom, that peaked in 2006, was spurred on by a few key factors, including:

-

- mortgage interest rates dropped from the double digits of the 1980s and early 1990s to as low as 5.23 in mid-2003

- the popularity of house flipping and other real estate investing led to a rapid, yet artificial rise in home prices—which lured even more people to pursue the promise of fast and easy money in real estate

- mortgages were easier to get—as lenders issued low down payment mortgages to high-risk buyers without proof of income documentation

This last reason—and the greed behind it—is arguably the biggest cause of the housing market crash.

“The mortgage companies were doing no documentation loans at that time, so a lot of people were lying about their income,” recalls Keyser. It was a get-rich-quick scheme. People were just buying up houses to try and turn a quick profit, and the prices were going up and up and up.”

Those flippers artificially drove up prices so high that eventually real buyers couldn’t afford to become homeowners. As demand dwindled, the meteoric rise of home prices began to fall off—and with it went the profit margins on flipped properties.

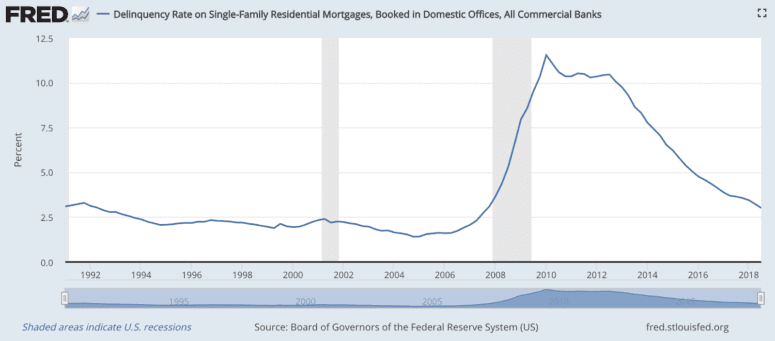

Soon house flippers could barely break even, let alone sell for a profit. As home prices continued to drop, flippers found they could no longer afford their mortgages. As more and more defaulted on their loans, mortgage lenders found they were forced to foreclose on more homes than they could afford.

But why did mortgage lenders make so many high-risk loans, especially without mortgage insurance?

Because they were making money on those loans by selling them to a secondary market. They were bundling the loans into mortgage-backed securities and selling them on Wall Street.

Seeing that easy money in the rising real estate market, more and more stock market investors wanted to get in on the housing boom—creating an unprecedented demand for those mortgage-backed securities.

In order to meet that demand, mortgage companies began issuing more and more high-risk, no doc loans, without bothering to check if the borrowers could afford their mortgages.

“The mortgage-backed securities they had been bundling up were essentially junk,” says Keyser.

All of those stock market investors who thought that they were buying into an appreciating asset, were actually buying up bad debt.

When the housing market took a downturn and home prices began to dip in 2007, all of those homeowners with high-risk mortgages began to default on their loans. This led to bankruptcy for many of those mortgage companies that had sold those failing mortgage-backed securities through the stock market—which led to the subprime mortgage crisis.

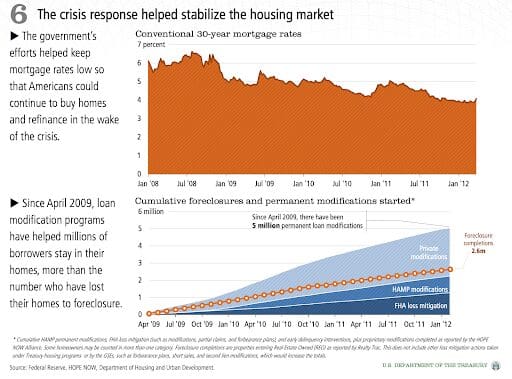

In order to prevent the economy from collapsing completely, the government stepped in to bailout the banks with the creation of the Fannie Mae and Freddie Mac Conservatorships. This need for government intervention led to massive economic reforms.

“After the financial crisis of 2008, the Dodd-Frank Act and a lot of other financial reform laws went into effect that essentially said, ‘We’re not going to have this happen again.’ We’re not going to allow these no-doc loans,” says Keyser.

“Now it’s so secure, they practically want to get your blood type now before you’re actually going to get a loan.”

These steps taken by the federal government are designed to ensure a housing crash that drastic never happens again.

Along with other reforms, the multi-pronged Dodd-Frank Act established five new regulatory offices in the S.E.C. And the Volcker Rule prohibits banks from conducting certain investment activities with their own accounts.

Thanks to those and other regulations, the stock market is no longer heavily dependent on risky real estate investment like those mortgage-backed securities.

It also helps that the housing market is no longer driving the economy.

The real relationship between the stock market and the housing market

Unlike the economic conditions of the early 2000s, these days the U.S. economy is strong on multiple fronts. For example, unemployment was on the rise in the 2000s, reaching over 9% in 2010—by 2018 unemployment had decreased to 3.7%.

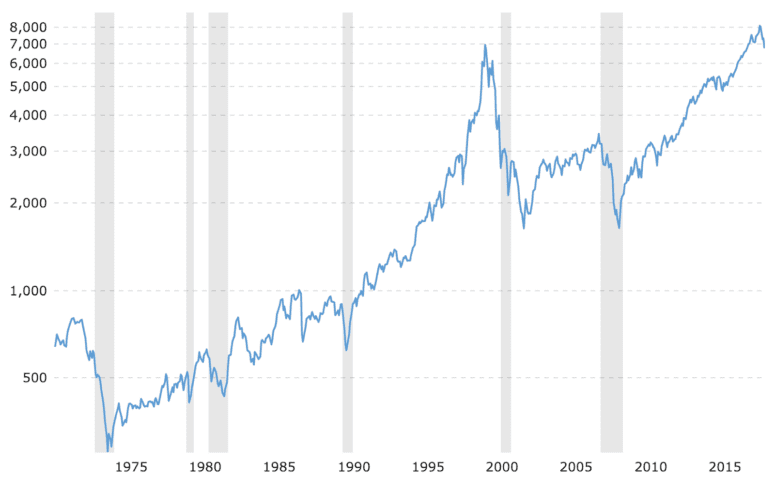

The stock market has seen a remarkable recovery since the financial crisis as well. While it still has its rollercoaster reputation, it’s been repeatedly making and breaking records—with the Dow hitting a record high for the 15th time in 2018.With both the stock market and the housing market making independently successful recoveries, the economic relationship between the two has returned to the status quo.

However, that doesn’t mean they don’t exert a bit of influence on one another.

“The link between equities and housing is really quite modest,” says Matthew Gardner, Chief Economist with Windermere Real Estate.

“But, that said, when the stock market rises, we feel wealthier and can be persuaded to spend more money on housing. However; they are also very different. In as much as many people review their portfolios very regularly, it is almost redundant to do the same thing with our homes. Housing is shelter first, and an investment second.”

Gardner’s point is also true in reverse.

“The housing market can have an impact on the stock market,” Gardner notes. “In rare situations when housing values decline, we are less likely to invest in equities.”

As Gardner points out, the main impact that a strong stock market has on the housing market these days is that buyers with strong stock portfolios have more money to spend on housing—which could theoretically influence a rise in home prices.

“Any short-term correction to stocks has little, if any, impact on housing markets,” explains Gardner. “However, any systemic contraction in equities can impact housing.”

So, when the stock market remains a strong bull market for an extended period, it may exert a positive influence on the housing market. If the stock market turned into a bear market for any significant length of time, the slow-moving housing market could also cool.

But that’s about it.

Thanks to the reforms put in place (and the fact that the stock market is no longer heavily invested in bad mortgage debt), it’s unlikely that any short-term correction or even more significant dip in the stock market will make such a significant impact on the housing market as it did in 2008.

While it’s true that the stock market can influence housing to a degree, there are other financial factors that play a larger role.

Other financial factors that impact the housing market

“The two macroeconomic factors on the housing market are job and income growth,” says Gardner. “As long as an area’s economy is adding jobs and seeing rising wages, there will be demand for ownership housing.”

Essentially, as long as people are employed with companies doing well enough to offer wages, they’ll feel confident enough to make that 30-year commitment to a sizable mortgage debt.

This confidence is bolstered further by low employment numbers—as people are reassured that even if they lose their current job, there’s a high probability that they’ll find another one in short order.

How should agents and home sellers prepare for a long-term stock market decline?

When you add the idea that “what goes up must come down” to the fact that the stock market keeps breaking record high after record high—it stands to reason this record-breaking highs trend cannot sustain itself.

Along with those highs, 2018 has also seen some noteworthy lows. If this volatility leads to a lengthy downturn in the stock market, that could negatively impact the housing market.

Why?

Because whenever a robust bull market looks like its trending towards bear market territory buyers may be influenced to postpone home buying until the stock market trends back.

And as we know, a drop in demand leads to a drop in home prices.

“I have been forecasting a business cycle recession to likely start at some time in 2020. As such, the best advice for agents would be to be prepared for a slowdown in sales—which almost always happens during recessionary periods,” Gardner advises.

But that doesn’t mean sellers should panic.

“As far as sellers are concerned, they need to understand that other than during the Great Recession, housing values do not drop during recessionary periods; rather they take a pause before rising again,” says Gardner.

In the end, you simply need to rely on the fact that real estate is an appreciating asset. So even if the stock market does adversely impact the housing market, the downswing is only temporary.

In the long run, your home’s value will always recover.