How to Invest in Real Estate For Retirement Without Risking Your Nest Egg

- Published on

- 2 min read

-

Christine Bartsch Contributing AuthorClose

Christine Bartsch Contributing AuthorClose Christine Bartsch Contributing Author

Christine Bartsch Contributing AuthorFormer art and design instructor Christine Bartsch holds an MFA in creative writing from Spalding University. Launching her writing career in 2007, Christine has crafted interior design content for companies including USA Today and Houzz.

Months traveling on international adventures, days volunteering for your favorite cause, hours pursuing your passions and hobbies—all of these exciting life-after-retirement plans require a steady stream of income. The problem is, that nest-egg you’ve saved up may not be enough…unless you keep your money working for you in a low-risk investment, like real estate.

While economic fluctuations may temporarily lower the value of your investment property on paper, historically home values steadily increase over time. In fact, U.S. Census Bureau data shows that in the 60 years after the first housing census in 1940, home values (adjusted for inflation) nearly quadrupled.

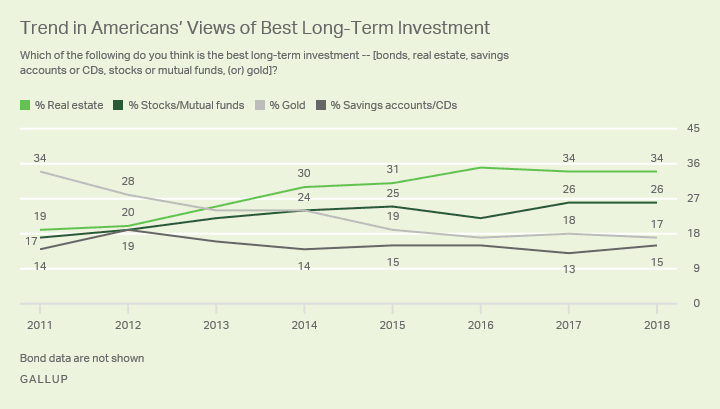

A recent report by Gallup found that Americans have chosen real estate as the best investment opportunity for the for the last five years.

According to Nile Lundgren, a top New York agent and Bloomberg TV commentator, who was named Executive of the Month by the New York Real Estate Journal:

“If you’re going to be retiring, it’s always a good thing to invest in real estate—not just for you as your life carries out, but for many generations to come.”

As a tangible asset, real estate boosts your monthly retirement income while appreciating as an asset to pass down to your children and heirs. But if you don’t invest carefully, you could be putting your life savings at risk at a time when you need it most.

We looked into all the options to find the two lowest risk real estate investments you can make as a retiree, backed by data and the advice of expert real estate investors, and how to make the most of each.

Purchase Your Own Income Properties

Buying a second home on your own offers the promise of the greatest return on your investment if you treat it as an income property. With an expert real estate agent helping you find the right property, the rent will cover the home’s mortgage and provide you with an additional monthly income—all while the home increases in net worth.

As Lundgren advises, “I love the investment side of buying a second home because it’s very cut and dried, very numbers driven. You look at what you can rent it out for, what the mortgage is going to be, what the taxes are, and with a couple of easy math problems you can model out your cash flow and a future line projection of what the asset will to be worth.”

If you’re thinking about purchasing an income property, here’s what you should do:

1. Work with an experienced real estate agent to find the right property.

Many real estate agents who specialize in investment properties get expert training to better help you navigate finding a rental property.

The National Association of Realtors offers certification for agents to become a Resort and Second-Home Property Specialist (RSPS), which means they’ve taken certain courses beyond regular real estate licensing.

The RSPS designation means the agent is an expert in finding “investment, development, retirement, or second homes in a resort, recreational and/or vacation destination.” Bingo!

Go to HomeLight to find a top-performing real estate agent who specializes in your area and the property type you’re looking for. Ask the concierge to connect you with an agent with the RSPS designation.

Article Image Source: (Elien Dumon/ Unsplash)

Find the Perfect Real Estate Agent

We analyze millions of home sales to find top real estate agents

Pick a market that makes sense for your investment.

Real estate values are generally on the rise right now, but some markets are for better rental investments than others.

Hitting the sweet spot is a little more complex than looking at markets with the fastest appreciation rates. Price growth is an important factor, but you also want to be looking at gross yield rates, aka, a property’s annual income as a percentage of the property’s value or purchase price. (The higher your yield, the better the investment).

Real estate analytics company House Canary measures “Effective Gross Yield” (EGY), a percentage that also factors in state and local taxes and fair rental market value to identify top markets for investors.

“Returns tend to be higher when prices are relatively low (though not always), and there are ripple effects spreading to nearby markets from hot real estate market centers exploding with buyer interest (like Denver),” House Canary reported in its Q1 2018 Rental Index. You can find the EGY for the state or metro you’re thinking about purchasing in here.

Of course, ROI isn’t your only consideration when buying an income property. Proximity and access are also key, as managing a property from out of state presents unique challenges.

If you are considering a property out of state, you’ll want to look into the area’s economic trends and state laws. If you like what you find and decide to invest in a property you can’t easily drive to, hiring a property manager could be the right move to open up your location options.

Figure out how much rent to charge.

Let’s say you decided to purchase an investment property in Phoenix, given its fast-growing population and high volume of student residents who likely need rental housing.

Imagine this 3-bed, 2-bath single-family at 7617 S 27th Way in Phoenix for $250,000 was in your budget and piqued your interest.

First, you could type the address of the home into a free online rent analyzer tool like MyRentRates.com.

From there you’d enter a few pieces of information, including the address, number of bedrooms and rent you plan to charge.

The tool would show you if the rent you’re considering would be reasonable for the home and location.

From there you could calculate your gross yield. In the case of 7617 S 27th Way, your gross yield would be:

$1,500 in monthly rent x 52 weeks in a year / $250,000 (purchase price), for a GY of 3.1%.

That gives you a percentage to shop around with (though GY does not account for taxes, maintenance, or management costs).

For example, take this property—3 beds, 1 bath—costing $165,000 in the same city (Phoenix).

For this home, if you charged $1,400 a month for rent, your gross yield would be:

$1,400 in monthly rent x 52 weeks in a year / $165,000 (purchase price), for a GY of 4.4%.

From a birds-eye view, the second property appears to be the better investment, but you also have to consider things like location, maintenance and taxes that could add or subtract to what you make.

Do the math!

Select a type of rental agreement.

Income properties also afford you the most freedom in deciding how to structure your rental agreements. You get to choose whether you want to lease your second home as a long-term or vacation rental.

Long-term renters offer the security of a guaranteed income from the property every month. They also typically pay for their own utilities, do their own cleaning, and provide their own furnishings.

As a vacation rental—especially if you buy an out-of-state or international property in your favorite travel destination—you have the option to use the home as your own personal getaway in between vacation renters.

Whether long-term or vacation rental, you, as the owner and landlord, do bear the full responsibility for the home’s upkeep. However, there’s no need to handle this alone.

Hire a property manager so you can really retire.

For as little as $80 to $90 a month, you can hire a property manager to find and communication with tenants, collect the rent, and make minor repairs.

Some real estate agencies will even handle the property management for their clients.

You can start your search for a good property manager with the National Association of Residential Property Managers search portal.

There you can search by your location for property managers who “must comply with real estate license law” and have taken the NARPM Code of Ethics course.

Screen your tenants carefully.

Of course, owning a rental property isn’t all flowers and sunshine.

There’s always a risk that you’ll get unpleasant tenants you’ll need to evict, or hunt down to pay rent.

Money Crashers, one of the most popular personal finance blogs on the web, offers a great guide for screening tenants.

To sum it up, before you allow someone to rent out your property, you want to be:

- Making potential tenants fill out an application

- Running credit and background checks

- Talking to employers and former landlords

Remember that this isn’t exactly a liquid asset. You’ll need to sell the property before you can get full access to the funds invested in your second home.

On the plus side, chances are that you’ll be pulling out more money than you put in if and when you decide to sell.

This means that your nest egg will continue to increase in value over time—potentially at a greater rate than you’d get with other real estate investment opportunities.

Invest in a Real Estate Investment Trust (REIT) or Mutual Fund

Purchasing an investment property may be one of the best prospects, but it’s certainly not your only option for putting your retirement money to work in the real estate market. Two alternatives are investing in a Real Estate Investment Trust (REIT) or Real Estate Mutual Fund.

What Are Real Estate Investment Trusts?

With a REIT you’re not directly investing in real estate yourself, as you are when purchasing property. Instead, you’re investing in a company that owns, operates or finances income-producing real estate, such as commercial office buildings or residential apartment complexes.

This takes all responsibility for the property and its tenants out of your hands and gives it to the trust and the real estate holdings it owns or employs. This also takes some of the control out of your hands, too. While you do have some power as a shareholder, properties may be bought or sold at a profit or a loss, often without your input or approval.

The beauty of REIT investments is that those in control of the trust are in the real estate game to make money, which means you’ll make money, too—without any real risk of losing your investment. However, the dividends from this investment may not be as high as you like.

Recent data puts the income you’ll see from a REIT investment at around 4% with a high of approximately 7%. Also, unlike monthly rental income, you’ll only receive your dividends at quarterly payouts (although there are some that pay monthly).

There are two types of REITS:

- Mortgage: The most common kind of REIT, which operates income-producing real estate

- Equity: Less common, and involves investing in a specific property type, such as retail or residential

REITs are traded on the major stock exchanges and you can purchase shares in REITs through a broker.

Your Other Option For Retirement Investing: Real Estate Mutual Funds

One step away from REITs are Real Estate Mutual Funds. Essentially, these operate as just a standard mutual fund with a focus on investing in multiple REITs and other real-estate related stocks. This extra layer of removal means your investment is more diversified, which means even lower risk as well as the potential for an even lower dividend percentage.

Whether you opt for a REIT or a mutual fund, this indirect method of investing is one of the lowest-risk ways of getting into the real estate game—albeit with a typically lower and less-frequent payout.

Investing in Real Estate for Retirement: What Are You Risking?

If you’re like many homeowners who recall the 2008-09 housing bubble, you might wonder, “Is real estate truly a low-risk investment?” In the short term, no.

Real estate definitely involves some risk if you plan on flipping your investment property for a fast return (notice that we don’t have it as one of your low-risk options). There is no guarantee that the house you bought low will sell high, even if you invest more money in renovations.

As a house flipper, you are at the mercy of the housing market, which means you might make a huge profit, you may just break even, or you may need to hang on to the property longer than planned until its value increases.

In the long term, though, real estate is low-risk. And you’re better off investing in the two avenues with the highest chance of success (income property or REIT/mutual fund) than getting into the flipping business, unless you really know what you’re doing.

The bottom line is taking funds from your retirement account and risking them through an investment is definitely scary. But by pursuing the safest bets, you can sleep well at night knowing your money is working for you, not the other way around.

Article Image Source: (Elien Dumon/ Unsplash)