Here’s How to Keep Your Moving Expenses to a Bare Minimum

- Published on

-

Lauren Vella Contributing AuthorClose

Lauren Vella Contributing AuthorClose Lauren Vella Contributing Author

Lauren Vella Contributing AuthorLauren is a writer based in Rhode Island. She attended Brown University, where she earned a B.A. in History with a concentration in East Asia. Her work can be found in Southern Rhode Island Newspapers, Brown University's Next Generation, and Awkward & Out.

The loud smack of the unraveling packing tape, the satisfying “pop!” of the bubble wrap, and the gentle crinkle of old newspapers as they hug the outside of your favorite “World’s Best Grandma” mug—ah, the glorious sounds of moving, you could almost get onboard with this exciting next step!

That is, until you feel the silent sting of the moving bill.

Sigh…moving is expensive, period. If you let moving expenses get away from you, you’re cutting into your bottom line and the nice pile of cash you just made on the sale of your home. We’re talking thousands, sometimes tens of thousands of dollars.

Keep more money in your pocket by taking advantage of our in-depth research on:

- The best moving cost calculators to budget for your move

- Surprise moving expenses to avoid with preparation

- Tax breaks and reimbursements you can take advantage of

- Tips from the experts for shaving off moving costs

Are you ready? Let’s get saving!

How to estimate your moving expenses

Whether you’re moving across town or across the country, the expenses you accrue can add up to a large chunk of change—especially if you’re hiring a professional moving service. Of course, the cost of moving varies depending on the amount of items you move, the value of your items, and the distance that you move them.

“[Moving expenses] are dependent on a seller’s treasures,” says Linda Quinn, a top-selling real estate agent in West Linn, Oregon, who has over 40 years of industry experience. “If they’ve got Waterford stemware, they probably need to hire someone that’s very meticulous about packing and moving.” And that comes at a price.

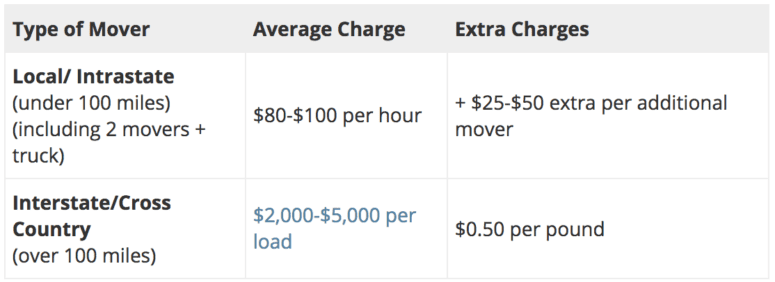

On average, the cost of an interstate move (any move from one state to another or over 100 miles) is about $4,300 based on an average of 7,400 pounds and the average distance of 1,225 miles.

To move completely cross-country, the average cost is about $1,000 per room. To move locally (to a location under 100 miles), the average cost to hire a moving company is between $574 and $1,578. Local moving companies can charge anywhere between $25 and $50 per hour.

Those cost estimates don’t seem too bad, right? Of course they don’t, but that’s just the national average. We have yet to factor in the number of items and their weight, the number of rooms in your home, where you live, and what day of the week and time of year you’ll be making your great escape.

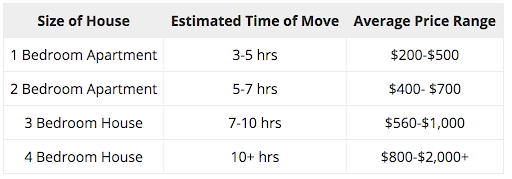

Figure 2 shows estimations of moving costs depending on the size of your home and the time it would take to move these items locally (under 100 miles). For those with small residences the cost is not too steep. However, as you graduate to 3-4 bedroom house rates, you’re looking at a hefty baseline bill, not to mention the added cost of moving if you had to travel cross-country.

If you’d like to keep moving costs low, the first step to keeping your cash is to accurately estimate how much it will cost you to move house.

This way, you know if you can afford a moving service and new packing materials or if you need to budget for a DIY move. We’ve scoured the internet and reviewed some of the best moving cost estimation tools. Here are some of the best tools you’ll want to anticipate the costs of your big day:

- Moving.com Moving Cost Calculator:

We love this moving cost estimation tool because it’s user-friendly. This simple and easy-to-use site provides its visitors with an accurate estimation of costs based on the location you’re moving, the number of bedrooms of your current home, and the type of services you require. They even provide other tools like a packing calculator, a move planner, and a utility finder for your new home. - Realtor Moving Cost Calculator:

Like Moving.com, Realtor provides its visitors with the basics of the moving cost calculator. But what’s unique about this tool is that after you’ve calculated your costs, you can also take advantage of 4 free moving quotes! - Relocation.com “How Much Will My Move Cost?” Tool:

Do you love detail and accuracy?! If the answer is yes, then relocation.com is the right moving calculator for you. Admittedly, the site needs some updates, but your estimation will benefit from its thorough data intake. On top of location-to-location information, Relocation.com asks you to plug in the number of items of furniture you have for an accurate estimation. You can also estimate by weight. - City to City Moving Costs Instant Estimator:

Want a cost calculation that’s super local? You have to do your research, but once you’ve figured out the rates and prices from your local moving companies, City to City moving provides a tool that will calculate a sum of local labor, carriage, packing, and insurance expenses. - Home Depot Moving Calculator:

Input your home specifics and this handy calculator from Home Depot will tell you the types of supplies you’ll need at what quantity (wardrobe boxes? Foam corner protectors for all your flat screens?) and an estimation for how much it all will cost.

Don’t get blindsided by surprise moving expenses

So, let’s say you calculate your moving costs and you were able to budget for a moving service. Phew! That’s a load of weight and stress of your back!

However, when the movers show up at your doorstep, they spot a piano in your drawing room. “That right there is going to cost you extra” he says.

And depending on the distance you’re moving, that total can be anywhere from $250 to $1,000 extra. Suddenly, your move just got more costly and the prized family antique you’ve cherished for generations has become a burden rather than a piece of nostalgia.

A specialty item like piano is just one of the many unforeseen expenses you might not account for (or movers will forget to mention) when you move. To be sure you’re “in the know” the day of the move, here is a list of extra charges you may incur:

- Specialty items such as pianos, pool tables, jacuzzis, and other oversized or awkward objects.

- Elevator carry and flight charges:

If you live in a high-rise or an apartment complex, the moving company may charge you for moving your personal belongings into an elevator. The same goes for flights of stairs. Obviously, it is not an easy task moving a bed frame or an armoire down two flights of a winding staircase. Thus, the harder the labor, the more expensive the move. - Inaccessible pick-up/drop-off locations (long carry charges):

If your old and new homes have particularly narrow entrance ways, alleys, or other difficult points of entry, it can and will slow down the speed of your movers on the day. As a result, your moving company can and will charge you for additional time. - Tips for your movers (around 10-20% of the cost of the move)

Write off your moving expenses if you’re active military

Every year we dread that April deadline—it’s tax season. Time to push those pencils, gather those documents, and whip out your checkbooks because Uncle Sam needs to collect his yearly contributions!

Filing your taxes is tedious, hairsplitting, stressful work. However, if you’re an active member of the Armed Forces permanently relocating due to a military order, you are able to deduct your “reasonable” moving expenses. That means there’s still mind-numbing paperwork to fill out- Form 3093, to be exact- but your wallet won’t be hit as hard.

That is, moving expenses directly related to the move, excluding meals. Here is a definitive list of what you can deduct from your taxes:

- The cost of traveling (flights, lodging, etc.) from your old residence to your new location. This includes travel costs for yourself and the family members of your household.

- Expenses incurred when traveling by car including bills for gas, oil, parking fees and highway tolls.

- The cost of packing, crating, and transporting personal and family effects from your old location to your new location. This also includes the cost of connecting and disconnecting utilities.

- Storage expenses (within 30 days that you move from your old home into your new home)

The good news is, the items listed above cover the bulk of moving expenses. The bad news is, there are quite a few expenses that are nondeductible. Items include:

- Meals

- Any percentage of the purchase price of your new home

- Car tags

- Driver’s license

- Expenses of buying/selling a home (real estate agent payments, closing fees, etc.)

- Home improvements

- Loss on the sale of your old home

- Losses from disposing of club memberships

- Mortgage penalties

- Pre-move house hunting expenses

- Real estate taxes

- Refitting of carpet and draperies

- Return trips to your former residence

- Security deposits

- Storage charges except for the ones listed above and for foreign locations

If you’re thinking, “Wait, I thought any job relocation qualified for this”- your memory serves you correctly. You used to be able to deduct moving expenses if your new home was at least 50 miles closer to your new job than your old home was (the distance test), and you’d been working that job full-time for 39 weeks within the first year after you moved (the time test). But the Tax Cuts and Jobs Act of January 2018 excluded all but active military from the opportunity to claim this deduction.

Find out which moving expenses are reimbursable

Sometimes, companies will pay for their talent to relocate as part of their hiring package. That means that expenses incurred like moving company costs, travel, lodging, storage, temporary housing, packing and unpacking, home finding and home buying services and sometimes even childcare will be covered by your new employer.

What does this mean for tax deductions? The updates we mentioned earlier apply here, as well: For tax years 2018- 2025, the exclusion of moving expense reimbursements for non-military taxpayers is suspended. This means that the cushy all-expenses-covered moving plan your new job came with will have to be included as part of your income for the year you moved.

Qualifying active military who were reimbursed by the government for moving expenses will have to do some basic math to confirm their tax liability.

Basically, if the government reimbursed you for more than it cost to transport you and your belongings to your new station (assuming the money was not designated specifically for moving or storage), you’ll have to claim the extra money as wages on Line 1 of Form 1040. If the applicable moving and storage services cost more than what you were reimbursed for, you can claim the difference as moving expenses on Line 26 of Form 1040.

Other tips for cutting down on your moving expenses

When you move, financial help from your employer or the federal government is a godsend. But, what if you’re just moving back home from college, or moving across town because the school system is better for your kids?

What if you want to move out of New York City and into the Connecticut suburbs to start a family? Then what?

With no work-related reason to claim moving expenses on your tax forms, the only person who can help you reduce the cost of your move is you. Luckily, there are several ways to make a move highly efficient and cost effective.

Rethink full-service movers and rent a portable container

To put it simply, you’re just not going to save money if you go through a moving service. Unless your Uncle Vinny (who just happens to own a professional moving service) can “help you out,” a moving service will always cost more than a DIY move.

One of the easiest ways to save money is to rent a portable moving container. On average, a portable moving container will cost anywhere between $2,000 and $3,000 per month to rent compared to $4,000 to $6,000 a moving service would charge you.

Just rent the moving container for as long as you need it, fill it with your household items, and let the container company haul it off to your new home.

Try these companies for all of your portable moving container needs:

- U-Hauls

- U-Boxes

- 1-800-PACK-RAT

- PODS

- ABF’s

- U-PACK

Don’t pay for moving boxes!

We’ve all been there—it’s getting closer to moving day, and procrastinating on getting moving boxes has left you with a great deal of pre-move anxiety. Where is all of your stuff going to go, and how will you have the time to pack it all?

So, you panic and head straight to Home Depot to pick out 10-20 overpriced cardboard boxes with a bright orange stamp on the front. Your problem is solved, but you also spent a large sum of money. If you have a four bedroom house, you’ll spend over $400—for cardboard. The best way to save money on boxes is to not have to pay for them at all.

Here are some of the best places to find FREE moving boxes:

- Craigslist! There’s always someone who is giving away boxes under the “free” section of your local area.

- Ask your neighbors and your family members if they have any boxes lying around. Maybe someone recently made a large Costco run and can give you what’s about to go in their recycling bin.

- Second-hand resale apps like Letgo, Offer Up, and Facebook to get boxes people are giving away.

- Your local liquor store

- Bookstores

- Target

- Office Depot

- Grocery Stores

Use regular household items to save on moving supplies

There comes a point during the move where you must ask yourself, “How much more bubble wrap and tape can I possibly buy?!” The answer is: no more.

To save money on packing supplies, repurpose things like towels, linens, and throw blankets to pad fragile items. You can also use suitcases, duffel bags, and backpacks in lieu of cardboard boxes.

Purge unnecessary clutter before your move

There may be a tchotchke or two lying around that you really don’t need to bring on your cross-country drive to Los Angeles.

If you’re using a moving service, movers will often charge by the pound and weigh your belongings. More weight equals more money.

So, make sure not to haul along things you don’t need or never use. If you’re having difficulty getting rid of what you think are prized possessions, employ the $20 in 20 minutes method. That is, if you were to need an item in your new home could you find it for less than $20 in under 20 minutes?

If yes, into the trash it goes!

Hire moving labor only

Is it the heavy lifting that scares you? There are several ways to hire people to do the physical moving of your belongings for you without having to pay for a full moving service (which would include packing, supplies, shipment, etc.)

In fact, this is one way to instate professional help without breaking the bank and can save you thousands of dollars. Use sites like Moving Help, Angie’s List, and Task Rabbit to hire local movers who will do the moving labor only.

Plan your move in the off season

Like “duck season” and “rabbit season,” there’s a moving season, and it spans the months between Memorial Day and Labor Day. 70% of moves take place during this time because children are on summer vacation and families are on the move because parents don’t have to worry about their kids missing class.

Just like buying flights around Christmas break, moving during the prime season is going to be extremely expensive.

Avoid the summer and move well into the fall, winter or spring (between October and April). Be sure to leave mid-day, mid-month to ensure you’re getting the cheapest price on movers, portable moving containers, or whatever other service you decide to employ.

Moving expenses: Sigh, you can’t avoid them, but you can reduce them!

The costs incurred from moving can cause lots of stress. But, with the right knowledge and tools to tackle your moving expenses head-on, you can save hundreds—if not thousands of dollars. So, what are you going to do with all of that money you saved?

Maybe throw a housewarming party for all of your neighbors to celebrate how cost-efficient your move was.