4 Common Mistakes People Make Selling Probate Real Estate (And How to Avoid Them)

- Published on

- 4 min read

-

Jennifer Billock, Contributing AuthorClose

Jennifer Billock, Contributing AuthorClose Jennifer Billock Contributing Author

Jennifer Billock Contributing AuthorJennifer Billock is an award-winning writer, best-selling author, and editor. She is currently dreaming of an around-the-world trip with her Boston terrier.

-

Sam Dadofalza, Associate EditorClose

Sam Dadofalza, Associate EditorClose Sam Dadofalza Associate Editor

Sam Dadofalza Associate EditorSam Dadofalza is an associate editor at HomeLight, where she crafts insightful stories to guide homebuyers and sellers through the intricacies of real estate transactions. She has previously contributed to digital marketing firms and online business publications, honing her skills in creating engaging and informative content.

Selling probate real estate is a different ball game than a traditional home sale. If a decedent’s estate has property you intend to sell during probate, buckle up for a long ride with bumps, twists, and turns you didn’t see coming — unless you’ve got a good grasp on how this process works.

Probate is a legal process overseen by the court, where beneficiaries receive the financial and physical assets bequeathed to them in a will, and the estate’s debts are settled. The whole point of probate is to prevent fraud after someone dies, so you can bet the court will keep a close eye on what’s typically an estate’s largest asset: the house.

Each state has its own probate laws, but universally, probate entails detailed regulations on paperwork, timelines, deadlines, and a specific order of procedures that must be followed.

Avoid these mistakes below to prevent delays and problems that could crop up along the way in the sale of your probate property.

Mistake #1: Hiring inexperienced professionals to represent you during the probate process

In life, you get by with a little help from your friends.

Navigating the sale of a home during probate requires a lot of help from a seasoned probate attorney and carefully choosing a real estate agent who understands local probate regulations and procedures. Both professionals are essential for a successful process. Whether you were named as the executor in the will or the court appointed you as such, you’ll need to partner up with a dream team to get this house sold.

A probate attorney assembles necessary court documents, prepares and submits the probate petition, and speaks on your behalf before the overseeing judge. They also assist in managing life insurance proceeds, resolving income tax matters, and serve as your overall advisor throughout the probate proceedings.

Your real estate agent will usher you through the nitty-gritty details of the real estate transaction, including special contracts and documentation specific to your locale’s probate regulations. A real estate agent also acts in an advisory role and helps to manage competing interests to guarantee a successful sale.

“A good real estate agent selling probate needs to be able to conduct themselves in a manner that is sensitive and respectful to the family, but with the ultimate goal of getting the property sold in the most cost-effective way,” says Jeremy Wages, a top-selling Texas agent with The Rhodes Team who specializes in probate sales.

If you pick the wrong agent, you’ll run into extra stressful situations that a true professional could diffuse — for instance, in the one sale Wages handled, about 30 people were involved, and one of the deceased’s children tried to hire an inexperienced agent who encouraged them to do all sorts of unnecessary fixes when selling a house.

“I just said, ‘Let’s look at: What is it going to cost to do it?’” Wages said. “How much time is involved in the process? Does this really make sense? When it was all said and done, it wasn’t worth it.”

Repairs also get complicated as the executor must determine if they are authorized to use estate assets to fund them.

Despite this, Wages successfully resumed the sale and ensured the family still earned money from the house. “We had to bridge the gap and work through all the different personalities. You need a realtor with experience dealing with probate and understanding the process.”

Prevention tactic: Vet your probate professionals carefully and only hire those who are best in class

Before you agree to let someone represent you in your probate real estate sale, do your homework.

Make sure to inquire about the number of cases the attorney candidates have managed and their experience in practicing probate law.

When evaluating agents, use HomeLight to find a real estate agent with probate experience. HomeLight tracks agent sales statistics and hosts agent profiles all in one place so you can compare facts, see who has the most probate know-how, and narrow down your options. Plus, you can speak with a trained live agent concierge about your specific circumstances and what you’re looking for in a probate agent by simply entering your address.

Once you’ve got your list of agents nailed down, interview a real estate agent by asking them:

- How many probate transactions have you handled?

- What’s the difference between probate and traditional real estate sales?

- Are you certified or educated in probate? (Agents who’ve received this training are known as Certified Probate Real Estate Specialists and have the CPRES designation.)

Mistake #2: Selling property in probate without authority

Just because you’re listed as the executor in a will does not mean you can stick a for-sale sign in the yard of the deceased’s property and start collecting offers like a typical real estate transaction, says Jeffrey R. Gottlieb, a Chicago lawyer who specializes in estate planning and probate sales and who has almost 20 years of legal experience.

You cannot legally take any action with the property or any part of the estate until you appear in probate court and get formally appointed by the judge to administer the estate. Typically, actions such as bringing in the mail or preventing pipes from freezing are OK, but you can’t start sorting heirlooms or hiring contractors for repairs at this stage in the process.

If an executor hasn’t been listed in the will, the court typically will appoint the next of kin to handle the proceedings. But in some situations, when the parties involved can’t reach an agreement and end up in court, the probate court appoints a receivership or a person in charge of the property sale overall.

“The Realtor is typically appointed the receiver,” Wages says. “Then they make all the decisions to sell the estate for the most money in the fastest amount of time, provided the court agrees with clear and compelling evidence of why that particular strategy is the best way to go.”

Prevention tactic: File your probate case with the court ASAP

File a petition to open probate with the court as quickly as possible. You’ll need your attorney to help you gather all of the required documentation, such as the death certificate, original will, and your state’s probate petition forms. You can find your state’s required probate forms with this list of all the paperwork required for each state.

Getting the petition in as quickly as possible is crucial because you could wait weeks or months to get a court date, and meanwhile, the costs associated with the house, including the mortgage, utilities, and lawn maintenance, continue to pile up.

If the paperwork has been filed correctly and everything goes according to plan, the court will sign an order deeming you the personal representative of the estate with a Letter of Administration (or Letters Testamentary if the estate doesn’t have a will.)

At that point, you’ll be legally able to sign a listing agreement with an agent and get the ball rolling on selling the property.

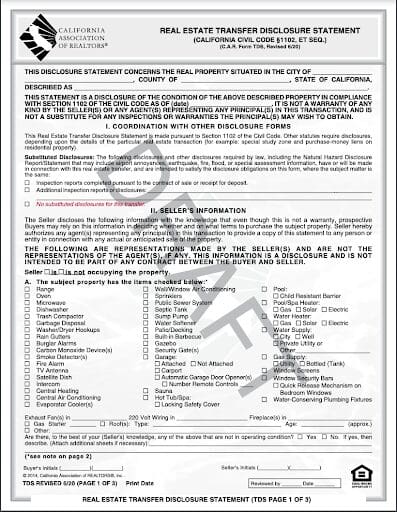

Mistake #3: Mishandling of real estate disclosures

Real estate disclosure laws set rules for what you have to tell buyers about a home before they follow through on the deal. Laws are a mixed bag from state to state, but most states, in some shape or form, require sellers and their agents to disclose any “material defects” about a home upfront in writing.

According to the National Association of Certified Home Inspectors, material defects are those that negatively affect a home’s value or could pose an unreasonable risk to the buyers’ safety, like bad wiring or a gas leak.

On a regular home sale, disclosures are a tricky area, and in many cases are best navigated with the help of an attorney or at least an experienced real estate agent. When it comes to probate real estate, however, it gets even murkier: Personal estate representatives in some states may be exempt from filling out their locale’s real estate disclosures form.

This is because if the seller of the home didn’t occupy the property before the sale, some personal knowledge disclosures won’t apply as he or she can’t be expected to know anything about the property.

However, failing to disclose could come back to haunt you later in the form of legal action if you haven’t meticulously navigated the intricacies of the law.

Prevention tactic: Communicate any disclosure questions to your agent and attorney early on, and follow their advice on whether to make an issue known

“Everybody that I’ve ever dealt with that ever had any potential hint of issues or trouble, it’s because they didn’t tell me about a problem until it was almost too late,” Wages said. “Then we had to scramble to figure out how we protect them so they’re not going to have an issue a couple years down the road before the statute of limitations expires.”

In some cases it may be in your best interest to fill out the disclosure forms even if it’s not required, or provide a verbal disclosure, rather than sweep issues under the rug. In any case, trust the advice of your attorney.

Mistake #4: Leaving the house vacant for an extended period

Sometimes disagreements among stakeholders can delay a probate sale, meaning the property sits vacant for an extended period of time.

This can create a number of issues; if a pipe breaks and no one discovers it for weeks, that may cost thousands of dollars to repair.

If the lawn starts to look shabby and overgrown, that could result in a fine by the city for a code violation.

That’s not to mention insurance companies don’t like to cover empty houses. If a house sits empty for more than 60 days, it’s possible that the insurance policy could revoke important coverages.

Prevention tactic: Get the probate process rolling quickly and keep up with all necessary property maintenance

Don’t dilly dally in your handling of the estate. File the petition to set a court date as soon as possible to get the ball rolling on the distribution of assets. If infighting starts to stall progress, consult your lawyer and involve the probate court as necessary to make a decision.

Don’t let home maintenance slide if no one will be living there in the interim. Be sure to maintain the homeowner’s insurance policy on the decedent’s house until ownership is officially transferred to the new buyer of the home.

Header Image Source: (Rikki Austin/ Unsplash)