U.S. Housing Market (2023 Trends)

An abrupt spike in interest rates has hit the U.S. housing market like a blast of cold air. As a result, real estate activity feels especially sluggish heading into 2023 — even for housing’s traditionally slow season.

Before the pandemic, the median price for an existing home in the U.S. was $266,300. In June 2022, that figure had ballooned to $413,800 due to the cheap cost of borrowing and broadening of work-from-anywhere jobs. Alongside housing, inflation in other sectors including food, transportation, and raw materials reached levels not seen in four decades.

Having risen rapidly over the past few years, home prices cooled to around $380,000 by the end of 2022 since their summer peak. But higher interest rates, triggered by the Federal Reserve to help bring inflation under control, are offsetting the affordability gains buyers have made with declining home prices.

According to HomeLight’s survey of over 1,000 top real estate agents nationwide, here are the trends that are likely to shape the housing market in 2023.

1. Seller’s market retreats

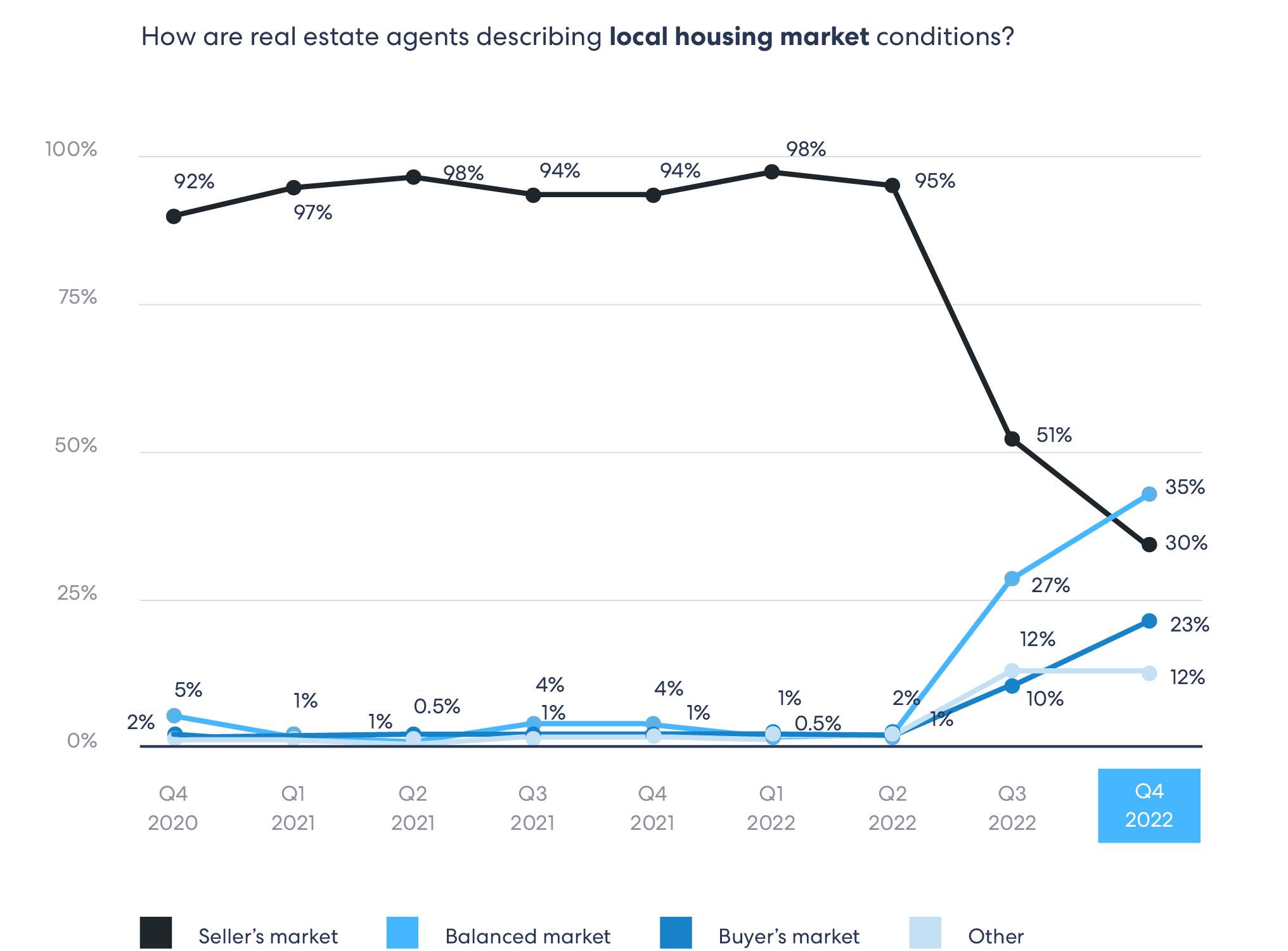

Buyers are seeing more favorable conditions when it comes to pricing and competition for homes as the market continues to rebalance. In Q2 2022, 95% of agents surveyed by HomeLight characterized their market as a seller’s market. In Q3, that number had declined to 51%, and in Q4 it fell further to just 30% of agents.

In Q4 2022, 23% of agents characterized their market as a buyer’s market, up from 10% in Q3. This is in sharp contrast to the market that prevailed from 2020 to mid-2022, when only 1%-2% of agents reported a buyer’s market.

For 2023, 45% of top agents surveyed are predicting a balanced market, while 34% predict a buyer’s market. Only 12% think they will see a seller’s market in the communities they serve. Because of the rapid shift in the market, 32% of agents surveyed say that sellers are now revisiting offers they had previously declined from buyers, up from 27% in Q3 2022.

2. Buyers enjoy newfound leverage

The cooling of the seller’s market means buyers are no longer having to craft hyper-competitive offers in all cases. Buyers willing to accept higher interest rates (or pay cash) are taking advantage of their newfound leverage, our survey finds.

53% of agents say that an increasing number of buyers are pushing back on inspection items, up from 30% in Q2 2022. 77% of agents are reporting that contingencies are coming back, and that buyers are less likely to waive them. 51% of agents say that buyers are making fewer offers on homes, compared to 39% of agents reporting this in Q3 and 23% in Q2.

Buyers also generally have more houses to choose from. In Q4, 53% of agents said that inventory is increasing. Agents on average expect inventory to increase by 11% in the first six months of 2023.

3. Prices cool to reflect reduced demand

Since peaking in June 2022, the median price of existing homes has since depressed by 8%, to $379,100 in the fourth quarter. No one knows exactly where home prices will land in 2023, but agents we surveyed on average expect prices to decline by 7% in the first six months. The National Association of Realtors predicts prices to rise by 1% over the course of the year. However, a lot will depend on broader economic conditions and what happens with interest rates.

4. Starter-home market remains competitive

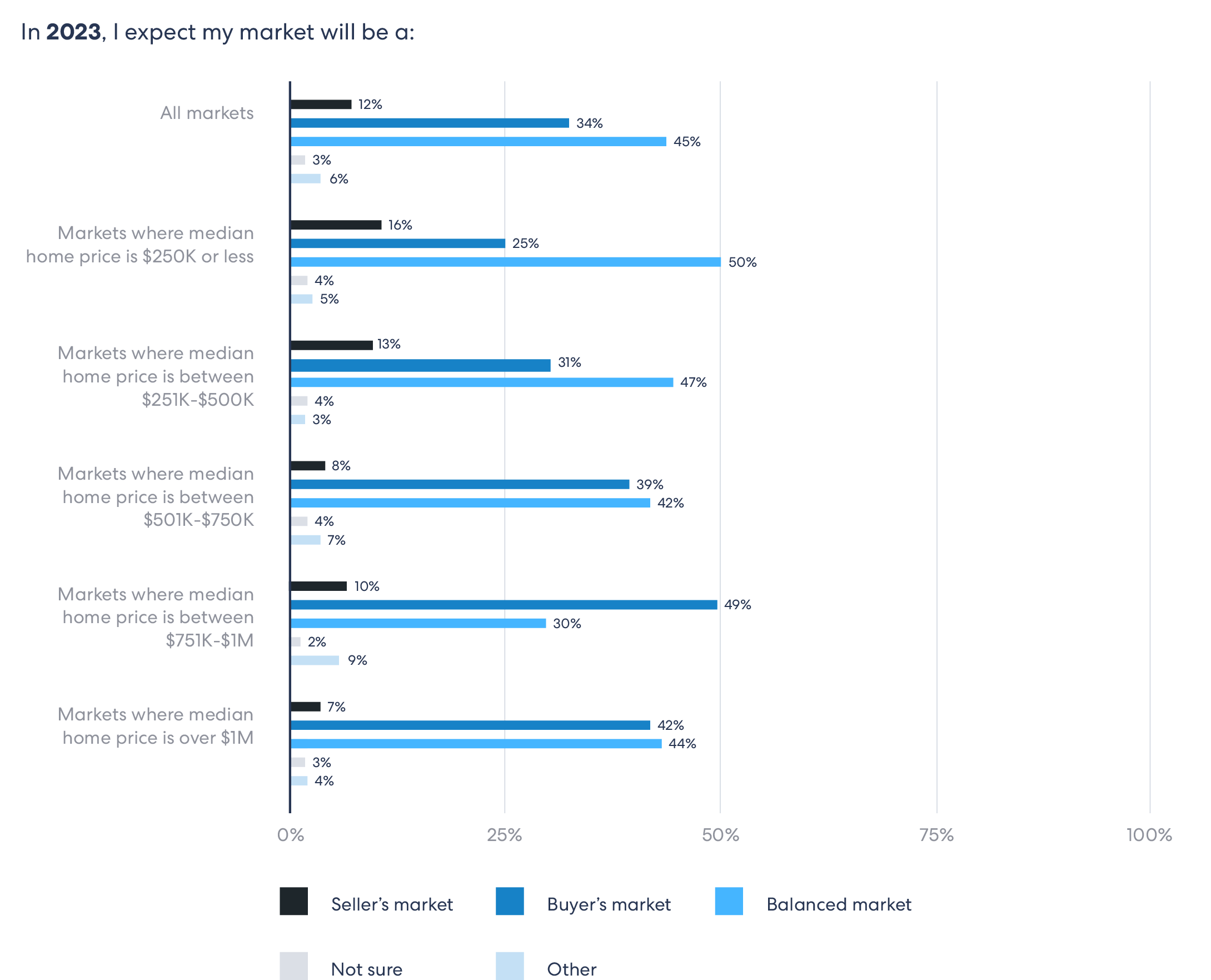

While the projected decline of home prices in 2023 may ease housing affordability overall, agents do not expect significant relief for buyers looking in the most affordable segments of the market. In fact, survey data shows that the more expensive a market is, the more likely that agents predict a buyer’s market for 2023. In the most affordable market segment (areas with the median home price under $250,000), only 25% of agents predict a buyer’s market. Meanwhile, areas with more luxury homes are seeing increases in inventory, alongside larger, move-up homes more generally. Remote workers, who have unique flexibility to respond to market shifts, are predicted to favor affordable areas when relocating in 2023.

5. Would-be sellers renovate rather than move

The seller’s market of 2020-2022 was largely fueled by low mortgage interest rates. Homeowners with mortgages could also take advantage of these low rates by refinancing to save money. Homeowners with mortgages are now less likely to sell and risk losing a favorable rate, depressing inventory.

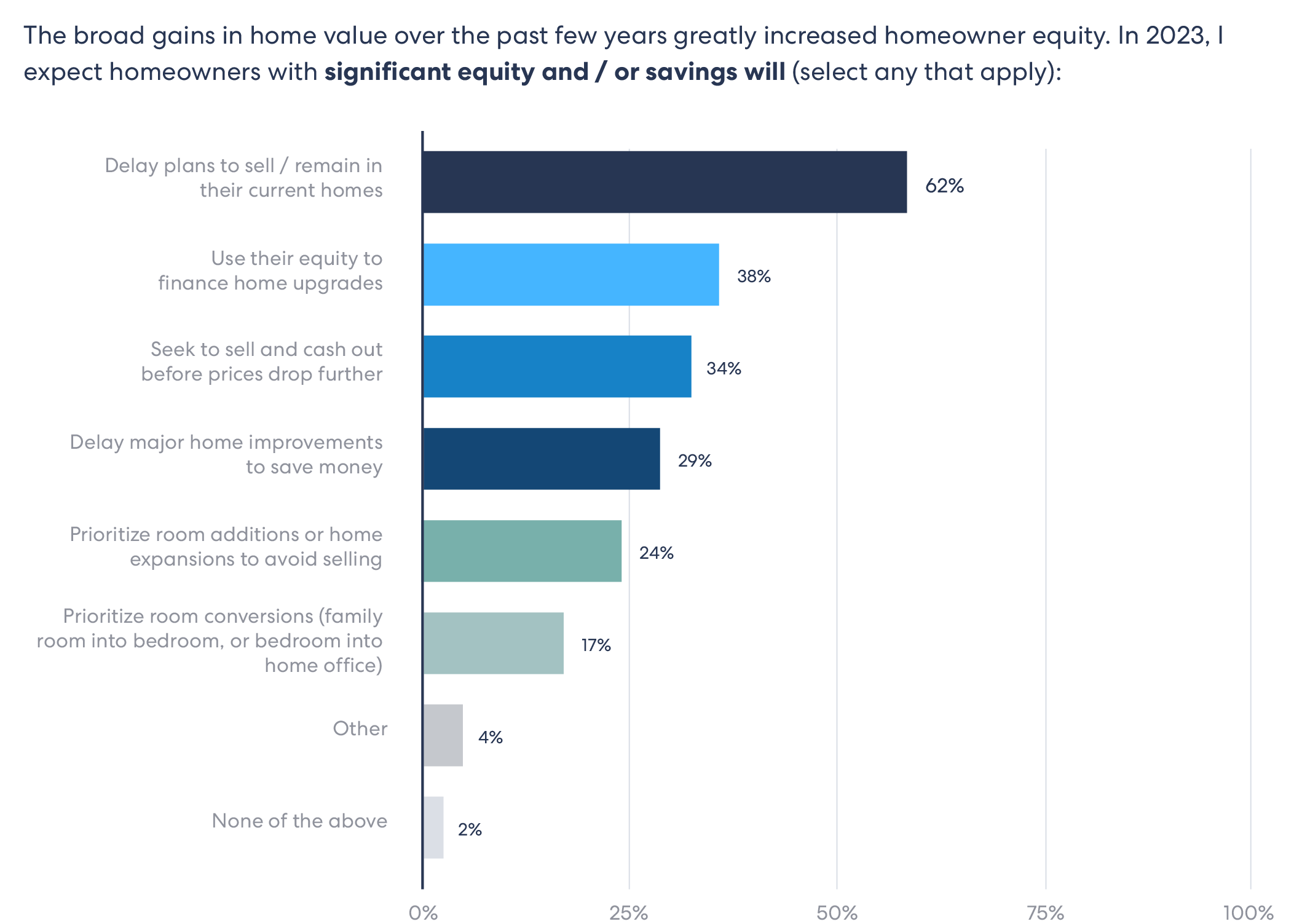

Nearly two-thirds (62%) of the agents surveyed agreed that would-be sellers would delay their plans to sell and opt to remain in their current homes. To adapt their current homes, 38% of agents predict that homeowners will use their equity to finance home upgrades; 24% predict that owners will build additions in order to avoid selling; and 17% predict that owners will convert rooms (such as a family room into a bedroom or a bedroom into a home office) to meet their needs.

6. First-time buyers face ongoing challenges

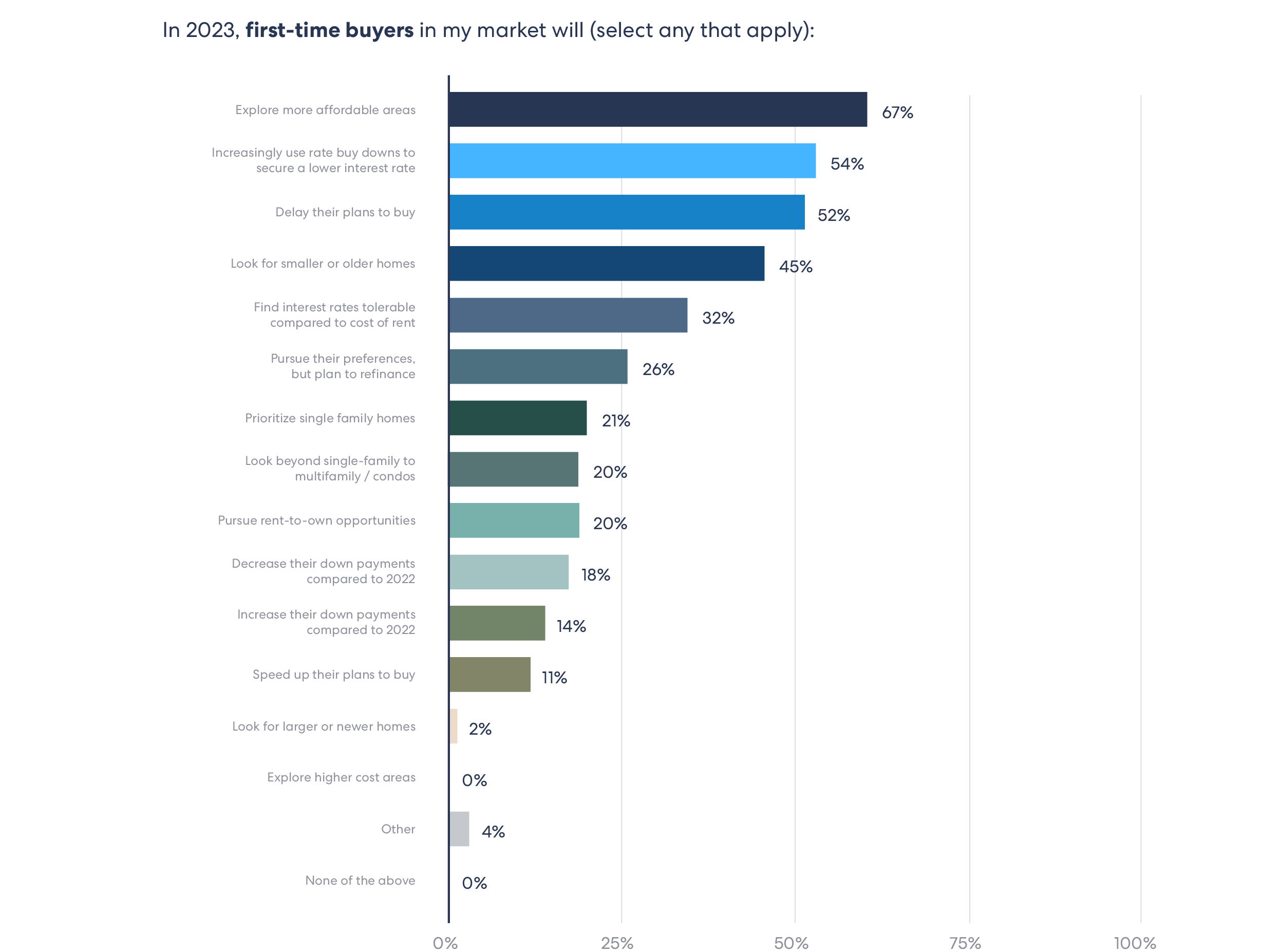

Some first-time buyers remain determined to make a purchase, our survey shows, despite an array of challenges. 26% of agents predict first-time buyers will choose not to modify their plans to buy in 2023. 32% of agents predict that first-time buyers will find interest rates tolerable compared to the cost of rent in 2023, which has also risen sharply. Many of these buyers have plans to refinance if and when rates drop.

Still, the feeling of being shut out of homeownership is leaving a psychological toll. To get a sense of the frustration many aspiring first-time buyers are feeling, we asked agents if they’ve heard clients express “hope” for a market crash. We found that over 70% reported clients expressing this sentiment. While homebuyers may not seriously wish the U.S. housing market and broader economy ill (a crash would entail a drop in home values of 20%-30%) it does indicate the sense of desperation that has grown as affordability challenges pile up.

54% of agents say that first-time buyers will increasingly use rate buy down to secure a lower interest rate. 45% of agents surveyed say that first-time buyers will look for smaller or older homes in response to market conditions as another coping strategy.