Coronavirus Casts Shadow of Uncertainty on What Would Have Been a Roaring Spring Housing Market

- Published on

-

Caroline Feeney Former Executive EditorClose

Caroline Feeney Former Executive EditorClose Caroline Feeney Former Executive Editor

Caroline Feeney Former Executive EditorCaroline Feeney was previously HomeLight's Executive Editor / Director of Content. With 7 years of real estate reporting and editing experience, she previously managed content for Inman News and co-authored a book on real estate leadership. The Midwest native holds a master's from the Missouri School of Journalism and was formerly a real estate contributor for Forbes.

As recently as the third week of February, all signs pointed to a robust seller’s market dominating the first quarter of 2020. Recession worries appeared to be firmly planted in the rearview. This spring was set to be busier than last year. However, in a quick about-face, top agents have softened their projections and outlook for the year amid concerns over how the coronavirus outbreak will impact real estate.

Everything was coming up roses for housing in February. Three weeks later, it’s a whole new world.

Between Feb. 17 and Feb. 23, 2020, HomeLight sent out a survey to top agents nationwide asking them the same series of recurring market-related questions that we do every quarter regarding the state of inventory, home prices, interest rates, and whether they’d characterize their market as favoring buyers or sellers. Building on their general optimism in Q4 2019, agents appeared to be extremely confident that housing in 2020 was off to a strong start, even stronger than last year.

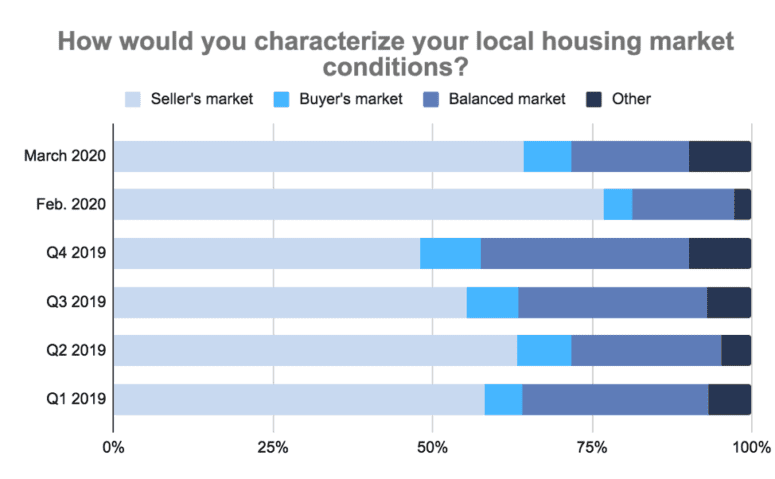

At the time of the February poll, reports of a seller’s market were up 33% year over year, from 58% in Q1 2019 to a dominating 77% in Q1 2020. The percent of top agents who said they believed home values would rise over the next six months had nearly doubled over Q4.

Meanwhile, 94% of top agents (compared to 79% in Q4 2019 and 70% in Q3 2019) reported that low rates were boosting buyer activity in their market, and 62% of agents said that bidding wars were becoming more frequent, up from 19% in Q4 2019. It seemed that a perfect combination of low rates and scarce supply would stoke another round of fierce competition over available homes and drive up prices once again.

However, not long after closing the survey did news of the rapidly expanding coronavirus on U.S. soil start to change just about every aspect of life. In response to the fast-evolving situation, HomeLight sent out a second “Flash Poll” between March 13 and March 17, 2020, with a combination of identical and brand new questions to the same list of top agents who were invited to participate in the first round.

About three weeks later, the sentiment among top agents is noticeably different based on HomeLight’s comparative data.

The percent of top agents characterizing local conditions as a “seller’s market” dropped from 77% to 64%.

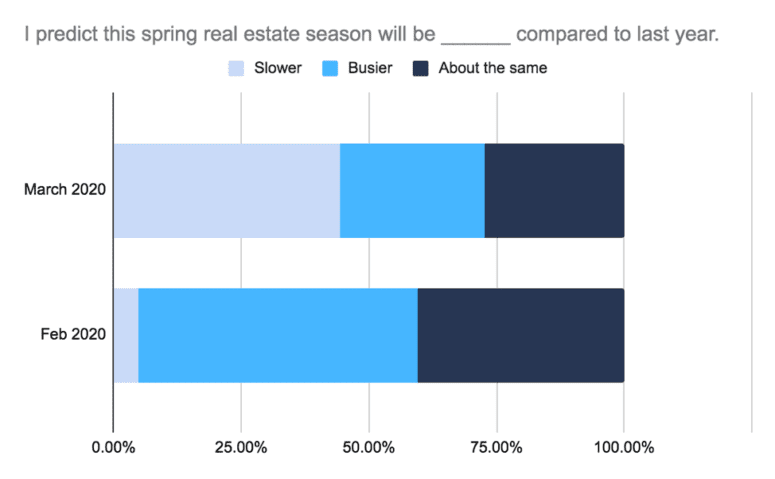

In February, only 5% of top agents predicted that the 2020 spring real estate season would be slower than last year but that number jumped to 44% in the new March poll. In the same vein, the percent of agents who expected home values to rise over the next six months dropped from 65% in February to 25% in March.

Bidding wars have lost a bit of steam as well. While 62% of top agents said that bidding wars were on the rise in February, that number declined to 40% in March. At the same time, the power of low mortgage rates is being put to the test. Although 94% of agents originally reported that low mortgage rates were boosting buyer demand in their market, as of March, a more modest 80% of agents say current rates are still encouraging buyers to get out there.

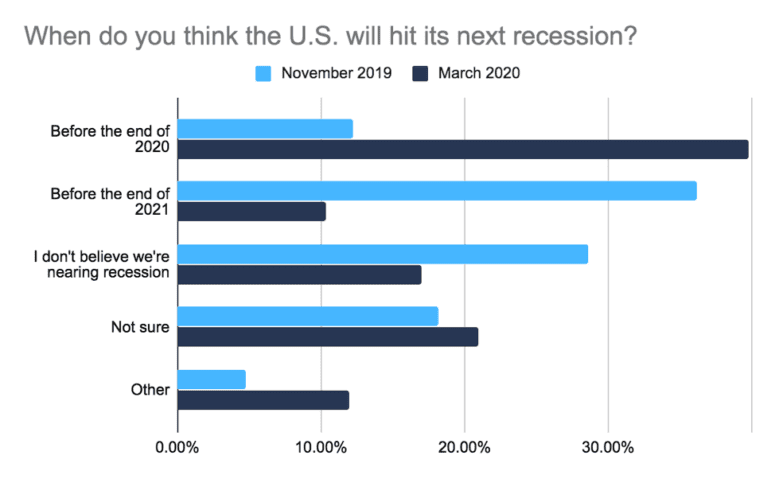

Lastly, the coronavirus delivered a hit to top agent sentiment. The percent who predict the U.S. will hit its next recession in 2020 has more than tripled between November and March, from 12% to 40%. Optimism is down as well. While 76% of agents reported feeling extremely or somewhat optimistic about 2020 in Q4 2019, a smaller 56% of agents maintain that same confidence as of the latest poll.

What’s clear is that as the entire U.S. economy enters a vulnerable position, real estate will be impacted. However, one silver lining is that, unlike 2008, the housing market is unlikely to be in the eye of the storm. As Chief Economist of the National Association of Realtors, Lawrence Yun, said in a statement on March 15, 2020: “During the last recession, real estate was on wobbly ground with loose lending and too much supply. Today, there is no subprime lending and too little supply. The real estate market will hold on much better.”

Indeed, of all the market indicators HomeLight polled agents on, inventory remains the most unchanged (73% of agents said inventory was lower than expected in February, compared to 70% in March). Only time will tell if buyer hesitation on a grand scale will tip the scales, and by how much.

How the coronavirus is changing homebuyer and seller behavior

As health concerns rise, governments encourage residents to stay indoors, restaurant and school closures are announced across the country, and the nation goes into social distancing mode, some buyers and sellers have no choice but to take a step back.

So far, buyers appear most likely to press the pause button.

HomeLight’s March 2020 Flash survey also asked agents to report how they are seeing clients react to the coronavirus outbreak specifically. While homes remain a critical asset, the data shows that the pandemic could have an immediate chilling effect on the housing market.

Since the escalation of the coronavirus in the U.S., 41% of agents say they’ve seen seller activity decline in their market, while 45% have seen buyer activity slow down in their market. Among those sellers forging on, 66% are taking measures of some kind to protect their home — 32% are halting open houses in favor of a showings-only policy, while 21% are asking buyers to wash their hands or use hand sanitizer.

Meanwhile, 22% of respondents have seen sellers take their home off the market in response to coronavirus concerns. Perhaps most strikingly, the majority, or 52%, of top agents have seen buyers put their home search on hold. Highlighting a trend happening in the business world as more employees work from home, nearly 20% of top agents have seen an increase in the demand for virtual showings amidst the coronavirus outbreak.