Should I Sell My Home to a ‘We Buy Houses Anywhere’ Company?

- Published on

- 15 min read

-

Richard Haddad, Executive EditorClose

Richard Haddad, Executive EditorClose Richard Haddad Executive Editor

Richard Haddad Executive EditorRichard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

-

Sam Dadofalza, Associate EditorClose

Sam Dadofalza, Associate EditorClose Sam Dadofalza Associate Editor

Sam Dadofalza Associate EditorSam Dadofalza is an associate editor at HomeLight, where she crafts insightful stories to guide homebuyers and sellers through the intricacies of real estate transactions. She has previously contributed to digital marketing firms and online business publications, honing her skills in creating engaging and informative content.

A tough life change — a divorce, sudden financial strain, or an unexpected inheritance — can make a home sale particularly challenging, especially when the property requires extensive repairs. In these instances, “We Buy Houses Anywhere” companies could be just what you need. These businesses offer an easy, no-fuss way to sell your home fast, making all-cash offers, often for distressed homes.

With cash offers on the table, you won’t have to worry about expensive remodeling projects or lengthy transactions. However, the big question is, is it the right choice for you?

In this post, we’ll explain the process, the pros and cons, and provide expert insights to help you determine the best route for your unique home-selling journey.

Should I sell to a ‘We Buy Houses Anywhere’ company?

Deciding on the best avenue for selling your home isn’t a decision to be taken lightly, particularly when you’re weighing the pros and cons of engaging with a We Buy Houses company. For some sellers, it’s a lifeline, offering an efficient, straightforward way to bypass the traditional property market.

A house-buying company may be a fitting solution if you’re facing one of these situations:

- Urgent relocation needs: A new job, divorce, or other life change demands an immediate move, and you don’t have the luxury of time.

- Costly repairs required: Your home needs major repairs, and you either can’t afford them or don’t want to deal with the hassle.

- Financial distress: You’re facing financial challenges and need to liquidate assets quickly to alleviate your burden.

- Foreclosure solution: You’re on the brink of foreclosure and are searching for a quick solution to dodge further credit damage.

- Estate sales: You’ve inherited a property and want a simple way to sell without navigating the traditional market.

- Landlord fatigue: Handling a rental has become too much of a hassle, or a difficult tenant has made keeping the place more trouble than it’s worth.

- Discreet home sale preference: You value your privacy and prefer to sell off-market.

- Life transitions: Age or health-related concerns prompt homeowners to downsize and move to a care facility or a relative’s home, making selling the current property swiftly a priority.

- Out-of-state ownership: You own a property in a location where you no longer reside and want to sell from out of state quickly without the need to travel back and forth.

If any of these scenarios resonate with your current situation, partnering with a We Buy Houses company might just be the answer you’re looking for.

While these reasons make a compelling case, there are still factors to explore so you can make a confident, informed decision.

Can I trust a We Buy Houses company?

The world of house-buying is vast and varied. Like in any industry, some operate with integrity, while others seek shortcuts at others’ expense.

Real estate expert Garri Tigranyan is the founder of CashNvestors and has a rich history of buying and flipping properties and helping home sellers. He sheds some valuable light on the issue.

“There are good people out there,” he says. “There are good companies […] that are ethical and moral. But there are also bad companies out there that portray themselves to be real estate investors.”

Beware of wholesalers

In the house-buying industry, you may encounter wholesalers, companies that act as middlemen. Instead of buying the home themselves, they assign the contract to the end buyer and make a profit from the difference.

Tigranyan explains: “Sometimes, home sellers get stuck with wholesalers that try to tie up a project under a contract and then sell it off to a real buyer like ourselves.”

Wholesalers may present themselves as being the same as other cash buyers, but they don’t actually have the money to close on a property. Tigranyan, who serves nearly 100 cities in California, says he’s seen “hundreds of times” when homeowners are left with empty promises and wasted time because of a wholesaler.

Unscrupulous players may also use pressure tactics to take advantage of your urgent situation. Tigranyan says it’s vital to vet companies carefully and find one with a trustworthy reputation.

His company, part of HomeLight’s Simple Sale network, takes a high-integrity approach:

“Number one: treat every client as you want to be treated. No one gets taken advantage of,” Tigranyan explains.

“I’ve seen both sides of the industry. When I go home to my kids and my wife, I want to sleep with peace of mind that, ‘You know what? I really did take care of this person. I did the right thing.’ I’m a firm believer in (the Golden Rule) ‘Do unto others as you would have them do unto you.’”

If you shop around, you may find company owners like Tigranyan, who prioritize helping others over profits and maintain hands-on involvement in property progress. HomeLight’s Simple Sale platform connects you to one of the largest networks of trusted cash buyers in the U.S.

What kind of companies buy houses?

For homeowners considering a cash sale, understanding the different types of house-buying companies is vital. Each has its unique purposes, strengths, and best practices for purchasing properties. Here’s a closer look at the variety of companies you might encounter in your journey:

- Franchisors: Operating under recognizable brand names, these companies purchase homes in their current state, renovate them, and then either sell or lease them out. Examples include We Buy Ugly Houses, HomeVestors, and We Buy Houses.

- House flippers: These savvy investors search for homes that need repairs, invest in renovating them, and then resell them as fully upgraded properties. Examples include FortuneBuilders, FlipSplit, and FlippingJunkie.

- Buy-and-hold investors: Focusing on the long game, these companies or individuals buy houses and convert them into rental properties, seeing them as long-term assets. Examples include Invitation Homes, Tricon Residential, American Homes 4 Rent, and Progress Residential.

- Trade-in or Buy Before You Sell: Catering to homeowners looking for a seamless transition, these companies purchase your current home, often providing options that unlock your home’s equity to help you buy a new property without the usual financial constraints. Examples include HomeLight Buy Before You Sell, Flyhomes, Orchard Move First, and Knock.

- iBuyers: Revolutionizing the market with tech-driven solutions, instant buyers or iBuyers utilize automated valuation models (AVM) to present all-cash offers. They often present more competitive offers than franchisors or house flippers and make profits through volume. Additionally, they typically charge a service fee ranging from 5% to 6% of the home’s sale price. Examples include Opendoor and Offerpad.

As you navigate the selling process, it’s crucial to recognize which type of company aligns best with your priorities, goals, and the unique circumstances of your property. Each category has its advantages and potential drawbacks, so always do thorough research before making a decision.

How much do We Buy Houses companies pay?

Understanding how much a We Buy Houses company will offer for your home is a nuanced process. The final figure can vary significantly based on several factors, including the specific company you’re working with, your property’s location and condition, and broader market dynamics.

The core distinction between house-buying companies and traditional buyers is motivation. While a regular homebuyer might see value in subjective aspects like a home’s proximity to amenities or its aesthetic appeal, house-buying firms primarily aim for profit. So, expect a lesser amount from a cash-for-homes company than what the open market might bring.

The 70% rule is often cited

Many We Buy Houses companies apply the 70% rule, meaning they’ll offer you about 70% of your home’s after-repair value (ARV), minus their estimated repair costs.

Here’s an example of what a simplified formula might look like:

(Your home’s ARV x .70) – repair costs

To see how the 70% rule might work in a real-world scenario, let’s take a look at an example offer equation. Let’s say your home could sell for $450,000 after repairs, but it’s going to need $30,000 of work to get there. The computation will look like this:

($450,000 x .70) – $30,000 = $285,000

In this example, a We Buy Houses company might offer you around $285,000 for your home.

The 70% rule does not always apply

While the 70% rule is regularly used as a benchmark for estimating what sellers might receive, it’s not a consistent standard. The actual figures can deviate significantly.

Some house flippers might offer as little as 50% of ARV, while certain national iBuyers are known to pay up to 85% or even more.

Tigranyan highlights the complexities in this calculation. He notes that the vast range of influencing variables makes it challenging to set a consistent percentage expectation. “Homes could sell for X amount of dollars on one street, and the next street over could sell at a different price,” he explains.

Exaggerated costs from predatory companies

While some homeowners might find a decent deal with house-buying firms, particularly if they prioritize speed and convenience over maximizing profit, caution is essential. Not all players in the industry operate ethically. Some predatory firms might attempt to exploit sellers by inflating repair cost estimates or making unjustifiably low offers.

Importance of multiple home value sources

Tigranyan cautions sellers: “Sometimes sellers look at websites like Zillow or Redfin, and they might think that’s what the property is worth, but that’s not always the case. That’s just the starting point.

Zillow doesn’t know the condition of your house. It’s just a big driven data piece. They don’t know you might have a roof that needs to be replaced. You might need to replace the plumbing. Zillow doesn’t know the condition of the house, interior, or exterior.”

For sellers aiming to make an informed decision, conducting independent research is crucial. You can check one source now by using HomeLight’s Home Value Estimator.

Additionally, reaching out to a seasoned real estate agent for a comparative market analysis (CMA) can provide valuable expert insights. CMAs, which many agents offer for free, offer estimated property valuations based on recent sales of similar homes (called comps) in the vicinity.

»Learn more: How to Find Comps for My House: An Illustrated Guide

How fast can I sell my home to a house-buying company?

The speed at which you can sell your home to a We Buy Houses company can vary widely based on the company and your specific circumstances. However, one of the major selling points of these firms is their ability to close deals much more swiftly than traditional sales. In general, you can expect to sell your home in a matter of days or weeks, compared to the months it can take to sell on the open market.

Tigranyan, with his extensive experience, sheds light on this topic, emphasizing the flexibility his company offers.

“First, we like to understand what timeframe the seller needs,” he explains. “Every seller is different. For instance, I had one in Baldwin Hills (in Los Angeles County) who wanted their escrow to close in 60 days. On top of that, they requested an additional 30 days post-closing to move out.”

A reputable company will strive to align with the seller’s needs and expectations, including more urgent needs.

“With all the paperwork in order, we’ve managed to close deals in as short as five days,” Tigranyan says.” However, the specific timeline often varies, sometimes stretching to 30 days or more, depending on the seller’s preferences.”

In essence, while a rapid five-day closing is possible with companies like Tigranyan’s, the timeline will typically be tailored to suit the homeowner’s requirements. Whether you’re seeking speed or a more measured approach, these companies offer flexibility to accommodate a wide range of needs.

Pros and cons of using a We Buy Houses company

Navigating the decision to use a We Buy Houses company comes down to weighing the pros and cons. On one hand, you may find the speed and convenience of selling without repairs appealing. On the other hand, you may get a lower offer.

Pros of using a We Buy Houses company

For homeowners in a hurry or a tight spot, the allure of a house-buying company often centers around speed and the assurance of a sale regardless of the property’s condition. Below is a summary of the most significant advantages:

- Quick sale: These companies can close deals within days or weeks, providing immediate financial relief for homeowners.

- No repairs needed: Sellers don’t have to spend money or time on repairs or renovations since the company buys the property as-is.

- No commissions or closing costs: Unlike traditional sales with agents, there are no commission fees, and often no closing costs.

- Flexible closing date: As Garri Tigranyan mentioned, sellers have the leverage to decide the closing timeline based on their convenience and needs.

Cons of using a We Buy Houses company

However, while there are evident perks, homeowners must also recognize the drawbacks. The most notable of which is receiving less than market value for the property. Here’s a snapshot of the potential downsides:

- Lower offers: Typically, these companies will offer less than market value since their primary aim is to turn a profit, and they handle all repairs and paperwork.

- Little or no negotiation power: Unlike traditional sales, there’s minimal room for negotiation on price and terms.

- Hidden fees: While rare, some companies might charge unexpected fees or costs that aren’t transparent initially.

- Pressure tactics: Some unscrupulous players may apply pressure tactics to take advantage of your urgent situation. There is also a risk of falling victim to a house-buying scam. You’ll want to seek out an established, reputable company.

The process of selling to a house-buying company

The process of selling to a We Buy Houses company is straightforward. Here’s a snapshot of what you can expect:

- Submit your property details: Start by providing the house-buying company with basic information about your home. This typically includes its location, size, age, and current condition.

- Get a home evaluation: The company will assess your home either in person or virtually. This helps them understand its value and the cost of any repairs or renovations required.

- Receive an offer: Based on the evaluation, the company will present you with a cash offer. This is generally a take-it-or-leave-it proposition, with little to no room for negotiation.

- Accept or decline: You decide whether to accept the offer. If you agree, the company will start the paperwork and handle most administrative details.

- Close the sale: Choose a closing date that aligns with your needs. Once everything is finalized, you’ll receive cash for your home, typically through a wire transfer or a check.

Tigranyan says his company works hard to keep sellers informed every step of the way. “One of the things regarding the process is that sellers want to know that everything is fully transparent. They’re obviously kind of on their tippy-toes when meeting a stranger who’s going to buy one of their biggest assets.”

He explains that a reputable company will make sure you feel at ease and present options that make sense in your situation. “You have to listen to them, figure out what the reason is for them to sell, and you have a solution for that.”

Some top ‘We Buy Houses Anywhere’ companies

When considering a quick sale of your home, it’s essential to know the major players in the industry.

Below is a list of reputable ‘We Buy Houses Anywhere’ companies that have established a national presence. These companies offer homeowners the flexibility to sell their homes regardless of their location.

- HomeVestors / We Buy Ugly Houses®

- Simple Sale (a HomeLight platform)

- We Buy Houses

- Express Homebuyers

- HomeGo

- MarketPro Homebuyers

- Sundae

- Opendoor (National iBuyer)

- Offerpad (National iBuyer)

»Learn more about each of these national companies in our post: 9 of the Top Companies that Buy Houses for Cash in 2023

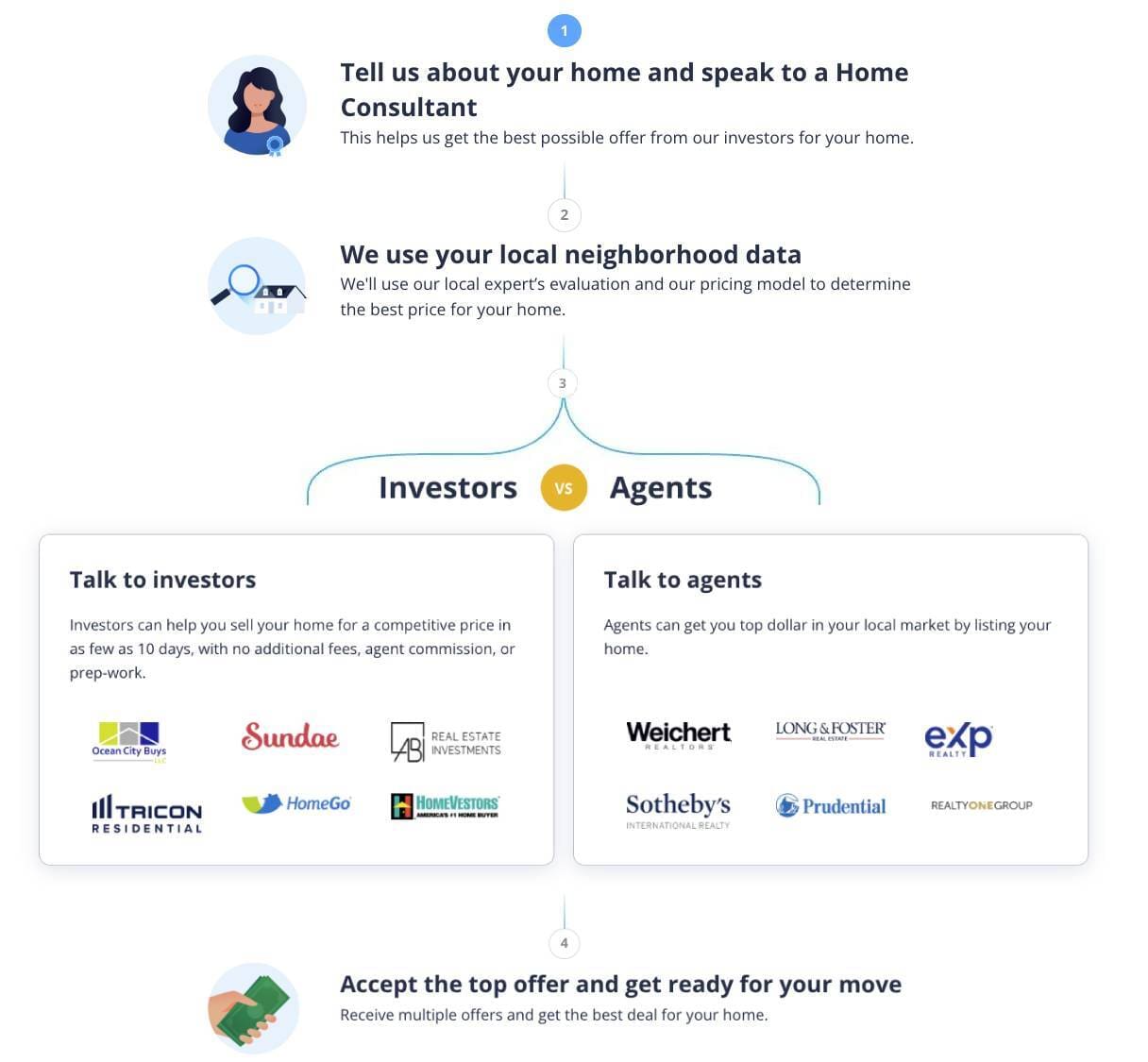

How does HomeLight Simple Sale work?

Simple Sale is an all-cash offer platform created by HomeLight. It takes the stress and uncertainty out of selling your home. This free online tool provides a competitive, no-obligation cash offer to buy your home.

On top of this, Simple Sale compares your cash offer amount with an estimation of what a seller would likely receive if they chose to list their home instead.

Here’s the easy four-step Simple Sale process:

As an added value, Simple Sale also recommends top-rated real estate agents in your area based on transaction data. The online platform reveals which agents sell the most in your market and price range, so as a seller, you can be more empowered and informed, whether you choose to list with a top local agent or sell to a We Buy Houses company.

HomeLight’s Simple Sale platform can provide cash offers for homes nearly anywhere in the U.S. and in almost any condition.

Simple Sale testimonial

“Thanks to HomeLight, I was able to sell my home quickly and without any hassle. I was very skeptical at first because of all the many ‘we buy houses for cash’ [companies] that are out there nowadays, but I am thankful that I decided to give them a try. I didn’t need to do any repairs, and we closed on my timeline. This was the absolute best decision that I could have made. Thank you HomeLight, and I will recommend you to my family and friends.”

— Karen S. from Olive Branch, Mississippi

A top agent may still be a good option

Though it may seem unconventional in a We Buy Houses Anywhere story, selling your home with an agent can be a fairly fast and smooth transaction with the right professional and in a favorable market. Strategic pricing and top-notch marketing can yield higher selling prices. HomeLight data indicates that the top 5% of agents achieve prices up to 10% higher than average agents.

For those leaning toward a We Buy Houses company, consulting an agent ensures a well-informed decision. HomeLight can connect you with a leading agent in your market.

Key takeaways

- Fast, straightforward transaction: We Buy Houses companies offer convenience and speed, but it’s essential to do your homework to ensure a fair deal.

- Multiple offers: Not all We Buy Houses companies offer the same prices. Many factors determine the price they’ll pay for your home. It’s wise to shop around companies before you commit.

- Speedy closing: Many house-buying companies can close in as little as five to seven days, but the timeline largely depends on the seller’s preferences.

- Lower offers: While selling to these companies eliminates the need for home repairs and preparations, and provides a quick sale, you might not fetch the market value for your property.

- Due diligence: There are reputable and transparent We Buy Houses companies, but it’s essential to be wary of predatory companies that might take advantage of uninformed sellers.

- Home value insights: It’s essential to understand your home’s market value to evaluate offers effectively.

If you’re considering selling to a We Buy Houses Anywhere company, it’s prudent to gather multiple offers and carefully weigh your options.

“I would suggest talking to, maybe, one or two referenced home buyers who have a track record and get an idea of what someone else might pay for your house, then you make that educated decision,” Tigranyan says, and reemphasizes, “Make sure you deal with a real home buyer. There are a lot of wholesalers out there. Be careful of that.”

It can also be a good idea to consult with a top agent who can provide expert insights on how soon and for how much your property might sell on the open market.

At HomeLight, we’re happy to lend a guiding hand in navigating your real estate journey. Let us help you make an informed and confident decision, whether you’re looking for a no-obligation cash offer through a trusted platform like Simple Sale or seeking to consult with a top agent.

Header Image Source: (Harry Thomas/ Pexels)