One of the biggest questions when buying a home is: ”How much should I put down?” Our House Down Payment Calculator can help you find your Goldilocks amount by showing how your choice affects your upfront costs now and your monthly mortgage payments for years to come.

With a few quick entries, you can estimate a ballpark monthly payment based on different down payment percentages and interest rates.

How Much Do Buyers Usually Put Down?

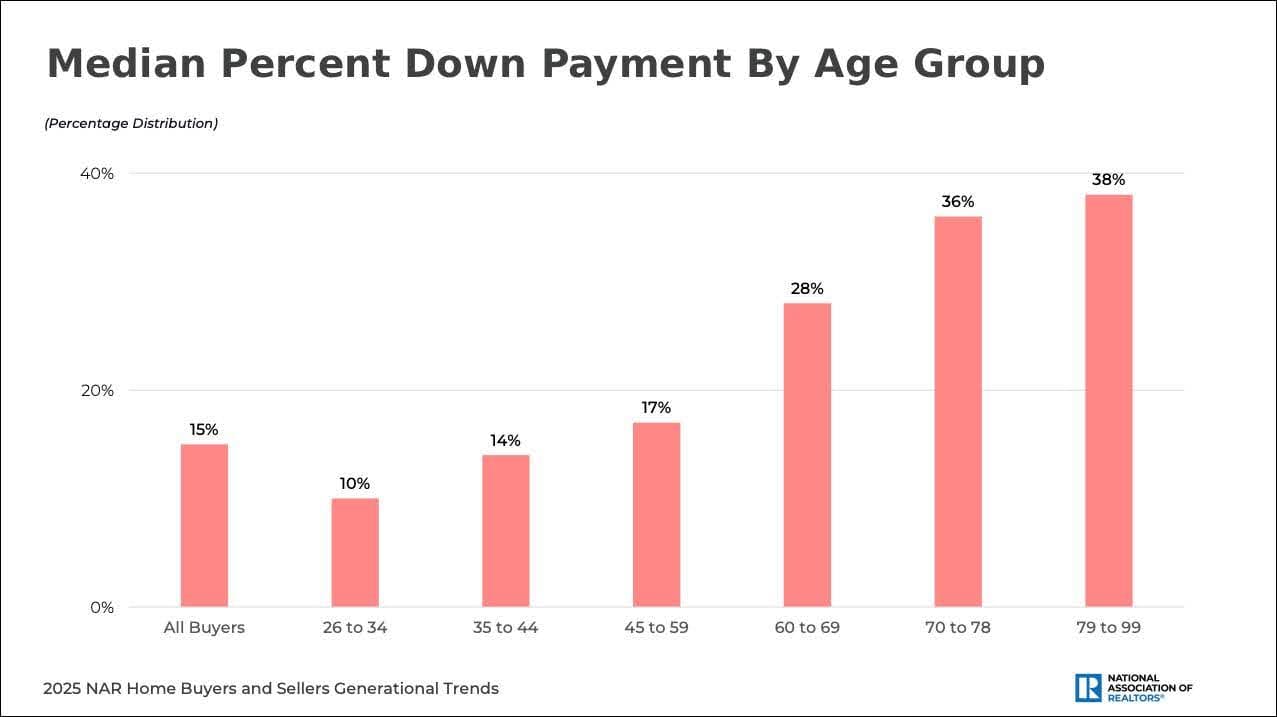

The standard down payment has often been considered 20%, but many buyers today put down less. According to data from the National Association of Realtors (NAR), the median down payment for all U.S. homebuyers is 15%. First-time buyers put down 8%–9%, while repeat (often older) buyers put down 19%–23% or more, typically because they’ve built equity in a previous home. The NAR chart below breaks down the median house down payment percentage by age group.

Down payment assistance programs: Many buyers qualify for national or state-level down payment assistance programs. To explore options in your area, search online for a HUD-approved housing counselor near you or visit its state-by-state resources page. You can also check out HUD’s guide to buying a home.

How Your Down Payment Affects Monthly Payments

As our calculator demonstrates, your down payment directly impacts the size of your loan. The larger your down payment, the less you need to borrow, which means lower monthly payments.

For example, putting 20% down on a $400,000 home reduces your loan amount to $320,000. At today’s interest rates, that could lower your monthly principal and interest payments by hundreds of dollars compared to a smaller down payment.

Our calculator uses a 30-year fixed loan, since more than 90% of U.S. homebuyers choose this option. Keep in mind that your actual monthly payment will also include property taxes, homeowner’s insurance, and possibly private mortgage insurance (PMI).

What Happens If You Put Down Less Than 20%?

If you buy with a down payment below 20%, your lender will typically require private mortgage insurance (PMI). This is an added monthly cost designed to protect the lender, not you, in case of default.

The good news: PMI doesn’t last forever. Once you reach 20% equity in your home, you can often request to have it removed, reducing your monthly payment. And many buyers successfully purchase homes today with less than 20% down, especially through FHA loans or conventional low-down-payment programs.

Here are some additional HomeLight resources to learn more:

When Is a House Down Payment Due?

You don’t pay your down payment when you first make an offer. Instead, it’s typically due at closing — the final step in the homebuying process. That’s when your lender, title company, or closing attorney will collect the funds and apply them toward the purchase price of your home.

Until then, you’ll usually only need to provide earnest money after your offer is accepted — a good-faith deposit that shows sellers you’re serious about buying their home. This is separate from your down payment and held in escrow until closing.

On closing day, your earnest money deposit is credited toward the down payment and closing costs.

Estimate Your Earnest Money Deposit

Use our Earnest Money Calculator below to see typical deposit amounts based on the price of the home you’re considering.

Planning for both your down payment and earnest money deposit will give you a clearer picture of your upfront costs.

Tips For Buyers

When deciding how much to put down, keep these points in mind:

- Look at your full budget: Make sure you’ll still have funds for closing costs, moving expenses, and an emergency cushion.

- Compare loan programs: FHA, VA, USDA, and some conventional programs allow for lower down payments with different requirements.

- Balance flexibility and savings: A bigger down payment reduces monthly payments, but a smaller one may keep more cash in your pocket for renovations or reserves.

- Think about market competitiveness: In hot markets, a larger down payment can help your offer stand out to sellers.

- Take advantage of government programs: Depending on your situation, you may qualify for government-backed home-buying assistance programs.

Partner With a Top Agent to Find Your Next Home

Your down payment plays a huge role in shaping both your upfront costs and your long-term, month-to-month budget. The key is finding an amount that works for your finances today while setting you up for stability tomorrow.

Ready to take the next step? Run the numbers using our house down payment calculator and other tools, then connect with a top-rated agent using HomeLight’s free Agent Match platform.

A top agent can guide you on the best strategy to buy a home in your selected market. Our free tool analyzes nearly 30 million transactions and thousands of reviews to determine which agent is best for you based on your needs.

If you’re trying to buy and sell a home at the same time, check out HomeLight’s innovative Buy Before You Sell program. This modern solution unlocks your equity to streamline the process. Make a non-contingent offer on your new home and only move once. Watch this short video to learn more.