Where to Start When Buying A Home: Your First 7 Steps, Explained

- Published on

- 12 min read

-

Eileen Wubbe, Contributing AuthorClose

Eileen Wubbe, Contributing AuthorClose Eileen Wubbe Contributing Author

Eileen Wubbe Contributing AuthorEileen Wubbe is a New York-based writer and editor covering finance and real estate.

-

Jedda Fernandez, Associate EditorClose

Jedda Fernandez, Associate EditorClose Jedda Fernandez Associate Editor

Jedda Fernandez Associate EditorJedda Fernandez is an associate editor for HomeLight's Resource Centers with more than five years of editorial experience in the real estate industry.

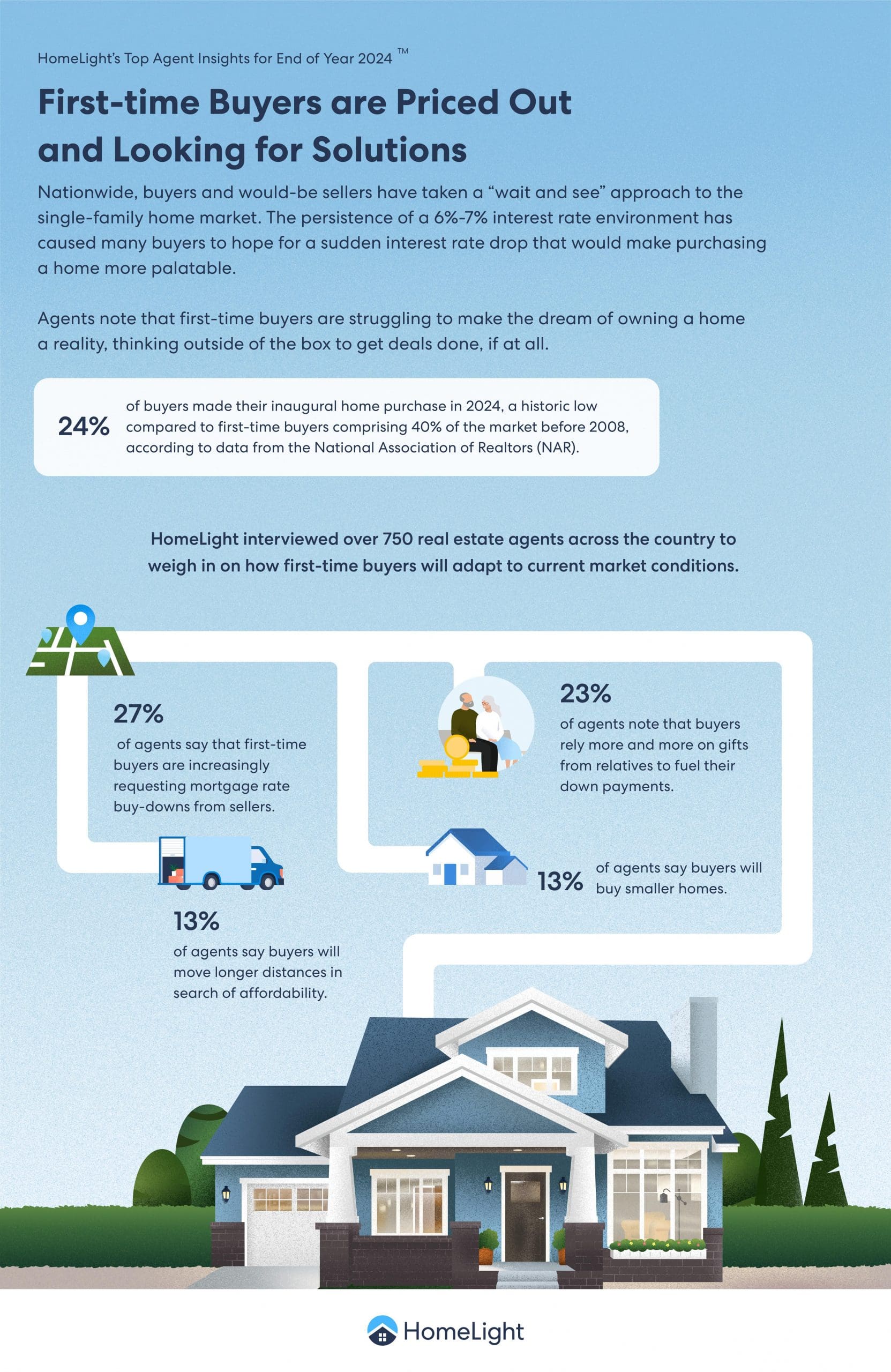

The skimpy heat and dreadful-looking carpeting in your apartment have finally worn thin, and you’ve decided it’s time to buy a house. You’ve scrolled through listings and researched neighborhoods way past your bedtime. Maybe you’ve even opened a savings account and have made steady progress toward saving for a down payment.

While homebuying seems daunting, you feel ready to jump in. Your rental lease is up in four months — now is the time to begin! But, what exactly happens next? What is the first step in buying a home? In this step-by-step guide, we’ll walk you through the first 7 steps in your homebuying journey so you’ll know where to start when buying a home.

Step 1: Save for your down payment and closing costs

While putting 20% down is known to be the standard amount for a down payment when buying a home, there are other options that allow you to put down much less or even nothing at all, with some caveats.

Regardless, plan to save more than you think you’ll need when buying a home because you’re saving for more than just the down payment — you need to consider the costs of mortgage insurance, closing costs (between 2% and 5% of the purchase price), and any unexpected homeownership costs.

Sample down payments

To get an idea of what a down payment translates to dollar-wise, we’ve mapped out down payments for three different price points.

20% down payment

$400,000 purchase price – $80,000 down

$500,000 purchase price – $100,000 down

$600,000 purchase price – $120,000 down

5% down payment

$400,000 purchase price – $20,000 down

$500,000 purchase price – $25,000 down

$600,000 purchase price – $30,000 down

For those with a conventional mortgage who do not put 20% down, they will have to purchase private mortgage insurance (PMI). In the event that the homeowner can no longer pay their monthly mortgage, PMI is a policy that protects the lender.

Lenders will choose a PMI company on your behalf (usually the most cost effective option) and will require ongoing monthly payments, full payment at closing, or a combination of both. The amount can range between 0.5% and 1% of the loan amount annually. So, for a $500,000 house with a 5% down payment, your PMI would be about $4,750 annually if your PMI is 1% of your loan amount.

The good news is that PMI won’t last forever and it can be canceled (with some qualifications) once your loan-to-value ratio, or your loan amount balance divided by your house’s market value, ends up lower than 80% of the original appraised value.

There is not a one-size fits all approach when considering whether to put down 20% or to make a smaller down payment and purchase PMI.

“The biggest pro of having PMI is that you don’t have to necessarily come in with a large 20% down payment; you can get in with less,” shares Richie Helali, a mortgage specialist from HomeLight. “A lot of times people think, ‘Let me just wait another year or two and save 20%.’ If that person does end up saving the full 20% within those few years, by then the problem is more than likely the property price is going to be so much more. What you thought was 20% was 20% three years ago, but it’s no longer 20% now. So, you’re still in the same spot but now spending more.”

Step 2: Look into first-time homebuyer government programs and down payment assistance programs

The next step on your list of where to start when buying a home is to check your eligibility for certain assistance programs. There are more than 2,500 down payment assistance (DPA) programs across the U.S., most run by state, county, or city governments. Some may require PMI or mortgage insurance premiums (MIP), high upfront fees, and have special requirements, so be sure to do your research.

“Lenders have programs where they can help you with down payment assistance,” explained Saud Rai, who completes 19% more sales than the average agent in Homestead, Florida. “Work with the right people who are able to walk you through those programs.”

We’ll walk you through some of the more popular programs below.

FHA Loan

Loans backed by the Federal Housing Administration (FHA) require as little as 3.5% down and typically have lower credit qualification requirements than conventional loans. Lenders will also check your work history for the past few years and your credit history when applying for an FHA loan.

Conventional 97 Mortgage

Backed by Fannie Mae and Freddie Mac, a conventional 97 mortgage requires buyers to put 3% down and have a minimum credit score of 620. The “97” part refers to the loan-to-value ratio. In addition to the usual credit score and income check, Conventional 97 loan programs for first-time homebuyers require at least one borrower to complete a homebuyer education course, available through a HUD-approved counseling agency, and meets HUD standards for the delivery of this service.

Home Possible

If your annual income isn’t more than 80% of the Area Median Income (AMI) or a higher percentage in designated high-cost areas, a Home Possible loan by Freddie Mac might be an option, offering down payments as low as 3%. AMI is defined each year by the U.S. Department of Housing and Urban Development (HUD).

HomeReady

HomeReady helps lenders work with prospective buyers who are considered credit-worthy as long as they have a minimum credit score of 620 and meet the other requirements. For this loan, your annual income must be below 80% of the AMI in the property’s location. Additional restrictions may apply for buyers who are putting less than 5% down.

Homes for Heroes

The Homes for Heroes program allows qualifying healthcare workers, teachers, firefighters, law enforcement, military (active, reserve, and veterans), and EMS professionals to receive assistance when they are looking to buy, sell, or refinance a home. This program provides qualified community members with significant discounts through partnering with affiliated real estate agents, title and escrow services, and lenders.

USDA loans

The U.S. Department of Agriculture (USDA) offers loans for low-income borrowers in more rural areas. USDA loans feature low fees and 0% down payments for qualified borrowers. To find out if a property you are looking to purchase might be qualified for participation in a USDA program, you can use this eligibility page.

VA Home loans

If you are a service member, veteran, or eligible surviving spouse, you might qualify for a home loan benefit or other housing programs offered through the U.S. Department of Veterans Affairs. The loan is often considered the crème de la crème of loan programs because 0% down payment is required, there’s no need for Private Mortgage Insurance (PMI), and the VA home loan can be used multiple times.

Financial discipline is going to help you buy the home. If you have decent credit, you’ll most likely get a better interest rate and that’s going to be fixed interest for the 30 years of your mortgage so you’re going to reap those rewards for 30 years.

Saud Rai Real Estate AgentClose

Saud Rai Real Estate AgentClose Saud Rai Real Estate Agent at Skywalker Group of Keyes Company Currently accepting new clients

Saud Rai Real Estate Agent at Skywalker Group of Keyes Company Currently accepting new clients

- Years of Experience 8

- Transactions 699

- Average Price Point $389k

- Single Family Homes 426

Step 3: It’s time for your credit checkup

Some would argue that when it comes to considering where to start when buying a home, you should check your credit score first. A good credit score can make a world of difference in applying for a mortgage loan. The higher the score, the more likely it could be that you will receive better terms for your mortgage, thus saving you thousands of dollars over the life of the loan. Credit scores can range between 300 (poor) and 850 (excellent). Most credit scores are calculated based on your payment history, your credit utilization, credit history length, and other factors.

Check your credit score

It’s a fairly simple process to keep tabs on your credit — each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) are required by law to provide consumers with one free credit report per year. Many banking institutions also offer credit scores to their customers for free.

The three nationwide credit bureaus have a centralized website, toll-free telephone number, and mailing address, so you can order your free annual reports in one place. Here is how to order your free credit reports:

- Visit AnnualCreditReport.com

- Call 1-877-322-8228

- Complete the Annual Credit Report Request Form and mail it to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281

For a conventional loan, you’ll need a credit score of at least 620, whereas the Federal Housing Administration (FHA) requires a credit score of at least 500 to buy a home with an FHA loan, provided you put down 10%. VA and USDA programs do not have minimum credit score requirements, but your lender might have a minimum score that they require for qualification.

How credit affects interest rates

A credit score is also used to determine the interest you’ll pay on your loan. Generally speaking, the higher the score, the lower your interest rate could be. Lenders may also look at a few other factors, including your down payment amount, to determine your interest rate.

“Financial discipline is going to help you buy the home,” adds Rai. “If you have decent credit, you’ll most likely get a better interest rate and that’s going to be fixed interest for the 30 years of your mortgage so you’re going to reap those rewards for 30 years.”

To help improve your credit score, pay bills on time and strategically pay down some of your debt — credit utilization accounts for 30% of your score. If you have found errors on your credit report, having them corrected can also greatly improve your score.

Your lender will also monitor your credit score throughout the mortgage process, not just with the initial credit report that they pull. Opening new accounts, increasing your balances, or closing accounts could potentially put your loan in jeopardy. “Wait until the loan has closed and you have signed off on everything and have the keys, then go ahead and buy furniture or open a new credit card, but not prior to that,” says Rai.

Step 4: Shop around for a mortgage lender

When purchasing a home, your choice of a mortgage lender is just as important as your choice of a real estate agent. Shopping around and requesting quotes from a few different lenders could potentially save you both money and time.

“Look for a lender partner that has the ability to close on time, or even better, can offer some sort of guarantee. This will require doing upfront approval, rather than just a preapproval,” advises Helali.

“Most of the time, when buyers come to us, we recommend them to work with a certain lender because they have a good reputation,” Rai says. “When we recommend people, we have dealt with them almost 100 times and they have always delivered.” Asking your real estate agent for recommendations and comparing each lender’s terms, fees, and reviews might get you a great deal on a mortgage with only slightly more effort on your part.

Step 5: Get preapproved for your mortgage and assess how much home you can afford

Getting an underwritten preapproval for a mortgage can take as little as one business day once you submit an application and required documents to your lender. Most real estate agents will require that a client get preapproved for a mortgage before they start house-hunting because it provides an accurate picture of what the homebuyer can afford.

To get preapproved, which is different from prequalified, lenders will want to see documents such as your W-2s and 1099s, pay statements, tax returns, and bank statements. Your lender will provide a preapproval letter detailing the amount you are approved to borrow, and therefore a maximum purchase price you can shop for.

A preapproval is not a guarantee that you will qualify for a mortgage, but as long as your financial picture remains the same, it is less likely that you will be denied.

How much can you afford?

Once the lender has their hands on all of your documents, they’ll factor in your debt-to-income ratio (DTI), credit score, and the down payment you have saved to make their decision.

Your DTI is your monthly debt payments divided by your gross monthly income. This is used by lenders to determine if you would be able to afford your monthly mortgage payment. HomeLight’s Home Affordability Calculator makes it easy to get an idea of what your DTI is.

Fixed-rate mortgage vs. adjustable-rate mortgage

When getting preapproved for a mortgage, you’ll need to decide between a fixed-rate mortgage and an adjustable-rate mortgage (ARM). Understanding the differences between these two loan types can help you choose the best option for your financial situation.

Fixed-Rate Mortgages

A fixed-rate mortgage has an interest rate that stays the same for the entire loan term, whether it’s 15, 20, or 30 years. This means your monthly principal and interest payments won’t change, making budgeting easier.

Best for buyers who:

- Plan to stay in their home long-term.

- Prefer consistent, predictable monthly payments.

- Are buying when interest rates are relatively low.

Example: If you lock in a 30-year fixed-rate mortgage at 6.5%, your rate and monthly payment will remain the same for the next three decades.

Adjustable-Rate Mortgages (ARMs)

An adjustable-rate mortgage (ARM) starts with a lower introductory interest rate for a set period (typically 5, 7, or 10 years) and then adjusts periodically based on market conditions.

Best for buyers who:

- Plan to sell or refinance within a few years.

- Want a lower initial monthly payment.

- Can handle possible payment increases in the future.

Example: A 5/1 ARM means your interest rate is fixed for the first five years but will adjust annually after that based on market conditions. If rates rise, your mortgage payments could increase.

Fixed vs. ARM: Which Is Right for You?

| Feature | Fixed-Rate Mortgage | Adjustable-Rate Mortgage (ARM) |

| Interest Rate Stability | Remains the same for the loan term | Changes after the fixed period ends |

| Initial Interest Rate | Typically higher | Starts lower, then adjusts |

| Best for | Long-term homeowners | Short-term buyers or those expecting rates to drop |

| Risk Level | Low – No surprises | Higher – Rates may increase |

Tip: If you expect mortgage rates to drop, an ARM could save you money early on, but if you’re in it for the long haul, a fixed-rate mortgage offers stability.

Step 6: Hire a real estate agent

Research online, ask friends and family who they have worked with, and interview potential real estate agents to find the right fit. HomeLight’s agent search tool can match you with real estate agents who have worked with clients in situations similar to yours to purchase homes in your area.

“You should be asking about the real estate agent’s experience, especially for the local neighborhood you’re looking at, and if they work with buyers who are similar to you,” Helali says. “Just because a real estate agent works in one city doesn’t mean they’re going to be the best match for the entire city. Also, ask yourself how comfortable you are with them.”

So, what does a real estate agent do, anyway?

First-time homebuying involves a lot of emotional ups and downs, even more so in a hot real estate market. Luckily, real estate agents have the experience to guide you through the homebuying process. This includes explaining the mortgage process and available down payment assistance programs, as well as showing you homes in your area that are within your price range.

They will also help you evaluate the pros and cons of the homes you’re interested in, negotiate a winning offer, schedule inspections, and support you through the closing process.

Should you use a real estate agent or buy solo?

Some homebuyers consider purchasing a home without a real estate agent, either to save on commission fees or because they believe they can handle the process alone. However, buying a home is a complex financial and legal transaction, and working with an experienced agent can provide key advantages.

Advantages of using a real estate agent

- Expert market knowledge – Agents provide local market insights and help you find the best home within your budget.

- Negotiation skills – A skilled agent can negotiate on your behalf, potentially saving you thousands on the purchase price.

- Access to listings – Agents often have early access to properties and can show homes that aren’t widely advertised.

- Help with paperwork & legalities – From purchase contracts to closing disclosures, an agent ensures that you comply with all legal requirements.

- Support during inspections & appraisals – An agent will guide you through home inspections and help resolve any issues that arise.

Buying a home without an agent: What to consider

While it’s possible to buy a home without an agent, you should be aware of the challenges:

- You’ll have to negotiate directly with sellers, which can be intimidating.

- You may miss out on key market data that agents have access to.

- The contract and closing process can be overwhelming without professional guidance.

- For-sale-by-owner (FSBO) sellers may not offer a price advantage, as they are also trying to maximize their profit.

Is it worth going solo?

| Factor | With an agent | Buying solo |

| Market Expertise | High – Agents know the local trends and pricing | Limited – Requires personal research |

| Negotiation Power | Strong – Agents negotiate better deals | Weaker – Sellers may take advantage |

| Legal & Paperwork Support | Full guidance | Must handle all paperwork yourself |

| Access to Listings | Early access to new homes | Limited to public listings |

| Time & Effort | Less stress – agent manages process | High – DIY approach takes more time |

Bottom Line: If you’re a first-time homebuyer or purchasing in a competitive market, using a real estate agent is highly recommended. If you’re an experienced buyer and comfortable handling negotiations, contracts, and inspections, going solo may be an option — but it requires extensive research and effort.

Step 7: Make a wish list

When the time comes to go to open houses, it’s easy to become overwhelmed and forget what you are looking for in the first place. Making a wish list can help narrow down your searches ahead of time.

To start, think big picture — which neighborhoods can you see yourself living in? What are the schools and commute times like? Break down what are wants and what are needs.

Helali recommends putting multiple sections on a wish list — your non-negotiable items, such as a big bedroom or a lot of bathroom counter space, and what you are willing to be more flexible on. Ask yourself if you would still buy the house if you don’t get everything you want.

Whether it’s a fireplace, huge yard, or a separate laundry room, a homebuying wish list can help you keep organized during this process. For first-time buyers, this is an especially important step to find the perfect home for your needs.

Home shopping

Congrats, you’ve made it to the shopping part of the homebuying journey! By now, you’ve gotten your finances in order, you’re preapproved for a loan, you’ve interviewed and found a real estate agent, and narrowed down what you’re really looking for in a home within your budget. While it’s scary and exciting, you’re more than ready to shop! This is where the real estate agent’s culmination of experience (that you found out all about when you interviewed them) comes in super handy.

While you may be preapproved to purchase a certain amount, look for homes below your budget. There may be unexpected costs that spring up, either at closing or at any point during the homebuying process. Also, be realistic about how much you might need to spend on home repairs and updates after closing.

Once you’ve found a home that you would like to make an offer on, it’ll be time to continue with the remaining steps in home buying. This includes a home inspection, appraisal, title search, final walkthrough, and at last, the closing.

Read more on the entire homebuying process, from start to finish, to begin your journey to homeownership.

Header Image Source : (Roger Starnes Sr / Unsplash)