80% of Lenders Report a Spike in Consumer DTI, Raising Concerns for 2026, HomeLight Survey Says

- Published on

- 7 min read

-

Joseph Gordon EditorCloseJoseph Gordon Editor

Joseph Gordon is an Editor with HomeLight. He has several years of experience reporting on the commercial real estate and insurance industries.

As the final quarter of 2025 approaches, the single-family home market remains turbulent.

A number of headwinds have defined 2025, frustrating consumers and industry professionals alike. Buyer hesitation and a volatile economy have stifled growth.

First-time home buyers are finding it more challenging than ever to purchase their dream homes, and foreclosures have steadily increased since last year. Consumer debt-to-income (DTI) ratios have been rising to unprecedented levels.

HomeLight’s Q3 2025 Lender Insights Survey breaks down some of the causes, with insight from lenders at 80 top lending companies across the United States, including American Pacific Mortgage, Fairway Independent Mortgage Corporation, The Loan Store, and more.

The full report can be downloaded here.

Below is a look at some of the key takeaways.

Lenders are worried about the fallout of rising consumer debt

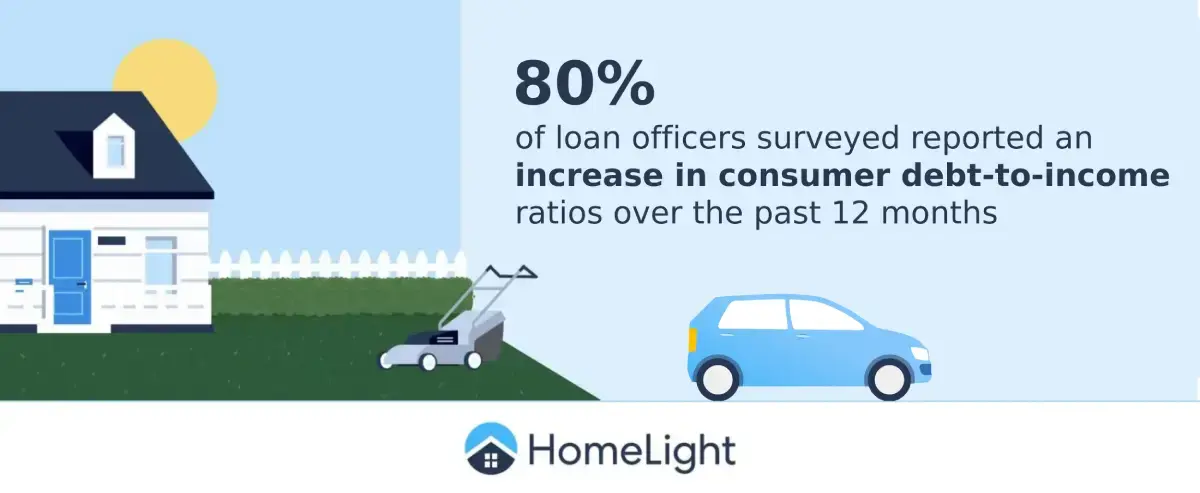

In HomeLight’s Q3 2025 Lender Insights & Predictions survey, 80% of lenders surveyed reported an increase in consumer debt-to-income ratios over the past 12 months, with 38% categorizing this as a significant increase. 42% considered it a slight increase, while only 19% said they observed no change in their markets.

Lenders also told HomeLight that rising debt will continue to be a frustration.

Michigan-based loan officer Tera Sommer considers supply and affordability to be two of the biggest obstacles the housing market faces for 2025 and into 2026.

“Mortgage rates remain elevated compared to recent years, keeping monthly payments high, while home prices haven’t fallen enough to balance things out. At the same time, inventory is still tight in many areas, limiting buyers’ options and keeping prices sticky. If rates don’t ease or incomes don’t rise meaningfully, we could see more buyers sidelined, slower sales, and pressure on first-time homeownership, even if the demand is there,” she says.

Debt consolidation is dominating home equity lending

Lenders say that borrowers are increasingly tapping their equity.

81% of loan officers told HomeLight that they have seen a spike in homeowners’ borrowing against their equity, with 29% qualifying this as a significant increase and 52% calling this only a slight increase.

In 2024, 88% of loan officers told HomeLight that debt consolidation was the main reason borrowers accessed their equity with home equity lines of credit (HELOC).

This year, the results were nearly identical, clocking in at 87%.

5.75% rates? Consumers won’t give up on the dream

Mortgage rates dipped to 6.67% in mid-August (their lowest levels since April), but new buyers were unfazed. Purchase applications rose only by 1%, while refinance applications spiked by 23%. Lenders have already seen reduced rates ahead of the Federal Reserve’s rate announcement in mid-September.

While rates dropped to 6.49% following a soft job openings report the first week of September (the lowest of the year), lenders say consumers want rates to drop even lower.

Like our Q2 2025 Lender Survey Insights report, most lenders surveyed (37%) told HomeLight that consumers are still hoping for mortgage rates to drop to 5.75% before considering entering the fray.

Lenders, however, want buyers to get off the sidelines.

“Waiting and timing rates is a fool’s gamble. Buy the home before it gets even more expensive. The opportunity to get a lower payment will come with the next rate cycle. Home price declines are statistically very uncommon,” says loan officer Jeff Abel, who has been in the industry for 28 years.

Service industry workers are getting priced out of homeownership

Across professions, the homebuying experience has proven to be very different, for some, non-existent.

74% of lenders surveyed by HomeLight said that those working in the healthcare industry (nurses, doctors, or allied health professionals) have had the best results in successfully purchasing a home.

Conversely, those employed in service industries, such as retail or hospitality, have struggled to make a home purchase a reality.

For first-time buyers who make less than $75,000 a year, home ownership is becoming an impossible hurdle.

“The primary concern for the majority of potential buyers is affordability. Even though rents are high, renters have nice homes with amenities in great locations. They find it unjustifiable to increase their housing payment by 50% or more to buy a home that needs work and that is far from their current life activities,” says April Blackwell, a North Carolina loan officer.

The inability of first-time buyers to enter the market was a recurring theme of anxiety among lenders.

“The cost of everyday things is making homeownership unattainable. Large investors [are] buying single-family homes and bidding more than first-time homebuyers can compete against,” says loan officer Rachel Fransen, who has more than a decade of experience.

Fannie and Freddie Inc.? Lenders share their thoughts on possible IPO

In August, The Wall Street Journal reported that the Trump Administration is preparing to sell stock in mortgage enterprises Fannie Mae and Freddie Mac, in an attempt to make them public.

Loan officers gave HomeLight their thoughts on what this could mean for the average buyer and seller and the broader real estate market.

“I am concerned that turning Fannie Mae and Freddie Mac public could increase the costs to the buyer. Private enterprise will want to maximize earnings, which could impact interest rates,” says Dave Henry, a loan officer with 30+ years in the industry.

Fannie Mae and Freddie Mac have been under the United States government’s control since the 2008 financial crisis. Since then, speculation of how making these offerings public has cropped up every few years, usually met by industry experts with a blend of revulsion and excitement.

Some lenders told HomeLight that the proposal would ultimately prioritize making profits, instead of maintaining strong regulations that have worked to level the playing field of lending. In contrast, others expressed optimism over what it could bring to reduce interest rates.

“Look at the last time they were private; it didn’t benefit the average homeowner. It benefited shareholders until the system collapsed, and then, taxpayers had to bail them out. If history is any guide, privatization could again prioritize profits over affordability, leaving regular buyers and sellers worse off,” says Arizona loan officer, Daisy Garza Jardine.

Lenders agree, now is the time to buy

Despite the market’s many frustrations, many lenders agree that buyers have more power than they realize. One of the most challenging roadblocks lenders encounter is buyers giving up too quickly.

“Many high-earning professionals continue to believe they need a 20% down payment to purchase their first home when that couldn’t be farther from the truth. There are various options, including reduced down payments, that allow many of my clients to get into the real estate game without that traditional percentage, helping them start to build their own generational wealth,” says Kristi Norton, a loan officer in California.

Regardless of your situation, you can’t play the game if you don’t step onto the field. The best thing you can do amidst the uncertainty is arm yourself with the knowledge of how it all works and find a trusted professional to help you sort out what it all means.

“Now more than ever, it is critical that consumers work with seasoned professionals on both the lending and real estate sides to ensure they are making smart financial decisions. True pros will be able to help the consumer find ways to overcome the affordability issue financially,” says Bradley Hacker, a loan officer with 22 years of experience.

HomeLight can connect you with a trusted real estate expert today to give you the peace of mind you need to purchase your dream home with confidence. With innovative programs like Buy Before You Sell and Simple Sale, buying a home has never been easier, even in a challenging market.

Header Image Source: (Imphot/ Depositphotos)