Cutting Big Costs in Retirement: 10 Ways to Reduce Your Housing Expenses

- Published on

- 7 min read

-

Christine Bartsch Contributing AuthorClose

Christine Bartsch Contributing AuthorClose Christine Bartsch Contributing Author

Christine Bartsch Contributing AuthorFormer art and design instructor Christine Bartsch holds an MFA in creative writing from Spalding University. Launching her writing career in 2007, Christine has crafted interior design content for companies including USA Today and Houzz.

Ahh, the carefree, golden days of retirement. No rushing off to the rat race, no overworked exhaustion, no sizeable and steady monthly paycheck…

Ouch!

The cost of living can feel excruciatingly expensive once you’re no longer receiving a salary—especially your biggest monthly bill: housing expenses.

According to the 2018 Retirement Confidence Survey conducted by the Employee Benefit Research Institute, 26% of surveyed retirees said their housing expenses were higher than expected.

Even with money coming in from investments, retirement accounts, and Social Security, you’ll be strapped for cash on a monthly basis if you don’t cut your costs and come up with a budget you can live with.

“Whether it’s the cash received from selling a home, or money in an IRA, when it comes to making your money last you need to make sure you’re not spending more than you should on an annual basis,” says Matthew Stewart, president of Forestview Financial Partners, LLC and a certified financial planner with 20 years of industry experience. “A financial plan can help you determine how much you can spend, based on what your resources may be able to provide for you over your life expectancy.”

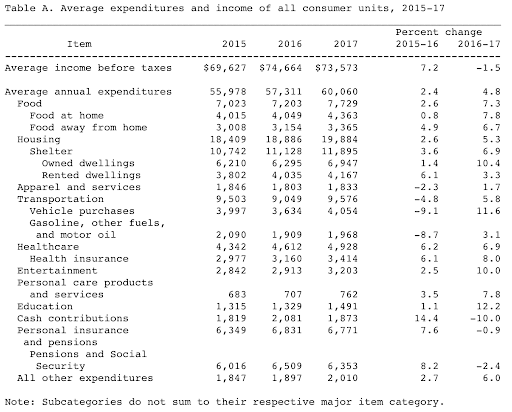

Reducing living expenses is almost a rite of passage for retirees because practically everybody’s doing it. In fact, the average retired household spends 25% less than the average working household.

So how do you go about cutting your costs in retirement?

Reducing your housing costs is a good place to start.

1. Pay off your mortgage

If you’re like most people, you’ve been spending around one-fourth of your annual income on mortgage payments. As one of your biggest monthly expenses, it’s no surprise that by paying off your mortgage you’ll dramatically reduce your monthly housing costs.

“The security and peace of mind that a completely paid off home gives to people as they enter retirement is pretty powerful,” observes Stewart.

2. Relocate to a less expensive locale

Cutting back on housing expenses isn’t just about how you live, it’s about where you live. Even if you reduce your utilities usage, shop economically, or eliminate unnecessary spending—your monthly bills are still going to be too much if you live in an expensive city.

Maybe you think you’re in the clear because you don’t live in a high-profile metropolitan like Los Angeles, New York City, or Chicago. Well, think again. Some unlikely areas have seen the most dramatic increase in the cost of living this past year—increasing as much as 25 to 36%.

So, no matter how much you love your current city, it makes good sense to keep your options open to relocating to another state when it’s time to retire. When you consider expenses like grocery, energy, and medical costs, the three most affordable states to live in 2018 are: Mississippi, Arkansas, and Oklahoma.

3. Check out areas with low property taxes (and tax breaks for retirees)

Paying off your mortgage doesn’t mean your house is now completely expense-free—you’ll still need to pay annual property taxes on the place. Or will you?

When you do your homework on the best low-cost locations to move to when you retire, make sure you check out the property tax laws, too.

Along with picking a place that has lower property taxes for all residents, be sure to check out whether or not your potential new home has reduced rates or exemptions for seniors. If you play your cards right, you’ll be paying very little or nothing at all on property taxes.

For every property you’re seriously considering, your real estate agent will provide you with documentation on the property’s price history as well as a monthly property tax breakdown. They should also be able to supply you with a list of property taxes county by county in your city.

You can also find out the property taxes on a house by doing a search on the physical address online. For the most accurate information, check the local county assessor’s website or head to your county assessor’s office.

4. Downsize into a smaller home

Living small can actually save you big bucks in the long run. Not only are property taxes less expensive on a smaller house, your other bills will be reduced, too. For example, less square footage means your heating and air conditioning costs will shrink.

Maintenance will be cheaper, too. A smaller yard means less work for your landscaper. Fewer rooms means less spent on cleaning supplies or cleaning services. And a smaller roof is less expensive to repair or replace.

Just keep in mind that downsizing doesn’t come cheap. Home prices have skyrocketed in recent years, which means buying a smaller house may cost you more than you expect. Plus, don’t forget to budget for moving expenses, including closing costs.

5. Buy in a 55+ community with a homeowner’s association

Relocating to a smaller home or less expensive area aren’t the only way to save money by moving. You can actually reduce expenses by moving into a 55+ community with a homeowner’s association that provides low or zero maintenance living.

“Homeowners associations that provide zero maintenance living cover everything from the drywall inside, out to the exterior of the home, including the roof and all of the landscaping,” explains Zack Morris of the Huff Group.

“So homeowners no longer needed a traditional homeowners insurance policy. They can just get a content insurance policy for their belongings that costs an average of around $675 versus $3,500 for a homeowner’s insurance policy. That’s a tremendous savings for retirees.”

While this does make for maintenance-free living, it does come at a cost. You’ll be required to pay the homeowners association’s dues and assessments, which could potentially lead to you paying out more in the long run.

6. Consider a roommate or intergenerational living

If you’re single, retiring can be an especially scary time. You alone are on the hook to cover all living expenses with your retirement income, and that can deplete your savings in no time.

That’s why some solo retirees are teaming up and becoming roommates to cut down on housing costs.

Others are seeking intergenerational living arrangements after they leave the workforce. Beyond saving money, this gives retirees an opportunity to impart a little life wisdom to the younger generations.

Whether your roommate is a college student, young professional, or fellow retiree, with the right roomie you’ll find someone who can share household chores and companionship, too.

7. Make Home Improvements to help you age in place

It’s no secret that long-term care and nursing homes can eat away at your life savings. If you want to put off the possibility of that expense as long as possible, you’d be wise to make safety and accessibility home improvements sooner rather than later.

So add motion sensor lighting in your dark hallways that’ll pop on at night. Install senior-safe flooring like low-pile carpet to reduce trip and slip hazards, or impact-absorbing flooring to lower the chance of injury from a fall. Replace doorknobs with easier-to-turn lever door handles. Revamp your bathroom with safety features like grab bars and non-slip safety mats in the shower.

After all, if you wait until you feel you need them, that may be too late. So invest in safety and accessibility features in your home now and you’ll save medical costs later on.

8. Install Energy-Saving Features

Downsizing isn’t the only way to cut down on your monthly energy bill. Home improvements can go a long way to reducing your utility costs.

“The more efficient you can be, more cost savings you’re going to see,” Morris advises. “So, install double pane windows, reinsulate in your attic, put in new weather strips and seals on doors and windows. These things help the efficiency of the home, so you’re going to see savings in utility bills.”

Technology can help out, too. After all, “smart” isn’t just for cellphones anymore—energy-saving tech like a smart thermostat, smart lighting and smart appliances can be programmed to do the saving for you.

And with the right home automation apps, you can adjust your smart tech with your smart phone, even when you’re out and about. So you no longer have to worry if about forgetting to adjust the thermostat or turn out the lights before you hit the road.

9. Ask for a senior discount

What’s the first thing that pops into your head when you hear the term “senior discount?” Cheap eats, right? Well, lucky for you these discounts aren’t just for early bird specials anymore.

Stores that sell groceries, home decor, cleaning supplies, and more offer senior discounts too—on certain dates or on specific products. For example, Kohl’s department stores offer a 15% discount to seniors every Wednesday.

Contact your local utility companies and ask if they have any reduced rates for seniors. Some service companies may provide senior discounts, as well—like Roto-Rooter.

For even more discount opportunities, ask the real estate agent who helped you sell your home for referrals for services like home repair and remodeling.

“We have a list of preferred vendors who offer a discount, typically 15%, simply because we’ve referred them out to them,” says Morris.

Not every place offers a senior discount, but it doesn’t hurt to ask!

10. Increase your income (and improve mental health) with a part-time job

If you still can’t quite make ends meet and you don’t want to cut down on any more expenses, you can always increase your monthly retirement income with a part-time job.

With minimum wage on the rise, many companies are looking to hire seniors for their great work ethic and sense of responsibility.

Aside from padding your pocketbook, working part-time can improve your mental health too. The activity and interaction with others on the job helps reduces depression and other health issues.

Figuring out how to make ends meet after you retire can be tricky—but with careful financial planning and some strategic cost-cutting, you’ll be living better with less.