Do Solar Panels Increase Property Value? Does it Add Green to Go Green?

- Published on

- 9-10 minute read

-

Jennifer Schmidt, Contributing AuthorClose

Jennifer Schmidt, Contributing AuthorClose Jennifer Schmidt Contributing Author

Jennifer Schmidt Contributing AuthorJennifer Schmidt is a freelance writer based in Vancouver, Washington, who specializes in real estate, human resources, and technology. When not writing, you’ll find her scanning real estate listings for the latest housing trends and decorating ideas.

-

Richard Haddad, Executive EditorClose

Richard Haddad, Executive EditorClose Richard Haddad Executive Editor

Richard Haddad Executive EditorRichard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

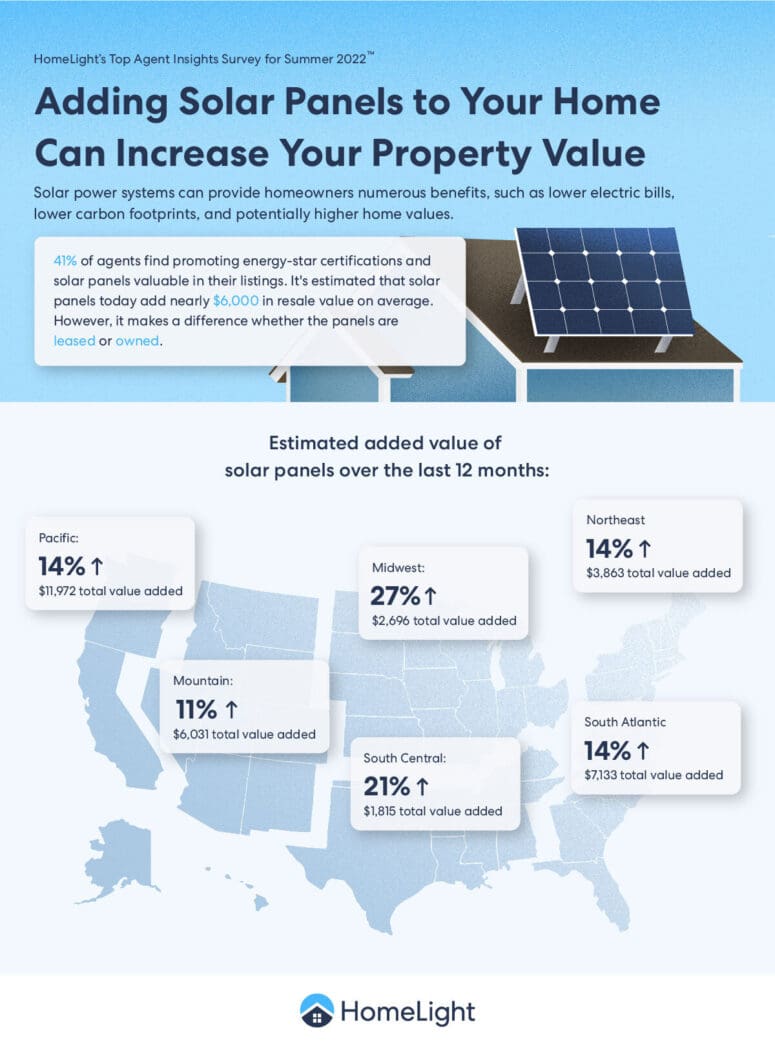

As a homeowner, you love the idea of green energy, and installing solar panels to help the environment. And if you can save money by adding some green to your wallet, that’s even better! In order to understand if your initial investment will make financial sense, you need to know more about solar panels and how they could add value to your home.

To shine some light on the subject, we’ve researched and interviewed experts who know all about solar panels. This includes award-winning real estate agent Janet Anderson, from Tracy, California, who is a single-family home expert with 16 years of experience.

We also have additional insights from Graham Alexander, Solar Sales and Design Manager at Southern Energy Management in Raleigh, North Carolina, who has 17 years of experience in the solar industry.

Do solar panels increase home value?

Although thousands of solar panels have been installed since 2008 and steadily increase in number, a lot of homeowners still consider it a newer feature. As more information becomes available, many are installing solar panels as a viable energy option while also weighing the cost of installation.

Many factors should be considered before you decide to add solar to your home. The value you get back will depend on the choices you make, including buying or leasing, the system you choose, and your total investment.

How much do solar panels increase home value?

“It depends on the price. I’ve had some people pay $20,000 for [solar panels] and they got that back when they sold it. So it just depends, it depends on how many solar panels you’re putting on, how much it’s going to cost,” says Anderson.

According to Anderson, most people will add solar to save energy, but may not see a dollar-for-dollar return on their upfront investment, especially if they move from their home soon after installing their system.

Factors that can influence how much value you get from your solar panels include:

Your home’s location

According to the Solar Energy Technologies Office, location is important for your solar panels to be the most effective. Generally, you would want your roof to be south-facing with a slope between 15 and 40 degrees and enough space for the panels. Also, if you have large shade trees near your roof they can hinder the effectiveness of the system and ultimately, your savings.

Solar installation prices in your market

Before having solar panels installed, your roof should be inspected to see if it’s in good repair. If the roof will need to be replaced in 3 to 5 years, then you will want to do that first. Otherwise, you’ll need your solar panels removed and reinstalled when you replace the roof. According to HomeAdvisor, the national average of installing solar panels typically costs approximately $25,252, with most homeowners paying between $17,909 and $33,687.

How much output the system provides

There are generally three types of solar panels: monocrystalline, polycrystalline, and thin film. Each type of panel has different levels of efficiencies and lifespans. Typically, solar panels will produce between 250 and 400 watts of power, and an average of 20 to 25 panels can generate enough electricity to power most homes.

The age of the system

As solar technology advances, efficiency improves and the cost decreases. For example, according to the Solar Energy Industries Association, installing solar panels in 2010 cost $40,000 compared to about half that cost today. Also, the lifespan for each type of panel varies, ranging from 14 to 35 years.

The system’s replacement value (insurance)

Since solar panels are considered an improvement to your home (if you own them), you’ll typically need to increase your homeowner’s insurance. Your insurance company will determine if you’ll need to increase your dwelling policy or have a separate policy for your panels. Many insurers will consider the solar panels as part of your home when they are mounted to your roof. The cost of the policy will depend on what it covers, such as repairs or replacement.

Owning vs. leasing (leasing complicates selling your home)

Sometimes you don’t have the money to pay for your solar panels upfront and some solar companies will offer a leasing option as a low-cost alternative. While the initial outlay is lower, and you’ll have the advantage of using solar, this lack of ownership can cause some challenges, especially if you’re thinking of selling your home.

“Some people just don’t like the whole idea of having a lease; I mean they’d rather pay the electric company,” says Anderson, explaining that the buyer is typically asked to take over the solar lease contract.

In many cases, solar companies will attach the lease agreement and power purchase agreement (PPA) to the home’s title. These are typically long-term agreements lasting 15 to 20 years.

If you’re unable to find a buyer willing to take over your lease, you may need to buy out the remaining portion of your solar contract. As the seller, this could cost you $20,000 or more, depending on the terms of your lease agreement. In her solar-strong California market, solar lease transfers don’t scare away many buyers. “A lease hasn’t been a huge issue,” she says.

Financed sale vs. an all-cash sale

Some lenders will not be able to finance a home if the solar panels are leased until the leasing agreement is transferred to the buyer who then becomes responsible for that payment.

Luxury real estate agent Pam Zaragoza of Burlingame, California, explains, “If [the panels] are leased it’s difficult to get a loan, and there are many more steps. If they’re owned it’s easier to buy the house and the loan process is much easier. Certain lenders will not even give loans on a home leased with solar panels.”

Even though a cash offer wouldn’t have to go through financing, if the lease can’t be transferred to the buyer then a buyout is usually the alternative for the seller.

“Some of these leasing companies have gotten better about it, so they’ll transfer it. But I’ve had some solar companies that will run credit and their debt-to-income ratio, and that one literally had to get a cosigner because they did not qualify,” says Anderson.

Warranty questions on the solar package

Alexander explains that since solar panels are static pieces that are bolted to the roof they don’t have a lot of moving pieces in a residential application, but most will come with a long-term warranty.

“Most all solar systems come with monitoring to be able to see exactly what’s happening with the system,” says Alexander. “Most solar systems have a 25-year warranty on all the equipment on the roof. The brains of the operation is called the inverter, and the warranty on that, depending on the manufacturer, is going to vary from 10 to 25 years.”

Maintenance needed

According to Alexander, most solar panels don’t need a lot of maintenance as they are pretty durable and typically won’t get physically damaged unless something like a large tree falls through the roof. The monitoring a homeowner can view through their app also typically alerts the solar company. Usually, the company will see the specific malfunction and a service call can be arranged at that time.

Net metering

Sometimes when you produce more solar energy than you can use, depending on your energy company, you may have the option for future credit which is known as net metering. Generally, you aren’t paid cash for the electricity your solar panels generate but instead use those credits in the winter months when there isn’t as much sunshine.

Are buyers looking for homes with solar panels?

“We’re seeing more and more people looking for homes that are, one, more energy efficient and, two, cleaner. From a value-add, our company does Energy Star testing for new homes and installing solar energy. The market’s demanding homes that are more environmentally conscious, cheaper to operate, and cleaner to live in, and solar is a big part of that,” says Alexander.

Q&A: More expert advice about solar panels and home values

Do solar panels affect property taxes?

As of February of 2022, there are solar property tax incentives for 36 states. Many of these incentives are designed to help defer the cost and encourage homeowners to purchase solar alternatives. Many exempt partial or all property tax that would normally increase by adding solar power.

Do you really save money with solar panels?

Alexander explains that once a home seller has their solar panels installed, they can monitor the system through a phone app to see exactly what their system is doing.

“You can see at any given time what your system is producing, using, does the system need any maintenance, the installer should be able to see it as well,” says Alexander.

Oftentimes, he explains there are also many ways homeowners can share this information about their energy savings when listing their home on multiple listing sites.

What is community solar?

When homeowners can’t afford to put solar panels on their roof, sometimes they’ll be part of a neighborhood that has access to community solar. This is where multiple houses share the benefits of solar which can lower their electric bills.

What states are more likely to see a home value boost from solar panels?

A comparison that was done between homes with solar and without solar between March 2018 and February 2019 showed a home value boost in the states listed below. They are listed in order starting with the highest solar premiums gained.

- New Jersey: 9.9%

- Pennsylvania: 4.9%

- North Carolina: 4.8%

- Louisiana: 4.9%

- Washington: 4.1%

- Florida: 4%

- Hawaii: 4%

- Maryland: 3.8%

- New York: 3.6%

- South Carolina: 3.5%

Summary: Benefits and drawbacks of solar panel home values

When solar may help home values

- When buyers are looking for environmentally-friendly homes

- If the location is good for southern exposure and can lower energy costs

- When solar panels are owned and don’t need to be transferred to the buyer

When solar may hurt home values

- If solar is not being used and the market isn’t supporting the investment

- The location doesn’t support solar due to a lack of sunshine

- When solar panels are leased and can’t be transferred to the buyer

If you’re selling a home with a solar system, or want to purchase an energy-efficient home, HomeLight’s Agent Match platform can connect you with a top-performing real estate agent in your market who has experience with solar-equipped homes.

If you’re curious about your home’s current value, HomeLight’s free Home Value Estimator tool can give you a real-time ballpark estimate.

Header Image Source: (American Public Power Association / Unsplash)