Handing Your House Back to the Bank: Better Than Foreclosure?

- Published on

- 6 min read

-

Astrid Storey Contributing AuthorClose

Astrid Storey Contributing AuthorClose Astrid Storey Contributing Author

Astrid Storey Contributing AuthorAstrid Storey is originally from Panama and spent most of her early years traveling through Central and South America. She arrived in Denver in 2003, the day after graduating college. During the next decade-and-a-half, she’s juggled a career in a variety of creative and marketing roles while building her own studio, Storey Creative, with clients in real estate, health care, publishing, and tech.

Disclaimer: As a friendly reminder, this post is meant to be used as a helpful guide and for educational purposes only. If you need legal or tax assistance with your mortgage, HomeLight always encourages you to reach out to a skilled real estate attorney or CPA.

“I can’t pay for this house anymore! Lender, will you take it back?”

If only handing your house back to the bank, a process formally known as a deed in lieu of foreclosure, was that easy.

In reality, it usually goes something like this: You tried to do a short sale — but it failed. As a last resort, you ask if you can convey the title of the home to the bank.

If you’re lucky, in exchange for ownership of the property, the lender agrees not to foreclose. In addition, the lender cancels the loan and clears you of any remaining debt owed on the mortgage.

However, a deed-in-lieu will hurt your credit and it is not a magic bullet solution. So what does this route entail and should you pursue it?

We’ve dug into recent government guidance for details and spoke to Glen Henderson, a top San Diego real estate agent with almost two decades of experience working with financially distressed homeowners.

Armed with the facts, we’re here to answer your top questions about the colloquial “hand-back” strategy and give you the unvarnished truth about its advantages and drawbacks.

Can the bank rightfully take your house?

A lender has the right to seize your home through foreclosure when you stop making payments.

During foreclosure, a lender takes over the property, evicts the owner, sells the home at auction, and then collects as much of the balance of the original loan as possible.

If the sale price doesn’t cover the mortgage debt, the lender may be able to go after the difference in funds through what’s called a deficiency judgment (more on that later).

According to top-three credit bureau, Experian, a foreclosure is one of the most catastrophic events that can appear on your credit report and will in turn limit your ability to qualify for new credit or loans for several years.

Foreclosures appear on your credit report for seven years from the date of the first missed payment that led to the foreclosure. Once the seven years are up, the foreclosure should fall off your report.

To help homeowners avoid foreclosure, the government provides an entire portal of resources. Your lender may also offer a help center, so check your mortgage statement and your online account for guidance.

When does foreclosure begin?

Individual states and mortgage companies have different rules and guidelines for when foreclosure begins. According to HUD (the Department of Housing and Urban Development), it’s usually three to six months after your first missed mortgage payment.

Keep in mind: Lenders hate foreclosures! They don’t want to go through with it if they can help it. According to the U.S. Congress Joint Economic Committee, a lender will lose 12%-19% of a home’s value and spend about $50,000 on foreclosure proceedings if they have to foreclose.

“Letting the property go into a foreclosure means the property will probably sit empty for an extended amount of time,” says Henderson. “In my opinion, the only entity that benefits from a foreclosure is the real estate investor that gets to buy the property from the bank after 12-24 months of it sitting empty and deteriorating.”

When faced with the risk of foreclosing, Henderson urges homeowners to be proactive:

“Contact the lender immediately,” he says. Henderson believes that the sooner you can begin explaining your situation and working with the lender on various options,the better the chances the lender will take the time to analyze all the factors in your specific situation and work with you to find alternatives to foreclosure.

What happens if I surrender my house to the bank voluntarily?

When you’re desperate to be free of mortgage debt that you can’t afford, you may be eager to let the bank claim the title to your home so you can walk away from a messy financial situation fast. But before you can wave the white flag, you’ll need to exhaust your other options.

These include:

Open market sale

After about three months of missed mortgage payments, you’ll likely receive a Demand or Notice to Accelerate letter, informing you of how much you owe and providing 30 days notice to get your balance current. From there, it can be two to three months to the scheduled sale of your property if you take no action to square up with the mortgage company, HUD’s guidelines note.

That gives you a little wiggle room to see the writing on the wall and get this house sold before foreclosure takes place.

Even if your mortgage company has initiated the foreclosure process, you can still sell your home independently prior to your scheduled auction date.

A recent report from CoreLogic shows that U.S. homeowners gained 10.8% in equity from 2019 to 2020, making it possible your home has increased in value substantially in the past year alone to help cover your debts.

The trick is that you also need to make sure that the value of your home will cover all the regular fees for selling a house (which can amount to 9%-10% of the sale price) plus any lawyer charges and late fees you owe for missing payments.

“Sometimes an agent will only take into account the loan balance on the property, and assume it will be simple to recoup the past-due amount after a sale. But they don’t consider the late fees and attorney fees that get added to the balance on a defaulted mortgage,” Henderson says.

At HomeLight, we’re here to help you find an agent in your market who’s comfortable dealing with lenders and attorneys, and who can help you navigate the nuances of your situation. In fact, some agents have earned special designations for handling short sales, foreclosures, and distressed sales. We’re happy to elevate these agents to the top of your search so you can get the help you need in record time.

Loan modification

With a loan modification, you work with your lender to change the terms of your mortgage when you’re struggling to afford payments. The lender may agree to lower the payment amount, lengthen the term of the mortgage, or lower the interest rate to reduce your risk of default. To qualify for a loan modification, you’ll need to formally apply and be able to show proof of hardship.

Due to circumstances surrounding the coronavirus pandemic, the government has offered additional mortgage relief options through the CARES Act, including forbearance plans.

Forbearance plans do not wipe out your mortgage debt but allow you to pause or reduce mortgage payments for a limited time period and repay what you owe at a later date.

However, as an additional form of relief, the Consumer Financial Protection Bureau has stipulated that mortgage servicers who offered forbearance plans under the CARES Act cannot require borrowers to pay back what’s owed in a lump sum.

Outside of the CARES Act and pandemic-related relief options, however, you should temper your expectations that your loan modification request will be approved. “They are very difficult to obtain,” says Henderson. ”In my experience, most of the (pre-pandemic) loan modification requests resulted in a denial.”

Short sale

A short sale is when your lender agrees to let you sell your home for less than you owe on your mortgage. Lenders will usually prefer a short sale over a deed-in-lieu of foreclosure.

“The lender is going to recommend you try to do a short sale first. If that has failed, they will allow a review of a deed-in-lieu of foreclosure,” Henderson says.

With a short sale, the lender receives the funds from the sale of the property. With a deed-in-lieu, they get ownership of the property, but they also have to take on the hassles and logistics of selling it.

See how that’s more work for them?

These types of sales are referred to as “short” because the lender agrees to cancel your mortgage debt even if the funds “fall short” of the principal loan balance. However, don’t expect a “short” speed of closing.

A short sale will take 4 months to 5 months (sometimes much longer) to close, and you’re obligated to keep up with your mortgage obligations until the transaction closes. A short sale can also lower your credit score by 100 points or more.

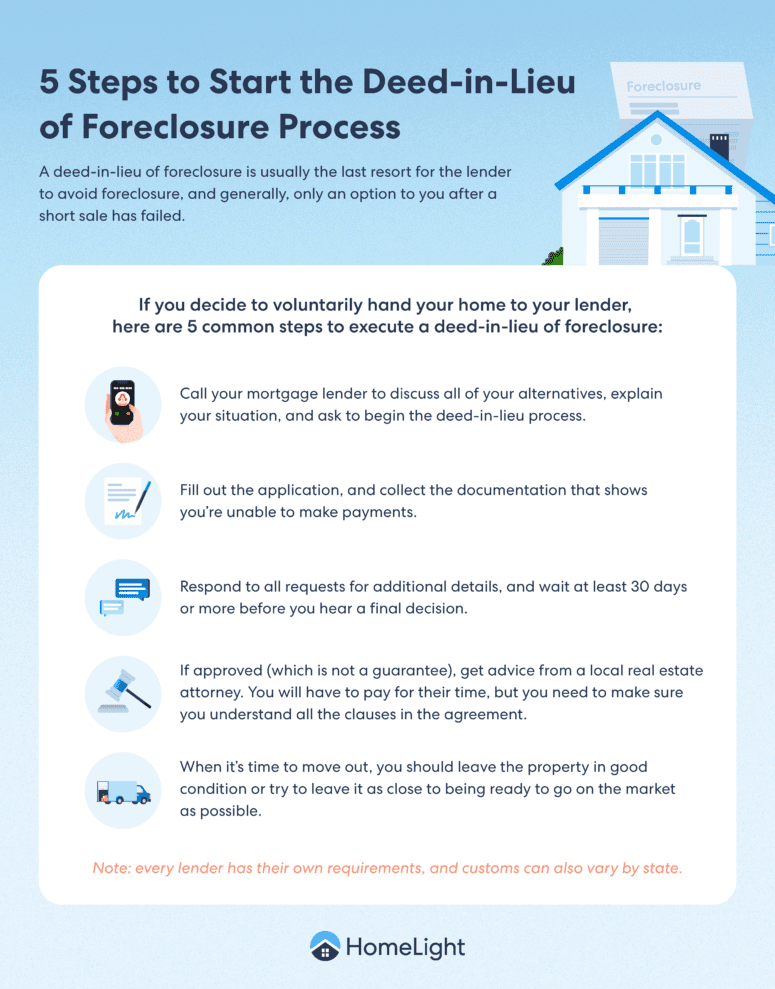

How do I start the deed-in-lieu of foreclosure process?

A deed-in-lieu of foreclosure is usually going to be a last resort for the lender to avoid foreclosure, and generally only an option to you after a short sale has failed.

As far as kicking off the process, every lender has their own requirements, and customs can also vary by state. But generally, the steps to executing a deed in lieu of foreclosure include:

- Call your mortgage lender to discuss all of your alternatives. Explain your situation and ask to begin the deed-in-lieu process.

- Fill out the application and collect the documentation that shows you’re unable to make payments.

- Respond to all requests for additional details and wait at least 30 days or more before you hear a final decision.

- If approved (which is not a guarantee) get advice from a local real estate attorney. You will have to pay for their time, but you need to make sure you understand all the clauses in the agreement.

- When it’s time to move out, you should leave the property in good condition. Try to leave it as close to being ready to go on the market as possible.

Can I give my house back to the bank without penalty?

Unfortunately you can’t give the title of your house to the bank and expect to emerge with a clean slate as if nothing happened. Here are a few key outcomes to be aware of with a deed in lieu:

Credit impact

Like a short sale, a deed-in-lieu of foreclosure can cause your credit score to drop 100 points or more. The truth is the credit score impact with either of these non-foreclosure routes are about the same as you’ll see after a foreclosure.

On the plus side, however, a deed in lieu could reduce the time period where you won’t be likely to qualify for another loan, so to speak. You will likely be able to qualify for a new mortgage after two years as opposed to the seven-year waiting period required after a foreclosure.

Avoidance of deficiency judgment

The main benefit of a deed in lieu vs. a foreclosure is typically the avoidance of a deficiency judgment. With a foreclosure, in many states a lender can use a “deficiency judgement” granted by a court to go after you for the balance due after they take your house.

For example, if the total debt owed on your house is $200,000, but the home sells for $180,000 at the foreclosure sale, the deficiency is $20,000. You could be on the hook for that amount by garnishing your wages or levying your bank accounts.

This is possible because most states allow lenders to issue what are called recourse loans, or loans that enable a lender’s ability to get a deficiency judgment if the borrower defaults.

As of this writing, there are only 12 “non-recourse” states that don’t allow lenders to pursue additional funds through deficiency judgement. Those states are Alaska, Arizona, California, Connecticut, Idaho, Minnesota, North Carolina, North Dakota, Oregon, Texas, Utah, and Washington.

By contrast, a deed in lieu of foreclosure — similar to a short sale — is often set up to satisfy the outstanding mortgage debt by way of giving up your title to the home even if you have a recourse loan.

Tax implications

Keep in mind that with either a deed in lieu or short sale, the debt that the lender forgives could be considered taxable income. Your lender will report the debt forgiveness using Form 1099-C. Talk to a trusted tax professional to find out what you could be liable for.

Act fast to avoid a deed-in-lieu

Life throws curveballs sometimes which can threaten your stability as a homeowner. One recent study found that 25% of Americans have no emergency savings and that one-third report lower income since the start of the pandemic. The loss of a job or realization that you took on more house than you can afford can lead to unexpected trouble paying your mortgage.

However, as HUD encourages homeowners to realize: “Foreclosure doesn’t happen overnight.” Denial of the problem will only force you into last resort options like a short sale, deed in lieu or foreclosure, or foreclosure. Sooner than later, connect with a HUD-approved housing counselor. If you can salvage your credit history by selling before foreclosure, by all means partner with a local agent to list now. Your bank (or lender) would rather not take a hand-back, and you’d be better off avoiding it!

Header Image Source: (Micheile Henderson / Unsplash)