Selling a House With Code Violations? Review Your Options

- Published on

- 14 min read

-

Lori Lovely, Contributing AuthorCloseLori Lovely Contributing Author

Lori Lovely edited the Real Estate Home section for the Indianapolis Star and covered the annual Dream Home construction and decor for Indianapolis Monthly magazine. She has written guides for selling houses and more.

-

Taryn Tacher, Senior EditorCloseTaryn Tacher Senior Editor

Taryn Tacher is the senior editorial operations manager and senior editor for HomeLight's Resource Centers. With eight years of editorial and operations experience, she previously managed editorial operations at Contently and content partnerships at Conde Nast. Taryn holds a bachelor's from the University of Florida College of Journalism, and she's written for GQ, Teen Vogue, Glamour, Allure, and Variety.

Whether you’re selling a mid-century ranch in an established neighborhood, a 1920s arts and crafts bungalow on a tree-lined avenue, or a brand new contemporary white box in a just-built subdivision, a home inspection may very well reveal code violations. This should not create a panic situation. While the news can be surprising and a little distressing, selling a house with code violations is possible. And the discovery of code violations is more common than you might think.

Do-it-yourself (DIY) home repairs and renovations will almost surely have code violations. “They happen all the time,” says Jared Davis, a top real estate agent who works with 80% more single-family homes than the average agent in Richmond, Virginia. He speaks from experience as both an agent and a house flipper. Even work performed by contractors is subject to code violations.

The most frequent issue he sees is a lack of permits. He recalls, “One flipper bought a house where the previous owner didn’t get permits for the third bathroom.” It came to light during the home inspection. “The contract fell through,” he says.

If you’re facing a code violation, this post can help calm your nerves. We incorporated insights from Bruce Barker — ASHI (American Society of Home Inspectors) Certified Inspector, 2021 ASHI President, and president of Dream Home Consultants, LLC — into our research on selling a house with code violations to help you plan your selling strategy.

What are code violations?

Most cities and municipalities adopt a set of universal building codes for residential construction that are developed and updated by the International Code Council (ICC), collectively referred to as the International Residential Code (IRC).

Municipalities can then add more specific building codes, primarily for safety and public health. National codes, such as the National Electric Code (NEC), oversee electrical design, installation, and inspection. In addition, individual homeowners associations (HOAs) can set codes intended to protect property values.

Any of these codes can change, particularly as technology evolves, making it difficult for the average homeowner to keep pace. For example, the NEC is updated every three years, so what was considered safe and up to code a few years ago may no longer be so.

“Codes change over time,” Barker reiterates. In addition to amendments and changes, he points out that each jurisdiction has its own set of codes. “For example, there are about two dozen jurisdictions in the Phoenix area. Each has a different set of codes.”

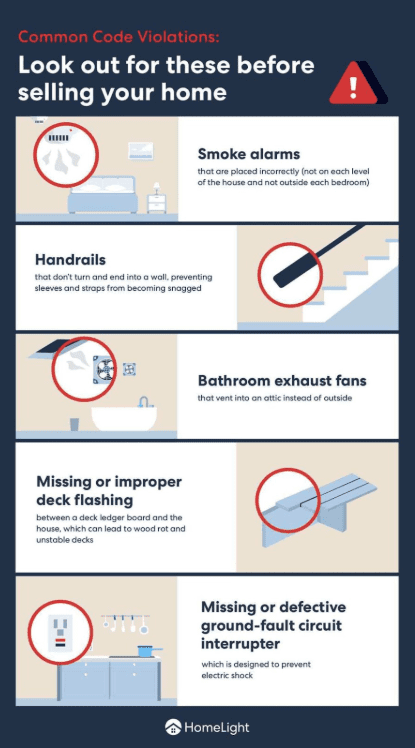

Does your home have any of these common code violations?

Code violations indicate areas that don’t comply with requirements, resulting in violation notices or orders of correction that explain the code and how to correct the substandard component to be in compliance. Building code violations range from simple fixes that a homeowner can make to major repairs that require a professional’s expertise.

5 most common building code violations

- Misplaced smoke alarms: Smoke alarms should be on each level of the house and outside each bedroom.

- Handrails without returns: Handrails should end by turning into the wall so sleeves and straps don’t get caught on the ends.

- Missing or defective ground-fault circuit interrupter (GFCI): Kitchen, bathroom, garage, and outdoor circuits should have a circuit breaker to shut off the power if there’s a current change to avoid electrical shock.

- Improper bathroom venting: Exhaust fans should vent outside, not into an attic.

- Missing or faulty deck flashing: Flashing should extend between a deck ledger board and the house, preventing wood rot and keeping the deck stable. According to Barker, this is a complicated issue because flashing on decks or chimneys is not necessarily a code issue. “The code says there should be no leaks. It’s a performance requirement,” he explains. “It doesn’t say how to accomplish it.”

Other areas where code violations can be discovered:

- Messy or overloaded electrical panel: If the circuit carries more than its rated capacity, breakers will trip, or worse, a fire could start. However, Barker says that electrical panels aren’t a code issue and that determining if they’re overloaded is a complex proposition.

- Inadequate amp circuits: For example, kitchen and utility areas typically require 20-amp circuits, while lights and other 120-volt household circuits use 15 amps.

- Polybutylene piping: This is an inexpensive, flexible, freeze-resistant plastic tubing used for plumbing that can break and leak over time, causing water damage.

- Missing expansion tank for water heater: This small tank is a water vessel placed inline in a closed hot water plumbing system to help protect against leaks caused by excessive pressure due to the natural expansion of water as it’s heated.

- Windows not up to local housing standards: Windows should have intact glass with no cracks or missing pieces, securely held in frames that are properly sealed to the wall. The frames, sashes, and glass should fit tightly to prevent water, moisture, and air from getting inside. Any windows near stairways, landings, or with a total area of nine square feet or more must be made of safety glass to help prevent injury.

- Renovations made without permits: Some renovations do not require permits, but if they do and you don’t have one, you’re liable to pay a fine and may be required to demolish the renovation if it can’t be brought up to code. It can even void your homeowner’s insurance.

- Remodels that don’t meet current standards: Rules regarding shower door openings, sink spacing, shower size, ventilation, and more are governed by standards and codes. Keep in mind that items only have to meet the code that was in effect when they were built or installed. “What was the code when the house was built?” Barker queries. “Those things don’t need to meet current code,” as they are “grandfathered in.”

- Rooms added after original construction: Work must be permitted and meet the building code. Davis notes that this issue often arises, especially with flippers. “One of the big things is building permits for bathrooms, additions, and finished basements.”

- Egress window in basement bedrooms: To be labeled as a bedroom, a basement room must have an egress window at least 24 inches tall by 20 inches wide.

- Roof pitches: If the pitch isn’t steep enough, it shouldn’t have shingles. According to Davis, this has been a recent code violation getting attention. Roofs with less slope should be covered by rubber, metal, or Thermoplastic Polyolefin (TPO) roofing.

It’s important to point out that a home inspector’s job is not to find and report code violations. “Our job is to find and report defects,” Barker says. While there may be some overlap, he emphasizes that the ASHI standard specifies that inspectors look for items that are:

- Significantly deficient

- Not functioning properly

- Unsafe

- At the end of their service life

As you can see, code violations can come in many shapes and sizes, and addressing them on your own can be overwhelming. For guidance on how to deal with your specific code violations, consult a qualified real estate agent. Partnering with an experienced agent who is knowledgeable about the local codes and requirements can take a lot of pressure off a seller.

Does the homeowner need to fix code violations to sell?

Whether or not you must fix a code violation to sell your home depends on where you live and what the problem is. Many issues do not have to be fixed, and you can sell your home as is, but some state or local authorities may require certain safety issues to be corrected before the transfer of property. Check with city hall, the building department, or your real estate agent to find out what must be addressed.

In addition, the buyer’s lending company may dictate whether code violations must be fixed before purchase. For example, FHA loans typically won’t allow buyers to purchase properties with unpermitted converted garages or outdated electrical panels.

Similarly, since homeowner’s insurance may cost more for a home that’s not up to code, this could become a point of leverage for the buyer to negotiate a lower sales price. If you choose to stick to your asking, your property may sit longer on the market.

How do I handle fines associated with violations?

Sellers are responsible for paying off liens on their property. Confirm any outstanding fines with local municipalities or through property records. If you’ve accumulated several fines, you can negotiate with government authorities for a lower amount or set up a flexible payment plan. In some rare instances, the buyer may offer to take on the liens, but if you agree to go this route, it must be clearly outlined in the sale agreement.

Do sellers need to disclose code violations to buyers?

Yes, most states require sellers to disclose any known defects of a house in writing. In fact, some states have standard disclosure forms, which include questions about structural issues, safety hazards, and code violations that could affect the property.

Even if your state follows the caveat emptor (buyer beware) principle and doesn’t require disclosure, it’s a good idea to inform potential buyers of any issues you know about. Doing so could protect you from a lawsuit and give buyers greater confidence in your property.

A title company will discover any liens or title defects, which must be resolved before closing, and a home inspector will note anything that’s a defect. According to both Barker and Davis, the home inspection is when most code violations are discovered.

Can code violations reduce your buyer pool?

Yes, code violations can reduce your buyer pool because some buyers may be concerned about safety, repairs, or legal issues. Additionally, lenders might be hesitant to finance homes with unresolved violations, further limiting your potential buyers.

Most people include a home inspection contingency, and they can walk away from a sale after discovering major code violations. “Most buyers don’t want to deal with repairs,” Davis says.

Some specific buyer roadblocks include:

- Encumbered title: If the home’s title is encumbered—meaning there’s a legal claim or restriction on the property—due to code violations, the seller can’t pass a clear title to a buyer until the violations are fixed. A buyer will likely not be able to get title insurance until code violations are resolved.

- Unpaid fines or liens: Some code violations incur fines or liens, putting a sale on hold until they are resolved. The most common are unpaid taxes or HOA dues.

- Mortgage restrictions: Many lenders won’t issue a mortgage for a property with code violations or liens.

Even if the buyer can get insurance, it’s likely to cost them. Most standard homeowners’ insurance policies protect against “common perils” such as fire, theft, water damage, windstorms, and vandalism. If your home isn’t up to code, it’s considered more susceptible to those perils, making insurance premiums higher. Not all buyers can afford or will agree to pay higher premiums.

How do code violations affect appraisals, inspections, and loan approval?

Code violations have a way of popping up at the worst possible time, usually right when the appraiser, inspector, or lender gets involved. Here’s how those issues can slow things down or throw a wrench in the deal:

- Appraisals hit the pause button: If an appraiser spots a code issue, they may label the home “subject to repairs,” which puts the process on hold. There won’t be a final appraisal until the fixes are done and verified.

- Certain loans won’t make the cut: FHA, VA, and USDA loans come with strict safety and livability rules. Even minor violations can make your home ineligible for buyers using these programs.

- Lenders ask for fixes before the finish line: When lenders see unresolved code issues, they often require repairs before closing. This can slow down the timeline or lead to last-minute negotiations.

- Property value drops: Code problems can lower the appraised value if repairs look expensive. In more serious cases, financing may be denied until the issues are resolved.

Three options to consider when selling a house with code violations

There are basically three ways you can deal with a code violation when you’re selling your home: fix it, offer money for someone else to fix it, or ignore it by selling your house as-is.

1. Fix the code violations

This option often depends on legal requirements, budgets, the scope of the problem, and the state of your local housing market. In a seller’s market, you will have more leverage regarding which, if any, violations you’re willing to correct.

Violations like these are often affordable and easy to fix:

- Move a mounted smoke alarm: $70-$150

- Test a GFCI outlet: $15-$50

- Replace an old outlet with a GFCI unit: $130-$300

The following violations can cost more to correct, but are generally still manageable:

- Upgrade your home’s electrical panel: $1,200-$2,000

- Restore a cracked foundation: $250–$800, may cost more if hydraulic piers, priced $1,000-$3,000 per pier, are required

- Re-plumb a house: $149-$5,800, depending on the piping material and size of the house

Some items are better replaced than repaired. For example, if polybutylene piping is under a concrete slab, it will inevitably become damaged over time, so you’re better off replacing the piping altogether.

2. Offer the buyer credit or lower the selling price

If the seller is unwilling or unable to bring a home up to code, offering a price reduction or a repair credit are options, particularly if the code violations don’t present a health or safety risk.

Since most buyers want a free and clear title, reducing the price can help attract someone willing to assume responsibility for addressing any violations. After all, the majority of buyers prefer to move into a home without needing to make repairs or deal with issues like plumbing or electrical problems.

Some examples of the most common credits sellers might offer include:

- Roof

- Electrical issues

- Water heater

- Plumbing repairs

- HVAC system issues

- Foundation or structural concerns

But take note that issuing repair credits can put the buyer’s mortgage at risk because the lender doesn’t know if the repair is warranted or will be performed by the buyer. Thus, a safer way to issue a credit is to simply reduce the home’s price.

Keep in mind that many loans only allow seller credits against closing costs, so technically, you cannot give a seller credit for repairs or things such as a carpet allowance, landscaping, or fencing. This could limit how much your “credit” can be.

For these reasons, working with a top agent who knows the market and has experience with code violation scenarios can be of immense value. A proven agent will know the ins and outs of mortgage loans, closing costs, and repair credits, and will be able to advise a seller on what repairs really should be taken care of and which ones can be skipped.

3. Sell your house as-is to a cash buyer

Your agent can advise if an as-is sale is right for you. It usually won’t get you top dollar, but it can be faster and save you the hassle of fixing anything else.

Selling your home as-is to an instant homebuyer or iBuyer before it hits the multiple listing service (MLS) may offer an attractive option if you don’t have the time or funds to bring it up to code. The pool of iBuyers includes institutional investors, national house flippers, and digital-age startups, all of whom purchase homes directly at scale.

If you’re considering an as-is sale but want to get an idea of how much a cash buyer might offer, you can consult HomeLight’s Simple Sale platform. Just answer a few questions about your home, its condition, and your selling timeline, and you can get an all-cash offer in 24 hours and sell your home in as little as 7 days, skipping the months it can take to sell the traditional way.

Additional tips and expert advice for sellers facing a code violation

Davis says there’s no need to disclose features that were grandfathered in before the code changed, even if they would be considered a code violation if done now. However, he always advises sellers to disclose flaws and safety issues.

This can depend on how hot or cold your selling market is. In general, don’t worry about fixing minor cosmetic flaws from normal wear and tear, like small cracks in tile flooring or the driveway. You can also skip repairing electrical issues that are not a safety hazard, such as a light switch that doesn’t control anything. Davis explains that in many cases, “it’s not advantageous for a seller to fix small things.”

While it may not be necessary to fix every little thing, making at least some of the minor corrections demonstrates to buyers that you attend to maintenance issues and are taking action to improve the house and meet them halfway in closing the deal. This can be especially helpful in a buyer’s market where inventory is high, and home shoppers have lots of options. Sometimes small repairs can send a bigger message.

“Any change in wiring needs a permit,” Davis explains. Moving plumbing requires a permit. Even recessed lights need a permit. Permit issues are beyond the scope of an inspector, according to Barker, but an appraiser can ask for them. Be sure to have permits on file for all the work done on your property.

How to save the deal

Davis repeats the three basic ways to “save the deal” when selling a house with code violations: fix them, drop the price, or offer financial concessions at closing.

Code violations are so “impossibly complicated” that inspectors don’t even call them code violations, Barker says. But selling a house with code violations doesn’t have to be overly complicated. There are many ways to deal with them, whether you fix them or not.

No home is perfect. Partner with an experienced real estate agent who can guide you on how to respond to a report of code violations.

Header Image Source: (FrankWinkler / Pixabay)