Why Selling Your Home For Retirement Could Be the Key

- Published on

- 5 min read

-

Presley Attardo Contributing AuthorClose

Presley Attardo Contributing AuthorClose Presley Attardo Contributing Author

Presley Attardo Contributing AuthorPresley is a Seattle based writer covering interior design trends, home improvement, and market updates. She has lived in San Francisco, Los Angeles, Chicago, and Washington, D.C., giving her a unique perspective on the diversity of U.S. real estate.

You’re edging retirement, the phase of your life where you can finally set work aside and spend time with your grandkids, travel to all the places on your bucket list, and wake up knowing the day is yours.

If you’re a lucky homeowner, there’s a shortcut to boosting your retirement funds so you can maintain the lifestyle you desire: selling your home. The average American has roughly twice as much value in home equity as they have in their retirement savings. By tapping into this equity, you can free up thousands of dollars a month to steer your retirement destiny.

Financial benefits of selling your home for retirement

Selling your home can help fund your retirement in numerous ways, liquidizing cash to allocate towards your savings, buy a new property in full, pay off remaining debts, reinvest into other areas of your portfolio, or use as spending money.

Increase your monthly spending budget

A general rule for budgeting for retirement is to withdraw no more than 4% of your account a year. If you sell your current home, you can allocate part of the earnings from the sale into a lower cost home and shift the rest into your retirement account, boosting your 4% figure.

Say you have $1 million saved—you respectively can spend $40,000 a year. You sell your $600,000 home and downsize to a $350,000 home. Transfer the $250,000 proceeds into your retirement account and you’ve bumped your 4% figure to $50,000 a year.

Lower your monthly property expenses

In addition to saving proceeds from your home sale, you can boost your retirement budget by moving into a lower maintenance home with less monthly expenses. Selling your home and downsizing to a smaller home lowers your property taxes and utility bills in most cases. Trade in your pool and you’ll have thousands more. The average pool maintenance (water, cleaning, and repairs) costs between $3,000 to $5,000 yearly, meaning in 5 years you can save $25,000 by using a community pool instead of having your own.

Live a debt-free retirement

Selling your home to purchase a less expensive property relieves you of making large mortgage payments with your limited retirement income (your investments and social security, supplemented by limited withdrawals from savings).

“We find a lot of people don’t want to carry a mortgage into retirement,” shares Ben Fernandez, a financial advisor at Finn & Meehan Wealth Management with 7 years experience assisting retirees across 35 states.

“If you have that amount of debt when you’re in retirement, it can be a burden which you’re contractually and legally bound to pay it off. If the market doesn’t do very well, your investment assets go down and you’re on the hook for some amounts—that may be stretching your budget a bit.”

Likewise, if your current home is paid off, but you’re carrying credit card, student loan, or any additional debt, selling with the intention to move into a lower cost living situation gives you an opportunity to pay these off.

Leave your family with an asset, not with a mortgage

When you plan for retirement, you need to plan for after retirement—how will your passing affect your family? If you bring a mortgage into retirement and something happens to you, you’re leaving your bereaved with the burden of monthly payments until your home sells. This not only reduces any inheritance passed down, but also adds a layer of financial stress to emotional loss for your loved ones.

Instead, sell your home in exchange for a property you can pay for in cash and leave them with a strong asset. Pass down your new home to your children with limited tax liability by expressing the property transfer in your will.

The Unified Federal Gift and Estate Tax Exemption exempts taxes on property gifts at or under $11,400,000 (approx. $22.8 million for married couples), meaning your inheritors can receive your property mortgage and tax-free. Now that’s a powerful legacy to leave.

Lifestyle benefits to selling your home for retirement

Whether your retirement dream focuses on quality time with family, community involvement, intrepid travel or a new life in an inspiring location, selling your home will free up cash to launch you towards actualization.

Selling your current home for retirement is also an opportunity to transition into a more accessible living situation where you can age comfortably. Your must-haves at this age will likely be different than they were the last time you searched for a home: no stairs, close to quality medical facilities, and proximity to friends and family who can support you with health challenges over the years are now much bigger priorities.

Make a strategic move once you sell

Once you sell your home, there are several routes to choose from to achieve your desired lifestyle.

Downsize to upgrade

You don’t need three extra bedrooms or a home in a great school district anymore. Downsizing for retirement is a straightforward way to reduce or eliminate your mortgage, as well as lower monthly bills and property taxes so you have more money to play with.

Use the equity you’ve built up from your current home to purchase a smaller, less expensive home outright with cash. If you can’t pay in full, downsizing can at least lower your mortgage. If this is the case for you, make the transition while you’re still working so you can better qualify for a loan.

Move to a new state and save thousands a month

If you’ve always imagined retirement launching you into a new adventure, consider moving out of state. A big move can improve your life, whether it’s for a better climate, lower housing prices, or a different pace of life.

Renowned out-of-state retirement destinations gained popularity for their easy lifestyle and low taxes. Moving to a state with lower property taxes can save you thousands a year. For example, your home valued at $630,000 is taxed at 1.73% in Illinois, costing you $9,513 annually; move to New Mexico and a $630,000 home is taxed at 0.55%, only costing you an estimated $2,457.

That $7,056 savings a year adds up with some quick math: $35,280 saved in 5 years, $70,560 in 10 years, and a massive $176,400 in 25 years. If you’ve been looking for a retirement travel financing scheme, well there you have it.

Moneywise provides a holistic overview of the top states to retire in; if you want to get into specifics, USA Today provides a detailed overview of the best counties in each state to retire in ranked by primary care physicians, population of 65 and older, estimated monthly living expenses, and median home value.

Join an age restricted community for an all-inclusive retirement package

When you move into an age restricted community (PC for retirement community), you gain a home designed to support you as you age, plus a social injection on a scale you haven’t seen since your freshman year of college.

“One of my client’s big things was she wanted the activities. She didn’t want to be alone in her retirement,” shares Louise Juracek, a top real estate agent in Bakersfield, California with over 36 years of experience.

Juracek recommends a gated 55+ community in the area her client fell in love with. After a few months of convincing her husband, the couple sold their home and made the big move.

“Now her and her husband are involved in a homeowners association, they’re involved in pickleball, they’re involved in quilting. They’re so so happy out there!” says Juracek.

The best age restricted communities feature 24-hour health care nearby, golf cart and walking friendly layouts, tennis courts, community pools, fitness centers, and plenty of organized activities to keep you busy.

Find relaxation through renting

Renting after you sell your home may initially sound like a step backwards, but there’s a case to be made here. To start, say goodbye to home maintenance forever. If pipes leak, if the garage door breaks, it’s your landlord’s responsibility to fix it—not yours. Without the need to budget repairs, you have a fairly predictable cost of living give or take rent rises over time.

Another bonus, renting gives you the flexibility to move locations as you please with low commitment leases. For travel lovers, live a year abroad with no mortgage payments or, if timed wisely, even without rent to disturb you.

Plan ahead to make the most of selling your home

The earlier you plan for retirement, the more strategic you can be with your home sale. With basic planning, you can sell while the market is in your favor and home prices are on the rise.

Go a step further in your preparations and you can structure an elaborate plan to get you to your dream retirement location.

Take for instance how another of Juracek’s client sold her large home with a pool as part of 6-year plan to move from Inland Southern California to the beach:

“She was able to get enough equity out of her house to pay cash for a condo and get rid of the mortgage payment,” Juracek recalls.

“Then she was actually able to use the money she was saving every month and some other savings to purchase at the coast—that was over a five year period. She just [this past year] sold the condo and now has additional money to pay off that house at the coast.”

Make the most of your retirement with expert advice

With so many paths to choose from, selling your home for retirement and finding a new place to settle down can be daunting.

So find a top real estate agent to sell your home for the maximum price to kick off your golden years in style. Consider hiring a Senior Real Estate Agent Specialist for a selling experience tailored to your demographic needs. (SRES-certified agents are trained to understand and educate real estate opportunities for homeowners in the 50+ demographic.)

The bottom line is…team up with pros to take care of business now, and get the most out of retirement later.

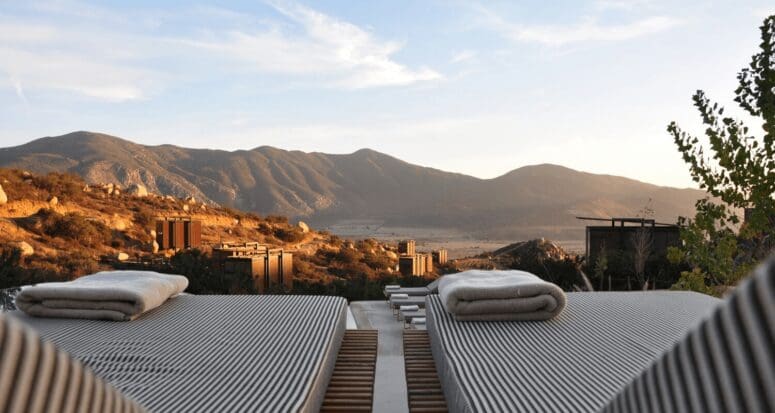

Header Image Source: (Manuel Moreno/ Unsplash)