What’s a Short Sale in Real Estate? This FAQ Sheet Breaks Down the Basics

- Published on

- 7 min read

-

Christine Bartsch, Contributing AuthorClose

Christine Bartsch, Contributing AuthorClose Christine Bartsch Contributing Author

Christine Bartsch Contributing AuthorFormer art and design instructor Christine Bartsch holds an MFA in creative writing from Spalding University. Launching her writing career in 2007, Christine has crafted interior design content for companies including USA Today and Houzz.

-

Jedda Fernandez, Associate EditorClose

Jedda Fernandez, Associate EditorClose Jedda Fernandez Associate Editor

Jedda Fernandez Associate EditorJedda Fernandez is an associate editor for HomeLight's Resource Centers with more than five years of editorial experience in the real estate industry.

Every time you open your mailbox, you’ve got stacks of collection notices from every creditor. You’re behind on the mortgage with no way to catch up, and now you’re facing foreclosure. Soon, you’ll be out on the street with a big blot on your financial record.

In the midst of these financial straits, there may be a slightly better option: a short sale.

You’ll still have to sell the house and move out, but you’ll have more control over the situation and you’ll also put yourself in a better position to recover faster.

But what is a short sale, and is it the right route for you? We’ve broken out the most common questions about short sales to help you make a more informed decision about your next steps.

- What is a short sale?

- How do I know if I qualify for a short sale?

- Short sale vs. foreclosure: What’s the difference?

- What documents do I need to apply for a short sale?

- How is my home’s current value determined during a short sale?

- Who pays closing costs in a short sale?

- How does a short sale affect my credit score?

- What are the tax considerations of a short sale?

- Can I hire any agent to handle my short sale?

- What are the alternatives to a short sale?

- Is a short sale right for me?

1. What is a short sale?

“A short sale is a scenario where the mortgage company approves a loan payoff that is short of — or less than — the full loan balance,” explains Misty Soldwisch, an experienced short sale agent in Des Moines, Iowa.

In a short sale, your mortgage lender agrees to let you sell your house for an amount that is less than what you owe and forgives any extra debt remaining after the house sells. This essentially means that they’re giving you money for free, at least on paper.

Note: This only works if your house is currently worth less than you owe on your mortgage.

2. How do I know if I qualify for a short sale?

You must be underwater on your mortgage in order to qualify for a short sale, which means that you have negative equity.

This can happen for a variety of reasons:

- A real estate market downturn lowered your home’s value below the amount you borrowed to purchase it

- The debt from a second mortgage or a home equity line of credit (HELOC), combined with your primary loan, now totals more than the house is worth

- Missed mortgage payments, delinquency fees, interest charges that added up

Negative equity isn’t the only criteria you need to meet in order to qualify for a short sale, though.

“In order for a mortgage company to consider a short sale, the property needs to be in imminent risk of foreclosure. Lenders will not consider a short sale if there is no foreclosure pending,” says Soldwisch.

“The borrowers must also be able to demonstrate a distressed financial situation. The mortgage company will look for hardship factors like divorce, the loss of a job — which is a loss of income — or devaluation of the home, meaning that the house is currently worth less than the borrowers paid for it, putting them underwater on the property.”

Bottom line: If you’re underwater on your mortgage, if you’ve received pending foreclosure notices, and you can demonstrate financial distress, you may qualify for a short sale — as long as your lender agrees.

3. Short sale vs. foreclosure: What’s the difference?

Short sales and foreclosures are often lumped together because both are rock-bottom options for homeowners who are behind on their mortgage payments and in financial hot water.

They aren’t the same, though.

When you’ve reached the foreclosure stage, the bank has taken the house from you because you’ve defaulted on your mortgage. In that scenario, your lender cuts their losses and will move to evict you. When your house eventually sells, the bank is the one selling it — you are no longer involved.

However, letting your lender foreclose on your house doesn’t necessarily mean you’re freed from your mortgage debt. Depending on where you live, your lender can sue you to recoup some of what you owe.

None of this happens with a short sale. When you arrange for a short sale, your lender is agreeing to forgive any extra debt after the house is sold for less than you owe. With a short sale, you’re also the one in the driver’s seat during the sale of the house.

“With a short sale, negotiations are between the homeowner and the purchaser, not the mortgage company,” explains Soldwisch.

“The terms are subject to approval by the mortgage company, but the seller is still very much in control of determining the price, the terms, the closing date, and so on.”

Here’s a side-by-side comparison to help you quickly understand the key differences between a short sale and foreclosure:

| Feature | Short Sale | Foreclosure |

| Definition | Sale of a home for less than the remaining mortgage balance, with lender approval | Legal process where the lender seizes the property after missed payments |

| Initiated by | Homeowner (with lender cooperation) | Lender |

| Control of Sale | Seller maintains some control (e.g., chooses the listing agent, negotiates offers) | Homeowner loses control; the lender takes over |

| Credit Impact | Typically lowers score by 50–150 points; less severe than foreclosure | Can drop score by 150–300 points; stays on credit report for up to 7 years |

| Timeline | Can take several months depending on lender response | Often faster once the lender begins legal action |

| Eligibility for New Mortgage | May qualify for a new mortgage in 2–4 years | May need to wait 7 years to qualify for conventional financing |

| Deficiency Judgments | Possible, but may be waived in negotiation | Possible; lender may pursue borrower for remaining balance |

| Stigma/Long-Term Effects | Less damaging in the eyes of future lenders | Considered more severe by lenders and credit agencies |

Bottom line: A short sale is usually a more borrower-friendly option that gives homeowners a chance to minimize damage and move on with more dignity and credit intact.

4. What documents do I need to apply for a short sale?

Lenders aren’t in the business of giving away free money to just anyone. You’ll need proof that you’re in dire financial straits and unable to pay what you owe on your home.

“You’re going to have to show your lender all of your personal finance documentation. That’s going to include your most recent bank statements, your pay stubs, your credit card debt, and also your monthly expenses,” says Soldwisch.

“You’ll also have to provide documentation of your retirement savings — although your lender can never ask you to use retirement savings to get caught up on your mortgage.”

Aside from financial statements, your lender will also require several other documents when you apply for a short sale arrangement, including:

- Third-party authorization letter (gives your agent permission to work with your lender on the short sale)

- Client information form (your application)

- Tax returns from the past two years

- All bank statements from the last two months

- Most recent mortgage statement(s) (all mortgage loans on the property)

- Financial statement (including all assets and debts, such as retirement account statements, credit card debt, etc.)

- Hardship letter

5. How is my home’s current value determined during a short sale?

The only way to qualify for a short sale is if you currently owe more than your house is worth. So, how is the current value determined? That depends.

There are basically two options to get your home’s current value: either with a broker price opinion (BPO) or an appraisal by a licensed appraiser.

“With a BPO, the agent prepares the valuation — versus a licensed appraiser, whose perception of the market can be different. Which one will be required in your short sale depends on the lender,” advises Soldwisch.

6. Who pays closing costs in a short sale?

In traditional home sales, closing costs are typically up for negotiation between the buyer and the seller.

The same is true with short sales, although in this scenario, you have a third party — the lender, who needs to approve those negotiations — which may throw a wrench into the works.

Your mortgage company may agree to pay the seller’s closing costs but refuse any requests to cover the buyer’s costs.

Some lenders will also ask for a contribution from the short seller, which is a payment made at the close of the sale. This contribution is requested to offset the lender’s losses and may be used to cover any closing costs the lender agrees to pay.

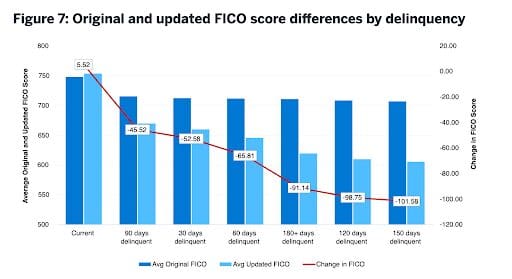

7. How does a short sale affect my credit score?

Going through with a short sale will have a negative impact on your credit.

In fact, FICO data suggests that a short sale and a foreclosure will have an equally negative impact on your credit score and recovery.

The news isn’t all bad, though.

“A short sale can have a serious impact on your credit,” explains Soldwisch.

“However, your credit score can recover more quickly after a short sale than it can after a foreclosure. And once your credit score has recovered, you’ll qualify for a guaranteed mortgage more quickly after a short sale versus a foreclosure.”

The impact on your credit from a short sale versus a foreclosure largely depends on your previous credit history. If you had great credit before the short sale, the negative impact would be a bit less than if you had a history of unpaid debt, defaults, and credit dings.

This is only true if you return to your good credit habits after the short sale by keeping your credit debt low and making payments on time. If you do, then your credit could potentially start to recover after two years post-short sale.

Unfortunately, there’s no guarantee that your credit will recover more quickly after a short sale than a foreclosure. However, a short sale is reported as “settled” debt, which is not the case with a foreclosure.

Debt marked as settled rather than paid isn’t great, but it’s better than having a foreclosure on your credit report.

Since a short sale reflects the borrower’s willingness to settle debt, many lenders will take this under consideration when you apply for future loans.

8. What are the tax considerations of a short sale?

Remember how the debt forgiven by your lender is kind of like free money (on paper)? Well, in some states, this forgiven debt may be taxable.

“Short sellers need to understand that in some states, after the mortgage company approves their short sales, they’ll receive 1099s for the amount of the discharged mortgage debt,” explains Soldwisch.

“So basically, the 1099 reflecting that discharged debt will show up on your taxes as if it were income that you received, which will have tax ramifications.”

The IRS refers to this loan forgiveness as a cancellation of debt. Whether or not it’ll be taxable depends on whether or not your state laws allow for recourse or non-recourse loans.

If yours is a recourse loan, the bank can go after your other assets to collect on the deficiency amount left after the home sale. Lenders who instead decide to forgive the remaining debt on a recourse loan will send you a 1099 because it’s considered income.

If yours is a non-recourse loan, the bank cannot go after your other assets to collect on any remaining debt. Any debt amount left after the house is sold to pay off a non-recourse loan is not considered cancellation of debt income. So, you will not receive a 1099.

9. Can I hire any agent to handle my short sale?

It’s in your best interest to hire an agent well-versed in short sales because they are different from a traditional listing.

Lenders require a lot of financial reporting that needs to be gathered and coordinated. Your agent will also help coach the buyer on how the short sale process works and keep their expectations realistic.

There’s a high rate of fallout when buyers don’t understand what’s happening during a short sale. When your buyer backs out, you’ll need to start the short sale process all over again with another buyer.

“Mortgage companies want you to use an agent to help you through a short sale,” says Soldwisch.

“Lenders are happy to pay the real estate fees because they know the short sale will be more successful if an experienced agent handles it. But, if you hire an agent who hasn’t gone through the process before, then you’re rolling the dice and hoping that it’s going to be successful.”

10. What are the alternatives to a short sale?

Believe it or not, the government and your lender don’t want you to default on your mortgage and face foreclosure — it’s bad for the economy and your lender’s bottom line.

So, the government provides a lot of resources to help you avoid foreclosures and short sales.

“One option is to borrow funds to make improvements to the house in order to raise the market value. Then you can sell it at a higher price to pay off the loan, including your delinquent payments, and maybe even get some money out of the property,” suggests Soldwisch.

“Also, many mortgage companies offer loan modification options, which restructure the loan terms. Rather than making up your missed payments, the deficiency total is added to your principal loan balance. I’ve had clients do that.”

One such modification option is the FHA-Home Affordable Modification Program (FHA-HAMP). This program helps FHA homeowners who are behind on their mortgages to reduce their monthly payments and avoid foreclosure, if you qualify.

Editor’s note: All FHA-HAMP options are temporarily suspended until April 30, 2025. For the latest update, visit the FHA National Servicing Center Loss Mitigation Services page.

Here’s a breakdown of the most common alternatives to a short sale:

| Option | What it is | Who it’s best for | Key pros | Potential cons |

| Loan Modification | Adjusts your existing loan terms (e.g., lowers interest rate or extends repayment period) | Homeowners with temporary or reduced income who want to stay in the home | – Keeps you in your home

– May lower monthly payments |

– Can extend loan term

– Requires paperwork & approval |

| Refinancing | Replaces current mortgage with a new one (possibly with better terms) | Homeowners with sufficient credit and equity | – Can reduce interest rate or payment

– Avoids credit damage |

– Not available if you’re already behind on payments |

| Forbearance | Temporary pause or reduction in mortgage payments | Short-term financial setbacks (e.g., job loss, illness) | – Buys time to recover financially | – Payments still accrue

– Lump-sum repayment may be required later |

| Deed in Lieu of Foreclosure | Voluntarily transfer ownership of home to lender to satisfy the debt | Homeowners who can’t sell and want to avoid foreclosure | – Quicker process than foreclosure

– May reduce credit damage |

– Loss of home

– May still owe deficiency unless waived |

| Renting the Property | Lease out the home to cover mortgage payments | Owners with marketable properties in high-rent areas | – Generates income

– Can preserve ownership |

– Still responsible for property management and mortgage |

Pro tip: Some of these options — like loan modification or forbearance — require early communication with your lender. Don’t wait until you’re months behind. Lenders often have hardship programs, but you need to ask early and document your situation.

11. Is a short sale right for me?

When debt threatens the roof over your head, the situation becomes desperate, and a short sale may be the only viable alternative to foreclosure. But that’s not always the case.

“I’ve had financially distressed clients behind on their mortgage payments who didn’t realize they had equity built up. We were able to help renegotiate the loan terms or sell the properties to pay off their debts. A few even walked away with a bit of a payoff,” recalls Soldwisch.

“So, even if you feel hopeless, there are options and remedies that can help.”

When in doubt, reach out to a HUD-approved housing counseling expert who can help guide you toward the best available solution.

Header Image Source: (Francesca Tosolini/ Unsplash)

- "Recourse vs. Non-Recourse Loans: An Overview," Investopedia

- "Does a Short Sale Affect Your Credit Score?," InCharge (January 2024)

- "How mortgage payments impact your credit score," Milliman (May 2024)

- "Foreclosure can cause your credit score to drop 100-plus points—here’s how to recover," CNBC (February 2025)