Selling Your California Rental? 6 Tips to Navigate the State’s Tenant-Friendly Laws

- Published on

- 8 min read

-

Dorothy O'Donnell, Contributing AuthorClose

Dorothy O'Donnell, Contributing AuthorClose Dorothy O'Donnell Contributing Author

Dorothy O'Donnell Contributing AuthorDorothy O’Donnell is a writer based in San Francisco. She covers lifestyle, travel, real estate and other topics for publications such as the Los Angeles Times and 7x7.

-

Sam Dadofalza, Associate EditorClose

Sam Dadofalza, Associate EditorClose Sam Dadofalza Associate Editor

Sam Dadofalza Associate EditorSam Dadofalza is an associate editor at HomeLight, where she crafts insightful stories to guide homebuyers and sellers through the intricacies of real estate transactions. She has previously contributed to digital marketing firms and online business publications, honing her skills in creating engaging and informative content.

If you own a tenant-occupied rental property in California, you might be thinking it’s time to sell and cash in on your investment. Strong demand coupled with a limited housing supply continues to fuel price increases in the Golden State. In March 2025, the median cost of a home in the Golden State increased to $884,350, a 3.5% growth from the same period last year. But amid such promising figures, if you’re a landlord selling house, tenant rights in California should be your top consideration.

Before you plant that for-sale sign and profit from your rental property, you need to know renters’ legal protections. California is known as one of the most tenant-friendly states in the country. Next to New York, California has the second-largest share of renters. Renters occupy some 44% of homes in California, which is higher than the national average of 35%.

Read on to get up to speed on California tenant rights so you don’t let an opportunity to turn this rental into gold slip between your fingers.

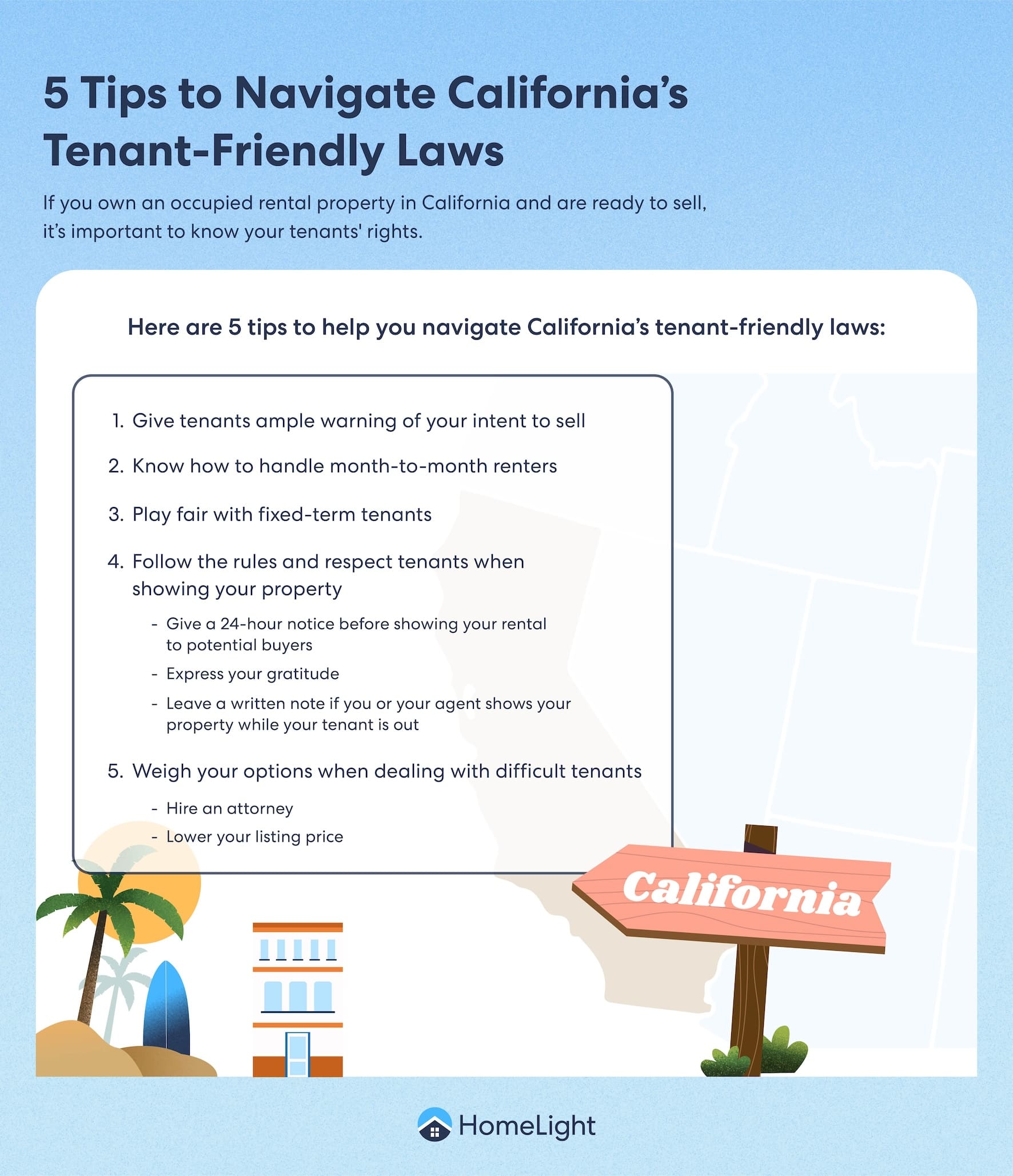

1. Give tenants ample warning of your intent to sell

Before you list your rental unit for sale, you’ll need to be familiar with California’s tenant notification requirements. One source to review these requirements is “A Guide to Residential Tenants’ and Landlords’ Rights and Responsibilities,” posted on courts.ca.gov.

The notification requirements vary depending on the type of agreement you have with your tenant. For example, a periodic month-to-month or week-to-week tenancy agreement may have different requirements than a longer-term lease agreement. How long your tenant has lived in the unit can also affect the notification requirements.

To avoid legal troubles, consult a trusted legal advisor regarding when and how to notify your tenants that you are selling the rental property.

There are additional notification requirements if you plan to let potential buyers in to show your unit (up to 120 days’ notice), according to California Civil Code, Section 1954.

As a landlord, you should also familiarize yourself with Assembly Bill 1482, which enacted the Tenant Protection Act of 2019. The bill broadens the state’s definition of “no-fault” evictions and the rights of tenants facing them. It applies to most multi-unit housing and single-family rentals owned by a real estate investment trust, LLC, or corporate member.

2. Know how to handle month-to-month renters

Many states require landlords whose renters have a monthly lease to provide only 30 days’ notice to vacate the property they’re selling. But California is more generous when it comes to giving month-to-month renters time to figure out their future living arrangements.

In the Golden State, if you have month-to-month tenants who have resided in your place for at least a year, you must provide a 60-day warning if you want them to move, according to California Civil Code 1946.1.

3. Play fair with fixed-term tenants

In California, renters with a fixed-term lease have the right to stay put until it expires. This is true even if you sell the property before the lease is up. “A fixed-term lease protects the tenant from eviction by the current or subsequent owner,” explains Brian Kram, a Marin County real estate attorney who specializes in California tenant and landlord law.

If your buyer is an investor, your tenant simply pays rent to the new owner until the lease ends. At that point, they can work out new terms.

However, when your buyer plans to live in the tenant-occupied home, the situation gets trickier. While you can’t legally force a tenant to leave, you can try to motivate them with money (aka “cash for keys”).

“It’s really about feeling out the tenant and having a conversation,” says Justin Bonney, a top Los Angeles-based real estate agent who’s helped clients maneuver the challenges of selling tenant-occupied rental homes, as well as other types of houses for sale in Los Angeles.

“The average varies, but between $4,000-$6,000 seems to be the sweet spot to help cover expenses like moving trucks and security deposits.”

4. Follow the rules and respect tenants when showing your property

Having strangers parade through the place they call home can be stressful for tenants. Be sure to abide by the law when arranging showings to avoid straining relationships and jeopardizing your odds of scheduling viewings in a timely manner.

- Give 24-hours’ notice before showing your rental to potential buyers

You deliver this message by email, phone, or in person. All showings must be at reasonable hours — late evenings or crack-of-dawn weekend visits probably won’t fly with most folks. And while you can ask your tenants to leave the premises for a viewing or open house, they are entitled to deny your request. - Express your gratitude

Consider giving your renters a gift certificate to a local coffee shop or restaurant to express your appreciation when asking them to disrupt their day for a showing. Such gestures will go a long way towards fostering cooperation and inspiring tenants to keep the place tidy to appeal to buyers. - Leave a note

If you or your agent shows your property while your tenant is out, California law says you must leave a written note letting them know you were in their home.

5. Weigh your options when dealing with difficult tenants

Let’s say you’ve been dealing with unreasonable tenants who haven’t paid rent for months. You’ve been patient, treated them fairly, and provided them with proper written notice of your plans to sell. Their lease is up, and they’ve had plenty of time to look for another place. You’ve even offered cash to motivate them to pack up and leave. But they still won’t budge.

Even worse, they refuse to let potential buyers inside the house. While such nightmare scenarios are rare, they do happen, so it pays to have a game plan just in case. Consider the following options:

- Bite the bullet and hire an attorney

If you find yourself in this kind of predicament, it’s probably time to hire an attorney who specializes in landlord-tenant law to pursue an eviction. “If you’ve already been in a period of a year or so of having no performance with a property because of a bad tenant, you might as well go through with the process of getting them out,” says Bonney. “You’ll net a lot more on the sale because it’s much easier to sell a property without an uncooperative tenant.” - Lower your listing price

If you’re not ready to commit to the cost and hassle of the eviction process or are under pressure to sell your home as soon as possible, you can continue to try and move it with a difficult tenant under your roof. But be prepared to settle for a lower price. “Just know you’re going to take a hit because you’re selling your problem to someone else,” warns Bonney.

Kram adds that unless you failed to disclose that the home was occupied by renters or had an agreement stating you would be responsible for getting them out before closing, the troublesome squatters will become the responsibility of the new owners.

Partner with professionals for the best outcome

The sale of a rental property can get complicated, especially when tenants are involved. That complexity is why you should work with professionals who have experience with these types of transactions.

An investor-friendly agent is well-versed in investor purchasing preferences, the amount they’re might pay, and the nuances of the investor market. Additionally, an agent who regularly works with investors can connect you with individuals or groups who may be interested in buying your property.

Use HomeLight to find the perfect real estate agent and sell your home faster. The service is 100% free, with no strings attached. It takes only two minutes to match you with an experienced agent who can help you navigate the murky waters of lease agreements and tenants’ rights.

Editor’s note: This blog post is for educational purposes only, not legal advice. Reach out to your own advisor for professional assistance on selling a house in California and understanding tenants’ rights.

Header Image Source: (Wonderlane / Flickr via Creative Commons Legal Code)