When to Downsize Your Home: 10 Signs It’s Time to Sell

- Published on

- 12 min read

-

Lori Lovely, Contributing AuthorClose

Lori Lovely, Contributing AuthorClose Lori Lovely Contributing Author

Lori Lovely Contributing AuthorLori Lovely edited the Real Estate Home section for the Indianapolis Star and covered the annual Dream Home construction and decor for Indianapolis Monthly magazine. She has written guides for selling houses and more.

-

Richard Haddad, Executive EditorClose

Richard Haddad, Executive EditorClose Richard Haddad Executive Editor

Richard Haddad Executive EditorRichard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

Not everyone dreams of living in a mansion — and even if they do live in one, there comes a time when they might consider downsizing to a smaller home. “Downsizing is 30% to 50% of my business,” says Ben Swanson, a real estate agent in Mesa, Arizona, “And with my clients, I stress the importance of knowing when to downsize your home.”

Timing a move is critical. Swanson says many of his clients leave the decision too long and end up with a big house that overwhelms them with maintenance and upkeep.

The key is knowing both: if and when to downsize. Delaying downsizing even a few years can result in tens of thousands of dollars lost. It can also be much harder later in life due to health issues or mobility restrictions.

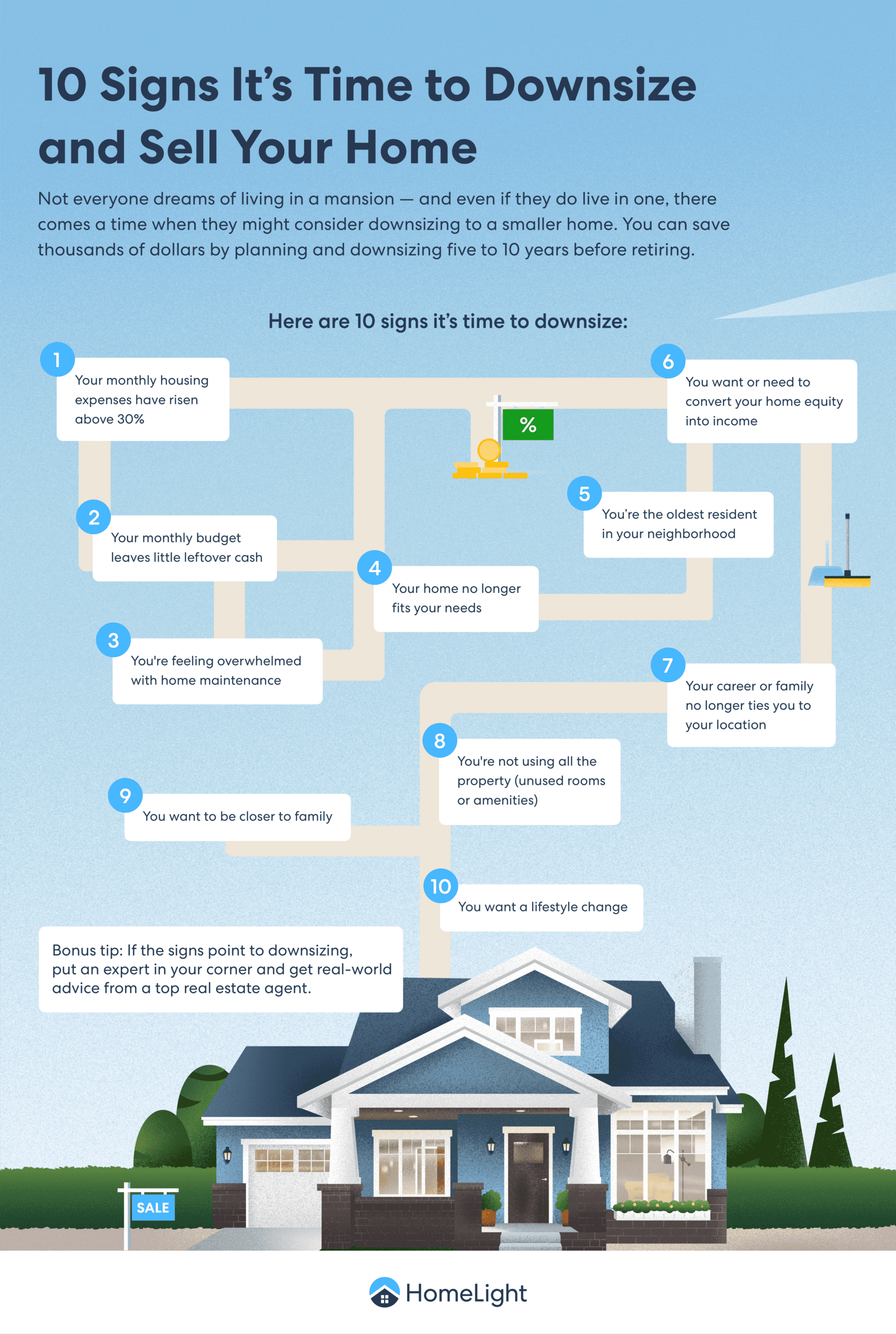

That’s why we’ve compiled this handy list of 10 clear signs it’s time to downsize. We hope to calm your concerns, quell your indecision, and empower you to know if you’re making the right decision at the right time.

When do most people downsize their home?

U.S. News & World Report recently surveyed 2,000 U.S. adults aged 55 and older to explore their use of assistive technologies at home and their intentions for using these devices to help them age in place. An overwhelming majority (93%) affirmed that aging in place was an important goal for them.

Downsizing is common among empty-nesters and retirees. The National Association of Realtors (NAR) found that 73% of recent buyers did not have a child under the age of 18 in their home.

Buyers aged 59 to 68 made up 19% of recent purchases, while those aged 69 to 77 accounted for 12%. Baby Boomers mainly bought homes to be closer to family and to find smaller, more manageable properties.

Downsizing isn’t just for older generations; younger demographics are also considering it — and should be. Here are 10 signs telling you it’s time to downsize.

1. Your monthly housing expenses have risen above 30%

Unaffordability has reached an all-time high. Nearly 50% of the 42.5 million renter households in the U.S. are cost-burdened, meaning they spend more than 30% of their income on rent and utilities. Households that spend more than 50% of their income on rent and utilities are considered severely cost-burdened.

Thus, if you experience a significant drop in income, whether through retirement, salary cuts, or job loss, it’s easy to slip into one of those categories. This can be a sign that it’s time to move to a smaller place with a more affordable mortgage.

It’s important to plan ahead for this possibility. Swanson says that seniors who want to avoid getting a part-time job just to make ends meet need to calculate how much house they can afford in retirement.

“Living in a smaller space can reduce the mortgage payment, and cost less for utilities, property taxes, and maintenance,” says Timothy M. Kennedy, a reverse mortgage and retirement mortgage specialist with Movement Mortgage.

Just beware of the short-term upfront costs involved with moving. “There are repairs on the home before selling, moving expenses, closing costs, and upgrades on the new place,” Kennedy says. You may need to buy new furniture to fit your smaller space. You may also want to hire a moving company to do the work for you.

“In the short term,” Kennedy continues, “those expenses may exceed that predetermined budget amount, but in the long term, downsizing can reduce monthly debt and increase monthly cash flow.” Downsizing before retirement can help pay for many of these costs.

2. Your monthly budget leaves little leftover cash

Many people expect to be free to travel after retirement. But if you’re using your savings to pay your housing expenses, it’s a sure sign you should downsize to something more affordable. By planning ahead and downsizing five to 10 years before you retire, you can save thousands of dollars each year.

For instance, if you move into a home that costs $100,000 less than your current one, you could earn $3,000 in proceeds and save $3,250 annually in housing costs. Over five years that adds up to an extra $31,250 for your household. Over 10 years, this doubles to $62,500 in savings by the time you retire.

According to Darryl Jones, a top agent who sells 61% more quickly than the average Brea, California agent, many Californians are moving out of state “for political and cost reasons.” He explains: “They can get a good price [for their home] in California and move out of state, [where homes are] cheaper.” Tennessee, Arizona, Colorado, and Nevada are popular destinations for these former Californians.

3. You’re feeling overwhelmed with home maintenance

One of the biggest reasons seniors decide to downsize is to rid themselves of the burden of maintenance. Taking care of minor repairs, painting, mowing the lawn, and shoveling snow are time-consuming tasks that aren’t most people’s vision of a relaxing retirement. Even worse, these projects may become too physically challenging for people as they age.

Hiring mowing crews, painters, or a handyman may be cost-prohibitive.

By selling your home while it’s still in good condition, you can save money on preparations because it shouldn’t need major repairs. You’ll also save years’ worth of maintenance expenses.

If you make the move too late, your home just starts deteriorating. You’re going to have to spend equity to repair your house before it goes on the market.

Ben Swanson Real Estate AgentClose

Ben Swanson Real Estate AgentClose Ben Swanson Real Estate Agent at Keller Williams Integrity First Currently accepting new clients

Ben Swanson Real Estate Agent at Keller Williams Integrity First Currently accepting new clients

- Years of Experience 24

- Transactions 925

- Average Price Point $269k

- Single Family Homes 651

4. Your home no longer fits your needs

While some seniors desire to age in place in the home they’ve loved for years, they may experience challenges to living in it as they grow older, such as:

- Stairs make it difficult to access living spaces

- A steep driveway presents a fall risk

- Large walkways and long driveways require shoveling snow

- Mowing the lawn has become difficult

- Cabinets or storage spaces are hard to access

- Too many windows to keep clean

- Landscaping requires high maintenance

- Bathtubs and showers without grab bars

Many seniors want a one-level home that features hallways wide enough to accommodate a wheelchair, zero-step entries, walk-in showers with a bench, and proximity to hospitals, clinics, and public transportation. Jones talks about the desire of older homeowners to move out of a “two-story monster house to a single story.”

These features are hard to find due to a shortage of affordable housing that meets the needs of older residents — particularly those with mobility limitations. According to a recent study, approximately one-third of 70-year-olds and most 80-year-olds report restrictions on mobility in their apartments and immediate surroundings. But nationally, fewer than 4% of homes offer single-floor living, no-step entries, and wide hallways and doorways — the three foundational features of accessible housing. Thus, planning ahead is crucial.

5. You’re the oldest resident in your neighborhood

In addition to the financial savings of moving to a retirement community comes the social aspect. If you stay in your home for a long time, you’re bound to watch neighbors move or pass away, leaving you isolated and maybe lonely — a condition affecting 60% of Gen Xers and 44% of Baby Boomers.

“Family neighborhoods tend to stay younger as families keep moving in, so seniors end up isolated by aging in place in that neighborhood,” Swanson says.

Moving to a senior living community can provide that social network and more, including transportation, activities, support, and security, all of which can improve your quality of life, thereby preventing depression-related health issues.

“When you downsize into a retirement community, you can actually raise your happiness by meeting more people from your generation,” Swanson says. “A lot of the adult communities have amenities like tennis courts, billiards rooms, woodworking shops, classes that teach you how to knit, clubs that play cards and board games.”

Just be advised that communities that provide activities, amenities, and services typically charge more, so be sure to determine what your budget permits.

6. You want or need to convert your home equity into income

As many as a third of older workers have saved less than $50,000 for their retirement. That’s why some seniors turn to their home’s equity to help pay the bills, sometimes through a home equity line of credit (HELOC) or a reverse mortgage.

However, it’s not a limitless supply of funds. Kennedy says homeowners should be cautioned to convert their home equity into “a stream of income that will last the remainder of your life.”

One way to do that might be downsizing to a less expensive home. For example, Kennedy continues, if you pay $4,200 a month on your mortgage, principal interest, taxes, and insurance, downsizing 10 to 15 years before you retire could save $40,000 a year in housing costs.

7. Your career or family no longer ties you to your location

Retirees aren’t the only ones free from career ties to a specific location. Commonplace since the global pandemic, approximately 22 million Americans now work remotely from home. Among the many benefits, this allows people to live wherever they want.

Parents whose children are grown and gone have no need to live in preferred school districts, opening up their choices of location for a new home in a less expensive neighborhood.

Some homeowners don’t even need to downsize; they can simply choose a more affordable location where homes are not only less expensive, but property taxes, utilities, and sales tax are lower, too.

8. You’re not using all the property (unused rooms or amenities)

Once the kids are grown and gone, their bedrooms may be used only for occasional visits. But you still have to clean them, heat them, cool them — and pay insurance and property taxes on them.

If you’re retired, you may not need a home office. Perhaps your new lifestyle keeps you too busy to make use of a game room or home theater. Features like these, plus swimming pools, three-car garages, exercise rooms, and fire pits may not suit your retirement plans but are great selling points.

9. You want to be closer to family

Many retired Baby Boomers may decide to move back in with their grown children later in life. In fact, this group is the most likely to move the farthest after selling their home.

More than Baby Boomers, however, the Silent Generation is the group most likely to buy a home near family and friends.

“The tipping point,” Jones says, “is grandchildren.” When young adults find it difficult to afford their first house, he says they may leave the state — and their parents follow out of a desire to be closer to their grandchildren.

While some seniors are moving great distances to be near their grandkids, others are downsizing to a condo or senior community in their current city, which enables them to travel to visit family and enjoy other locations.

10. You want a lifestyle change

Seniors have many options when it comes to housing. We’ve already discussed the benefits of age-restricted communities.

Sometimes, lifestyle changes are thrust upon us. For those with physical limitations or medical needs, there are independent living communities, assisted-living communities, and nursing homes where they can get the level of assistance they need.

People going through a divorce may no longer need the big house without a full-time family and find it more economical to downsize to a more affordable home.

Some seniors move in with their adult children, which can provide benefits for both generations, such as built-in babysitting and reduced housing costs. Alternatively, senior home-sharing can provide the benefits of socialization and cost-sharing.

Other seniors opt to take a “gap year” (or two or three) by living in an RV. It can be an economical option that allows them the freedom to pick up stakes and move any time they want.

Remember: Downsizing isn’t just for seniors. Downsizing to a smaller home that costs less and requires less maintenance frees up funds and time for other things. You may be able to work fewer hours and still pay off your mortgage faster. You may be able to save money by reducing or eliminating mortgage payments, enabling you to pay off credit cards and other debt, or possibly retire sooner.

Or, you simply might free up funds to enjoy life by traveling or engaging in activities you like, such as frequenting restaurants, taking classes, or picking up a new hobby.

On the practical side, downsizing may also allow you to save money for emergencies. If you’re environmentally minded, heating and cooling a smaller home consumes fewer fossil fuels.

Perhaps you just want to simplify your life and eliminate the time and effort that goes into maintaining a large home. This, along with cost savings, is part of what sparked the tiny home movement.

What are the most common downsizing mistakes?

Even if downsizing is right for you, it’s still possible to make mistakes in the process. Here are some common ones to avoid:

- Not having a plan: You should know where you’re going before you sell your home and strategize the details of the move. You should list your goals and the steps to reach them. “Closing escrow without a place to move to” is a mistake, Jones says. To get around this challenge, he advises clients to make the sale of their home contingent upon finding a new home.

- Underestimating what a new home and move will cost: Over the past five years, home prices have surged 54%, so your dollar may not go as far as it once did. The average cost of moving a distance of 250 miles ranges from $600 to $3,500. A long-distance move can be as high as $8,300.

- Overestimating your current home’s worth: Just because prices are up doesn’t mean your home is worth more. “Even in a seller’s market, you can overprice a home,” Jones says. Many factors go into the calculation of a home’s value. To get a ballpark estimate, consult HomeLight’s free Home Value Estimator.

- Not calculating closing costs into the decision: Closing costs typically amount to 2% to 5% of the sale price of the house. To get a better idea of how much you’ll owe at closing, use HomeLight’s Closing Costs Calculator.

- Failing to research tax implications before moving: The rules of capital gains tax are complicated. You may owe more than you think — or you may owe nothing. “Talk to a CPA,” Jones advises, “so it’s not a shock.”

- Selling too quickly: In a hot seller’s market, homes have been known to sell in a day or two, but Jones thinks sellers could get more if they wait a little longer and let the competition take place.

- Putting it off too long: You can miss out on savings if you wait too long to downsize, especially if the market isn’t favorable or few options exist. Do it before you’re in crisis mode.

- Downsizing too soon: You may not be emotionally ready to leave your beloved home, or you may have adult children moving back in with you temporarily. Downsizing isn’t always cheaper. If prices on smaller living quarters are too high, it may be best to wait.

- Rushing the process: Major life transitions take an emotional toll. Having enough time to think out a move and go through the downsizing process can make it much easier to live with.

If the signs point to downsizing, put an expert in your corner

It’s important to evaluate the financial, emotional, and practical aspects of downsizing to determine if it’s the right thing for you, and, if so, when is the right time. Jones believes that’s a personal decision, not a market-driven one. “The best time to sell is when you’re ready.” But, he adds, “Know the pros and cons … and the inventory.”

If the benefits outweigh the drawbacks, and you’re ready to pull the trigger on a move, create a plan that covers all the steps. Find some additional planning suggestions here.

You can also get real-world advice from your real estate agent. Put an expert in your corner by using HomeLight’s Agent Match. This free platform analyzes data from millions of transactions to provide a data-backed recommendation of a top local agent in your area who can help you downsize when you’re ready.

Header Image Source: (Shopify Partners / Burst)