Detroit Hard Money Lenders: Speedy Real Estate Loans

- Published on

- 9 min read

-

Joseph Gordon EditorCloseJoseph Gordon Editor

Joseph Gordon is an Editor with HomeLight. He has several years of experience reporting on the commercial real estate and insurance industries.

Looking to kickstart your next real estate venture in the Motor City? A hard money loan in Detroit might be just what you need. From flipping houses in Rosedale Park to buying rentals in Greektown, Detroit hard money lenders can get you fast funding with flexible terms. They’re perfect for short-term projects or if you don’t have a lot of cash or great credit.

If you’re not into real estate investments but need to bridge the gap between buying and selling a home, we’ll discuss alternative options for maximizing your home’s equity. This article will dig into the essentials of hard money lending in Detroit, guiding you to make informed decisions that align with your real estate objectives.

What is a hard money lender?

A hard money lender is a private individual or company that provides short-term loans secured by real estate. Unlike traditional banks, these lenders emphasize the property’s value rather than the borrower’s credit score. Most people who turn to this type of financing are house flippers and rental property buyers who need quick, flexible financing.

Loan amounts are based on the after-repair value (ARV) of the property, which is its estimated value post-renovation. Typically, lenders provide a percentage of the ARV to ensure profitability and security.

Interest rates for hard money loans range from 8% to 15%, with terms usually between six to 24 months. Additional costs may include origination fees, closing costs, and points (a percentage of the loan amount borrowers pay at closing). If you fail to repay the loan, the lender will take possession of the property to recoup their investment.

How does a hard money loan work?

If you’re in Detroit and need quick, flexible financing for a real estate project, hard money loans can be a solid option. Here’s how these loans typically work:

- Short-term loan: Hard money loans usually have repayment terms of six to 24 months, much shorter than the standard 30-year mortgage.

- Faster funding option: They can be processed and funded in a few days, whereas traditional mortgages can take 30 to 50 days to complete.

- Less focus on creditworthiness: Lenders prioritize the property’s value over the borrower’s credit score, making these loans accessible to more people.

- More focus on property value: Loan amounts are based on the property’s loan-to-value ratio, using the property as collateral.

- Non-traditional lenders: These loans are offered by private investors or companies, not traditional banking institutions.

- Loan denial: This financing solution is ideal for those who have been denied a mortgage but possess substantial home equity.

- Higher interest rates: These loans carry higher interest rates due to the higher risk for lenders.

- Larger down payments: A larger down payment of 20% to 30% is often required.

- More flexibility: Hard money lenders can provide more flexible terms, avoiding strict debt-to-income criteria.

- Interest-only payments: Some lenders offer the option of interest-only payments, easing initial financial burdens.

What are hard money loans used for?

Hard money loans are a useful option in Detroit’s real estate scene, especially if you need fast funding or can’t get approved for a traditional loan. Here are some scenarios where they’re commonly used:

- Flipping a house: If you’re flipping homes in Detroit, hard money loans give you quick financing so you can buy and renovate properties fast and turn a profit sooner

- Buying an investment rental property: These loans help investors acquire and rehab rental properties. Getting funds fast helps you start renovations sooner and bring in rental income quicker.

- Purchasing commercial real estate: Hard money loans make it easy to move quickly and stay flexible when you’re buying commercial properties.

- Seeking alternatives to traditional loans: If you’ve got a lot of equity but not the best credit, you can still go for a hard money loan. Since this type of financing is based on the property’s value, it’s easier to qualify for, even with credit issues.

- Facing foreclosure: When you’re facing foreclosure, a hard money loan can help you refinance your debt or give you extra time to sell your property. It’s a way to avoid foreclosure and protect your credit

How much do hard money loans cost?

Hard money loans usually cost more than traditional loans because they’re riskier and move faster. Common costs include:

- Interest rates: These can be 8% to 15% or more.

- Origination fees: Lenders often charge 1% to 5% of the loan amount.

- Closing costs: These can include various fees, such as legal and appraisal fees.

- Points: Lenders might charge upfront points, a percentage of the loan amount.

Use online hard money loan calculators to better estimate and prepare for costs.

Alternatives to working with hard money lenders

If you’re a homeowner exploring ways to leverage your home’s equity instead of using a hard money loan, consider these options:

- Take out a second mortgage: A home equity loan or a home equity line of credit (HELOC) can offer lower interest rates and provide necessary funds more affordably than hard money loans.

- Cash-out refinance your home: This method allows you to refinance your current property and withdraw cash to fund new investments, usually at lower interest rates.

- Borrow from family or friends: Personal loans from family or friends can provide flexible repayment options and lower interest rates, making them a cost-effective choice.

- Use a government-backed loan program: Government programs from the FHA, VA, or USDA can help you buy homes with reduced down payments and interest rates.

- Consider a peer-to-peer loan: These loans, through platforms like MeridianLink or Funding Circle, can connect you with individual investors who might offer more favorable terms.

- Explore specialized loan programs: Look into loans specifically designed for fixer-uppers or refinancing investment properties, which can help replace an existing hard money loan.

- Request a seller financing option: Some sellers may agree to finance the purchase, leading to lower closing costs and easier eligibility criteria.

How to buy before you sell

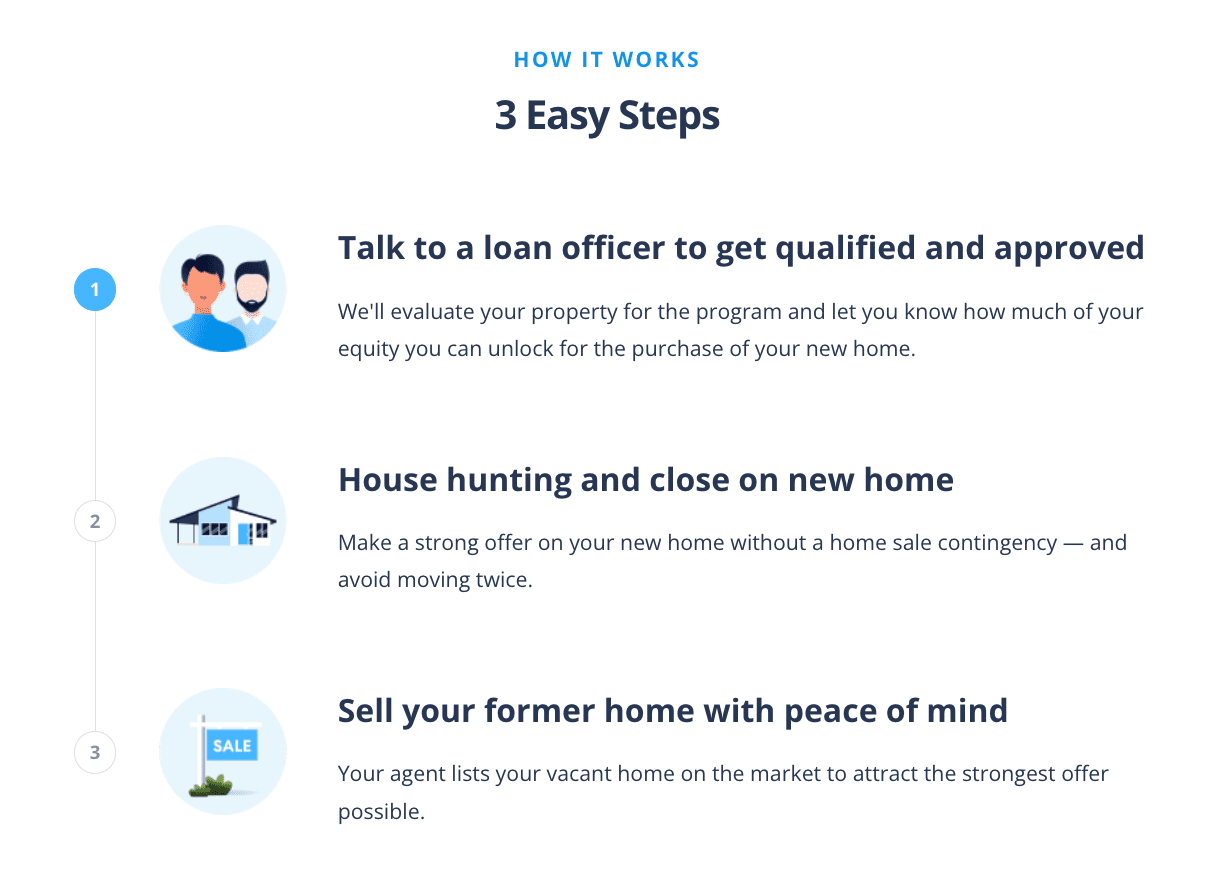

The perfect listing often appears unexpectedly, whether it’s a cozy bungalow or a modern loft downtown. If you can’t afford to wait for your old home to sell before buying a new one, HomeLight’s Buy Before You Sell (BBYS) program can simplify the process.

With this program, you can leverage your current home’s equity to make a competitive, non-contingent offer on a new property. HomeLight can approve your equity unlock amount within 24 hours, with no upfront cost or commitment. This enables you to secure your next home and sell your existing one vacant, avoiding the inconvenience of moving twice.

Here’s how HomeLight Buy Before You Sell works:

The program charges a flat fee based on your current home’s sale price. However, potential savings on moving costs, temporary housing, and the purchase price of your new home can make this worthwhile. Moreover, HomeLight’s BBYS fees are generally lower than the interest rates on bridge loans, which range from 9.5% to 12%.

3 top hard money lenders in Detroit

Detroit has plenty of options for fast, flexible hard money financing. These lenders can help you secure investment properties or handle quick renovations. Here are three of the top hard money lenders in the area.

Michigan Mortgage Solutions

Michigan Mortgage Solutions provides expert guidance and personalized solutions designed to simplify home financing, whether clients are purchasing their first home, upgrading, refinancing, or investing. Their approach focuses on clarity, support, and attentive service to ensure each client feels confident in their decisions. With a commitment to making mortgages straightforward, they prioritize education and transparency throughout the process.

Lending clientele: Residential real estate investors. They focus on funding single-family homes, condos, townhomes, and multi-family properties.

Loan criteria: LTV up to 80% of ARV

Michigan Mortgage Solutions has been accredited with the Better Business Bureau (BBB) since 2008. It now has an A+ rating. On Google, it received a high 4.9-star rating from past clients.

Reviewers share that the team was an absolute delight to work with. They were always quick to answer questions and offered the best advice on making the most of their budget. The team ensured clients felt comfortable and confident with both their loan and new property, and comes highly recommended for anyone in need of a knowledgeable and supportive loan officer.

Website: michiganmortgagesolutions.com

Phone number: 248-963-1894

Premium Hard Money

Premium Hard Money, a Michigan-based lender specializing in hard money and private money loans, brings over 40 years of combined experience. It has successfully closed more than 5,000 loans, totaling over $1 billion in transactions. Their deep industry knowledge and expertise in hard money lending distinguish them from other lenders.

Clients can receive preliminary approval in as little as 24 hours, with loans closed and funded in just five days. Committed to fast closings and exceptional service, Premium Hard Money delivers reliable solutions tailored to each client’s needs.

Lending clientele: Residential, commercial, and development investors

Loan criteria: LTV up to 75% of ARV

Premium Hard Money has received positive reviews from its clients, generating a perfect 5-star rating on Google. Some reviewers note the company’s professionalism and quick response times, especially in situations where time is a factor. Others say that the team made securing a loan for their flip project simple and stress-free.

The process moved quickly, from start to finish, and the service exceeded expectations. They are thankful for the team’s guidance and highly recommend them for anyone looking for a dependable loan solution

Website: premiumhardmoney.com

Phone number: 248-759-8777

Lima One Capital

Since its founding in 2011, Lima One Capital has been dedicated to empowering real estate investors to improve properties, neighborhoods, and communities. Founded by two U.S. Marine Corps veterans, the company approaches every deal with the grit, determination, boldness, and integrity that reflect its Marine Corps roots.

Over the years, Lima One has set the standard for private lending excellence, serving thousands of clients across 46 states, including Michigan. The team has successfully closed over 29,000 loans, generating more than $10 billion in funding for real estate investors.

Lending clientele: Residential and commercial real estate investors

Loan criteria: LTV 70% up to 80% of ARV

Accredited with the BBB since 2013, Lima One Capital reflects an A+ rating. Its Google Business Profile received 4.2 stars from satisfied clients. Some share that they’ve partnered with the company for several years, successfully financing rental properties and fix-and-flip projects in different places. Others appreciate the team’s market expertise, responsiveness, and professional yet approachable style.

Lima One provides competitive rates and financing solutions tailored to investment goals, helping clients grow their single-family rental portfolios. Their consistency, transparency, and dedication to investor success have made them a trusted partner.

Website: limaone.com

Phone number: 800-390-4212

Should I partner with a hard money lender in Detroit?

Whether a hard money lender in Detroit is right for you really depends on your situation and what you’re trying to do with your real estate investments. Hard money loans are great for investors who need quick, flexible funding and can handle higher costs and shorter payback periods. If that sounds like it fits your goals, a hard money loan could be a smart move for your Detroit properties.

If you’re planning to tap into your equity, HomeLight’s Buy Before You Sell program presents a practical alternative. Instead of incurring high interest rates, this program charges a flat fee, helping you make a stronger offer and facilitating a seamless move.

To connect with experienced real estate agents in Detroit who work with hard money lenders, HomeLight can introduce you to top professionals in your area.

Header Image Source: (iriana88w/ Depositphotos)

Editor’s note: This post is for educational purposes only and should not be considered financial advice. HomeLight encourages you to consult your own advisor.