Hard Money Lenders Houston: Fast and Flexible Loans

- Published on

- 11 min read

-

Kelsey Morrison Former HomeLight EditorCloseKelsey Morrison Former HomeLight Editor

Kelsey Morrison worked as an editor for HomeLight's Resource Centers. She has seven years of editorial experience in the real estate and lifestyle spaces. She previously worked as a commerce editor for World of Good Brands (eHow.com and Cuteness.com) and as an associate editor for Livabl.com. Kelsey holds a bachelor’s degree in Journalism from Concordia University in Montreal, Quebec, and lives in a small mountain town in Southern California.

Are you looking to finance your next real estate project in Houston with a hard money loan? Whether you’re eyeing a fixer-upper in The Heights or planning to invest in a commercial property in Downtown, hard money lenders in Houston offer a flexible and speedy alternative to traditional financing. These loans are particularly useful for investors needing quick access to funds and for those whose credit history might not meet conventional loan requirements.

In this article, we’ll explore the ins and outs of hard money lending in Houston, explaining how these loans work, what they’re typically used for, and how much they cost. We’ll also discuss alternatives, including HomeLight’s Buy Before You Sell program. Whether you’re a seasoned investor or a homeowner looking to bridge the gap between buying and selling, this guide will help you make informed decisions about your financing options.

What is a hard money lender?

A hard money lender is a private entity or individual offering short-term loans backed by real estate. Unlike traditional banks, these lenders prioritize the property’s value over the borrower’s credit score or income. They typically accommodate house flippers and rental property investors who need quick, flexible financing.

They determine loan amounts using the after-repair value (ARV), which is the estimated worth of a property after renovations. Hard money lenders typically offer a percentage of this ARV, ensuring the loan is secured by the property’s potential value.

Interest rates for hard money loans are higher, generally ranging from 8% to 15%, with terms lasting from 6 to 24 months. Borrowers also face origination fees, closing costs, and points or upfront fees. If a borrower defaults, the lender can seize the property to recover their funds.

How does a hard money loan work?

If you’re investing in Houston real estate and need fast, flexible financing, working with hard money lenders could be exactly what you need. Here’s an overview of how hard money loans work:

- Short-term loan: These loans typically have a repayment period of six to 24 months, unlike the 15- to 30-year terms common with conventional mortgages.

- Faster funding option: This type of financing can be approved within days, compared to the 40 to 50 days typical for traditional mortgage loans.

- Less focus on creditworthiness: Approval relies less on your credit score and income history, with more emphasis placed on the value of the property.

- Greater scrutiny on the collateral: These loans are based on the loan-to-value ratio of the property being used as collateral.

- Non-traditional lenders: Hard money loans are usually provided by individual investors or private lending companies, not traditional banks.

- Loan denial: These loans are often utilized by individuals with poor credit who have been denied a mortgage but possess significant home equity.

- Higher interest rates: Due to the higher risk involved, hard money loans come with higher interest rates compared to traditional mortgages.

- Larger down payments: Borrowers may need to provide a larger down payment, sometimes up to 20% to 30% of the property’s value.

- More flexibility: With fewer government regulations, hard money lenders in Houston can set flexible terms, including credit scores and debt-to-income criteria, and can help avoid foreclosure.

- Interest-only payments: Unlike traditional mortgages, hard money loans may allow for interest-only payments or deferred payments initially, providing additional financial flexibility.

What are hard money loans used for?

Hard money loans cover a lot of financing needs in the Houston market, giving investors and folks with unique situations quick access to cash. Let’s explore the common uses of hard money loans:

Flipping a house: If you plan to flip homes, hard money loans provide fast cash to purchase and renovate properties. They help flippers quickly acquire homes, make necessary renovations, and sell them for a profit within a short period.

Buying an investment rental property: If you’re looking to purchase rental properties, you can benefit from hard money loans, as they allow you to quickly acquire properties, especially those needing repairs. With this, you can complete renovations and start generating rental income sooner.

Purchasing commercial real estate: Hard money loans work great for commercial deals because they’re flexible and close fast. When timing really matters, they help you lock in valuable properties without the slowdowns that come with traditional financing.

Looking for alternatives to traditional loans: If you’ve got a lot of equity but your credit isn’t great, a hard money loan might be an easier option. These lenders care more about the property’s value than your credit score, making it a solid alternative when traditional loans aren’t an option.

Facing foreclosure: If you’re facing foreclosure, you can use hard money loans to refinance debts or buy time to sell your property. This gives you a temporary way to avoid foreclosure and get a better handle on your financial situation.

How much do hard money loans cost?

The cost of hard money loans is typically higher due to the increased risk and quick, flexible funding. Here are some typical costs associated with these loans:

- Interest rates: These can range from 8% to 15%, depending on the lender’s risk assessment.

- Origination fees: Lenders may charge 1% to 5% of the total loan amount.

- Closing costs: These can include legal fees, appraisal fees, and other administrative costs.

- Points: Lenders might charge points upfront, which are a percentage of the loan amount.

Many online hard money loan calculators are available to help estimate these costs.

Alternatives to working with hard money lenders

If you’re a homeowner looking for alternatives to hard money loans, here are some options to consider:

Take out a second mortgage: A home equity loan or home equity line of credit (HELOC) allows you to tap into your home’s equity at typically lower interest rates than hard money loans.

Cash-out refinance your home: This option lets you refinance your existing property and pull out cash to finance a new investment, often with lower interest rates than hard money loans.

Borrow from family or friends: Personal loans from family or friends can offer more flexible repayment terms and potentially lower or no interest rates, making them a cost-effective alternative.

Use a government-backed loan program: Programs from the FHA, VA, or USDA assist in purchasing homes with lower down payments and reduced interest rates.

Consider peer-to-peer loans: Loans from individual investors through platforms like LendingClub or Prosper offer an alternative to traditional hard money loans with different terms.

Explore specialized loan programs: Consider loans tailored for fixer-uppers or refinancing investment properties if you have an existing hard money loan and want to replace it.

Request a seller financing option: Some sellers may agree to finance the purchase themselves, offering lower closing costs and more lenient eligibility requirements.

How to buy before you sell

Sometimes, the perfect listing appears when you’re least expecting it. Perhaps it’s a charming bungalow in Montrose or a sleek, high-rise condo in Midtown. If you’re a Houston homeowner looking to buy a new home before selling your current one, HomeLight offers an innovative solution that simplifies the process.

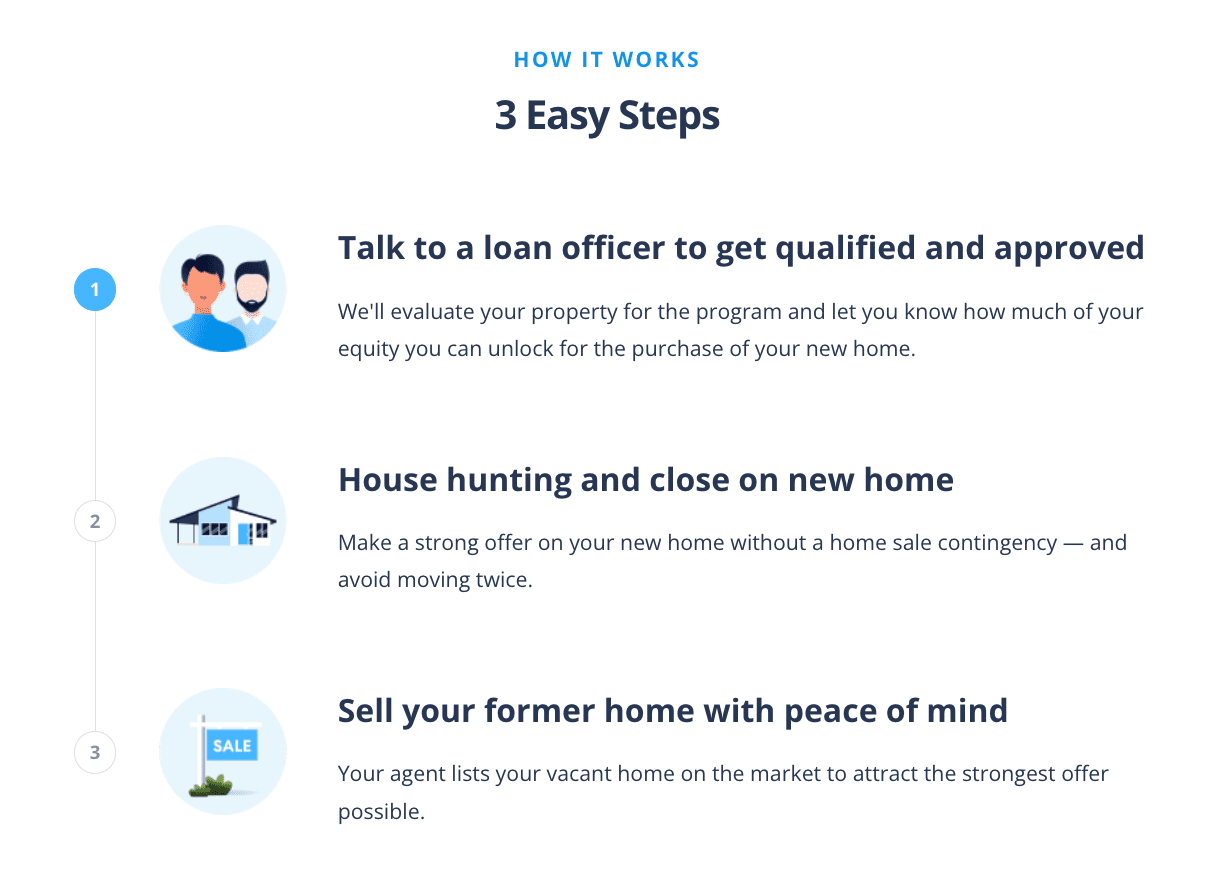

The Buy Before You Sell (BBYS) program allows you to leverage your existing home’s equity to make a stronger, non-contingent offer on a new property. If your home qualifies, you can get your equity unlock amount approved within 24 hours, with no cost or commitment required. Once approved, you can purchase your next home confidently and then sell your current one vacant, avoiding the hassle of moving twice.

Here’s how HomeLight Buy Before You Sell works:

While BBYS comes with a flat fee based on your current home’s sold price, the potential savings in other areas might outweigh this cost. You could save on moving expenses and temporary housing, and possibly fetch a higher sale price for your home. Additionally, HomeLight’s BBYS fees are typically much lower than the interest rates on bridge loans, which range from 9.5% to 12%.

3 top hard money lenders in Houston

If you’re looking for fast, flexible financing in Houston, hard money lenders can be a game-changer. They’re especially useful for investors or anyone needing quick access to cash without the hassle of traditional loans. Here are three top hard money lenders in Houston to consider.

Tidal Loans

Tidal Loans, a Houston-based hard money lender, specializes in flexible fix-and-flip and bridge financing solutions. Founded in 2016, the firm’s team brings over 50 years of combined experience in the real estate industry.

Once all required documentation is submitted, loans can typically be closed within a week through Tidal Loans’ streamlined process. The company serves the Houston, Austin, and San Antonio markets, providing funding for single-family and multi-family residential investment properties.

Lending clientele: Residential real estate investors

Loan criteria: Up to 70% ARV

Tidal Loans earned a high Google rating of 4.7 stars, as many clients report receiving exceptional service. First-time users navigating fix-and-flip deals highlight the team’s professionalism, attentiveness, and dedication to addressing every concern. Others note that Tidal Loans prioritizes clients’ needs long after the initial transaction, consistently exceeding expectations with thoughtful service.

Website: tidalloans.com

Phone number: 832-757-1262

Catalyst Funding

Catalyst Funding, based in Houston and founded in 2012, provides specialized hard money loan programs for house flippers and investors focused on rehabbing rental properties. Their streamlined process allows loans to close in as little as seven days, and borrowers typically receive six-month terms with the option to extend up to 12 months for an additional fee.

Lending clientele: Residential and commercial real estate investors

Loan criteria: 70%–75% ARV

Catalyst Funding boasts a 4.9-star rating on Google, with several clients praising the team’s communication skills, level of professionalism, and dedication to finding the best possible solutions for their clients.

Some appreciate the company representatives’ thorough understanding of client needs and clear guidance through every step of the loan process. Others highlight their attention to detail, making transactions smooth and stress-free.

Website: catalystfdg.com

Phone number: 832-699-6960

Noble Mortgage & Investments

Noble Mortgage & Investments, based in Houston, was founded in 2003 by Darel Daik, a seasoned real estate finance professional with experience dating back to 1995. The firm offers hard money loans to real estate investors ranging from $50,000 to $1.5 million, with a minimum of $100,000 for investments outside Houston. In addition to serving the Houston market, Noble Mortgage & Investments extends its services to Austin and San Antonio.

Lending clientele: Residential and commercial real estate investors

Loan criteria: Up to 75% ARV

Noble Mortgage & Investments boasts a perfect 5-star rating on Google, as reviewers commend the company’s quick funding process, competitive rates, and creative solutions. Some note receiving professional, attentive service from start to finish.

Others highlight the company representatives’ expertise in handling unexpected issues and keeping accounts on track. Many recommend Noble Mortgage for hard money loans, particularly those looking to transition to conventional financing, praising the team’s dedication and reliability.

Website: noblemortgage.com

Phone number: 832-583-1366

Should I partner with a hard money lender in Houston?

Deciding whether a hard money loan is right for you depends on your specific situation and real estate investment goals in Houston. This type of financing is ideal for real estate investors needing quick access to funds, especially for projects requiring fast turnaround times or when traditional financing isn’t an option.

If you’re prepared to handle higher interest rates and shorter repayment terms in exchange for flexible, rapid funding, connecting with a hard money lender in Houston could be the right move for your next investment.

For homeowners looking to leverage their home’s equity without the high costs associated with hard money loans, HomeLight’s Buy Before You Sell program offers a compelling alternative. This program lets you use the equity from your current home to make a stronger offer on a new one — for just a flat fee. It can help you make a more competitive offer and make moving a lot simpler.

As with any major financial decision, consider your long-term strategy and consult with a financial advisor to ensure it aligns with your overall investment goals. If you want to connect with investor-friendly real estate agents in Houston who have access to trusted hard money lenders, HomeLight can introduce you to top professionals in your area.

Header Image Source: (Jeswin Thomas / Unsplash)

Editor’s note: This post is for educational purposes only and should not be considered financial advice. HomeLight encourages you to consult your own advisor.