Discover Top Hard Money Lenders in Phoenix

- Published on

- 11 min read

-

Kelsey Morrison, Former HomeLight EditorCloseKelsey Morrison Former HomeLight Editor

Kelsey Morrison worked as an editor for HomeLight's Resource Centers. She has seven years of editorial experience in the real estate and lifestyle spaces. She previously worked as a commerce editor for World of Good Brands (eHow.com and Cuteness.com) and as an associate editor for Livabl.com. Kelsey holds a bachelor’s degree in Journalism from Concordia University in Montreal, Quebec, and lives in a small mountain town in Southern California.

-

Sam Dadofalza, Associate EditorCloseSam Dadofalza Associate Editor

Sam Dadofalza is an associate editor at HomeLight, where she crafts insightful stories to guide homebuyers and sellers through the intricacies of real estate transactions. She has previously contributed to digital marketing firms and online business publications, honing her skills in creating engaging and informative content.

Are you looking to kickstart your real estate investment in Phoenix with a hard money loan? Whether your goal is to flip a bungalow in the Roosevelt Historic District or purchase a rental property in Arcadia, hard money lenders in Phoenix provide the quick funding and flexible terms you need. These loans serve as an alternative to traditional financing — especially useful for projects requiring fast turnaround times or for those with less-than-perfect credit.

If you need to bridge the gap between purchasing a new home and selling your current one, this article provides valuable alternatives to leverage your home’s equity. Ahead, we’ll cover the basics of hard money lending in Phoenix, helping you decide if this financial strategy suits your investment or home-buying needs.

What is a hard money lender?

A hard money lender is a private individual or company offering short-term loans secured by real estate. Unlike traditional lenders, who emphasize the borrower’s credit history and income, hard money lenders in Phoenix focus on the value of the property being used as collateral. They usually accommodate house flippers and rental property buyers, looking for quick access to funds with flexible terms.

To determine loan amounts, hard money lenders use the after-repair value (ARV), which is the estimated value of a property after renovations. They offer a percentage of the ARV to ensure a secure and profitable investment.

These loans usually have higher interest rates, ranging from 8% to 15%, and shorter repayment periods, often between 6 to 24 months. Additional costs may include origination fees, closing costs, and points paid upfront. If a borrower fails to repay the loan, the lender can seize the property to recover their investment.

How does a hard money loan work?

Hard money loans make it easy to move fast and grab great investment opportunities in Phoenix. Here’s a breakdown of how these loans work:

- Short-term loan: Hard money loans typically have a repayment period of six to 24 months, unlike the extended terms of conventional mortgages, which often range from 15 to 30 years.

- Faster funding: When time is of the essence, hard money loans can be approved and funded within days, much quicker than the typical 40 to 50 days it takes for a traditional mortgage.

- Less focus on creditworthiness: Approval is less reliant on your credit score or income history, placing more emphasis on the property’s value.

- Greater scrutiny on collateral: These loans are secured by the property itself, with lenders considering the loan-to-value ratio of the collateral.

- Non-traditional lenders: Hard money loans are often provided by private investors or specialized lending companies, not by traditional banks.

- Loan denial: Ideal for those with poor credit who have significant home equity, hard money loans can be an alternative after being denied a conventional mortgage.

- Higher interest rates: Due to the higher risk involved, these loans come with higher interest rates compared to traditional mortgages.

- Larger down payments: Borrowers may need to make a larger down payment, sometimes as much as 20% to 30% of the property’s value.

- More flexibility: With less regulation, hard money lenders can offer flexible terms and criteria, often helping borrowers avoid foreclosure.

- Interest-only payments: Some hard money loans may allow for initial interest-only or deferred payments, which can help manage cash flow in the short term.

What are hard money loans used for?

Hard money loans help cover unique financial needs in the Phoenix real estate market. They’re especially useful if you need quick cash or don’t meet the usual bank requirements. Here are some common situations where a hard money loan can come in handy:

Flipping a house: If you plan to flip homes, hard money loans provide quick cash for buying and renovating properties. This allows you to act fast in competitive markets, complete necessary renovations, and sell the property for a profit in a short time frame.

Buying an investment rental property: If you’re aiming to purchase rental properties, you can use hard money loans to secure properties quickly, especially those in need of immediate repairs. This type of financing enables landlords to fix up the property and start generating rental income faster than with traditional bank financing.

Purchasing commercial real estate: Hard money loans are great for commercial deals because they’re flexible and get approved fast. That speed can be a huge help when you need to make quick moves to lock in a good investment or take advantage of a timely opportunity.

Looking for alternatives to traditional loans: Individuals with significant home equity but poor credit or other issues often turn to hard money lenders. These loans are based more on the value of the property than on the borrower’s creditworthiness, providing an alternative for those unable to get conventional financing.

Facing foreclosure: If you’re on the brink of foreclosure, a hard money loan can help you refinance your debts or buy some time to sell your home. It gives you a temporary way to avoid losing the property and protects you from the hit a foreclosure can put on your credit.

How much do hard money loans cost?

The cost of hard money loans is generally higher than traditional loans due to increased risk and quick, flexible funding. Here are some typical costs:

- Interest rates: These can range from 8% to 15%, depending on the lender’s risk assessment.

- Origination fees: Lenders may charge 1% to 5% of the total loan amount as an origination fee.

- Closing costs: Additional fees at closing can include legal fees, appraisal fees, and other administrative costs.

- Points: Lenders might charge points, a percentage of the loan amount paid upfront, which adds to the initial cost of obtaining the loan.

Online hard money loan calculators can help you estimate these costs.

Alternatives to working with hard money lenders

If you’re a homeowner looking to tap into your current home’s equity, here are a few alternatives to consider:

Take out a second mortgage: If you’ve got a lot of equity in your home, tapping it through a home equity loan or a home equity line of credit (HELOC) can give you funds at a better interest rate than a hard money loan.

Cash-out refinance your home: By refinancing your existing mortgage, you can pull out cash to fund your new venture, often with better interest rates compared to hard money loans.

Borrow from family or friends: Personal loans from relatives or friends can offer more flexible repayment terms and potentially lower or no interest rates, making them an affordable option.

Use a government-backed loan program: FHA, VA, or USDA programs can help you purchase homes with lower down payments and reduced interest rates, making homeownership more accessible.

Consider peer-to-peer loans: These loans come from individual investors via platforms like Funding Circle, providing an alternative to traditional loans with different terms and conditions.

Explore specialized loan programs: Explore loans tailored for fixer-uppers or investment property refinancing, which can replace a hard money loan with better terms.

Request a seller financing option: Sometimes, sellers are willing to finance the purchase themselves, which can lead to lower closing costs and less stringent eligibility requirements.

How to buy before you sell

When the perfect home suddenly appears on the multiple listing service (MLS), timing can be crucial. Perhaps it’s a remodeled ranch in North Central or a historic loft in Downtown Phoenix. If you’re a Phoenix homeowner eager to buy a new property before selling your current one, HomeLight has a solution to simplify the process.

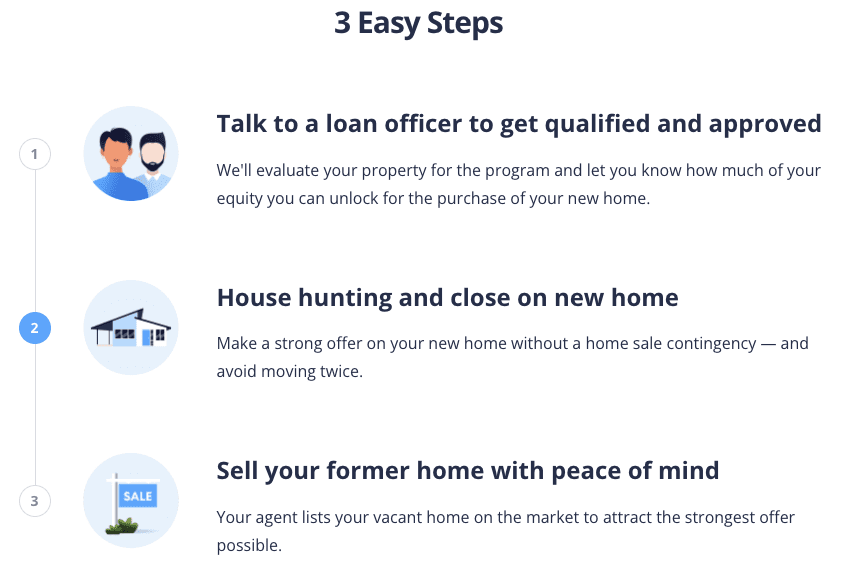

HomeLight’s Buy Before You Sell (BBYS) program allows you to use your home’s equity to make a strong, non-contingent offer on a new house. Once your home qualifies, you can get approval for your equity unlock amount within 24 hours, with no upfront costs or other obligations. This approval lets you purchase your next home with confidence and sell your current one vacant, eliminating the hassle of moving twice.

Here’s how HomeLight Buy Before You Sell works:

While BBYS carries a flat fee based on the sale price of your current home, the potential savings in other areas can offset this cost. You might save on moving expenses, avoid temporary housing, and secure a better deal on your new home. Additionally, HomeLight’s BBYS fees are generally lower than bridge loan interest rates, which typically range from 9.5% to 12%.

3 top hard money lenders in Phoenix

If you’re looking to move fast on real estate investments in Phoenix, hard money lenders can be a real advantage. They offer quick funding and flexible terms that traditional banks often can’t match. Here are three top hard money lenders in Phoenix to consider.

HD Lending

HD Lending is a Phoenix-based hard money lender with extensive experience serving Arizona investors. The firm offers fast approvals, with funding possible in as little as three to five days, and provides flexible terms for fix-and-flip projects, rental properties, or bridge loans.

It specializes in single-family homes, townhomes, land, and multi-family properties, offering loans ranging from $10,000 to $1 million, with terms of up to 30 years, all backed by personalized service tailored to the local market.

Lending clientele: Residential and commercial real estate investors and homeowners

Loan criteria: Up to 65% of LTV

HD Lending earned a near-perfect 4.9-star Google rating, as previous customers commend the team for their commitment to customer service, quick and efficient closings, and thorough communication.

Many appreciate the company representatives’ thorough understanding of clients’ needs and their ability to navigate complex transactions smoothly. Some even consider the company to be the top choice for hard money loans, valuing its expertise, reliability, and commitment to getting deals done.

Website: hd-lending.com

Phone number: 480-688-8686

Hard Money Lenders Arizona

Hard Money Lenders Arizona has supported a wide spectrum of real estate projects across the state with its reliable financing solutions. From revitalizing historic homes to spearheading large-scale commercial developments in key cities, the firm has handled deal sizes ranging from $100,000 to $100 million.

To facilitate efficient services to clients, the company commits to providing rapid loan approvals within 24 hours and can close transactions in as little as five days.

Lending clientele: Residential and commercial real estate investors and homeowners

Loan criteria: Up to 85% LTV or LTC; in some cases, up to 90%

Earning various praises from past customers, Hard Money Lenders Arizona boasts an impressive 4.9-star Google rating. Reviewers share that the team delivers attentive, professional service throughout the entire loan process.

Some highlight the company representatives’ dedication to keeping clients informed, working diligently to ensure loans close successfully, and making the experience smooth and stress-free. Many recommend the team for their expertise, professionalism, and commitment to client success.

Website: hardmoneylendersarizona.com

Phone number: 480-999-6183

Prime Plus Mortgages

Prime Plus Mortgages offers rapid financing solutions, with loan approvals in as little as one hour and funding available within 48 hours. The firm provides funding for fix-and-flip projects, rental rehabs, and land acquisitions, catering specifically to experienced real estate investors. Their streamlined application process requires minimal documentation, eliminating the need for bank statements, tax returns, or proof of income typically required by conventional lenders.

Lending clientele: Residential real estate investors

Loan criteria: Up to 90% LTV

Prime Plus Mortgages earned 5 stars on Google Reviews, with several clients commending how reliable and responsive the company is as a lending partner. Some note that the staff made the application process easy, provided great rates, and closed deals quickly. Many acknowledge the staff’s professionalism and expertise, recommending them for smooth, successful real estate transactions.

Website: primeplusmortgages.com

Phone number: 480-923-7602

Should I partner with a hard money lender in Phoenix?

Deciding whether a hard money loan is the right choice for you depends on your specific real estate goals and financial situation. This type of financing is best suited for Phoenix real estate investors who need quick access to funds, have a short project timeline, or can’t secure traditional financing. They offer fast, flexible funding but come with higher interest rates and shorter repayment terms.

If you’re a Phoenix homeowner looking to leverage your equity without the high costs associated with hard money loans, HomeLight’s Buy Before You Sell program is a compelling alternative. This program allows you to make a competitive offer on a new home using your current home’s equity, all while paying a small flat fee. It simplifies the moving process and avoids the hefty interest rates typical of hard money loans.

As with any significant financial decision, consider your long-term investment strategy and consult with a financial advisor. If you’re interested in connecting with real estate professionals in Phoenix who can guide you through either option, let HomeLight introduce you to top agents and trusted lenders in the area.

Header Image Source: (Chris Tingom/Unsplash)

Editor’s note: This post is for educational purposes only and should not be considered financial advice. HomeLight encourages you to consult your own advisor.