Hard Money Lenders Texas: Short-Term Loan Solutions

- Published on

- 10 min read

-

Kelsey Morrison Former HomeLight EditorCloseKelsey Morrison Former HomeLight Editor

Kelsey Morrison worked as an editor for HomeLight's Resource Centers. She has seven years of editorial experience in the real estate and lifestyle spaces. She previously worked as a commerce editor for World of Good Brands (eHow.com and Cuteness.com) and as an associate editor for Livabl.com. Kelsey holds a bachelor’s degree in Journalism from Concordia University in Montreal, Quebec, and lives in a small mountain town in Southern California.

Getting ready for your next real estate move in Texas and thinking about using a hard money loan? This could be the strategic edge that helps you lock in opportunities quickly and confidently.

Whether you’re looking to flip an American Foursquare in Old East Dallas or secure a rental property in San Antonio’s Pearl District, hard money lenders in Texas offer the speed and flexibility you need. These loans are an alternative to traditional financing and are ideal for projects with tight deadlines, limited upfront capital, or credit challenges.

For those not in the real estate investment game but needing to bridge the timing gap between buying and selling a home, we’ll also explore alternatives to help you leverage your home’s equity. This guide will walk you through the essentials of hard money lending in Texas, helping you determine if this financing method aligns with your real estate goals.

What is a hard money lender?

A hard money lender is a private entity that provides short-term loans secured by real estate. Unlike conventional lenders, who scrutinize a borrower’s credit score and income, hard money lenders in Texas focus on the property’s value. Their services are sought after by house flippers and rental property buyers who need quick funding and flexible terms.

Hard money lenders use the after-repair value (ARV), the projected value of a property after renovations, to determine loan amounts. They offer a percentage of this ARV to protect their investment. Interest rates on these loans are higher, ranging from 8% to 15%, with short repayment periods of 6 to 24 months.

Costs typically include origination fees, closing costs, and points or upfront fees, calculated as a percentage of the loan amount. If a borrower defaults, the lender may seize the property to recover their funds.

How does a hard money loan work?

If you’re thinking about investing in Texas real estate, it’s worth getting to know how hard money loans work. Here’s a brief overview:

- Short-term loan: These loans typically have a repayment period of six to 24 months, unlike the traditional 15- or 30-year mortgage terms. Some lenders might offer extensions of up to 36 months if needed.

- Faster funding: Hard money loans can be approved within days, a significant advantage over the typical 30 to 50 days required for conventional mortgage loans.

- Less focus on creditworthiness: These loans rely less on your credit score or income history and more on the collateral.

- Greater emphasis on property value: The loan amount is based on the loan-to-value ratio of the property, requiring collateral such as a home.

- Non-traditional lenders: Hard money loans are typically provided by private investors or lending companies rather than traditional banks.

- Loan denial: These financing solutions are ideal for individuals with poor credit who have been denied a mortgage but have significant home equity.

- Higher interest rates: Due to the higher risk involved, these loans carry higher interest rates compared to conventional mortgages.

- Larger down payments: Borrowers may need to provide a larger down payment, sometimes up to 20% to 30%, depending on the property’s value and loan specifics.

- More flexibility: With fewer government regulations, hard money lenders can offer flexible terms regarding credit scores and debt-to-income criteria, helping in situations like avoiding foreclosure.

- Interest-only payments: These loans may allow for interest-only or deferred payments initially, unlike traditional mortgages.

What are hard money loans used for?

Hard money loans serve specific needs within the Texas real estate market, particularly for those requiring quick funding or having difficulty securing traditional loans. Here’s a closer look at common scenarios where hard money loans can be beneficial:

Flipping a house: If you plan to flip homes, these loans help you cover the purchase and renovation costs so you can resell the property quickly for a profit.

Buying an investment rental property: If you’re shopping for rental properties, you may use hard money loans to quickly secure properties, especially those needing repairs. This quick financing helps you complete renovations and start generating rental income sooner than traditional bank loans would allow.

Purchasing commercial real estate: If you’re handling commercial real estate deals, hard money loans are ideal because they can be adapted to specific needs and close quickly. This is especially beneficial when timing is crucial and you want to act fast on promising opportunities without the wait associated with traditional bank loans.

Looking for alternatives to traditional loans: If you’ve built a lot of equity in your property, but you’re struggling with a lower credit score, you can turn to hard money lenders as an alternative option. These loans focus on the value of the home rather than your credit history, allowing access to funding for those who might not qualify for traditional mortgages.

Facing foreclosure: If you’re nearing foreclosure, consider hard money loans to refinance your debts or buy time to sell the property. This can provide a temporary solution to avoid losing your home or having a foreclosure mark on your credit report.

How much do hard money loans cost?

The cost of hard money loans is generally higher due to the convenience and speed they offer. Here are some typical costs associated with these loans:

- Interest rates: These can range from 8% to 15%, based on the lender’s risk assessment.

- Origination fees: Lenders may charge 1%–5% of the total loan amount as a fee.

- Closing costs: Additional fees at closing can include legal, appraisal, and administrative fees.

- Points: Lenders might charge points, which are a percentage of the loan amount paid upfront.

Use online hard money loan calculators to estimate your total costs.

Alternatives to working with hard money lenders

If you’re a homeowner looking to tap into your current home’s equity, consider these alternatives to a hard money loan:

Take out a second mortgage: If you have significant equity in your home, a home equity loan or home equity line of credit (HELOC) can offer the needed funds at a lower interest rate than a hard money loan.

Cash-out refinance your home: This method allows you to refinance an existing property, pulling out cash to fund your new investment. It usually comes with a lower interest rate than a hard money loan.

Borrow from family or friends: Securing a personal loan from family or friends can provide flexible repayment terms and potentially lower or no interest rates, making it a more cost-effective option.

Use a government-backed loan program: Programs offered by the FHA, VA, or USDA can help in buying homes with lower down payments and reduced interest rates.

Consider peer-to-peer loans: These loans are provided by individual investors through platforms like Funding Circle, offering similar benefits to hard money loans but often with different terms.

Explore specialized loan programs: Explore specialized loans designed for fixer-uppers or investment property refinancing if you already have a hard money loan and want to replace it.

Request a seller financing option: In some cases, sellers may agree to finance the purchase themselves, which can result in lower closing costs and more lenient eligibility requirements.

How to buy before you sell

Sometimes, the perfect home becomes available when you’re not quite ready to sell your current one. Maybe it’s an industrial-chic loft in Downtown Dallas or an architect-designed home in Marfa. If you’re a Texas homeowner looking to buy a new home before selling your current one, HomeLight offers a streamlined solution with its Buy Before You Sell program.

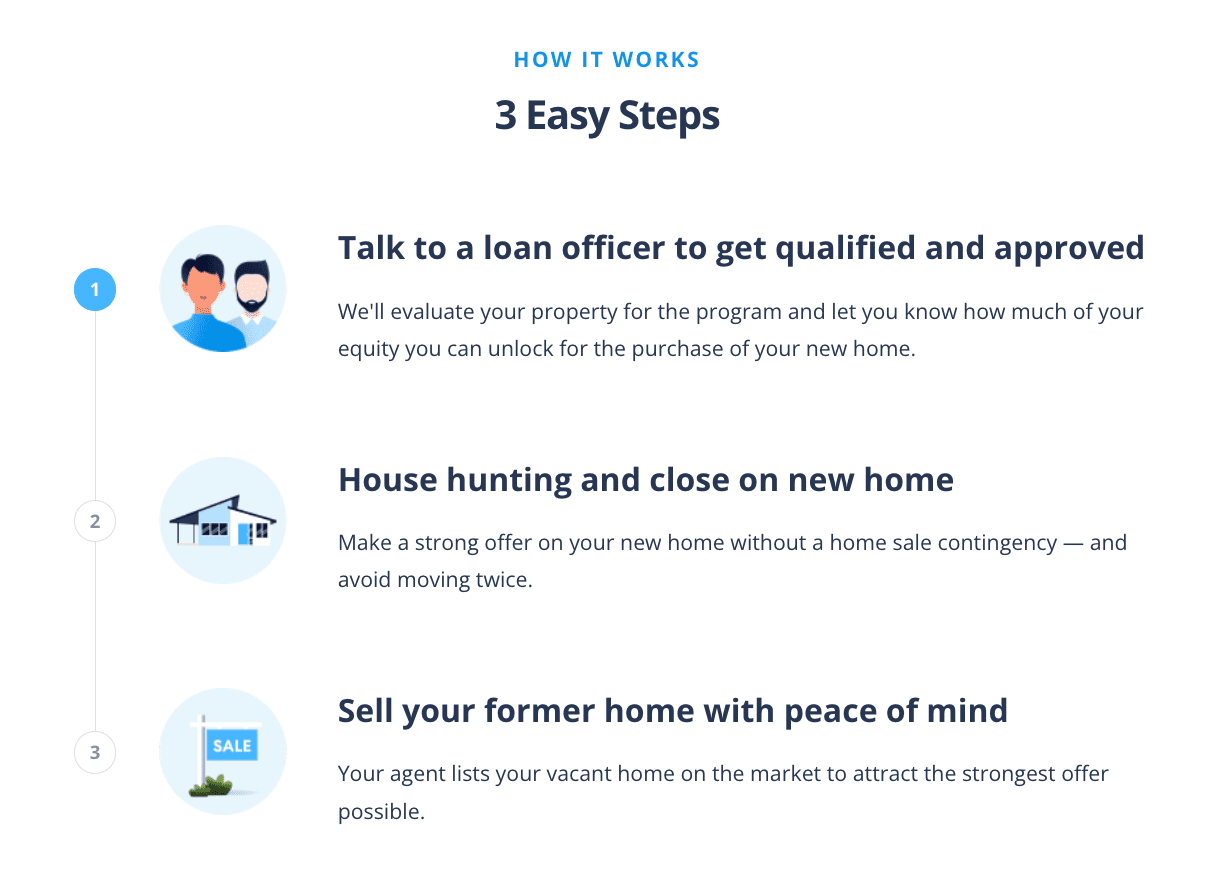

The Buy Before You Sell (BBYS) program allows you to use the equity in your existing home to make a stronger, non-contingent offer on a new property. If your home qualifies, you’ll get your equity unlock amount approved within 24 hours, with no initial cost or commitment. Once approved, you can purchase your new home first, then sell your old home without the stress of moving twice.

Here’s how HomeLight Buy Before You Sell works:

Although BBYS comes with a flat fee based on your current home’s sold price, you might find savings in other areas, such as reduced moving expenses, temporary housing costs, and even a better purchase price on your new home. Plus, HomeLight’s BBYS fees are typically lower than the interest rates on bridge loans, which range from 9.5% to 12%.

3 top hard money lenders in Texas

If you’re a real estate investor in Texas looking for fast and flexible financing, hard money loans can be a game-changer. They give you quick approvals and a streamlined process, making it easier to secure funds for both residential and commercial projects. Here are three of the top hard money lenders you can consider in the state.

Wildcat Lending

Wildcat Lending is a leading private money lender specializing in hard money loans for real estate investors. The company provides fast, reliable, and secure financing that allows borrowers to close quickly on residential investment properties.

Enabling borrowers to avoid the lengthy processes and strict requirements of traditional lenders, Wildcat Lending does not require tax returns or employment verification. With a team boasting 75 years of combined experience, the firm consistently delivers efficient service, closing loans in as little as three to five business days.

Lending clientele: Residential real estate investors

Loan criteria: Up to 80% LTV purchase or 75% LTV cash-out refinance

Wildcat Lending earned an A rating with the Better Business Bureau (BBB). It has 4.7 stars on Google, as many clients share that the company is a dependable partner for investors working on tight timelines. They frequently praise the team for their responsiveness, helpful guidance, and ability to keep real estate deals moving smoothly. Many recommend the company for reliable hard money solutions that support fast, efficient closings.

Website: wildcatlending.com

Phone number: 972-525-4777

Corridor Funding

Established in 2016, Corridor Funding emerged in response to a clear need for greater debt liquidity within the short-term value-add sector of real estate investing. Within its first year, the firm rapidly broadened its lending reach across all major Texas markets.

Today, Corridor Funding serves hundreds of committed real estate investors throughout Texas, Missouri, Kansas, North Carolina, South Carolina, Georgia, Tennessee, and Florida. The company also sets itself apart by providing flexible financing solutions with no prepayment penalties

Lending clientele: Residential and commercial real estate investors, LLCs, and corporations

Loan criteria: Up to 75% LTV on rental properties; up to 85% loan-to-cost (LTC) on flips

Corridor Funding boasts a Google rating of 5 stars, with customers commending its professionalism, responsiveness, and personalized service.

Some note how the financing process was straightforward and stress-free, acknowledging how the team guides clients through every step of the process. Many report staying on track and schedule with their real estate projects, as Corridor Funding provided reliable lending support.

Website: corridorfunding.com

Phone number: 210-941-3916

Loan Ranger Capital

Based in Austin, Loan Ranger Capital is a direct hard money lender serving Texas and other states. Specializing in fix-and-flip, construction, and bridge loans, it takes pride in its local market knowledge and quick closing timelines.

Loan Ranger Capital will lend on non-owner-occupied investment real estate properties, and can typically close in 24 hours. With its in-depth expertise and commitment to excellent service, the firm has funded over 7,500 flips across the country.

Lending clientele: Commercial and residential real estate investors

Loan criteria: 70%–75% LTV

Loan Ranger Capital achieved a high A+ rating with the BBB and earned a near-perfect 4.9-star rating on Google based on over 100 reviews. Customers commend the staff’s fast processing times, willingness to answer questions, and friendly demeanor.

Some note that the company representatives set the standard for organization and communication. Others appreciate how every detail is managed efficiently while still feeling like a personalized, one-on-one experience. Many note that despite handling multiple clients, the staff makes each project feel like their sole focus, combining professionalism with exceptional attentiveness.

Website: loanrangercapital.com

Phone number: 512-220-9916

Should I partner with a hard money lender in Texas?

Deciding whether to use a hard money lender in Texas depends on your specific circumstances and real estate investment objectives. This type of financing is perfect for projects needing immediate action or when traditional financing just isn’t feasible. If you can handle the higher costs and shorter repayment terms for the benefit of fast, flexible funding, reaching out to a hard money lender in Texas might be the best move for your next investment.

But if you’re a homeowner who wants to leverage your equity, HomeLight’s Buy Before You Sell program could be a better alternative. Instead of facing high interest rates, you’ll pay a small flat fee while enjoying the benefits of making a stronger, non-contingent offer and a smoother move.

As with any significant financial decision, it’s essential to consider your long-term strategy and consult with a financial advisor to ensure it aligns with your overall investment goals. If you’re looking to connect with investor-friendly real estate agents in Texas who have access to trusted hard money lenders, let HomeLight introduce you to top professionals in your area who meet these criteria.

Photo credit: (Daniel Lee / Unsplash)

Editor’s note: This post is for educational purposes only and should not be considered financial advice. HomeLight encourages you to consult your own advisor.