What’s a Reverse Mortgage, How Does it Work, and Is it the Right Option For You?

- Published on

- 7-8 min read

-

Christine Bartsch Contributing AuthorClose

Christine Bartsch Contributing AuthorClose Christine Bartsch Contributing Author

Christine Bartsch Contributing AuthorFormer art and design instructor Christine Bartsch holds an MFA in creative writing from Spalding University. Launching her writing career in 2007, Christine has crafted interior design content for companies including USA Today and Houzz.

Most people look forward to retirement when they’ll no longer have to go to work every day—but few love planning how to pay for it.

While you’ve got tons of options to help you develop a retirement plan and lots of experts advising that you start saving for retirement as early as possible, the truth is that too few are preparing for their financial security after retirement.

In fact, a recent survey by Northwestern Mutual found that 1 in 3 Americans have less than $5,000 saved for retirement. That’s probably why more retiring homeowners are relying on their home equity to help fund their post-career days.

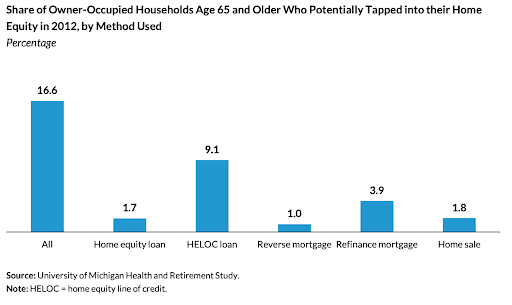

The Urban Institute discovered in their 2016 analysis of Home Equity Patterns Among Older American Households are tapping into their home equity in retirement.

The majority are doing so through a home equity line of credit (HELOC), but a reverse mortgage may actually be the smarter way to access that equity.

“For borrowers who are cash poor, but house rich, a reverse mortgage lets them access their home equity without taking out a line of credit that requires a monthly repayment plan,” explains Tim Kennedy, a mortgage loan originator and Certified Reverse Mortgage Professional with US Mortgage Corp.

Unfortunately, reverse mortgages have earned a “con game” reputation in their relatively short history.

But that was before the federal government stepped in with regulations and the U.S. Department of Housing and Urban Development developed the Home Equity Conversion Mortgage (HECM).

Reverse mortgages are less risky these days, but that doesn’t mean it’s the right retirement plan for you. So how can you decide if you should get one?

Let’s take a look at the answers to all of the tough reverse mortgage questions:

- What is a reverse mortgage?

- How does a reverse mortgage work?

- Do I qualify for a reverse mortgage?

- What are the different types of reverse mortgages?

- How are the reverse mortgage funds distributed?

- What are the pros and cons to getting a reverse mortgage?

- Can I sell the house with a reverse mortgage?

- How can I avoid reverse mortgage scams?

- Is a reverse mortgage right for me?

1. What is a reverse mortgage?

Simply put, a reverse mortgage is a type of loan that converts your home equity into cash while allowing you to continue living in the house.

“With a reverse mortgage, borrowers can live in their home for the duration of their lives as long as it remains their primary residence, they properly maintain the property, and they continue to pay the taxes and insurance,” explains Kennedy.

However, unlike a traditional mortgage, reverse mortgages don’t require borrowers to make a monthly mortgage payment to pay down the debt.

It’s also important to know that you remain the owner of the home throughout the entire reverse mortgage process—even if your loan debt exceeds the value of your home.

Confused? Let’s look into how reverse mortgages work.

2. How does a reverse mortgage work?

It’s true that borrowers are not required to make a monthly payment on a reverse mortgage—as long as the home remains your primary residence, you will never be required to make a monthly payment.

However, this freedom does come at a cost.

Instead of paying down your loan debt with your monthly mortgage payment, with a reverse mortgage your debt is steadily growing over time.

This is because interest accrues on the balance you’ve borrowed, increasing the size of your reverse mortgage debt—which in turn reduces your available home equity until the point that you’ve used it all up or you sell the home and pay off the reverse mortgage.

3. Do I qualify for a reverse mortgage?

There are two sets of requirements when qualifying for a reverse mortgage: borrower requirements and property requirements.

The borrower requirements determine whether or not you’ll get approved for a reverse mortgage, and the property requirements determine the amount of money you’re eligible to borrow.

To qualify for the popular HECM reverse mortgage:

- You must be 62 years of age or older.

- You must own the property outright (or have paid off a considerable amount on your existing mortgage).

- You must occupy the property as your principal residence.

- You cannot be delinquent on any federal debt.

- You must have the financial resources to afford ongoing property charges such as property taxes, insurance and Homeowner Association fees, etc.

- You must participate in a consumer information session given by a HUD- approved HECM counselor.

Properties that are eligible for a HECM loan include single family homes, 2-4 unit homes (with one unit occupied by the borrower), HUD-approved condominium projects, and manufactured homes that meet FHA requirements.

In addition, the borrower’s property must meet all FHA property standards and flood requirements.

Determining the amount of money you’re eligible to borrow depends on a number of factors, including your age, your financial situation, the current market value of the property, and this loan’s interest rate.

“The amount the borrower qualifies for is largely determined by the age of the borrower and the value of the home and the interest rate. The older you are and the higher the value of the home, the more you’ll qualify for. Those are the two numbers we look at,” explains Kennedy.

“We also look at income and credit history, but it’s more of a financial assessment. We just want to see that they have the ability and the willingness to pay their bills.”

The truth is that there are no minimum income requirements for a reverse mortgage. The real reason reverse mortgage lenders care about your financial situation is because it serves as an indicator on your ability and willingness to continue paying housing expenses like taxes, insurance and so forth.

Borrowers who fall delinquent on those housing expenses put the home at risk for foreclosure, which will trigger the reverse mortgage becoming immediately due and payable. And when that happens, you’ll likely be forced to sell the house to pay off those debts.

That’s why reverse mortgage specialists assess your financial standing before issuing HECM loans. If they’re at all concerned about a delinquency-triggered foreclosure, they can take out a Life Expectancy Set Aside (LESA) to ensure you have the funds to pay those housing costs for the life of the loan.

4. What are the different types of reverse mortgages?

There are a number of reverse mortgage types available from a variety of lenders, with the three main types being: single-purpose, proprietary, and the Home Equity Conversion Mortgage (HECM).

A single-purpose reverse mortgage allows qualifying retirees to pull funds out for a specific, lender-approved reason, such as replacing a roof or paying a tax debt. This type of loan isn’t available in every state, and in some areas it’s only an option for low-income applicants.

The proprietary reverse mortgage typically appeals to more affluent retirees. That’s because there is no cap on the amount of equity that can be borrowed against the value of the home.

Proprietary reverse mortgages are also rare, most likely because they’re not available in every state and only a handful of companies offer them. However, there are signs that they will soon be more widely available.

As availability grows, proprietary reverse mortgages are worth looking into—however buyer beware. These loans are privately issued, so the lender sets their own terms rather than following federal regulations and guidelines.

Both single-purpose and proprietary reverse mortgages are private loans, so they aren’t subject to as many of the rigid regulations of a government-backed loan. They are also not insured by the federal government.

While some proprietary reverse mortgages are also non-recourse loans like HECM loans, there’s no guarantee—so make sure you read the fine print before signing any papers.

Currently, the most common type of reverse mortgage is the HECM which are only available through FHA-approved lenders, This is the only reverse mortgage insured by the U.S. Federal Government.

As a protective measure, HUD requires all applicants to work with an HECM counselor who will use HUD-approved Reverse Mortgage Analyst software to help determine if a reverse mortgage is the right financial option.

In another step to protect retirees, the federal government also regulates how much equity can be pulled out with an HECM loan. According to Kennedy, the HECM lending limit is $726,525 (as of January 1, 2019), regardless of your home’s current market value.

One variation of the standard HECM can even help you finance a new house.

A HECM for purchase, also known as a reverse for purchase loan, allows the homebuyer to move into their new home without the financial obligation of a monthly mortgage payment.

“If a homeowner wants to downsize, they can utilize a HECM for purchase loan which allows the borrower to use a portion of the proceeds received from the sale of their current home to finance the balance on the new home,” explains Kennedy.

With a reverse for purchase loan, you’re taking out a sizable lump sum when the reverse mortgage closes. Of course, you can make payments on your reverse for purchase mortgage to reduce the deb amount that’s accruing interest—but you’re not required to do so.

Obtaining a reverse for purchase mortgage doesn’t mean you won’t have any monthly housing expenses. You’ll still be responsible for paying property taxes, home insurance and any other mandatory housing expenses associated with the new home, such as HOA fees.

5. How are the reverse mortgage funds distributed?

There are several ways you can arrange to access your reverse mortgage funds.

“Borrowers can take out a lump sum at closing. Or they can arrange one of two types of monthly payments—either higher monthly payments over a set timeframe say five years or 10 years, or lower monthly payments for the duration of their life,” says Kennedy.

Taking out a lump sum at closing is the least cost-effective way of arranging your reverse mortgage payout. With a lump sum you’ll be paying interest on the entire mortgage amount for the entire life of the loan—which means your home equity will be used up in a shorter period of time.

“The third option is to set up a reverse mortgage line of credit where they don’t take out any money initially. The borrowers just let the line of credit grow and only use the money when they need it,” explains Kennedy.

Reverse mortgage line of credit (LOC)

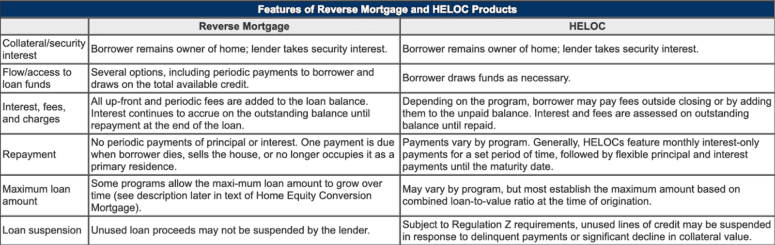

A reverse mortgage line of credit (LOC) is similar to a HELOC in that they both open a line of credit that allows you access to your home equity as cash—if you need it.

However, there are several significant differences, The biggest difference is: with a HELOC you’ll need to make monthly payments to repay that debt. With a reverse mortgage LOC, you’ll never need to make payments unless you want to pay down the debt.

“I’m a huge proponent for the reverse mortgage line of credit. I advise taking one out early in retirement, say when you’re 62 and have a relatively free and clear house, but don’t touch it. Let it sit there,” advises Kennedy.

“That line of credit is a safety net for the future. Maybe you use it for long-term care, or maybe to renovate the home for handicap accessibility. Instead of paying penalties and taxes for dipping into their retirement portfolio, the money that they withdraw from the reverse mortgage line of credit is tax-free.”

It’s a wise idea to open up the reverse mortgage LOC early on so that the growth rate can increase the amount of money you’re eligible to borrow over time. However, it’s best that you leave the LOC untouched for as long as possible.

“Basically by taking a reverse mortgage line of credit out early on, you can access more of your home equity interest, and tax-free, than you could if you wait to take out a reverse mortgage until after you need one,” explains Kennedy.

For example, let’s say two borrowers take out and qualify for $100,000 line of credit with the reverse mortgage LOC. Borrower A takes the hundred thousand dollars out and spends it all. Borrower B also takes out a $100,000 reverse mortgage LOC, but doesn’t spend it.

In 10 years, Borrower A no longer has access to any funds because it’s all been spent. And when it comes time to sell the house, he’ll owe $200,000 on that $100,000 because of the ten-years of interest he accrued on the entire LOC loan amount.

But Borrower B let that $100,000 LOC sit, and with the growth rate factor, they now have access to $200,000 in accrued equity. This is the reason why it’s wiser to take out a reverse mortgage earlier in retirement. It’ll give you access to more money down the road.

The good news is, if you take out a reverse mortgage LOC and you never use it, it’s no big deal. Whatever equity is left in the house goes back to you the homeowner or to your heirs.

Setting up a reverse mortgage LOC isn’t a completely free safety net, though. You will have to pay closing costs to set up the mortgage initially—and those closing costs are typically higher than traditional mortgage closing costs.

And if you use some of the LOC to pay the closing costs that will be accruing interest over the life of the reverse mortgage that’ll have to be paid back. But if you pay for the closing costs out of your own pocket, then you won’t owe the bank anything on the reverse mortgage if you never use the LOC.

6. What are the pros and cons to getting a reverse mortgage?

Reverse mortgages come with a number of significant pros and cons.

Let’s start with the pros:

- A reverse mortgage lets you spend equity without selling as the bank lends you cash using your home’s equity as collateral.

- You don’t need to make monthly payments on a reverse mortgage, instead the bank pays you out of your home equity a monthly income that’s typically tax free.

- You can use the reverse mortgage to delay collecting social security so that you can collect the maximum benefits.

- You’ll never owe more than your home is worth.

“The great thing about a HECM reverse mortgage is that they are considered nonrecourse loans,” explains Kennedy. “So the settlement payment for your balance is limited to the value of the home. This means that the surviving spouse or heirs cannot be charged if the balance exceeds the appraised value or sales price.”

In other words, if interest has pushed the amount owed on the reverse mortgage higher than the value of the house, the mortgage lender is paid the balance by the federal government—neither the surviving spouse nor the inheriting heirs are required to pay that debt.

The cons:

- The minute the home is no longer your primary residence, your reverse mortgage comes due immediately, whether you transition into assisted living, permanently move to another residence, or pass away.

- Using a reverse mortgage to delay social security can backfire because you are likely to pay more in fees and interest for the lifetime of the reverse mortgage than you’ll get in lifetime benefits of delaying your Social Security claim.

- You’re putting all of your ‘in case of emergency’ equity at risk—because once you tap into your home’s equity, accruing interest will eventually lead to that equity being tapped out.

7. Can I sell the house with a reverse mortgage?

Yes. And selling a house with a reverse mortgage is pretty much the same as selling a house with a traditional mortgage—with one significant difference.

Reverse mortgages are non-recourse loans, which comes with some great benefits that traditional mortgages don’t have.

“If the borrower decides to sell the home—or when the last surviving spouse passes away—the used portion of the reverse mortgage and any accrued interest must be paid back. Any additional equity is retained by the homeowner or the heirs,” explains Kennedy.

On the plus side, your heirs can satisfy the reverse mortgage debt by selling the home or purchasing the property for 95% of its appraised value.

However, sometimes the home depreciates in value or the debt grows so large that there’s no equity left in the home when the reverse mortgage comes due.

“Reverse mortgages are non-recourse loans. This means that when the home is sold, neither the homeowner nor the estate needs to pay any more than the current appraised value,” says Kennedy. “If the home depreciates in value or the balance of the loan plus the accrued interest increases to the point that the balance owed exceeds the value of the home, the purchaser will not be responsible for repaying more than what the home is worth.”

Essentially, because a reverse mortgage is a non-recourse loan, you can continue living in your home without making payments or paying off that loan debt as long as it’s your primary residence.

This remains true even if the interest pushes the debt amount above the current market value of the home—that is, only if it’s a federally-insured HECM loan, which most reverse mortgages are.

8. How can I avoid reverse mortgage scams?

Even though there are measures in place to protect retirees from reverse mortgage scams, they still happen—especially if you don’t choose a federally-backed HECM loan.

The best way to avoid them is to make sure you work with a qualified, Certified Reverse Mortgage Professional.

“The best tip I can give for avoiding reverse mortgage scams is to go to the official website for the National Reverse Mortgage Lenders Association where they have a list of Certified Reverse Mortgage Professionals,” advises Kennedy, a CRMP himself.

“Becoming a CRMP requires commitment and we take these things seriously. We follow a code of ethics and professional responsibility. Certification requires passing an exam initially and continuing education, including an ethics class every three years.”

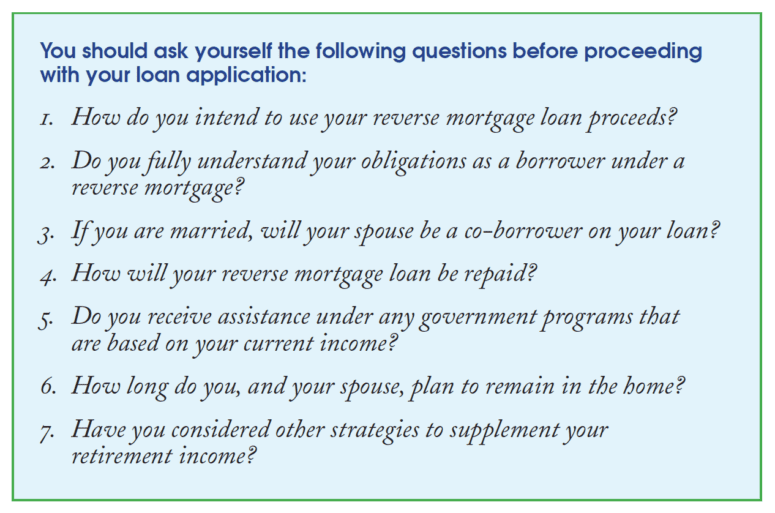

9. Is a reverse mortgage right for me?

Contemplating a reverse mortgage is a scary proposition, because you are essentially depleting your home equity—albeit with the benefit of still living in the home (and without a monthly mortgage payment). While it’s a great way for some retirees to access home equity, it’s not right for everyone.

Before signing on the dotted line, consult with a CRMP to help you decide if a reverse mortgage is right for you. It’s also wise to consult with a top real estate agent to learn your home’s current value and to explore other available retirement housing options.

Article Image Source: (Peter Boccia/ Unsplash)