Sell My Inherited House for Cash: Your Fastest Options Explained

- Published on

- 6 min read

-

Richard Haddad Executive EditorCloseRichard Haddad Executive Editor

Richard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

Inheriting a house can bring up mixed emotions. On one hand, it may feel like a generous gift. On the other, it can also create stress, especially if you live far away, don’t have the time or money to maintain the property, or simply don’t want to manage it.

If you’re thinking, “I need to sell my inherited house for cash,” you’re not alone. Many people in this situation want a fast and certain way to move forward.

Selling to a cash buyer can give you speed, certainty, and immediate funds, but there are some trade-offs. This guide will help you understand your options so you can make the best choice for your circumstances.

Can I sell an inherited house for cash quickly?

Yes. In fact, a cash buyer may be one of the fastest ways to handle an inherited property you don’t want. Because cash buyers don’t rely on financing, you can skip the waiting period for mortgage approvals, appraisals, and underwriting. Closings can happen in as little as 7 to 14 days.

Your timeline can vary depending on the buyer type and whether the property has cleared probate. If multiple heirs are involved, you’ll also need agreement from all parties before the sale. Still, cash buyers often offer the simplest way to turn an inherited home into cash quickly.

»Learn more: 10 Steps to Sell an Inherited House

Compare cash home sale options

Not all cash offers are the same. Some buyers focus strictly on speed, while others may compete more closely with what your home might fetch on the open market. That’s why it helps to compare scenarios side by side.

With HomeLight’s Home Cash Offer Comparison Calculator, you can see ballpark estimates for how much different types of buyers might pay:

- A “we buy houses” company that takes homes as-is, often to flip or rent.

- A national iBuyer like Opendoor or Offerpad that offers speed but charges service fees and prefers homes in good condition.

- An average agent who can price your home to sell quickly or tap into their network of cash buyers.

- A top-rated agent who may attract stronger cash offers closer to market value.

Remember, the Cash Offer Comparison Calculator provides rough estimates. Your actual results will depend on your home’s condition, location, and which type of buyer you choose.

»Learn more: How Much Do House-Buying Companies Pay

Fastest ways to sell an inherited house for cash

If you’ve inherited a home you don’t want to keep, here are some common paths to a quick cash sale:

- HomeLight’s Simple Sale platform: Get a no-obligation cash offer in as few as 24 hours and close in as little as 7 days. You’ll also see an estimate of what a top agent might achieve for comparison.

- Local investors or “we buy houses” companies: These buyers often purchase properties as-is, but their offers are typically lower.

- Auctions or wholesalers: Auction houses are sometimes used for distressed properties or when heirs need an immediate resolution.

Because inherited homes often come with deferred maintenance, a direct cash buyer can remove the burden of making repairs or cleaning before the sale.

What’s more, some companies that specialize in buying houses “as is” will even take on properties with all their contents. This is a common arrangement, especially when dealing with inherited homes, hoarder situations, or properties needing extensive work.

»Learn more: Wait! Read This Before You Sell Your House for Cash

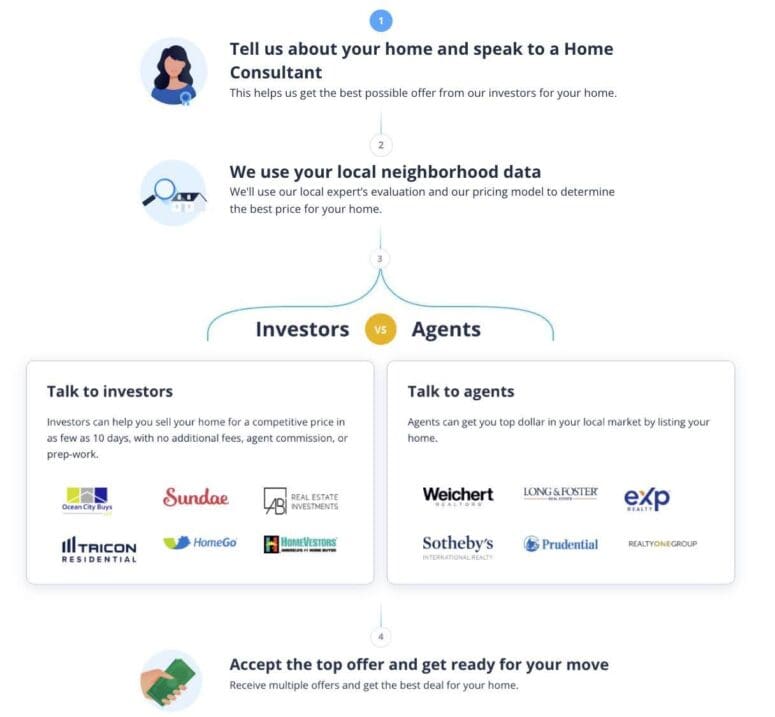

How HomeLight Simple Sale works

The 4-step Simple Sale process starts with answering a few questions about your home:

HomeLight’s Simple Sale platform is an example of a trusted option for finding vetted cash buyers interested in purchasing your inherited home. If speed and convenience are top priorities, you can receive an offer and close in days rather than weeks or months.

»Learn more: How to Find Real Estate Cash Buyers for a Quick Sale

Pros and cons of selling an inherited house for cash

Selling your unwanted inherited home for cash can be a big relief, but it’s important to weigh what you gain against what you might be giving up.

| Pros | Cons |

| Speed: Close in days or weeks instead of months. | Lower price: Offers often come below market value. |

| Certainty: Fewer risks of financing falling through. | Limited competition: No exposure to the full pool of buyers. |

| Convenience: No showings, open houses, or negotiations. | Little room to negotiate: Many cash offers are “take it or leave it.” |

| No repairs: Sell as-is without investing in updates. | Possible family disagreements: Multiple heirs must agree to sell. |

| Avoid ongoing costs: Stop paying taxes, insurance, and utilities | No appraisal benchmark: Off-market sales may leave you without a valuation record. |

»Learn more: We Buy Houses Pros and Cons for an Informed Decision

What to consider before selling an inherited house

Before you accept a cash offer, there are a few important factors to keep in mind:

- Probate: If the estate is in probate, the property may not be eligible to sell until the process is complete. (Probate timelines vary by state.)

- Taxes: Inherited homes benefit from a “step-up in basis,” which means you’re taxed on the home’s value at the time of inheritance, not the original purchase price. Still, consult a tax professional to understand potential capital gains.

- Multiple heirs: All heirs listed on the title must agree to the sale. If opinions differ, a cash buyer may provide the compromise everyone accepts.

»Learn more: Steps For Selling an Inherited Property With Multiple Owners

Can an agent sell an inherited house quickly?

Even if you’re focused on a cash sale, a top local agent can sometimes help you move faster than you might expect. Many agents work with investors who pay cash, and they can also recommend pricing strategies that draw quick offers on the open market.

If you want to explore this path, HomeLight’s Agent Match platform can connect you with proven agents in your area. While this option may not be as immediate as selling directly to an investor, it could balance speed with stronger proceeds.

»Learn more: Should I Sell to a Home Investor or List With an Agent?

How to avoid scams when selling for cash

Unfortunately, inherited homes are sometimes targeted by predatory buyers who assume heirs want a quick sale. To protect yourself:

- Be wary of buyers who pressure you to sign immediately.

- Confirm the buyer’s track record through reviews or an online presence.

- Watch for vague or shifting contract terms.

- Be cautious of “too good to be true” offers.

HomeLight’s Simple Sale platform removes this uncertainty by connecting you only with vetted cash buyers. That way, you can sell with confidence and avoid scams.

»Learn more: 8 Common Home Buying Scams and How to Spot Them

Which path is right for you?

If you’re looking to sell an inherited house for cash, the best option depends on your priorities.

- If you want speed and convenience, a direct cash buyer may be the fastest option. For peace of mind, Simple Sale can connect you with a vetted buyer and give you a no-obligation offer in just 24 hours.

- If proceeds are a priority and you’re open to a slightly longer process, working with a top agent could be a better fit.

Not sure which way to go? Use the Home Cash Offer Comparison Calculator above to see side-by-side examples of what your home could sell for depending on the path you choose. Then, request a no-obligation Simple Sale offer or get matched with a trusted agent — and compare both solutions.

Still have questions about selling a house? Visit HomeLight’s free Seller Resource Center, where you can search for answers and sell with confidence.

Header Image Source: (iriana88w/DepositPhotos)