What Do Title Companies Do for Your Home Sale?

- Published on

- 9 min read

-

Valerie Kalfrin, Contributing AuthorCloseValerie Kalfrin Contributing Author

Valerie Kalfrin is a multiple award-winning journalist, film and fiction fan, and creative storyteller with a knack for detailed, engaging stories.

-

Sam Dadofalza, Associate EditorCloseSam Dadofalza Associate Editor

Sam Dadofalza is an associate editor at HomeLight, where she crafts insightful stories to guide homebuyers and sellers through the intricacies of real estate transactions. She has previously contributed to digital marketing firms and online business publications, honing her skills in creating engaging and informative content.

If you’re buying or selling a home and have ever wondered, “What do title companies do?”, buckle up, because they’re the unsung heroes of real estate. While buyers and sellers negotiate, tour homes, and sort out finances, title companies dive into decades of paperwork, hunting for hidden liens, ownership disputes, and deal-killing surprises.

They make sure sellers can legally pass the home on, and buyers don’t inherit someone else’s financial mess. Without them, closing day could turn into a full-blown legal thriller. Once you understand what title companies do, you’ll realize they’re the reason the deal actually makes it across the finish line.

Before the paperwork starts flying, it helps to know exactly what role a title company plays in getting a deal from “under contract” to “keys in hand.” Here’s a quick breakdown of what title companies do to protect both buyers and sellers and keep the closing process running smoothly:

- Search the title for any defects or “clouds”

- Provide the buyer with title insurance to protect against fraud and forgeries

- Safeguard money and documents in escrow

- Oversee the final phase of closing and fund distributions

What does a title company do?

1. Perform the title search on your house

Before you can sell your house, you have to “clear title.” Lingering title or lien issues are a frequent deal-breaker, often surfacing late in the process and causing transactions to fall apart after a contract is already in place.

The “title” is a collective term for all of your legal rights to own, use, and dispose of any real estate property. Having a clear title before the sale is complete guarantees that your ownership is valid. That means no one else can stake a claim to the property you’re trying to sell.

The title company will perform a title search, which involves pulling public records and details about a property’s history to dig up documentation, liens, or encumbrances tied to a house. The title search will turn up any defects or “clouds,” a jargony term for any discoveries that cast doubt on the title’s legitimacy.

Title companies leave no stone unturned. “[One] seller had an $80,000 lien against their house from some casino in Las Vegas,” recalls Anna Terry, a Durham, North Carolina, real estate agent with over 30 years of experience.

“It had actually been paid off, and it was canceled in Vegas, but they had neglected to cancel it in the records in our county. It all worked out because the debt had been paid, but there are a lot of things that pop up.”

Here are some of the most common red flags a title search can reveal:

- Contractor liens: This refers to money owed to general or subcontractors for a home’s renovations, repair work, or remodeling projects

- Divorce decrees: This includes a lien placed for past-due child support or spousal support.

- Personal bankruptcies: This involves bankruptcy cases against the owner that must be discharged to clear title.

- Outstanding taxes: County, school, and property taxes all must be up to date

- Clerical or recording errors: Mistakes in public records, like misspelled names or wrong property descriptions, can create confusion over who actually owns the property.

- Boundary disputes or easements: Conflicts over property lines or rights of way can affect how a property can be used

- Unknown heirs or ownership claims: Sometimes, a previous owner’s relatives or others may come forward claiming a stake in the property. Title searches help identify these potential claims and allow them to be resolved before closing.

A seller must clear up any such issues before he or she can convey the property. Often, resolving such issues simply means verifying that a debt has been satisfied and then recorded properly, similar to when consumers clear up errors on a credit report.

“It’s just a matter of recording the proper documents, and a lot of times, to be honest, it’s just laziness on the part of the person who was holding the lien,” says Erica MacLean, senior escrow officer at All Set Escrow. “After they get paid up, they don’t properly record the documents to release that person from any balance owed or any future payoff.”

In states such as North Carolina, the seller must sign a lien waiver stating that any outstanding debts on the property will be paid at the time of closing.

“Let’s just say you had to do $10,000 of foundation work. It’ll be required that the company [be] paid at closing. You couldn’t finance that,” Terry said.

The same goes for if you had a new heat pump installed five years ago and were doing a payment plan with Lowe’s — you couldn’t carry that after you sold the house.

“The attorney has to make sure there are no liens that would affect the quality of the title for the new owner,” Terry explains.

Sometimes, you can speed up the title search process by providing a copy of your title insurance policy from when you bought the house to the title company. In some circumstances, if your policy was purchased within the past 15 years, the search can be limited to the duration during which you’ve owned the house instead of doing a full search on the title back to when the house was built.

2. Issue title insurance to the buyers of your property

A title company not only performs a title search but also issues title insurance to the buyer of your home, guaranteeing that the new owner is protected against any future claims of property ownership.

That extra layer of protection matters because no title search is ever truly foolproof. Even highly experienced title professionals can’t uncover every issue tied to a property, since some risks, like clerical mistakes, forged documents, or unknown heirs, are especially hard to detect

A title insurance policy does not negate the need for a title search, but is issued regardless of the title search outcome.

In a standard transaction, the seller will pay for the buyer’s title insurance policy, while the buyer pays for the lender’s title insurance.

3. Maintain escrow accounts and act as escrow officer

In addition to performing the title search and issuing insurance, a title company also manages the escrow account for a home sale.

They protect the money and documents related to the transaction for the parties involved, such as the deed to the house, closing costs, earnest money deposit, and eventually the down payment and money to purchase the house from the buyer.

The title company only disburses payment and releases documentation with the written permission of the buyer and seller.

4. Oversee the final steps of the closing process

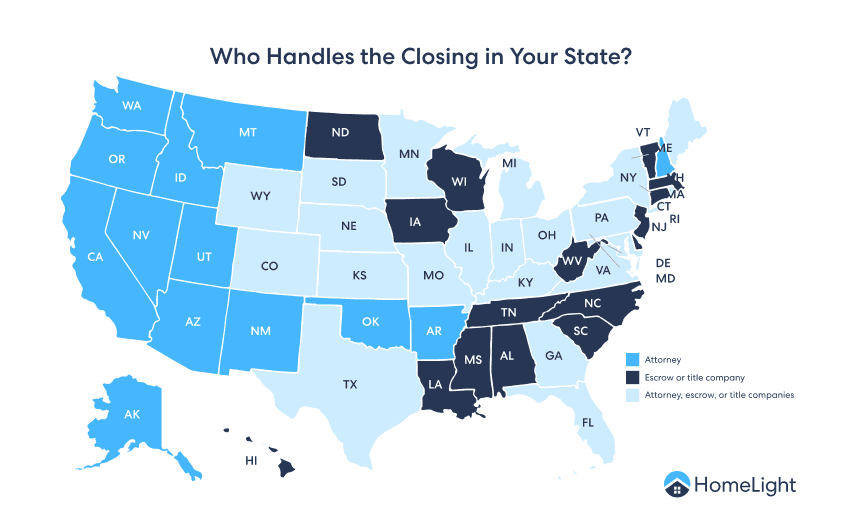

Closing a home isn’t the same in every state, and who handles it can vary. In some states, an attorney leads the closing and ensures all the legal details are correct. In others, title companies take the primary role, managing the paperwork, title insurance, and escrow. Some states use a combination of both, with attorneys and title companies working together to complete the process.

The responsibilities and procedures can differ depending on local laws and regulations. Buyers and sellers benefit from knowing who is in charge to avoid confusion during closing. Ultimately, whether it’s an attorney, a title company, or both, their job is to make sure the transaction is completed smoothly and correctly.

The closing process involves:

- Drafting up final paperwork and documentation

- Overseeing signatures on all of the closing documents

- Making sure the property title passes from seller to buyer

- Overseeing the disbursement of funds from escrow, including closing costs and fees

Who chooses the title company?

Who gets to pick the title company usually depends on your state and local traditions. In some places, the buyer gets to choose since they’re the ones taking the financial risk and want to make sure the title is clean. In other areas, the seller makes the call, often because they’re coordinating the closing and want things to run smoothly. Lenders can also have a say, especially if they require you to use a company from their approved list.

Whoever ends up choosing, it can affect how fast the closing goes, how smooth the process feels, and how much you’ll pay. Choosing a trusted, experienced title company can help prevent delays, uncover potential issues early, and make the process smoother for both parties.

What should you look for in a title company?

How involved the title company will be depends on the customs and regulations of your state, but regardless, experts recommend using a company that is transparent about its processes, responsive and communicative, and has good customer service to help make each step go smoothly.

“A lot of times, because principals are not familiar with title companies or escrow companies, they will refer to the guidance of their agent,” MacLean said.

If you’re working with a real estate attorney, they’d also be a good person to ask for a title company referral.

“Attorneys just gravitate toward the companies that give them good service,” Terry said. “You want to know [that any issue] can be turned around in a matter of hours instead of a matter of days.”

Article Image Source: (midascode/ Pixabay)