What Should I List My House For? How to Price Your Home Right

- Published on

- 15 min read

-

Katie Licavoli, Contributing authorClose

Katie Licavoli, Contributing authorClose Katie Licavoli Contributing author

Katie Licavoli Contributing authorKatie Licavoli is a freelance content writer with experience writing about the outdoor industry, travel, lifestyle, and real estate. When not behind her writing desk, you can find her at work on her latest home improvement project, or enjoying the recreational offerings of her area.

-

Sam Dadofalza, Associate EditorClose

Sam Dadofalza, Associate EditorClose Sam Dadofalza Associate Editor

Sam Dadofalza Associate EditorSam Dadofalza is an associate editor at HomeLight, where she crafts insightful stories to guide homebuyers and sellers through the intricacies of real estate transactions. She has previously contributed to digital marketing firms and online business publications, honing her skills in creating engaging and informative content.

There’s a fine line between pricing a house too low or too high. List it too cheap, and you’ll miss out on netting a higher profit, but list it too high, and it can sit on the market for months, making it harder for the property to sell. So, you’re probably wondering, “What should I list my house for?”

To avoid the quicksand of under- or overpricing, we sat down with two top real estate agents to vet their expert advice on how to price a property to sell.

“If you can price it and show it right, you can create more urgency [on] day three on the market than you can day 33, or day 63, or day 93,” advises Kenny Klaus, a top agent in Mesa, Arizona, with 26 years of experience.

Price the house wrong, and you could be stuck with a series of price cuts, which could attract lowball offers down the line, and months of extra costs, not to mention, as Klaus says, the “disruption of putting your house on the market.”

With a little research, market analysis, and some cold, hard logic, you can price your home to sell – and sell fast – on the first try. In this guide, we’ll show you stat-backed ways to find your perfect list price.

What are the dangers if your home is priced too high?

There are a number of reasons real estate experts caution sellers to avoid overpricing their homes. While it may seem counterintuitive, asking too much can backfire. Here are some of the dangers you might encounter.

You’ll be forced to reduce your price eventually

If you hope that an above-market list price will get you more in the long run, reconsider. Klaus told us about one client who made that fatal mistake: “My brother went and did the listing appointment, and they went with another agent and priced it $20,000 to $25,000 more than what we said. They did two price reductions and fired the agent.”

Sure, it’s exciting to think about selling for more money for your home than you originally thought, but overpricing isn’t the way to go.

“[Eventually], they list[ed] with us at a price that we feel, based on black and white — not emotions, not what their neighbor said, not what their best friend’s co-worker’s spouse told them to list it for, not what Zillow listed it for, but truly what the market is based on adjustments to the property,” says Klaus.

According to the National Association of Realtors® (NAR), homes typically sold within 27 days in May 2025, with 60% of surveyed Realtors reporting that properties sold in less than one month.

A stale listing attracts fewer buyers

“The longer the property sits on the market, the staler it becomes,” says Wendy Rich-Soto, a top real estate agent in Los Angeles who sells properties 50% faster than the average agent in her market.

“You really want to move it in the first two weeks because that’s when all the excitement and all the traffic happens.”

Potential buyers become skeptical of long-listed properties, wondering about the condition of the home, whether it’s located in a dangerous neighborhood, positioned next to a noisy freeway, or if it’s suffering from a damaged foundation.

The buyer may not be able to get loan approval

Besides a slow sale, pricing a property too high can also lead to problems when it comes time for the appraisal. Even if you get a buyer at a high price point, the home might still appraise for market value. In that case, you’ll likely have to lower the price anyway so that the buyer can get approved for a mortgage loan. Or the buyer will have to come up with cash for the difference.

You might field lowball offers

Another risk is that if a home is priced too high, buyers might come in with lowball offers to get the home right at or right below market value. All in all, you’ll simply make more if you start at market value from the beginning.

Klaus adds, “Statistically, people end up netting less list price to sales price once they have to start making adjustments from where they should have just listed it in the first place.”

What are the common reasons a home is priced too low?

Rich-Soto says you cannot underprice a home.

“What I mean by that is a house is going to be worth what somebody is willing and able to pay. So, if you don’t get an exact target perfect – I think that’s a big worry, ‘Oh, we should be $10,000 higher,’ – if it’s worth more than it’s listed for, you’re going to get offers higher than what it’s listed for.”

There could be several reasons a house is priced below market value. A seller may want to sell the home as quickly as possible due to a major life change, like relocating for a job or a death in the family, or perhaps their listing agent is unaware of the current market value of the home.

Properties may also be priced low because they:

- Require costly repairs

- Are dated and need large-scale renovations

- Have foundation issues

- Are in an undesirable location

- Have a history that buyers are wary of

Rich-Soto shares a story about a listing she had in a great neighborhood and school district, but the house had one catch.

“You can’t move the house. It’s always going to back up to a shopping center, and people don’t want to live in a house that backs up to a shopping center.”

That’s a big drawback, says Rich-Soto, sharing that a good listing agent will be kind but explain this to the seller to set a clear expectation.

How can you price your home just right?

An online home value estimator is a great starting point for estimating your home’s worth, but we recommend getting a full comparative market analysis (CMA) from a top real estate agent.

Rich-Soto explains how automated valuation tools give you a price range, but it’s an automated computer giving you that range, and it may not be accurate. Your house could actually be worth a lot more than you’re seeing.

“When you are looking to get your house evaluated so you know what it’s worth, you have to get a real person there to evaluate the property and tell you pluses and minuses and what your property is [roughly] worth based on what’s happening in the market right now.”

Your best bet is to list your home at a price that’s based on what a CMA says the market can support today. We’ll show you how you can run your own base-level CMA further below.

If you’re still searching for a reliable real estate agent in your area, use HomeLight’s free online Agent Finder. Our platform has introduced over one million buyers and sellers (and counting) to top-performing local real estate professionals.

Our data shows the top 5% of agents across the U.S. help clients sell their homes for as much as 10% more than the average real estate agent, and they can provide a CMA to help determine your home’s market value.

Let’s take a look at what makes up a comparative market analysis.

What is a comparative market analysis (CMA)?

A comparative market analysis is a report real estate agents create to determine a fair list price of a home based on the sale price of recently sold or pending homes similar to yours in your neighborhood. Based on what these comparable houses (comps) sold for, you can get a more accurate read on what you should list your home for in the market today.

Property details used to determine homes of similar value include:

- Home condition

- Age

- Location

- Number of bedrooms and bathrooms

- Parking spaces

- Lot size

- Property renovations

- Neighborhood amenities

- HVAC system, roofing, and other major features

- Local school districts

- Crime rate

Real estate agents compile stats on similar houses by pulling information from the multiple listing service (MLS), which they use to create one large, comprehensive overview report. This report can then be shared with sellers to answer any questions about pricing or how a suggested sale price was selected.

Rich-Soto says that while CMAs can be used as a pricing framework, they aren’t an exact science, and a Realtor should always visit a property in person before pricing it to see its current condition.

“You can have two houses, and one can be in really amazing condition and fetch a really high price, and the next-door neighbor could have the exact same floor plan and have let their house go to pot, and guess what? They’re going to have a much lower sale price, even in this market.”

Can you perform your own comparative market analysis?

Yes, a key part of this process involves reviewing recently sold home prices. However, not all states publicly disclose this information. If you live in a non-disclosure state and need a home’s sold price for a CMA, you’ll need to ask the seller or work with a real estate agent who has access to this data.

We sat down with a licensed real estate agent and asked him how he would run a CMA without the tools of a real estate agent. This is how he walked us through the process.

For example, let’s say you want to sell a three-bedroom, two-bathroom, 1,500-square-foot single-family home in a suburb of Grand Rapids, Michigan.

- First, go onto Zillow’s website. Then, search your home’s address. (Exit out of the page that pops up, including your home value, details, etc.)

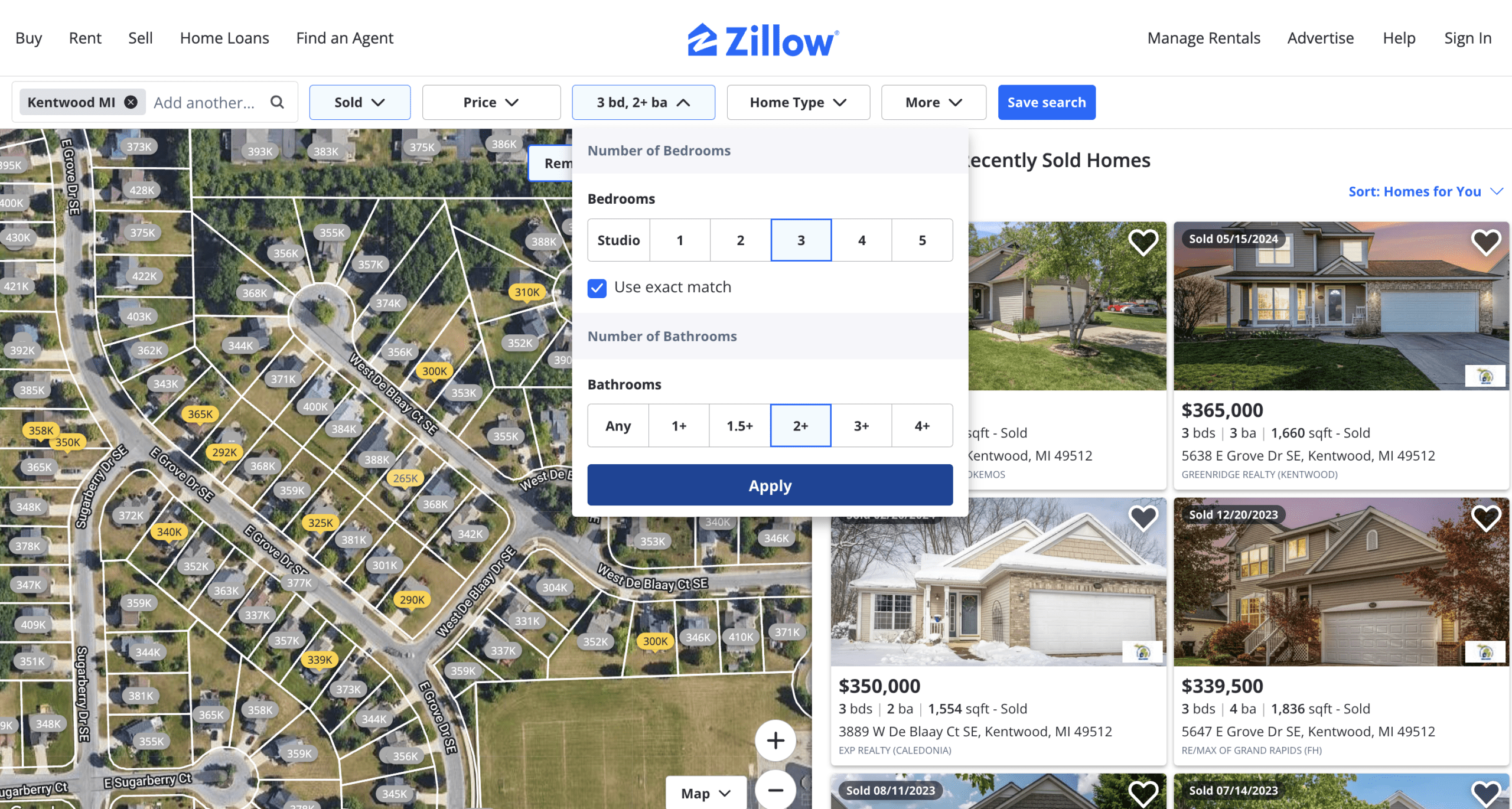

2. Next, go to the top display bar, select “Sold” on the left-hand side, and hit “Apply.”

3. Then, click “Beds and Baths” from the top display bar, select the same number your house has (for this example, three bedrooms and two bathrooms), check the box for “Use exact match,” and hit “Apply.”

4. Next, click on “Home Type” in the top display bar, choose the type of home you have, and select “Apply.”

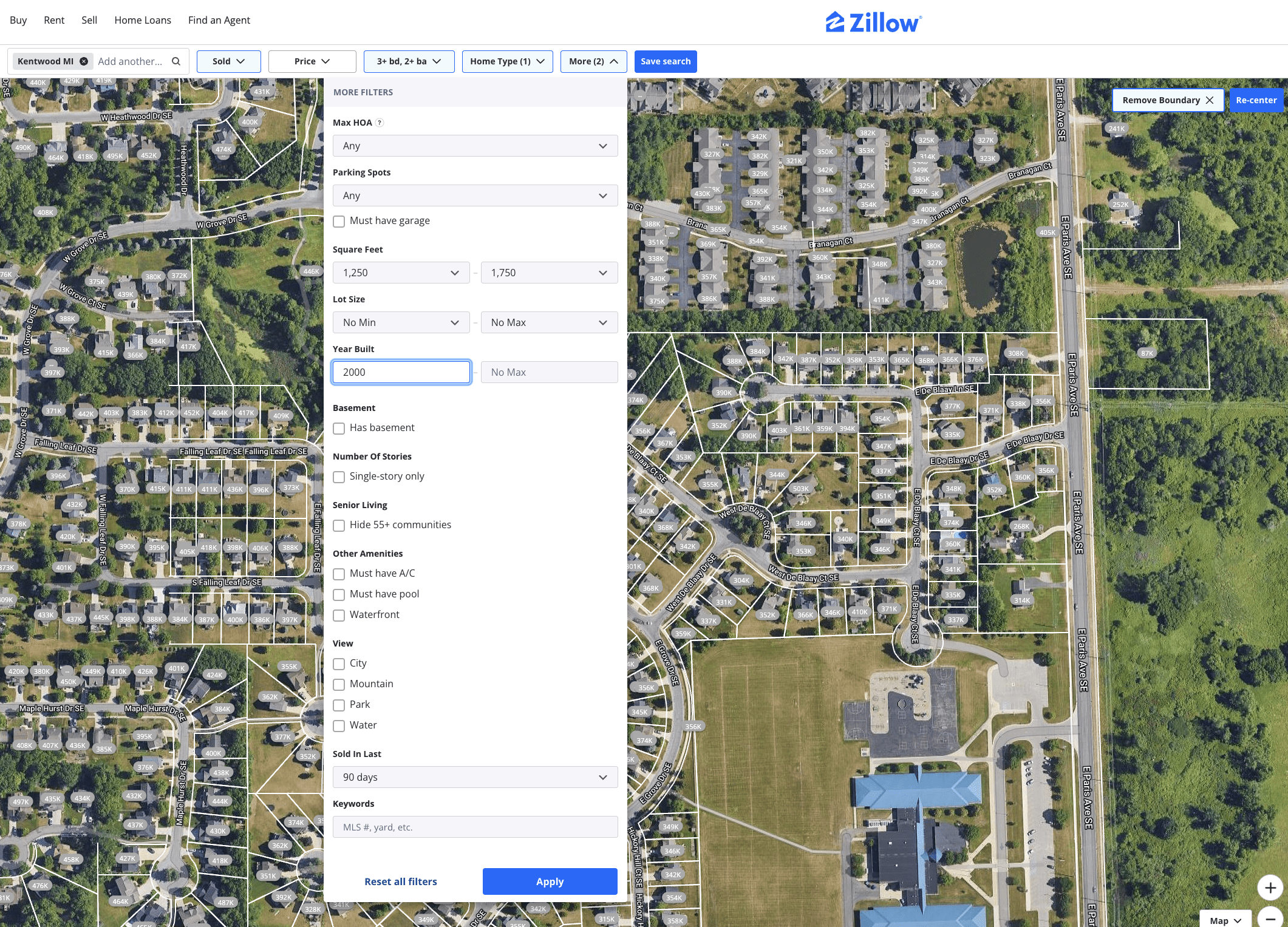

5. Now, go under “More” and select any similar features to your house. For example, enter your home’s square footage range, lot size, the year it was built as a minimum, and if your home has a garage, etc. At the bottom of this tab, click on the drop-down menu called “Sold In Last,” and select 90 days (or shorter) to get the most up-to-date sale prices.

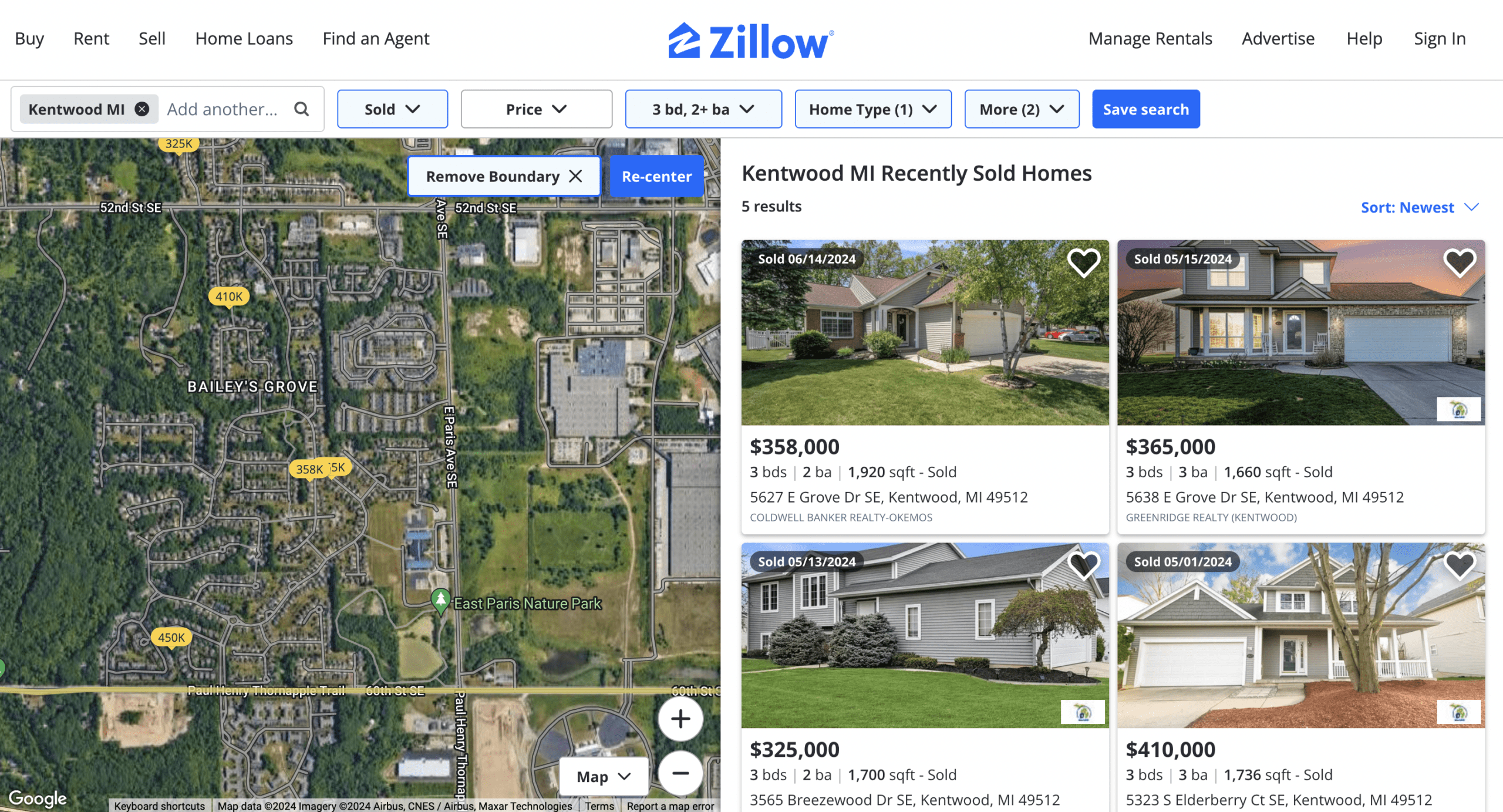

6. After hitting “Apply,” outcomes for “Recently Sold Homes” will appear on the right side of the screen.

Pay close attention to the number of beds, baths, and square footage in each comparable house. The more similar those numbers are to yours, the better. Also, aim to find homes that sold as recently as possible.

Select the homes nearest yours and see when and what they sold for. If possible, limit your search to houses within a mile of your home. You need three or four similar houses to make your comparative market analysis report. If you don’t see many results, you can always expand your parameters.

Once you have three or four homes, you can create a price range. Using this example, similar homes in the area have sold anywhere from $325,000 to $410,000.

Another option for getting a real-world home value estimate in less than two minutes is through HomeLight’s Home Value Estimator tool. This free tool uses your property information and local housing market data to deliver an estimated home value.

While an automated valuation model (AVM) is a great tool for providing a ballpark estimate of your home’s current value, running a reliable CMA or getting an appraisal remains the most accurate, stat-backed way to figure out your home’s worth.

How to read market conditions that affect your home sale

The temperature of the current real estate market will absolutely affect your home sale. That’s true on a national, state, city, neighborhood, and even street level. Make sure you’re up to date on the most recent national and statewide real estate market news.

Take a look at these resources to understand the real estate market and price your home right:

NAR Pending Home Sales

NAR releases a pending home sales report every month to help you gauge the number of homes in contract nationwide. While this report does not offer local insights, its percentage of pending homes is an important forward-looking indicator of the market.

In general, high pending sales suggest strong demand, allowing for more competitive pricing. Conversely, if pending sales are low, sellers may need to adjust their price expectations to attract buyers.

NAR Existing-Home Sales

NAR also releases an existing-home sales report, which tracks closed home sales across the U.S. This report shows where the percentage of closed sales falls relative to the previous month and year. It also gives you an idea of the current number of months of inventory.

Months of inventory measure how long it would take for every house on the market to sell, given the current pace of sales. A balanced market typically has four to six months of supply available. Less than that suggests a seller’s market, whereas more than six months of inventory indicates a buyer’s market.

In a seller’s market, where demand exceeds supply, homeowners can typically price their homes higher due to increased buyer competition. With fewer homes available, bidding wars and multiple offers often drive prices above the listing price. However, note that even in a hot seller’s market, overpricing can still drive away buyers, which is why it’s important to set strategic pricing.

S&P Case-Shiller Home Price Indices

The Case-Shiller home price index tracks the value of residential real estate by examining changes in prices. You can look at the price index nationally, but you can also sort by city if you live in one of 20 metropolitan areas. This includes major cities like New York, San Diego, and Chicago.

Cotality’s US Home Price Insights Report

This monthly analysis report tracks national and regional housing trends, including both historical and forecasted price movements. It helps you understand how their local market is performing, whether prices are rising, stabilizing, or declining, so you can set a competitive price and time your sale strategically.

The report offers data points like monthly and annual price changes and affordability rankings, making it a valuable tool for informed decision-making.

Cotality’s Loan Performance Indicators Report

This analyzes the current percentage of defaulted mortgages nationwide, statewide, and for a handful of metro areas. High or rising delinquency rates, indicating financial distress among homeowners, lead to an increase in foreclosed homes on the market, which can drive down home prices.

On the flip side, low or declining delinquency rates suggest homeowners are managing mortgage payments well. With fewer distressed properties available, buyers are less likely to seek heavily discounted foreclosures, allowing you to price your home more competitively without the need for significant reductions.

BLS Jobs Report

The Bureau of Labor Statistics’ report looks at unemployment rates nationally. A strong job market correlates with a strong housing market, as it indicates more people have stable incomes and can afford homes. This drives up demand, allowing you to sell your home for a higher price.

ADP Employment Report

Another way to get a reading on the job market is to look at the ADP employment report, which shows the number of new jobs by company size and industry.

Census Bureau New Residential Sales

The Census Bureau’s report on new residential sales provides data on the number of new construction single-family homes sold and for sale across the U.S., as well as the median and average sales prices. You’ll also see month-over-month and year-over-year comparisons.

This data helps you track market shifts, assess the influence of new construction on housing supply, and set a strategic listing price, particularly when competing with recently built homes nearby.

Census Bureau New Residential Construction

This monthly report provides data on the number of housing completions, housing starts, and building permits. Figures are released for single-family homes and units in buildings with five units or more. Here, too, there are month-over-month and year-over-year comparisons.

This report can offer insight into the housing supply. If there’s a surge in new construction, buyers have more housing options, which may reduce demand for existing homes and lower prices.

Partner with a top real estate agent you trust: Find one now

Now that you know how to run your own initial CMA and size up the market, you’re on the right path to pricing your property to sell. If you want to sell in the next one to three months, Rich-Soto advises meeting with at least one real estate agent in your area.

“Sellers should definitely meet with a Realtor that they trust so they can have an actual walk-through together, and a consultation about what things they can do for little to no money to get the property ready and presentable for sale,” says Rich-Soto.

You can also compare your own CMA to your Realtor’s report to see how the numbers match up. If they don’t align, it can be beneficial to see their CMA and learn how they pulled the numbers they did and why.

“A real estate agent knows the market,” says Rich-Soto. “They’ll know your house, and they’ll know it in comparison to things that have sold or are coming up or are already on the market. They’ll have an accurate understanding of what your property is worth… if they know the area.”

Searching for an expert in your local market is easy with our free Agent Finder tool. Get matched with a top-performing real estate agent in under two minutes.

Header Image Source: (Omri D. Cohen/ Unsplash)