How a 50-Year Mortgage Could Change What You Pay (Try Our Calculator)

- Published on

- 6 min read

-

Richard Haddad Executive EditorCloseRichard Haddad Executive Editor

Richard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

If you’re like many Americans, buying a home feels just beyond your financial grasp. If only the monthly payments could be lower, perhaps you could qualify and make ends meet. One idea being debated by lenders, economists, and politicians is a 50-year mortgage.

Extending the repayment term well beyond the standard 30 years could cut your monthly payment, but it would also change your borrowing costs over the long term. Just how much more would a 50-year loan cost you? How much less would your monthly payment be? Would the tradeoff be worth it to get your foot in the door to homeownership?

In this post, we’ll show you what a five-decade home loan could look like and provide a 50-year mortgage calculator to see how it might — or might not — work for you. We’ll also provide expert insights from a top lender.

Why a 50-year term is getting attention

Proponents say a 50-year mortgage could make homebuying more accessible by lowering the monthly payment threshold, helping buyers qualify for more or larger loans.

Opponents argue that extending repayment by 20 years will lead to higher lifetime interest costs, slow down equity accumulation, and potentially trap homeowners in debt for their entire lives. For example, the total interest paid over 50 years could double what it would be on a 30-year term.

“For some people, the lower payment might be exactly what helps them get into a home and stop renting,” says Eric Becerra, a Fresno, California, Mortgage Broker with over 28 years of experience. “For others, it might stretch things too far. It depends on the situation, not just the payment.”

For the remainder of this post, we’ll compare real numbers so that you can determine whether the additional years might be worthwhile for you if this type of loan product were to be created.

Editor’s note: Although widely discussed in the media, a 50-year mortgage term isn’t currently available because it’s not considered a “qualified mortgage” (QM) under the Dodd-Frank Act.

What the term ‘50-year mortgage’ really means

The concept of a 50-year mortgage works like a 30-year fixed loan in structure (meaning consistent monthly payments that apply to principal + interest) but stretches repayment out over five decades instead of three.

“A 50-year loan gives you a lower monthly payment, but it comes with much slower principal reduction and significantly more total interest over the life of the loan,” Becerra explains. “You’re trading short-term comfort for long-term cost. A 30-year loan builds equity much faster and keeps your total interest lower.”

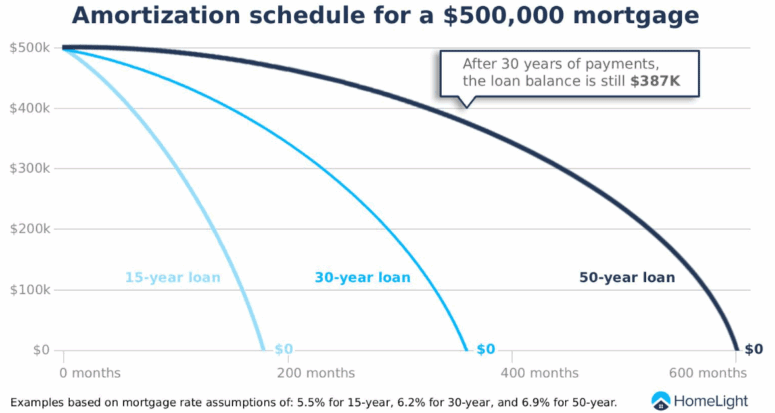

The chart below illustrates how a 50-year mortgage might compare to traditional 15- and 30-year loans on an amortization curve.

By spreading the same principal over more months, the monthly payment drops. But the interest you’ll pay over the full term rises because you’re borrowing for longer, and a larger portion of each payment goes toward interest early on.

“For short-term homeowners, the biggest drawback is how slowly the principal pays down,” Becerra says. “If you sell or refinance early, you may not see much equity gain from the amortization itself; you’re relying heavily on market appreciation. It’s flexible on monthly payment, but you give up faster equity-building.”

This would hold true even if the interest rate were the same for a 30-year and a 50-year term (which analysts say is unlikely because longer-term loans typically carry higher rates). But if you’re experimenting with hypothetical numbers, you should increase the interest rate for the longer-term loan.

For example, a $500,000 loan with 20% down could provide a $180 lower monthly payment under a 50-year term with a 6.5% interest rate, but about $611,960 more in total interest when compared to a 30-year fixed loan at 6%.

Use our 50-year mortgage calculator

Using the calculator below, you can enter your loan amount, interest rate, down payment, and compare how the monthly payment and total interest paid amounts look for a 30-year vs. 50-year term.

Our 50-year mortgage calculator inserts rough estimates for property taxes and home insurance costs. If your down payment is less than 20% of the home’s purchase price, the calculator will also add a ballpark monthly fee for private mortgage insurance (PMI). Actual costs vary by location.

How a 50-year mortgage could change affordability

“Since the payment is lower, some borrowers may qualify more easily under DTI (debt-to-income) rules,” Becerra says. “But lenders may look closer at the overall stability because longer terms mean slower equity growth. Down payment requirements probably won’t change much, but underwriting might get a little tighter until lenders get comfortable with how these loans perform.”

For example, a borrower who might only qualify for a $350,000 home on a 30-year term could be approved for something closer to $400,000 on a 50-year schedule, depending on rates and lender guidelines.

However, more purchasing power doesn’t always translate to improved affordability across the market. If more buyers can qualify for higher amounts, prices could rise to meet that expanded demand, particularly in already-tight housing markets.

“It helps lower the monthly payment, but it doesn’t magically make homes cheaper,” says Becerra. “I look at it as a tool, not a solution.”

And while the monthly savings may feel significant, the slower pace of equity building means it could take much longer to reach the point where selling or refinancing is financially advantageous.

How much more interest would you pay?

As our calculator illustrates, extending your mortgage from 30 to 50 years doesn’t just stretch your payments; it dramatically increases how much you’ll pay in interest over time.

For instance, assuming a 20% down payment to avoid PMI, below is a table comparing a 30-year mortgage at 6% with a 50-year mortgage at 6.5% (because longer terms have higher rates) using different loan amounts:

| Home loan amount | 30-year payment | 50-year payment (diff.) | 30-year total interest paid | 50-year total interest paid |

| $200,000 | $1,579 | $1,507 (-$72) | $231,676 | $476,460 |

| $300,000 | $2,272 | $2,164 (-$108) | $347,515 | $714,690 |

| $400,000 | $2,965 | $2,822 (-$143) | $463,353 | $952,921 |

| $500,000 | $3,659 | $3,479 (-$180) | $579,191 | $1,191,151 |

| $600,000 | $4,352 | $4,137 (-$215) | $695,029 | $1,429,381 |

| $700,000 | $5,045 | $4,794 (-$251) | $810,867 | $1,667,611 |

| $800,000 | $5,738 | $5,452 (-$286) | $926,706 | $1,905,841 |

| $900,000 | $6,432 | $6,109 (-$323) | $1,042,544 | $2,144,071 |

| $1,000,000 | $7,125 | $6,767 (-$358) | $1,158,382 | $2,382,301 |

Herein is the biggest tradeoff: a smaller monthly payment in exchange for a much higher total cost. And because interest dominates the early years of repayment, a 50-year borrower builds home equity far more slowly. This could limit options for refinancing, upgrading, or selling until later in the loan’s lifespan.

Who might benefit, and who might not

A 50-year mortgage could make sense for certain buyers, particularly those focused on short-term affordability or keeping cash free for other goals. First-time buyers in high-cost areas might use the lower payment to enter the market sooner, and long-term homeowners who plan to stay put for decades may feel comfortable with a slower path to equity.

If a 50-year mortgage is ever approved as a conforming loan by the Federal Housing Finance Agency (FHFA), Becerra suggests buyers ask these four questions before taking on such a long debt commitment:

- How long am I really going to keep this loan?

- Am I comfortable paying much more interest over time?

- Does a lower payment solve a temporary problem for me, or am I trying to stretch too far?

- If home values flatten or drop, will I still be okay with slower equity growth?”

“A lower payment is attractive, but borrowers need to understand the long-term math before saying yes,” Becerra advises.

For many, the long horizon poses risks. Buyers who anticipate moving or refinancing within 5 to 10 years could end up paying mostly interest without much principal reduction. And since the loan balance decreases more slowly, those homeowners could face tighter margins when it’s time to sell, especially if home values stagnate or dip.

Even so, Allison Schrager, a senior fellow at the Manhattan Institute, recently wrote a Bloomberg Opinion piece called, “A 50-Year Mortgage? It’s Not a Terrible Idea.” Regarding her column, Schrager commented that it’s no worse than a 30-year mortgage: “Most people don’t pay off their mortgage at maturity anyhow. Besides, policy makers are desperate to bring down mortgage rates, and I’d prefer a 50-year mortgage to financial repression or relaxing lending standards.”

More than 90% of home purchases in the United States are financed with 30-year fixed-rate mortgage loans. By contrast, in many countries, fixed-rate mortgages typically lock in the rate for much shorter terms, after which the rate becomes variable or the borrower must refinance.

Bottom line: A 50-year mortgage comes with higher costs

A 50-year mortgage could reshape what “affordable” means for many buyers, lowering monthly payments but extending debt well into the future. While the idea may sound appealing in a high-price market, it comes with long-term costs that deserve close examination.

“This type of mortgage shouldn’t scare anyone, but it shouldn’t be viewed as free money either,” says Becerra. “It’s a tool. For the right person, in the right situation, it can help them get into a home and stabilize their life. Just make sure the lower payment doesn’t distract you from the long-term cost. Get guidance, compare both options side-by-side, and choose the loan that supports your actual goals.”

For expert guidance in your selected buying market, consult with a top real estate agent. A seasoned agent can provide advice about local downpayment assistance and finance programs, and the most affordable housing opportunities that might fit your budget.

Find a trusted agent with HomeLight’s free Agent Match platform. We analyze over 27 million transactions and thousands of reviews to determine which agent is best for you based on your needs.

To learn more, visit HomeLight’s Homebuyer Resource Center, where you can search for answers to all your homebuying questions.

Header Image Source: (stetsik / Deposit Photos)