Credit Score for Home Loan 101: What Smart Buyers Need to Know

- Published on

- 15 min read

-

Chelsea Levinson, Contributing AuthorCloseChelsea Levinson Contributing Author

Chelsea Levinson, JD, is an award-winning content creator and multimedia storyteller with more than a decade of experience. She has created content for some of the world’s most recognizable brands and media companies, including Bank of America, Vox, Comcast, AOL, State Farm Insurance, PBS, Delta Air Lines, Huffington Post, H&R Block and more. She has expertise in mortgage, real estate, personal finance, law and policy.

-

Sam Dadofalza, Associate EditorCloseSam Dadofalza Associate Editor

Sam Dadofalza is an associate editor at HomeLight, where she crafts insightful stories to guide homebuyers and sellers through the intricacies of real estate transactions. She has previously contributed to digital marketing firms and online business publications, honing her skills in creating engaging and informative content.

When it comes to buying a home, your credit score packs a big punch. That little three-digit powerhouse helps determine both your eligibility to get a mortgage, and how much you’ll pay for that mortgage over time. Before even going to open houses, it’s smart to understand first what qualifies as a good credit score for home loan and how it impacts mortgage options, interest rates, and overall affordability.

Most first-time homebuyers feel understandably apprehensive about this whole credit score thing. In fact, gearing up to buy a home might be the first time you’ve really thought about your credit score in, well, ever.

You may have questions, such as: What exactly goes into your credit score? What credit score do you need to get a home loan? Why do lenders even care? And what can you do if you have no or low credit?

Worry not; we’ve got answers! We talked to top experts to find out everything you need to know about your credit and buying a home.

So without further ado, let’s break it all down.

What’s a credit score?

Your credit score is a three-digit number — ranging from 300 to 850 — that represents how well you manage and pay off debts.

Lenders use this score to decide whether to loan you money. The higher your credit score, the more likely you are to be approved for loans and lines of credit, and the better rates and terms you’ll be offered. If you have low or no credit, it’s much more challenging to borrow money.

There are three main companies — called credit bureaus — that measure and track credit scores: Equifax, Transunion, and Experian.

“They monitor your debt — what you owe, what you pay, if you’re on time, the frequency of your payments,” explains real estate agent Lynn Carteris who’s with the Oldham Group serving the San Francisco Bay area in California.

That information is then aggregated and used to calculate your three-digit credit score, a number lenders can use to quickly evaluate your creditworthiness.

Who calculates credit scores?

The most commonly used credit score among lenders and creditors is the FICO score. This is known as the industry standard in the mortgage world. Another popular credit score is VantageScore, though it’s less commonly used in home lending.

FICO and VantageScore calculate credit scores differently, so you can expect some variance in your scores for each.

FICO Score

- 300 to 579: Very poor

- 580 to 669: Fair

- 670 to 739: Good

- 740 to 799: Very Good

- 800 to 850: Exceptional

VantageScore

- 300 to 499: Very Poor

- 500 to 600: Poor

- 601 to 660: Fair

- 661 to 780: Good

- 781 to 850: Excellent

If you’re planning to buy a home, it’s probably best to focus on your FICO score for now. Ideally, you want to be in the Very Good range, as that’s where you’ll get the best mortgage rate. However, you can get a loan even with Fair credit. We’ll get to all that soon.

What goes into a credit score?

Let’s back up for a minute: Where exactly does your credit score come from?

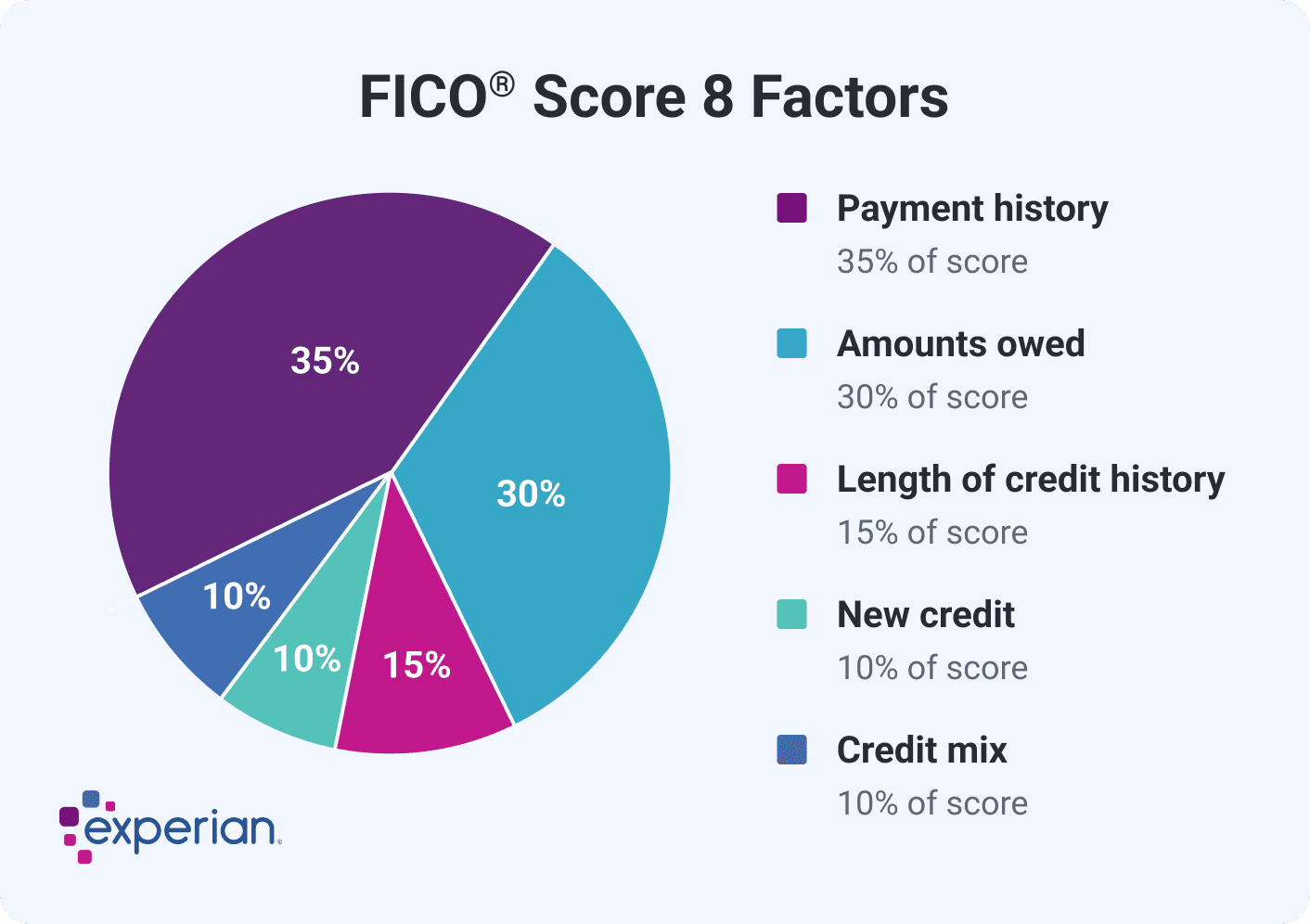

A credit score is made up of five main components, and according to Experian, they break down a little something like this:

1. Payment history (35% of your credit score)

This looks at how consistently you’ve made payments on your debts. To get the best score, you’ll need to make all payments on time and in full (meaning you make at least the minimum payment).

Payment history makes up the biggest piece of your credit score. Late or missed payments can tank your chances of getting a mortgage.

2. Amounts owed (30% of your credit score)

Credit utilization is how much credit you’re using compared to how much you have available. If you have $10,000 available in credit, and you’re using $9,000 of that while paying the minimum each month, it can hurt your score.

A lower balance compared to your available credit, on the other hand, will help your score.

3. Length of credit history (15% of your credit score)

Unfortunately, if you have a sparse or no credit history, it will hurt your score. The credit bureaus like to see a long history of credit so they can measure how consistently you manage your debts over time.

It takes a long time to build excellent credit — think years, not months.

4. New credit (10% of your credit score)

Whenever you take on new debt or a line of credit, your score will dip for a period of time (after which, it should improve in the long term thanks to the “mix of credit” component above).

This is why you should avoid making any big purchases or taking out any new lines of credit when you’re home shopping. You want every point possible in your favor so you can score a great mortgage rate.

5. Credit mix (10% of your credit score)

The credit bureaus also like to see variety in your credit history, meaning you’ve demonstrated that you can pay off several different forms of debt at once (car payment, credit card, student loan, mortgage).

Of course, being overburdened with debt that you can’t afford won’t help your score. But if you’re consistently paying off multiple debts at once, your score will likely be healthier for it.

Why your credit score is important for getting a mortgage

Your credit score plays a major role when it’s time to get a mortgage.

Its importance is twofold: You’ll need to meet a certain minimum credit score requirement to be approved for a home loan in the first place. On top of that, your score will impact the mortgage rate you’re offered, which affects how much you’ll pay for your mortgage.

“The better credit score you have, the better rate you’re going to get and the less risk you are,” Carteris shares.

Lenders want to know that you’re going to pay them back. A demonstrated ability to pay bills on time and in full each month gives your lender confidence that you’ll also pay your mortgage in full and on time each month.

Buyers with scores of 740 or higher (also known as those in the FICO Very Good credit club) tend to qualify for the best rates a lender has to offer. And that means saving big money on your mortgage over time!

How to find out your credit score

By now, you’re probably getting pretty curious about your credit score and how you’re faring according to FICO. There’s good news and bad news.

The good news is that all Americans have the right to one free credit report each year from all three bureaus. You can find yours at AnnualCreditReport.com, the only government-sanctioned website for free credit reports.

These free reports will give you invaluable information about your credit history and guide you as you make any improvements necessary to buy a home.

Now for the bad news: These credit reports won’t tell you your FICO score. They will tell you if there are any negative credit events impacting your score (you’ll likely want to fix these before applying for a mortgage), but if you want your actual FICO score, you’ll need to dig deeper.

You can pay to get your FICO score through an authorized retailer, but there are free ways to access that all-important number too!

One way you may be able to get your FICO score for free is through your bank or lending institution, thanks to the FICO Open Access Program. If you already use a major financial institution like Citi, Bank of America, Discover, or Wells Fargo, you can probably get a free FICO score today.

To check if your financial institution is part of the Open Access program, check here.

How can you build credit if you don’t have any yet?

What if you don’t have any credit at all? Not to worry — there’s plenty you can do to establish a credit history and build your credit, including:

Open a credit card

If you pay your card on time and in full each month, you’ll be building credit in no time. Sure, new credit will negatively impact your score for a time, but the longer-term benefits of making payments each month will help boost your credit over time.

If you can’t get a regular credit card (retailer and department store credit cards tend to be the easiest to qualify for), you may be able to get a secured credit card, which requires an upfront deposit that’s held until the card is paid back.

Take on an auto loan

Since auto loans are considered installment credit, similar to a mortgage, they show lenders that you can manage debt responsibly over time. By consistently making on-time payments, you establish a positive payment history, which is the most significant factor in your credit score. Taking on a car loan also diversifies your credit mix, another key component lenders look at when evaluating your credit score for a home loan.

If you’re just starting to build credit, consider getting a loan for a modest, affordable vehicle. Shop around for competitive interest rates and, if needed, explore options like a co-signer or a lender that specializes in financing for first-time borrowers. Just be sure the monthly payments fit within your budget. Missed or late payments can hurt your credit instead of helping it.

Join someone else’s account

If you have a loved one or significant other with a credit card, and they add you to their account, it will help build your credit.

However, understand that you could hurt your loved one’s credit if you, say, failed to make a payment or overcharge the account. Make sure to set ground rules first, and only go this route with someone you trust.

While establishing credit, you must make all payments on time and in full each month and try to keep your utilization low.

Keep in mind that you’ll need around six months to recover from the hit to your credit for opening a new account. After that point, you should see your score picking up steam.

Understand that there is no magic bullet, and building credit takes time. It’s probably best to give yourself a year or two to establish good credit before applying for a mortgage.

How can I improve my credit score?

If the only thing standing between you and buying a house is your credit score, worry not. There are a ton of ways to improve your score so you can get approved for a mortgage and nab a competitive mortgage interest rate.

But first and foremost is paying your bills on time every month and making sure you keep your credit utilization low.

“It’s extremely important to make sure you either pay off all of your debts or at least get all of your credit card debt to less than 25% owed,” explains top Chicago agent Melanie Giglio-Vakos, who works with 74% more single-family homes than the average area agent.

“What I mean by that is, if you have a credit card that has a $10,000 limit, you need to have no more than $2,500 owed on the card, or else it will affect your credit score negatively each month,” she adds.

Your monthly debt payments will also affect how much money you can borrow for a home, so reducing your debt may mean qualifying for a bigger mortgage.

But besides the obvious, what are some other ways you can improve your credit score? Let’s walk through some of your options.

Think being a first-time homebuyer with bad credit is impossible? Think again. This guide will show you how to turn your homeownership dreams into reality, even with little to no credit. Read on.

10 surefire ways to improve your credit score

1. Dispute any errors on your report. Errors on your credit report, such as incorrect account balances or fraudulent activity, can drag down your credit score for a home loan and make borrowing more expensive. Reviewing your report regularly and disputing any inaccuracies with the credit bureaus can help ensure your score accurately reflects your financial history, potentially boosting your chances of securing a better mortgage rate.

2. Settle any debts in collection. Make sure you “pay to delete” the debt, which removes the negative item from your credit report. Note that you can negotiate what you owe, but you must “pay to delete,” or the delinquency could continue to hurt your credit.

3. Set up autopay. It’s a simple way to make sure you pay bills on time each month. Remember, a strong payment history is the most important factor in your credit score for a home loan. By automating your payments, you reduce the risk of late fees and negative marks on your credit report, making you a more reliable borrower in the eyes of lenders.

4. Pay your credit card twice a month. There’s no rule that says you can only pay your card once a month. By making two payments a month, you can keep your utilization low.

5. Pay down credit card debts. This will improve your utilization and thus your credit score. It shows financial discipline and lowers your overall debt burden, making you a more attractive borrower. Lenders prefer applicants with manageable debt levels, as it suggests you’ll be able to handle mortgage payments without financial strain, ultimately improving your credit score for a home loan.

6. Keep credit balances low. Don’t overutilize your credit, as it can hurt your score. Aim to keep your utilization below 25% while shopping for a home loan — or ideally, below 20%. A good rule of thumb is to use your credit card moderately each month and pay it off in full each month (at least while you’re mortgage shopping!).

7. Don’t close any accounts for now. Closing accounts can hurt your credit mix, so make sure to maintain unused accounts until after you get your mortgage. With this, you can show a strong credit profile and a longer, more stable borrowing history.

8. Request a higher limit on a credit account. If you have a card you’ve been paying consistently for a while, ask for a credit limit increase. Having a higher available line of credit can improve your utilization.

9. Pay off your credit cards in full each month. This helps you avoid interest charges while also demonstrating responsible credit management, which can boost your credit score for a home loan. It keeps your debt levels low, allowing lenders to see you as a responsible borrower who handles credit wisely and not overextends when taking on a mortgage.

10. Avoid applying for other loans. Every time a lender runs a “hard inquiry” on your credit (that’s a fancy term for pulling your full credit report when you apply for a loan), it negatively impacts your score for a time. When you’re getting a mortgage loan, applying for other credits or debts during the process can hurt your approval. It’s best to wait until after you’ve closed to apply for any additional loans.

How long does it take to repair your credit?

Repairing your credit can take anywhere from a few weeks to years, depending on the damage.

For example, settling up with collections can positively impact your score within weeks. Meanwhile, a bankruptcy can stay on your credit for up to 10 years — and you may need to wait a few years before applying for a mortgage again.

If your credit only needs minor improvement, you might be looking at a time period of one to six months. If you’re recovering from a bankruptcy or foreclosure, you could, unfortunately, be looking at years.

Overwhelmed and unsure of where to start? Try enlisting the help of a credit counselor or credit repair agency. There are also nonprofits that may be able to help, like the National Foundation for Credit Counseling (NFCC).

Can you buy a house without a credit score?

Let’s say you have no credit score and are ready to buy a house now, not in the two years it would take to establish strong credit.

Can you buy a house without a credit score? Technically, yes. Though it’s not for the faint of heart.

If you want a home loan but don’t have a credit score, you’ll likely have to submit to manual underwriting (that is to say, underwriting that’s done by a human rather than an algorithm). This is a more strenuous mortgage approval process, and you’ll have to show a strong history of making monthly payments on non-credit accounts, such as rent, utilities, cell phone bills, cable bills, or insurance premiums.

You’ll also have to put more money down, have more cash on hand, and you’ll pay a higher mortgage rate — not to mention more for mortgage insurance.

Another drawback of a manually underwritten mortgage? You’ll be restricted as to which lenders you can work with since only a select few support creating these loans. If you’re dedicated to going this route, try a small or local lender to see if they can help you.

So, what credit score do you need to buy a house?

To get approved for a home loan, you need to meet the minimum credit score requirement. Each type of loan has its own credit score requirements (we’ll get to that in a minute).

Unfortunately, if you have Very Poor credit by FICO standards (meaning a score of 579 or less), it’s going to be difficult to qualify for any mortgage loan. That doesn’t mean you can’t qualify for a loan, but you’ll probably have to offset the lender’s risk by making a larger down payment.

In fact, even if you meet the minimum credit score to qualify for a loan, you may not qualify for their lowest down payment option.

“If you were trying to buy a home with, let’s say, 5% down — just because there is a 5% down program, doesn’t mean that you’re going to get approved for that program if you have a lower credit score,” shares Giglio-Vakos.

2025 credit score requirements by loan type

So what credit score do you need to be approved for a mortgage? Let’s walk through the minimum credit scores by loan type.

- Conventional loan: 620

- Notes and exceptions: While this is the minimum, most lenders require a higher score. Typically, lenders like to see a score of at least 680 or higher.

- FHA loan: 580

- Notes and exceptions: You can have a score as low as 500 if you’re able to put down 10% or more.

- USDA loan: 640

- VA loan: 620

- Notes and exceptions: This is not a hard-and-fast rule for VA loans. Some lenders will go lower.

- Jumbo loan: 700

- Notes and exceptions: Many lenders will require a higher credit score for jumbo loans, and a few may go lower.

One thing to note is that just because certain credit score minimums are required on loans, this doesn’t mean every lender will go that low. Some lenders require that borrowers have higher-than-minimum credit scores, and some will go right down to the minimum.

“Lenders vary. There are some that want the business, and they’ll be willing to take a little bit higher risk,” Carteris explains.

On the other hand, massive national banks like Wells Fargo, CitiBank, Chase, and Bank of America tend to have stricter lending standards because they have plenty of business.

If you’re just above the minimum qualifying credit score to get a home loan, try a smaller local bank. They may be more willing to work with you than a national bank.

Does your credit score drop when you buy a home?

Like we mentioned, your credit takes a hit when a lender does a hard inquiry and when you take on a new debt. Unfortunately, you’ll be doing both of those things when you get a mortgage. So yes, your credit score will temporarily drop when you close on your new home. Temporary being the keyword!

Remember: over time, paying your mortgage on time every month should actually raise your FICO score. It will improve your payment history and your mix of credit. So don’t fret; you’ll be on the up-and-up in no time. Your credit should recover fully in six months to a year.

And in the meantime, you’ll have your brand-new dream home to enjoy.

A knowledgeable real estate agent agent can guide you through sorting out your finances, improving your credit score for a home loan, and navigating the mortgage process. Connect with an agent today to start your journey.

Header Image Source: (JCS Chen / Unsplash)