How to Buy Your First Home in 19 Steps: A Complete Guide

- Published on

- 6-7 min read

-

Kim Dinan, Contributing AuthorClose

Kim Dinan, Contributing AuthorClose Kim Dinan Contributing Author

Kim Dinan Contributing AuthorKim Dinan is a writer, journalist and author. She's the outdoor news editor at Blue Ridge Outdoors and writes regularly for her local paper in Asheville, NC, covering everything from the necessity of home inspections to trends in the local economy. Kim is also the author of "The Yellow Envelope," a memoir about the time she sold her house and traveled around the globe.

-

Alexandra Lee, Associate EditorClose

Alexandra Lee, Associate EditorClose Alexandra Lee Associate Editor

Alexandra Lee Associate EditorAlexandra is an associate editor of HomeLight.com. Previously, she served as a writer and social media manager at Santa Barbara Life & Style Magazine, in addition to interning at the nonprofit honors society Phi Beta Kappa. Alexandra holds a bachelor's degree in communication and global studies from UC Santa Barbara, and she has three years of experience reporting on topics including international travel, luxury properties, celebrity interviews, fine dining, and more.

Buying a home can be a complicated and stressful process — even if you’re an old pro. And if you’ve never purchased a house before, you may feel as though you have no idea what you are doing!

Rest assured: Buying a house doesn’t have to be scary, especially when you take it one step at a time. Here’s a comprehensive guide to help you through the process of buying your first home, step-by-step.

1. Get your credit report

The first step to buying a home is to learn what kind of ground you’re standing on from a lender’s perspective — and that means knowing your credit score. Your credit score affects the rate and amount of mortgage loan you can get, so knowing what your score is and correcting any problems will be important for you to get a good deal on a mortgage.

According to the Federal Trade Commission, you’re entitled to one free copy of your credit report every 12 months from each of the three nationwide credit reporting companies. You can order your report online at annualcreditreport.com or by calling 1-877-322-8228.

2. Research first-time homebuyer programs in your area

First-time homebuyer programs can help demystify the homebuying process, so if you’re a first-time buyer, you’ll want to investigate first-time homebuyer programs offered locally in your city, county, or state.

“Homebuyer classes are great, if the buyer feels like they need it,” says Jeffery Sweet, a top real estate agent in Nampa, Idaho.

In many states, first-time homebuyer classes come with additional perks, such as down payment grants or no-down-payment mortgages, so make sure to find out what’s available in your state.

Be aware that in riskier loan environments, first-time homebuyer programs might not be as widely available, or lenders might impose loan overlays that increase the standard requirements for buying a house.

3. Decide what type of home will work best for you

Before you begin shopping for a home, you’ll need to determine the type of home that will work best for you. Will a condo or townhome fit the bill, or are you interested in a single-family home? What size home do you need?

Make sure you aren’t shortsighted when making your decision. Try to think about how you and your family might grow in the next few years. Is there the potential that you might get married or have children? Or do you have older kids that will soon leave the nest? Whatever your circumstances, try to look a few years down the road.

4. Figure out your budget

Before you begin shopping for a home, you need to determine how much you can realistically spend on one.

“Most of the people I deal with have been renting. They’re used to paying rent, which is just like a mortgage. They’re used to paying utilities,” explains Sweet. But in order to make sure that other costs of homeownership don’t take a buyer by surprise, “I recommend a budget,” he says.

Sweet also reminds buyers that when they purchase a home, their housing payments aren’t necessarily fixed forever — the payments can go up if their taxes or insurance premiums go up. “It’s good to be educated,” says Sweet. “Especially if a buyer is right on the cusp and wants to keep their payment under a certain threshold, they need to be aware of how taxes can affect their mortgage payments over time.”

5. Save up for a down payment

Most homebuyers, with some exceptions, will need to have a down payment when purchasing a home. While 20% down has become the gold standard in homebuying (and will help you avoid mortgage insurance), in reality, you may not need to put down nearly that much.

In fact, in 2023, first-time homebuyers put down an average of just 8% on their homes, according to the National Association of Realtors.

6. Talk to a licensed loan originator

A licensed loan originator is a necessary part of getting a loan. Whether you talk to your local bank, a direct lender, or a mortgage broker, the licensed loan originator is going to be your go-to point person for financing.

The loan originator’s job is to walk you through how the mortgage process works, find a great rate, and identify the loan product that would best meet your needs.

You’ll also want to determine whether you would like a 15- or 30-year mortgage loan. A shorter-term loan will increase your monthly payments but save you lots of money in interest over the lifetime of the loan. A longer-term loan will make payments more affordable, but your interest rate will likely be a bit higher.

7. Get preapproved

The next step in buying your first home is to get a Loan Estimate from the various lenders that could preapprove you. The Loan Estimate is intended to give you an idea of the closing costs and monthly payments associated with your loan.

Once you’ve compared the Loan Estimates, you’ll pick the lender that works best for you and get a preapproval letter. While a preapproval proves that you have been tentatively approved to borrow a certain amount of money, it does not guarantee financing, since all preapprovals are subject to verification.

8. Find a real estate agent

Now that you’ve done all your initial legwork, it’s time to find a real estate agent. You’ll need an agent to help guide you through the homeownership process.

“Get a good agent who is available full-time and is committed to making sure you see properties as they come up,” Sweet advises.

9. Start looking for homes

Your agent will help you find homes that are currently for sale that could be a good fit for you. Your agent will also make sure that you cover all your bases while house-hunting and avoid common house-hunting mistakes.

When it comes to searching for a home, “There are a lot of good resources online,” says Sweet. “But I think the best way to look for a home is to have an agent who is tech-savvy and has access to the MLS and can send listings instantly.”

Sweet also points out that sometimes buyers who are browsing internet websites looking for homes may get confused by the properties that are available. “A lot of real estate websites list homes that are auction homes or pre-foreclosures — these are homes that the buyer typically won’t qualify for unless they are a cash buyer,” Sweet explains.

10. Research neighborhoods

Before you decide on the location of your new home, you’ll want to do some extensive research on the neighborhoods on your list. Check out details such as school rankings (homes in good school districts may cost a little more, but they’re also more likely to retain their value), crime rates, and whether the values of the homes in the neighborhood are steadily increasing or remaining stagnant.

You’ll also want to check to see if there’s any planned development in the neighborhood, which could impact the experience of living there in a positive or negative way, depending on the type of development that is planned.

11. Make an offer on a house

When you find a house, your agent will help you make an offer on it that’s competitive but fair. The offer you make will depend, somewhat, on whether you are purchasing a home during a buyer’s or seller’s market.

During this time, you’ll also put down earnest money, which acts as a good-faith gesture that you would like to buy the house.

If the seller accepts your offer, you’re under contract!

12. Get an inspection

Once you’re under contract, you’ll enter the due diligence period, where you’ll make sure that the house you are buying is in the condition you want it to be. During a home inspection, an inspector will check the structure and systems of the home.

Homeownership is not inexpensive, and Sweet advises first-time homebuyers to keep that in mind.

A lot of first-time homebuyers don’t realize that the main components of the house, like the water heater or HVAC or roof — those can cost a lot of money. I always recommend an inspection to make sure those systems are in good shape.

Jeffery Sweet Real Estate AgentClose

Jeffery Sweet Real Estate AgentClose Jeffery Sweet Real Estate Agent at Sweet Group Realty Currently accepting new clients

Jeffery Sweet Real Estate Agent at Sweet Group Realty Currently accepting new clients

- Years of Experience 10

- Transactions 317

- Average Price Point $223k

- Single Family Homes 303

In addition to your traditional home inspection, you may want to consider getting supplemental home inspections if they apply to your home. For example, if your home is on a well and septic system, it makes sense to have those systems inspected before you buy.

13. Get an appraisal

Once your inspections are completed, you’ll need to schedule an appraisal. If you’re taking out a mortgage to buy your home, an appraisal will be required so that the lender is assured they aren’t loaning you more money than the home is worth. Even if you’re buying in cash, it’s probably a good idea to have an appraisal in order to ensure you’re not overpaying.

14. Negotiate again

If the inspection uncovers any issues, or if the appraisal comes in lower than the price you offered on the home, you will be able to negotiate again or walk away.

15. Get insurance

Before your loan closes, you’ll need to secure homeowners insurance on your house. Homeowners insurance insures the structure of your home, the possessions inside of it, and your liability should anything catastrophic happen to or on your property. Talk to more than one insurance agent to get quotes and see if you can get a discount by bundling your car and homeowners insurance.

16. Underwriting

Underwriting happens before closing. During this process, someone will go through all your loan documents with a fine-toothed comb to make sure everything is in order. The underwriter will verify your identity and assess your financial situation, and make sure that your name is spelled correctly on all the official loan documents.

17. The final walkthrough

One of the final steps in the homebuying process is the final walkthrough. This usually happens 24 to 48 hours before close, and it’s your chance to make sure everything is okay in the house before closing.

“It’s important to walk the property and make sure there are no new damages that occurred as the seller moved out,” says Sweet. “We walk through to make sure the home is up to the expectation when we initially put in the offer.”

He adds that the final walkthrough is usually an exciting time for buyers. “You can re-measure for furniture, talk about where your things will go in the home, and generally just get excited about owning the home.”

18. Closing time

You’re in the home stretch! During closing, you will sit down, sign a bunch of paperwork, and pay some money.

“Closing takes about 45 minutes,” says Sweet. At closing, you’ll go back through all of the documents that you’ve already seen from your lender in order to verify that your personal information is correct, and check to make sure that the payment and interest rate the lender gave you is the same as the numbers in your documents. “Everything should match up at closing,” says Sweet. “There should be no changes.”

You’ll bring a check with you to closing to cover the down payment and closing costs, if those apply to you. In some instances, says Sweet, buyers will actually get a check back at closing. “Buyers with VA loans can get 100% financing, so there are times when they’ll receive their earnest money back at closing,” he explains.

19. Prepare for homeownership

Congratulations, you own a house!

Sweet says that you should make sure you have all your ducks in a row before you leave closing with the keys. “I like to make sure that new homeowners know when their first mortgage payment is due and where to mail it,” says Sweet.

It’s also important that you prepare for homeownership by having a maintenance plan.

Sweet says that he always warns his new homeowners that the cost of maintaining a home might catch them off guard if they aren’t careful. “A lot of first-time homebuyers are unrealistic,” says Sweet. “If something breaks, you could be out a few thousand bucks. It’s not like you’re renting—when you own, there’s no one to take care of you.”

But owners shouldn’t worry. With a realistic maintenance plan, your home can run as it should for decades to come.

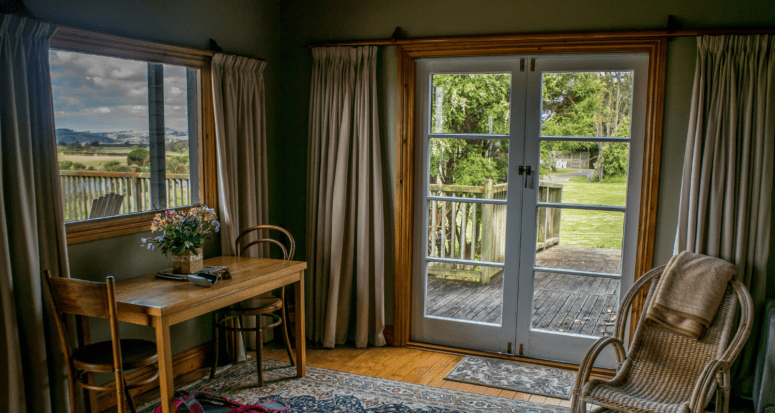

Header Image Source: (Oliver Lechner / Pexels)