Can I Sell My House if I’m Behind on Payments?

- Published on

- 8 min read

-

Richard Haddad, Executive EditorClose

Richard Haddad, Executive EditorClose Richard Haddad Executive Editor

Richard Haddad Executive EditorRichard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

-

Sam Dadofalza, Associate EditorClose

Sam Dadofalza, Associate EditorClose Sam Dadofalza Associate Editor

Sam Dadofalza Associate EditorSam Dadofalza is an associate editor at HomeLight, where she crafts insightful stories to guide homebuyers and sellers through the intricacies of real estate transactions. She has previously contributed to digital marketing firms and online business publications, honing her skills in creating engaging and informative content.

According to recent data, over six million Americans are behind on their mortgage payments. If you happen to be in a similar situation and want to ease your financial burden, you may be asking, “Can I sell my house if I’m behind on payments?”

In this guide, we’ll walk you through how to sell your home when you’re behind, with strategies tailored to different scenarios. Whether your home’s value exceeds what you owe or you’re underwater, there are paths available that could help you avoid foreclosure and move forward with financial stability.

Can I sell my house if I’m behind on payments?

Yes, selling your house is possible, even if you’re behind on payments. You have several options depending on your home’s equity and your financial goals. Below is a look at the two most common homeowner scenarios.

1. If the house is worth more than you owe (above water)

If your home is worth more than you owe, a traditional sale may provide a straightforward way to settle the mortgage and regain control of your finances.

Selling option: Traditional home sale

If you have positive equity in your home, selling through a traditional listing could allow you to pay off your mortgage and walk away with any remaining funds. This route offers simplicity and may enable you to meet your obligations fully, potentially even leaving you with extra cash.

Tips for a traditional home sale

- Price strategically: Consult with a real estate agent who understands your market to set a competitive price that encourages a quick sale. If you are considering the For Sale By Owner route (FSBO), look at recent sales of similar homes in your neighborhood to price your home right. Keep in mind that FSBO listings tend to sell for less than homes sold with the help of a real estate agent.

- Consider repairs and appeal: If your budget allows, small updates can make your home more appealing and will help it sell faster. A seasoned agent will also know what not to fix.

- Evaluate market conditions: Selling in a strong market will yield a faster sale. However, it’s still possible to sell for top dollar even if your home is in a down market.

Get a cash offer: Selling to a cash buyer can speed up the process significantly, often reducing the time and complications involved. HomeLight’s Simple Sale platform can connect you with trusted cash buyers throughout the country. Answer a few questions about your home and get a no-obligation cash offer in 24 hours. If you accept, you can close in as little as 7 days.

2. If the house is worth less than you owe (underwater)

When you owe more on your mortgage than your home’s current market value, selling can be more challenging. In this case, there are options like a short sale that may help you avoid foreclosure and minimize the financial impact of selling an underwater property.

Selling option: Short sale

A short sale involves selling your home for less than the remaining mortgage balance, but it requires your lender’s approval. While it doesn’t clear your debt completely, it can help you avoid foreclosure and potentially reduce the financial burden of an underwater mortgage.

Short sales can be time-consuming since they require lender cooperation, but they may provide a viable solution for underwater homeowners.

Tips for a short sale

- Work with an experienced agent: Short sales are complex, so having an agent familiar with the process can improve your chances of success.

- Prepare documentation for the lender: Lenders often require proof of financial hardship, like job loss or medical expenses. Gather any documents showing why a short sale is necessary.

- Be patient with the process: Short sales can take longer than traditional sales, as lenders review and approve offers. Staying organized and responsive can help smooth out the process.

Deed-in-lieu-of-foreclosure: If a short sale isn’t possible, a deed-in-lieu-of-foreclosure could be an alternative. This option lets you transfer ownership of your home to the lender, allowing you to avoid foreclosure and its impact on your credit. While you won’t receive proceeds from the sale, a deed-in-lieu can relieve your debt and potentially minimize further financial strain.

Credit impact: short sale vs. foreclosure

Most lenders will alert credit bureaus after a mortgage payment is 30 or more days late. If payment is still not received, they will typically wait 90 days to begin foreclosure proceedings.

In other words, a foreclosure usually occurs only after you miss at least four successive monthly mortgage payments, or about 120 days of delinquency. This will leave a negative mark on your credit report that can remain for up to seven years after you miss your first payment.

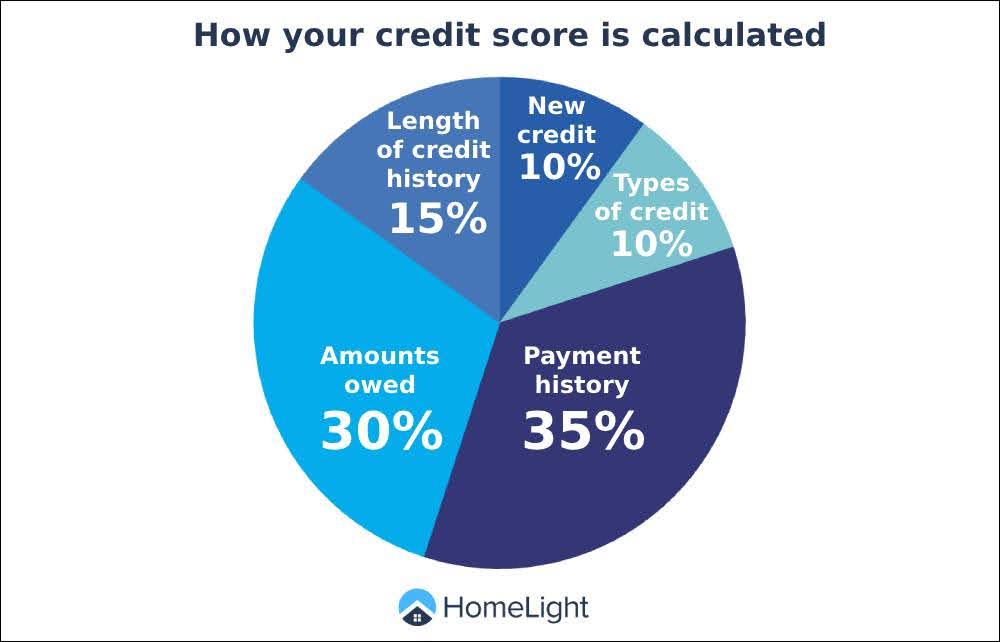

According to Consumer Education Services, the higher your credit score, the more impact a foreclosure can have. Below is an at-a-glance look at how you might be impacted by a foreclosure:

- “Good” credit score: You may see a drop of 100 points or more

- “Excellent” credit score: You may see a drop of up to 160 points

- Borrowing consequences: Expensive interest rates and limited credit on future loans

- Possible tax consequences: Debt cancellation may be taxable as ordinary income, depending on your situation.

- Time to restore credit score: 3 years or more of on-time payments

- Time to remove foreclosure from your credit history: 7 years (typically)

-

Source: FICO

A short sale typically has a less damaging effect on your credit score than a foreclosure, but the extent of the impact depends on your credit history and other factors. Some lenders may report a short sale as “settled” or “paid as agreed,” which can soften the effect on your score compared to foreclosure.

In short, while both options affect credit, a short sale is generally less damaging than foreclosure, making it a preferable choice when feasible.

How being behind on payments affects your home sale proceeds

When you sell your home while you’re behind on your mortgage, all those missed payments, late fees, and penalties come out of your sale proceeds. That means you won’t pocket the full sale price — the lender will take what you owe before you see any money.

A seller net sheet, or closing cost summary, can help you see exactly what will be deducted at closing. For example, if you sell your home for $250,000 and owe $200,000, you’d also need to subtract any past-due payments and fees — let’s say $8,000 — before you get your final check. That would leave you with $42,000, minus other closing costs like taxes and title fees. Going over this summary carefully can help you plan ahead and avoid surprises on closing day.

Ways to avoid selling your house when behind on payments

If selling your home doesn’t feel like the right choice, there are options that may allow you to stay in your home while addressing your missed payments. Here are several ways to possibly manage mortgage debt without selling.

Request a mortgage forbearance

Mortgage forbearance lets you temporarily pause or reduce your mortgage payments if you’re experiencing financial hardship. Lenders may allow this option to help you recover financially, but you’ll need to catch up on the missed payments after the forbearance period ends.

Negotiate a loan modification

A loan modification involves changing the terms of your mortgage to make payments more affordable. This might mean extending the loan term, lowering the interest rate, or even reducing the principal amount owed. Your lender will need to agree to this adjustment, but it can be an effective way to regain control over your payments.

Refinance your mortgage

If you qualify, refinancing your mortgage can lower your monthly payments by securing a better interest rate or extending the loan term. Although this option isn’t available if you’re too far behind, it can provide relief for those with improving financial stability.

Rent out your home

Renting out your home can generate income to cover your mortgage payments, allowing you to keep the property and avoid selling. This may work well if you can find a reliable tenant and manage the responsibilities of being a landlord, even on a temporary basis.

File for bankruptcy

Bankruptcy is typically a last resort option, but it may be appropriate for homeowners with significant debt who wish to stay in their homes. Chapter 13 (sometimes called wage-earners bankruptcy), in particular, can help restructure your debts, allowing you to make manageable payments and keep your house.

Chapter 7 bankruptcy is the filing for people who don’t have the income to pay their debts. Consult with a bankruptcy attorney to understand the implications and whether this is a viable path for you.

Learn more about avoiding foreclosure

The U.S. Department of Housing and Urban Development (HUD) maintains an online resource page where you can find tips on avoiding foreclosure or determining if you are at risk of foreclosure.

You can also call the Federal Housing Administration (FHA) for additional information through the National Servicing Center at 877-622-8525 or through the FHA Outreach Center at 800-CALL FHA (800-225-5342) or email answers@hud.gov.

Should I sell my house if I’m behind on payments?

Deciding whether to sell your home when you’re behind on payments largely depends on your financial goals and circumstances, especially whether you are above water or underwater in your mortgage. Selling may allow you to pay off your debt and move forward, but there are also options that might allow you to stay in your home.

If you decide to sell, partner with a real estate agent who has a proven track record in helping homeowners in your situation. HomeLight can connect you with trusted top agents in your market. We analyze over 27 million transactions and thousands of reviews to determine which agent is best for you based on your needs.

Editor’s note: This post is for educational purposes only. Reach out to your own advisor for professional assistance with your specific situation.

Header Image Source: (Curtis Adams/ Pexels)