Do I Accept the First Offer on My House, or Wait and See?

- Published on

- 6 min read

-

Lori Lovely, Contributing AuthorCloseLori Lovely Contributing Author

Lori Lovely edited the Real Estate Home section for the Indianapolis Star and covered the annual Dream Home construction and decor for Indianapolis Monthly magazine. She has written guides for selling houses and more.

-

Richard Haddad, Executive EditorCloseRichard Haddad Executive Editor

Richard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

After listing your home for sale, you eagerly, nervously … anxiously await the news that someone wants to buy it. Eventually, the call comes. But your euphoria at the news that an offer has been made can quickly change to disappointment if that offer is significantly lower than your asking price.

Disappointment may give way to despair, confusion, or frustration as you try to decide how to respond: do you accept the first offer on a house, even if it’s less than you want, counter and open negotiations, or stall in the hopes of another, better offer coming along?

To help you evaluate your first offer, we’ll walk you through key consideration points, how to weigh the strength of the offer, encourage you to assess your objectives, and how to factor in market conditions. For more expertise, top real estate agent Kris Shook, who works with 77% more single-family homes than the average agent in Tacoma, Washington, shares insights.

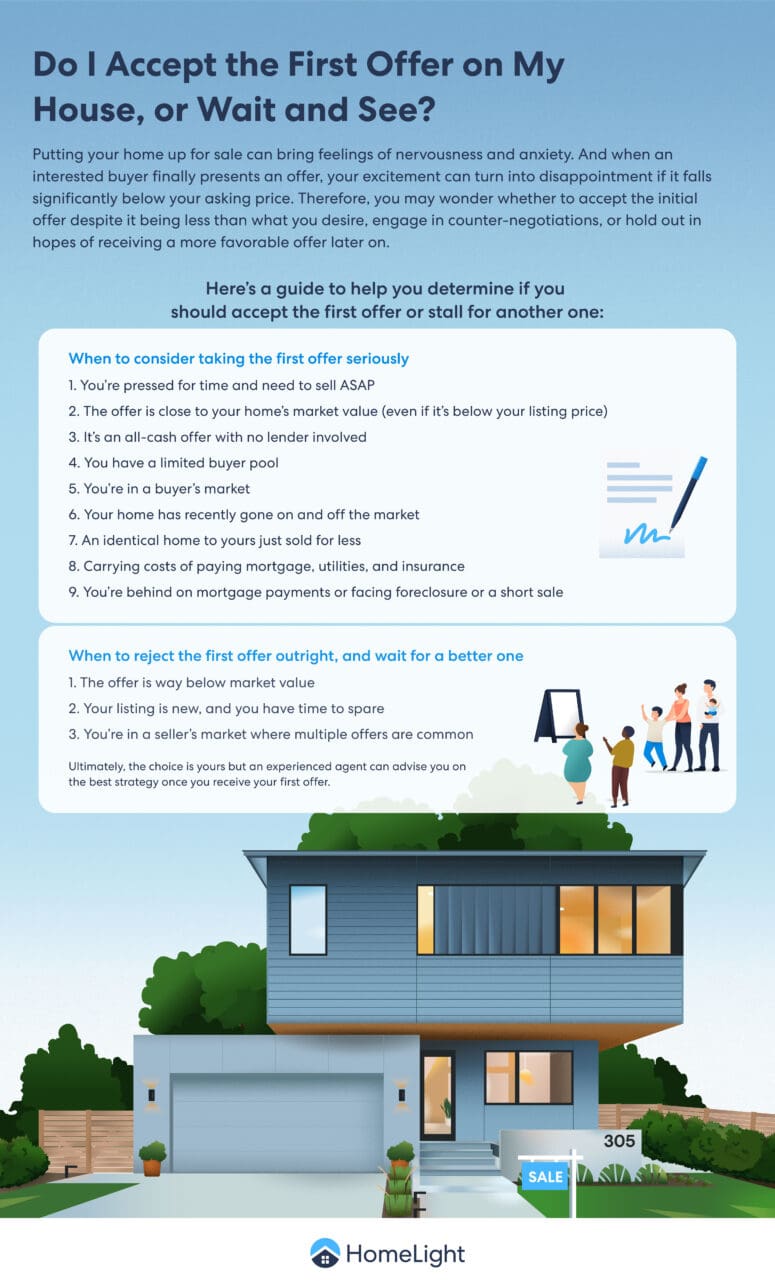

Here’s why you should take the first offer seriously

Should you take the first offer on your house? It depends. Sometimes it works out to negotiate or wait for another offer, but an old real estate adage states that the first offer is the best offer. Even if the offer is disappointing, there may be good reasons to give it serious consideration. Here are a few:

- It’s an all-cash offer with no lender involved

- You found your new home and want to buy and sell at the same time

- You need a victory right now (relocating for work or going through a divorce)

- Your house has been on the market for three months or more

- You’re headed into the doldrums of the selling season

- It’s an inherited house, and you want to sell it

- Price is not a priority

- The buyer really stands out

Even if this first offer is on the lower side, you can respond with a counteroffer to boost that number into your goal range. As a seller, you want to negotiate with a first offer type of buyer — you can use their attachment and fear of losing out to a hypothetical higher offer to leverage a better deal.

When you turn down the first offer outright, you’re taking a gamble. The longer your home sits on the market, the less likely you’ll receive a higher offer. Shook shares his perspective:

“At the end of the day, I tell my clients that if you don’t like the offer, you don’t have to choose it — it’s your choice. But the longer we stay on the market, the less likely we’re going to receive the offer that you guys want, because the longer we’re on the market, the longer that people are going to look at it as if it’s not priced right. Eventually, somebody’s going to come in and write another offer under list price.”

How to weigh the strength of the offer

Before you say yes to your first offer, take some time to consider its value. Some aspects to consider include:

Price: Obviously, the closer the offer is to your listing price, the better. All things being equal, if the first offer is within 10% of your listing price, it’s worth serious consideration.

Cash vs. financing: Cash offers usually result in a faster sale than mortgage-backed offers; if speed is an important aspect of the sale, this could make a significant difference.

Even if a buyer has been pre-approved by a lender, the loan could still be denied or delayed due to a change in job status, a low home appraisal, or a dozen different reasons. According to a recent HomeLight survey of top real estate agents throughout the country, financing difficulties are one of the top reasons home sales fall through.

Depending on your selling circumstances, a cash offer from HomeLight’s Simple Sale platform may be the solution you need for a quick, confident sale. We’ll provide a no-obligation, all-cash offer within 24 hours. If you accept it, your sale can close in as few as 10 days, often concluding with a moving date of your choosing.

Contingencies: Various types of purchase contingencies can delay a sale. If specific criteria aren’t met, the deal can fall through; i.e., the sale is contingent upon various factors outlined in the offer. Therefore, the fewer contingencies tied to an offer, the more likely the deal will reach closing.

Common contingencies include an inspection contingency and an appraisal contingency. A home sale contingency in which the buyer’s purchase is contingent on selling their home first is also common, but can be more problematic by either delaying closing or canceling it indefinitely if the buyer’s home fails to sell.

Buyer flexibility: If the seller needs to postpone closing or defer moving, it’s incumbent upon the buyers to be flexible if they want their offer to be accepted. One solution might be a rent-back that would financially compensate a patient buyer if the seller needs more time to transition after the sale.

Does the offer meet your primary selling objective?

When you partner with a top real estate agent, they can help you identify your selling objectives and priorities. For instance, if you need to sell quickly because you’ve already purchased your next home or have to move due to a job transfer, then a quick cash offer with few or no contingencies is appealing, even if it’s slightly below your listing price.

Finding a top-performing agent with knowledge of your area is easy with HomeLight’s Agent Match. Just input some basic information into this free online platform to find your match.

How market conditions can influence your decision

Market conditions are another factor that could influence your decision on whether or not to accept that first offer on your home.

In a buyer’s market, housing supply exceeds buyer demand, causing homes to sit on the market longer and decrease in price over time. If a nearby home similar to yours (called a comp) sells for less than your listing price, then a first offer reflecting that price is totally valid. Shook provides this example:

“One of my clients received an offer $10,000 lower than what their home was listed for. I know why, because an identical home next to them just sold for $10,000 less. Now, if the homeowners sold their home under list price for a reason — maybe they needed to get out of there and move, or something happened — and they just took the first offer that was $10,000 less, then, unfortunately, that affects you.”

Even if you receive an offer for more than a comparable home just sold for, your neighbor’s sale price may haunt you when an appraiser values your home against recent sales in the area.

1. Are you receiving multiple offers in a hot market?

In a seller’s market, when inventory is low and buyer demand is high – especially when mortgage rates are low – it’s common to receive multiple offers. In situations like this, Shook says Tacoma sellers can accept offers as they come in or schedule an offer review date to allow time to receive multiple offers. “This puts the review window in your control, rather than the buyer’s,” he says.

2. Are homes in your market a dime a dozen?

As Shook’s example illustrated, in a buyer’s market, inventory exceeds buyer demand, resulting in homes remaining on the market longer and often decreasing in price. In HomeLight’s Q2 2025 industry trends survey, top agents agreed that the majority of the country is experiencing a buyer’s market. In our Q3 survey, we asked agents to share the best pricing strategy for today’s market. The majority, 50% of agents, recommend pricing slightly below market value to attract multiple offers.

3. Has your home been sitting longer than the average ‘days on market’?

The longer your home sits on the market, the more likely you are to receive low offers. The number of days on market (DOM) is often considered a bellwether for price. A high number of DOM will typically indicate that your home is overpriced. As Shook noted, the longer your home is on the market, the more likely it is to develop a stigma that it’s not priced properly or that there is something wrong with it.

That’s why you should consider the first offer if it’s not far off from your home’s market value. Waiting for a better offer puts you at risk of fielding lower offers.

4. Does your home appeal to a niche or limited buyer pool?

If your home’s location, condition, or features limit the buyer pool, it can also limit the number of offers you receive. There are some things you can do to appeal to a wider audience, but you can’t eliminate power lines, train tracks, road noise, or the condition of neighboring properties. For this reason, it’s wise to consider the first offer on the table.

Should I counter before I accept the first offer?

Responding to the first buyer with a counteroffer poses some risk. They could accept, but they could also walk away, never to return – or, you might get drawn into an extended back-and-forth negotiation.

Consult with your real estate agent to help you determine whether it’s a good idea to counter and fine-tune the sticking points, such as price, contingencies, closing costs, or moving date. Keep in mind your objectives: do you need to sell quickly? Your agent might also have some insight into how motivated the buyer is.

To accept, or not to accept: Let’s recap

An experienced agent can advise you on the best strategy once you receive your first offer. If you don’t already have an agent, you can find an experienced real estate agent familiar with your area with HomeLight’s free Agent Match.

Consider accepting the first offer if…

- You’re pressed for time and need to sell ASAP

- The offer is close to your home’s market value (even if it’s below your listing price)

- It’s a cash offer

- You have a limited buyer pool

- You’re in a buyer’s market

- Your home has recently gone on and off the market

- An identical home to yours just sold for less

- Carrying costs of paying the mortgage, utilities, and insurance

- You’re behind on mortgage payments and facing selling a house in foreclosure or going through a short sale

Reject the first offer outright if…

- The offer is way below market value

- Your listing is new, and you have time to spare

- You’re in a seller’s market where multiple offers are common

Take these factors into account, and know that ultimately, the choice is yours.

Presley Attardo contributed to this story.

Header Image Source: (fizkes / ShutterStock)