How Much Can You Make Flipping Houses? The Answer May Surprise You

- Published on

- 8 min read

-

Christine Bartsch, Contributing AuthorClose

Christine Bartsch, Contributing AuthorClose Christine Bartsch Contributing Author

Christine Bartsch Contributing AuthorFormer art and design instructor Christine Bartsch holds an MFA in creative writing from Spalding University. Launching her writing career in 2007, Christine has crafted interior design content for companies including USA Today and Houzz.

-

Jedda Fernandez, Associate EditorClose

Jedda Fernandez, Associate EditorClose Jedda Fernandez Associate Editor

Jedda Fernandez Associate EditorJedda Fernandez is an associate editor for HomeLight's Resource Centers with more than five years of editorial experience in the real estate industry.

Flipping can be a great way to earn quick cash,” advises Dustin Parker, a top-selling real estate agent in Millsboro, Delaware, who’s also a house flipper himself.

“However, you run the risk of purchasing a property at a high price point right before the market takes a downturn. If home values fall while you’re doing the renovations, then you’re stuck with a lot of money invested in a house that you can’t sell at a profit.”

So, how much can you make flipping houses? Here we’ll cover:

- How much you can make on a single flip

- The average earnings for a house flipper

- House flipper success rates

- All the costs you need to budget for on each flip

- How to get financing for your investment property

Then, we’ve got 5 tips from experienced investors on how to avoid losing money on your first few house flips.

How much can I make on a single flip?

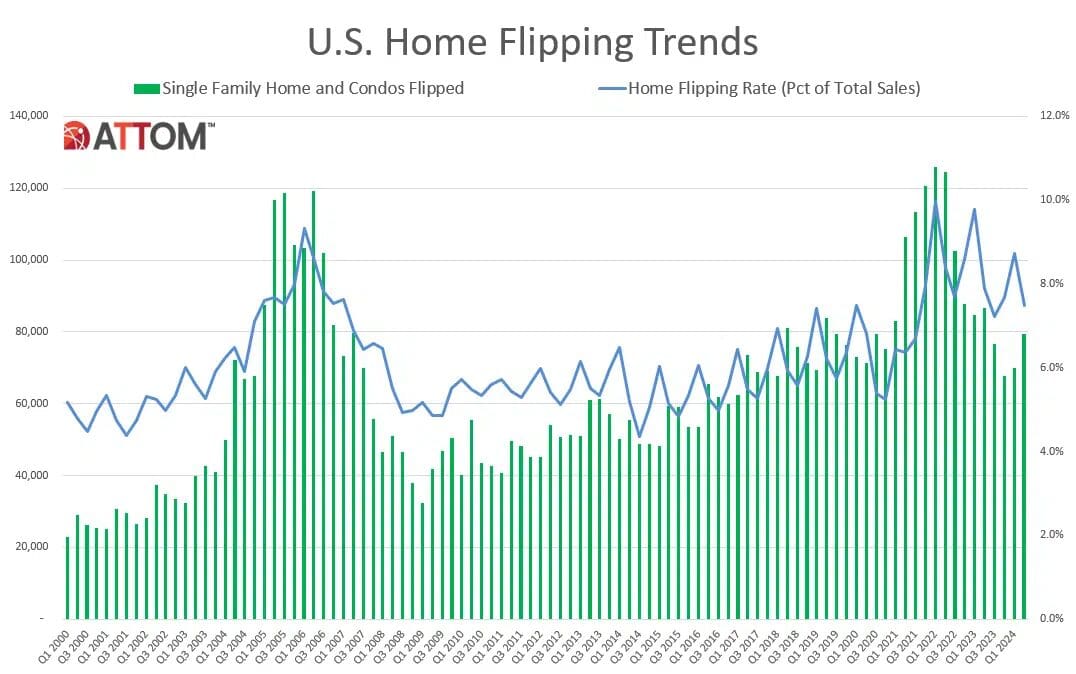

In the second quarter of 2024, flippers averaged a 30.4% ROI or a gross profit of $73,492 per flip, according to leading property data firm ATTOM Data Solutions. In this case, ROI is calculated by dividing the gross flipping profit ($73,492) by the purchase price (a median of $241,508). To be considered a flip by ATTOM’s standards, a property has to be bought and sold within a 12-month span.

It’s important to note that the gross profit figure is the difference between what a property originally cost and what it sold for. In ATTOM’s methodology you’ll see that this number does not include the cost of rehab and renovations, which flipping veterans estimate will run between 20%-33% of the home’s value after repairs.

So let’s see how much you’d make with a hypothetical flip house based on these gross average returns while also accounting for your expenses.

- You buy a house for the median price of $241,508 with the intention of flipping it.

- Based on the current averages, your gross profit would amount to $73,492 (or 30.4% ROI) for a resale price of $315,000.

- Your average cost of renovations as 20%-33% of the after repair value (in this case $315,000) amount to: $63,000-$103,950.

At best your calculations work out like so:

Sale price: $315,000

–

Purchase price: $241,508

–

Rehab costs and other expenses incurred (low end): $63,000

=

You take home: $10,492 flip (4.34% profit)

At worst, you lose money:

Sale price: $315,000

–

Purchase price: $241,508

–

Rehab costs and other expenses incurred (high end): $103,950

=

You lose: $30,458 on this flip (-9.67% profit)

- Source: ATTOM Data Solutions

“It’s always our goal to make about 20% profit margins for the investors that we work with on flips, which is pretty standard for our area,” says Parker. “While we target 20%, sometimes you fall a little short. I would say the average margin for a flip is 15%. However, it’s possible you’ll hit a home run and get 50% or 60% on one flip alone.”

But there’s no guarantee that you’ll make that much — especially if you have inexperience working against you.

What is the average annual income for a flipper?

How much you can earn overall as a flipper depends on a lot of factors, including whether you’re able to identify and purchase discounted properties, hit your targeted budget for rehab and repairs, and how many houses you flip each year. According to one experienced home flipper and blogger, full-time house flippers may flip anywhere from 1-20 houses per year, but looking past those extremes, 2-7 houses per year is a more realistic range to work with.

Let’s say you flip two houses a year at the median price point and make $10,492 per flip at a 4.34% ROI, after renovations and costs incurred per the example above. That’s only $20,984 per year at the very low end of the rehabbing cost spectrum. However, if you’re able to do all 7 flips that year, you’d rake in $73,444. If you’re dreaming of making $1 million a year flipping houses, you have a long way to go and you’ll need a huge capital to begin with.

Experienced flippers are able to maximize their profit margins for a number of reasons. For starters, they can afford to buy materials in bulk for multiple houses at once. Plus, as steady customers, they’re able to negotiate better deals with vendors and contractors. Not to mention the fact that they develop relationships with investor-friendly agents and other investors who tip them to great buys before they hit the market.

Maybe you’re thinking you’ll just flip a few more houses every year to increase your profits. Keep in mind, though, that it takes an average of 177 days to flip a house — that’s almost 6 months during which your capital is tied up, with no guarantee on what kind of return you’ll see.

Regional variations in house flipping profits

How much you’ll average as a house flipper also depends on where you’re buying and selling your flips. Some markets are more profitable than others.

Looking at individual cities from ATTOM’s report, a handful saw unbelievable gross flipping margins in Q2 2024: Akron, OH (78.1%); Cape Coral-Fort Myers, FL (56.4%); Springfield, IL (75%); and Gainesville, FL (65.3%). Meanwhile, in metropolitan areas with a population of over 1 million and enough data to analyze, the cities with the highest percentage of homes flipped in Q2 2024 that had been purchased with cash were Buffalo, NY (80.5%); Pittsburgh, PA (76.9%); Cleveland, OH (75.6%); Birmingham, AL (74.3%) and Rochester, NY (74.1%).

The popularity of flipping in your area makes a difference, too. As investors flock to the next opportunity, competition gets stiff for profitable properties. So, while it is possible to make some serious cash as a house flipper, many who attempt it won’t, because flipping is such a high cost, high risk investment due to the many variables involved.

What’s the home flipper success rate?

As flipping is a high-risk investment, it’s not at all surprising that for every flipper who made an impressive profit, there were plenty who didn’t.

There’s not a lot of hard data on how many flippers only manage to break even or actually lose money on a flip — probably because people aren’t too keen on publicly proclaiming their failures.

“The success rate for flippers is probably pretty low because it’s become a really competitive market thanks to people watching house flipping reality TV shows,” advises Parker. “The difference between successful and unsuccessful flippers is treating it like a full-time job and not a hobby. Those hobby flippers who get burned on their first flip probably won’t try it again, which is typically what we see.”

What costs do I need to budget for on each flip?

Flippers who want to make serious cash need to become frugal budgeters.

Your biggest expense is the purchase of the property itself — and you need an as-is property that’s in good enough shape to fix it up without spending too much money.

Once you find the right property, priority one is making sure you don’t pay too much.

Figuring that out requires estimating the after repair value (ARV). You find this by averaging the sold prices of nearby good-condition comps (with similar lot size, square footage, number of rooms, etc.) to determine how much your as-is property will sell for once it’s fixed up.

Once you have that ARV, and an estimate on how much it’ll cost to fix the house up, you’ll know how much you can pay for the property itself and still hit your ROI goals.

But you can’t just price out the cost of a bucket of paint and new flooring to determine your expenses. Flipping requires juggling and budgeting a lot of factors that you may not even think of as a first-timer:

- Purchase price of the home

- Closing costs x 2 (yes, both buyers and sellers have closing costs to cover)

- Agent commissions

- Special insurance (such as vacant home and builder’s risk)

- Estimated repairs (resurface driveway, refinish cabinets, repair HVAC, etc.)

- Cosmetic improvements (new paint, flooring, countertops, etc.)

- Labor for all repairs, improvements, and upgrades

- Taxes, permits, and other legal fees

- Housing expenses (may include the mortgage payment, utilities, HOA fees, etc.)

Add it all up, and that’s a lot of money to have tied up in a property for six months.

Even after all that, you still need a sizable chunk of capital held in reserve for any unexpected expenses, such as finding termites in the house or the ancient HVAC going kaput.

“Even experts run into unexpected, unpleasant, and expensive surprises. We once helped a client that does about 50 flips a year as a full-time job get a really good deal on a foreclosure property,” advises Parker.

“He found more issues than expected during the renovations, so his costs far exceeded his budget. The property did eventually sell, but he ended up only making a 2% return on that house when he’d expected to make 20%. It was a lesson learned to budget a good sum more than you’re expecting to need.”

Bottom line is some flips are quick and easy and all you’ll need to do is slap on some paint and install new flooring. But you also have to be prepared in the event you need to jack the entire house up and replace foundation, the roof, and everything else.

How can I get financing for flipping?

Ask this question of most pro flippers and they’ll tell you: “We don’t finance our flips.”

“Cash is king. In today’s market, there’s so much competition for flips that we’re finding as-is sellers aren’t entertaining too many financed offers — especially if it’s a foreclosure or a bank-owned property. They’re looking for cash,” advises Parker.

“Plus, you’re not going to be able to finance a flip traditionally because the property is going to have problems. Most government-backed mortgages, like FHA, VA, and USDA will not support the purchase of any property that’s not move-in ready.”

However, just because most pro flippers don’t finance, doesn’t mean it isn’t available.

“There are some ways to borrow money to flip. A conventional loan may be an option,” suggests Parker.

“There are also exotic loans like the FHA 203K, which is essentially a construction loan to finance a flip — but that’s a difficult and time-consuming process for both the lender and the contractor you select to do the renovations.”

Two “exotic” loan types available for flippers are the Fannie Mae HomeStyle Renovation Mortgage and the FHA 203(k) Mortgage.

While similar in many ways, the FHA 203(k) loan caps the home repair expenses at $75,000. If your flip needs more extensive and expensive repairs, the HomeStyle loan allows you to borrow up to 75% of the “completed” appraised value.

Both of these loan types have pros, cons, and conditions that could hamper your flipping plans, so go over the fine print with your lender before signing on the dotted line.

If traditional lenders are a no-go, you can also seek out a hard money loan.

In just about every market you’ll find investors who have money that they’re willing and interested to invest into flips — they just don’t want to do the work themselves.

The downside is that the interest rates on hard money loans are typically high — from 10% up to 18% or more. So you need to complete the flip as quickly as possible so you don’t incur those high interest rates for too long.

Plus, they’re typically for a shorter time frame, such as 12 months to five years — which makes the monthly mortgage payments higher, and can make it difficult to hold onto the property if it doesn’t sell right away at the right price.

5 pro tips to avoid losing money on your house flip

There are plenty of tips to get you started as a house flipper. Here are a few that’ll prevent you from losing your shirt.

1. Don’t overspend on renovations (and budget for the unexpected)

Marble would look marvelous in the kitchen, and you’d love to go with luxury faucets in the bathroom. But this isn’t about your personal taste.

It’s. Not. Your. Home.

If you want to make a profit as a flipper, you can’t overspend on expensive materials or unnecessary home improvements.

Buyers won’t pay more for marble when a low-end granite or solid surface countertop would look just as good.

“Don’t overdo it on the renovations or you’ll significantly cut into your margins,” advises Parker.

“Newbies who love to watch the flipper TV shows want to put in expensive granite countertops and hardwood floors. That may look beautiful, but it’s also very expensive. Buyers aren’t looking to move into the Ritz Carlton. They’re looking for something that’s nice, affordable, and move-in ready.”

2. Account for closing costs when calculating your margins

Newbie flippers often forget to budget enough for closing costs.

“Let’s say you purchase a house for $100,000, and you need to spend about $50,000 in renovations. At that point you’ve got $150,000 into the property,” says Parker.

“If your goal is to get a 20% return, or a profit of $30,000, on that $150,000 investment, you can’t just sell for $180,000 and think you’ll hit your margins. You’ve got to account for closing costs, association fees, agent commission, and so forth.”

Experts recommend setting aside 2% to 5% of the home’s value to cover closing costs. If your property’s ARV is $200,000, you need to set aside $4,000 to $10,000 for closing costs on one transaction (buying or selling).

So if you want to hit your $30,000 profit margin, you’ll need to sell that property for closer to $190,000 or $200,000 to cover those closing costs times two.

3. Surround yourself with an experienced team

No matter how much you read up on successful flipping strategies, there is no substitution for actual experience. The only way to get that when you’re a newbie is to partner with people who’ve done it before.

“It’s vital to have a good team of professionals to help you safeguard against making big financial mistakes. Assemble one that includes an agent, an attorney, several lenders, and multiple contractors,” says West.

The first teammate to enlist is a real estate agent with flipping experience. They’ll know the best neighborhoods for flipping, have a line on bargain properties, and keep a digital Rolodex of other flipping experts to connect you with investors, contractors, and even lenders.

4. Join an investment group (No, not that kind)

We’re not talking about pooling your money with others and investing as a group, which could be goldmine or an unmitigated disaster), or even plunking your money into a Real Estate Investment Trust (REIT).

We’re talking about local social clubs and groups that focus on networking, tip trading, and education.

“In Delaware we have at least three or four investment groups that have monthly meetings to share ideas, share contractors, and share strategies. They’ll also bring in speakers to share information on successful flipping,” says Parker.

You can find these networking and investor education groups through online searches, on social media platforms like Facebook, or by joining professional organizations, like the Real Estate Investment Association.

5. Find properties to flip before they’re listed

With more flippers competing in the market, bidding wars drive the prices for properties with profit potential higher and higher. As home prices rise, profit margins become razor thin.

Eventually, even the most rundown houses become so overpriced that it’s no longer affordable to fix and flip them.

The best way to combat rising prices is to find properties to buy before they hit the market.

“The hardest part of the job for a flipper is to find that good buy, because if it’s a good deal and it hits the open market, every other investor in that area will be after it and that’ll drive that price up,” advises Parker.

“Our best flips with the highest returns have typically been found off-market. You can find sellers off-market through mailings, advertising, cold calling, door knocking, and referrals.”

Asking your flip-experienced agent to keep an eye out for good deals on off-market properties is essential. You may also luck out in your investment club networking and meet a real estate wholesaler who makes money by pounding the pavement to dig up pre-market listing tips for a modest finder’s fee.

Never lose money flipping houses

There’s no way to guarantee how much money you’ll make as a house flipper, or even if you’ll turn a profit at all.

However, if it looks like you’re going to break even or lose money on a flip, there is one thing you can do to salvage your investment:

“Here’s the nice thing about flipping — if it doesn’t make sense to sell the property at the moment, then you can just rent it out for a couple of years,” advises Parker.

“That way you’ll recoup some of your expenses through the rental income, and you can always sell when the market’s improved.”

Header Image Source: (Austin Dean Photography/ Shutterstock)