How to Sell and Buy a House at the Same Time

- Published on

- 13 min read

-

Jody Ellis, Contributing AuthorCloseJody Ellis Contributing Author

Jody Ellis is a freelance writer with more than 15 years of experience in the writing industry. Her work includes copywriting and content marketing for real estate professionals, stories covering real estate trends and housing markets, and varied articles on decor and design. In addition to buying and selling several homes herself, she's also owned and managed rental properties, and previously worked in mortgage lending.

-

Sam Dadofalza, Associate EditorCloseSam Dadofalza Associate Editor

Sam Dadofalza is an associate editor at HomeLight, where she crafts insightful stories to guide homebuyers and sellers through the intricacies of real estate transactions. She has previously contributed to digital marketing firms and online business publications, honing her skills in creating engaging and informative content.

In a perfect world, the stars align so that after pricing your home to sell on the market, you’re able to sell quickly while finding your next dream home just as quickly. In the real world, however, it’s not always that easy, and you can usually expect some overlap as you navigate how to sell and buy a house at the same time.

This can be especially stressful if you’re hoping to make a down payment from the proceeds of your home sale. In recent years, several companies have worked to streamline this process by designing programs tailored to address these challenges.

One solution is HomeLight’s Buy Before You Sell program, which enables you to unlock a portion of your home equity and avoid moving twice. This program, among others, has made significant strides in solving the buy-sell conundrum.

We’ve spoken to top real estate agents and other professionals to create a guide that covers common challenges you could face and some routes that might work for you if you decide to sell and buy a house at the same time.

How to sell and buy a house at the same time

When looking at trying to sell and buy at the same time, there are a few specific challenges that can make it difficult to tackle both transactions at once:

1. Funds for the new house

Unless you happen to have a lot of cash on hand, it might be difficult to come up with the money for a down payment while your equity is still tied up in your current home. Having a lot of equity in your home doesn’t mean you have immediate access to it. You typically have to sell your house and close on it before you can use that money as a down payment on a new home.

How HomeLight Buy Before You Sell solves this: Our proprietary algorithm will calculate how much equity you can unlock from your current property to put toward the down payment on your new home.

2. Complicated logistics

Managing the logistics of either selling a house or buying a new one can be complicated enough, and when it’s all happening at the same time, it can feel completely overwhelming.

“The logistics include timing the purchase and the sale, negotiating with both sides on moving or possession dates, and organizing belongings to get ready for the move,” said Mike Qiu, owner of Good as Sold Home Buyers. “This is where a good real estate agent can help take some of the stress away from the homeowners.”

How HomeLight Buy Before You Sell solves this: Move into your new home before you’ve even listed your existing one. This means you won’t have to worry about renting temporarily or moving twice.

3. Contingencies

Some homeowners may decide to make their offer on a new home contingent on the sale of their current home. HomeLight’s Top Agent Insights Report reveals that 59% of surveyed agents noticed an increase in contingencies.

When you submit an offer with a home sale contingency, it’s very likely to lose out to a non-contingent offer.

“If this happens, you have to decide whether or not you want to remove your contingency,” says Erik Jacobs, an experienced real estate attorney. “This is risky and not always financially feasible.”

How HomeLight Buy Before You Sell solves this: You’ll be able to put your best foot forward with a strong, competitive offer with no home sale contingency.

With these challenges in mind, let’s take a look at everything you can do to make selling and buying a house at the same time a more seamless process.

If you decide to buy first

You’ve found your dream home that checks all of your boxes, but your home hasn’t sold yet — and perhaps isn’t even listed. In spite of this, you might decide that you simply can’t pass up the chance to pursue a special or unique property.

According to top Virginia Beach agent Anna Paduhovich, it used to be more common for clients to sell first, then buy, but a new normal seems to be taking hold.

“This might be due to more people working from home — some of them permanently — and finding that they need more space than before,” she says. “Or maybe after being home for so much time, homeowners are realizing they don’t like their neighborhoods or surroundings and are anxious to make a change without waiting around for a sale.”

Whatever the reason, with HomeLight’s Buy Before You Sell program, you don’t have to wait for your current property to sell before you can snap up your dream home and make the move.

HomeLight will evaluate your existing property using a proprietary algorithm to figure out how much of your home equity you can unlock to put toward the down payment of your new home, moving expenses, closing expenses, or property repairs.

Then, with Buy Before You Sell, you’ll be able to make a contingency-free offer on a home, even though you still own your current home. Once you move into your new home, your agent will list your previous, now vacant, home to attract the strongest offer.

This way, you can avoid potentially paying two mortgages or rental fees, and you won’t have to move twice. As cited in our latest Top Agent Insights report, 31% of agents used Buy Before You Sell Programs like HomeLight to help clients secure their new home before selling the current one.

Should you choose to go another route, here’s how to navigate the buying-while-selling process while keeping the stress and risk at a manageable level.

1. Figure out your finances

Before you jump into house hunting, you’ll need to determine whether or not you can afford to buy first. Remember, the equity in your current home won’t be available to you until you close on the sale, so you may need cash reserves that can cover the down payment on the new house.

Or you may be able to use a bridge loan, a form of short-term financing that helps bridge the gap between buying and selling (more on this option in a minute).

If you do decide to buy a home first and your previous house doesn’t sell right away, you might end up on the line for two mortgage payments, which can be difficult to juggle. Travis Steinemann, a property investor with BuyHousesBR, notes that buying first isn’t going to be good or viable for everyone.

“If you’re living paycheck to paycheck, this isn’t for you,” he says. “But if you earn a strong income and have low monthly debts, you can likely utilize this option.”

2. Take a look at your current home’s potential value

Early on, it’s important to get a ballpark idea of your current home’s value, so you know how much equity you can access for your home purchase. HomeLight’s Home Value Estimator can help with this by giving real-world home value estimates in just a couple of minutes.

We’ll ask you some questions about your home, and pair your answers to housing market data from multiple trusted sources. Once you get your value estimate, we’ll help you connect with a top local agent, who will help you develop a smart pricing strategy and will give an accurate value based on a comparative market analysis (CMA).

3. Talk to a trusted agent and lender on how to sell and buy a house at the same time

Paduhovich advises that it’s best to consult with a trusted real estate agent, who can then help you talk to a lender about your situation.

“The lender will look at what your current house is likely to sell for, what your payment is, and what you want to spend on the next house,” Paduhovich says. “They’ll also look at your debt-to-income ratio to determine whether you can get preapproval for the loan before selling your current home.”

4. Consider the pros and cons of a bridge loan

If you don’t have enough available assets to cover your down payment, you could talk to your lender about a bridge loan. Bridge loans are short-term loans that you secure with your current home’s equity, so you can use that equity toward the down payment on your new house.

These types of loans are kind of like an advance against your equity, a “bridge” between the time you buy a new house and sell your current house. They can be a good solution, but because they are intended to be short-term, interest rates tend to be higher.

You’ll also want to keep in mind that lenders have shorter loan terms on these kinds of loans. You’ll be required to pay the full loan amount back within six months to a year, and the terms usually involve a lump sum payment once the funds are available from the sale of your home.

For an interest-free solution, consider HomeLight Buy Before You Sell. Not only will you be able to unlock your home equity without any interest, but you’ll also have the option to put that equity toward more than just your down payment. You can leverage those funds for home repairs and closing costs.

5. Be flexible with contingencies

If carrying two mortgage payments is too much of a stretch, one possibility is to make a contingent offer, which includes a condition that you’ll only buy if your current home sells. If it doesn’t sell, the contract states that you won’t lose your earnest money. While this eliminates your financial risk, it also weakens your offer.

“If a seller has one offer that is cash with no contingencies, and another offer that is a little higher but has an inspection contingency, financing contingency, and a contingency on the sale of their current home, they will go with the cash offer every time,” notes Steinemann.

Las Vegas agent Rick Ruiz, who completes 13% more sales than the average agent in his area, says, “Even new home builders won’t allow contingent sales now unless you use an iBuyer company that they’re partnered with.”

This doesn’t mean you can’t add a contingency to your offer, but you’ll want to talk to your agent about the best way to handle it.

“Contingencies are still necessary and are used every day,” adds Ruiz. “That’s why it’s so important to work with a seasoned agent who can navigate everything that this involves. It’s not the best to be a contingent buyer, but with good negotiation skills, you can usually make it work.”

If you decide to sell first

Even though you might have some control when it comes to selling your current house, you still need to get a buyer in the first place. When you start thinking about listing your home, make sure these key bases are covered to help make your sale go quickly and smoothly:

1. Clean, declutter, and stage

This is the time to purge your house of any unwanted items and do (or hire out) a deep cleaning, including carpets and floors. Remove personal items on display, including those family photos you love. Buyers want to get the feel of living in the house themselves, not see evidence of other people living there.

You should also try to move extra furniture and boxes into storage or to the garage, which can help create a sense of space and openness. Buyers gravitate to organized and clutter-free spaces, which showcase the home’s day-to-day functionality.

2. Take care of any outstanding maintenance or repairs

Deferred maintenance or repairs should be taken care of before you list the house, if possible. This move makes the house look more attractive to buyers and, at the same time, expedite the sale process. Some sellers will even order their own inspection prior to putting their house on the market, especially if they know the house needs significant work.

3. Decide on contingencies

Will you need extra time after your home sale to complete the purchase of your new home? If so, you’ll want to decide what kind of contingency you plan to include with the listing.

As Ruiz reports, it’s not uncommon for a seller to ask for either a rent-back option, where they rent the property back from the buyers for a period of time, or to make it a condition of the sale that they have 30 or more days after closing to actually vacate the house.

4. Price to sell

Setting the right price for your house isn’t just an important part of bringing in buyers. It can also affect your new home purchase.

If you price your house too low, you could undervalue its worth, leaving you with less money for your next down payment. If you price it too high, you could lose potential buyers altogether or run the risk of the appraisal coming in low and putting the deal in jeopardy.

Caleb Liu, owner of House Simply Sold, recommends pricing the home in line with or even slightly below market value to get multiple offers, then choosing the most dependable offer with the fewest contingencies.

5. …Or sell immediately with a cash buyer

If you’re looking to sell your home quickly and simply, HomeLight’s Simple Sale platform allows you to sell your home in a matter of weeks rather than months. You can get a competitive offer while skipping the hassle of repairs, open houses, and negotiating with buyers.

Simple Sale can be a stress-free way to get your current house sold, so you can move on to buying and enjoying your new home. It eliminates the risk and uncertainty of a traditional sale falling through, and you won’t have to worry about additional fees, commissions, or upfront costs.

Plus, you can pick a move date that works for your schedule (up to 30 days after closing), which gives you some lead time to get into your next home.

6. Plan for a possible gap period

While selling before buying removes the risk of overextending yourself financially, it also means you’ll need to secure some kind of housing until you find your next home. You could try to find a buyer who will allow you to do a rent-back on the property, but if that isn’t available, you may need to move into a temporary rental property.

“If possible, try to sign a month-to-month lease on a single-family home with enough space for all your belongings,” suggests Liu. “Be upfront with the landlord or leasing agent and tell them that you intend to leave after several months. Not all listings are willing to accommodate this, so your options may be limited, and the monthly rate might be increased, but this is better than breaking a 12-month lease and having to pay penalties.”

Selling a home can be incredibly taxing with all the moving parts involved. But don’t let the pressure overwhelm you — dive into our ultimate guide, packed with expert tips and strategies to handle stress like a pro and navigate the process smoothly.

7. Partner with an experienced agent

Working with an experienced agent is one of the most important parts (if not the most important part) of selling and buying a house at the same time. HomeLight can help you connect with an agent who has experience in your local area and the expertise needed to transition from selling to buying.

Paduhovich says that a reputable agent will aggressively market the home and help sellers get the most out of the sale. “It’s especially important in a competitive market where there are multiple offers,” she explains. “A good agent can give you an advantage in getting to a successful closing.”

Making selling and buying at the same time work for you

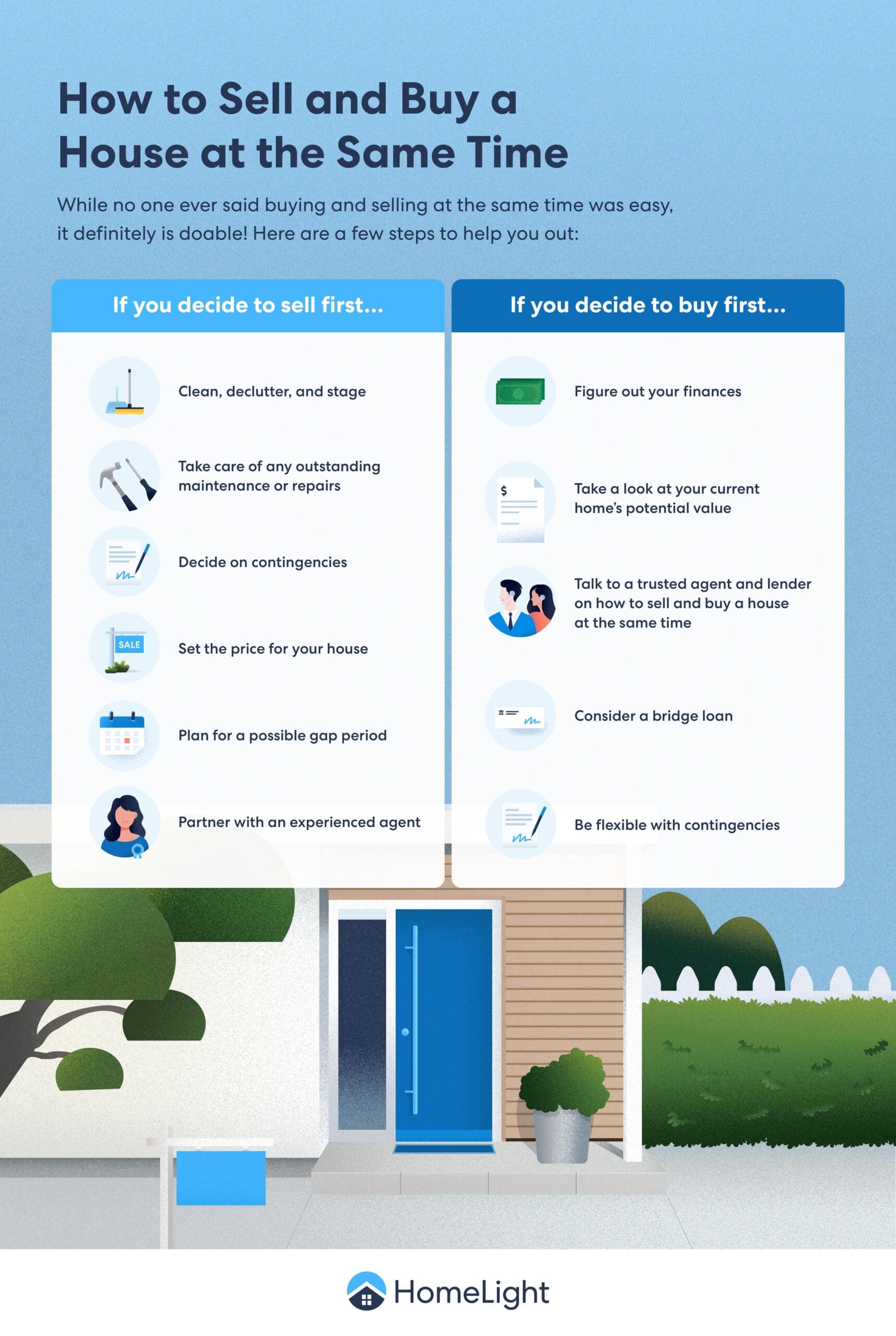

While no one ever said buying and selling at the same time was easy, it is doable. If you decide to buy first, use Buy Before You Sell to unlock your home equity to put toward a down payment, moving expenses, closing costs, or property repairs before you even list your current home on the market.

If you decide to sell first, HomeLight Simple Sale can be a great option for finding a cash offer and using that money toward the down payment for your next home.

Whichever route you choose, be sure to partner with an expert agent to guide you through the process. You’ll be in a much better position to achieve it while keeping the risk and stress to a minimum.

Header Image (Source: Luke Stackpoole / Unsplash)