5 Signs of Real Estate Market Slowing and How to React Rationally

- Published on

- 8-9 min read

-

Christine Bartsch Contributing AuthorClose

Christine Bartsch Contributing AuthorClose Christine Bartsch Contributing Author

Christine Bartsch Contributing AuthorFormer art and design instructor Christine Bartsch holds an MFA in creative writing from Spalding University. Launching her writing career in 2007, Christine has crafted interior design content for companies including USA Today and Houzz.

“When a real estate market slows, it takes longer and longer to sell a home,” explains Barbara Dopp, whose team ranks as one of the top 10 in production out of over 4,000 agents in the Boise, Idaho area. “And the longer a home is on the market, the less it’s going to sell for.”

Sounds simple in theory, but what are the signs of a real estate market slowing? It’s not like you’ll get a memo in the mail warning you about it. Even experts who watch the markets for a living have a hard time reading the real estate tea leaves.

But a little knowledge goes a long way if you want to get a handle on the future of your largest financial asset. So put your economist hat on and get ready to study these market indications of a cool down—then, adjust your home sale plans proactively.

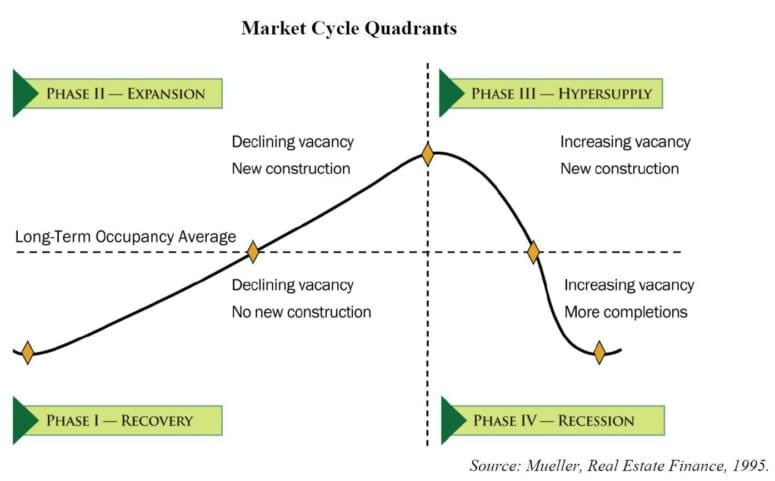

Crash, recovery, expansion: Understand real estate cycle basics

The highs and lows of the U.S. residential real estate market are traditionally cyclical. There’s a distinct 17 to 18-year pattern after a housing crash of recovery, expansion, oversupply of vacant homes, and recession.

This cycle has been relatively consistent—since as early as 1800—with only two notable exceptions: WWII and the double-digit interest rate hike of 1979.

Since the most recent housing market crash happened in 2008, if the current cycle follows this same pattern, we won’t see the real estate market peak until 2024. So a true recession and housing market slowdown shouldn’t happen until 2025 or 26.

However, just because “the big one” may still be years away, that doesn’t guarantee a steady upward trajectory in residential real estate demand, inventory, or home values.

It’s natural for any economic market, including housing, to see market corrections that shift trends from a seller’s market to a buyer’s market multiple times throughout a single year, let alone an 18-year cycle. While these may be mere blips on the overall trajectory of national real estate trends, they can still have a devastating impact on your home sale.

5 Signs of a Slowing Real Estate Market

It’s helpful to group the array data that goes into reading the housing market into five distinct buckets:

- Home inventory levels

- Days on market

- Home price movement

- Number of price reductions

- Mortgage interest rates

Let’s dig deeper into each one of these factors and how to tell if conditions at any one time are showing evidence of a slowdown.

1. Rising home inventory levels

In real estate, months of supply is how agents refer to inventory—by how many months it would take for the current number of available homes to sell.

This is determined by looking at the average number of homes listed for sale each month and how many properties actually sell each month.

For example, if your area has an average of 60 homes listed for sale each month—and an average of 10 homes sell each month—your market has a 6-month supply of inventory or 6 months of supply.

According to the experts, markets at 6 months of supply are considered balanced. Markets with less than a 6-month supply are seller’s markets, because there are more buyers and fewer homes for sale.

Markets with more than a 6-month supply are buyer’s markets because there are more homes for sale, but fewer buyers.

Unsold inventory is at a 3.7-month supply at the current sales pace, down from 3.9 last month & up from 3.2 months a yr ago #NAREHS pic.twitter.com/nJVI18KnHR

— NAR Research (@NAR_Research) January 22, 2019

So when inventory in the housing market starts climbing toward 5 or 6 months of supply, that’s a sign the housing market is slowing.

“Real estate is basically supply and demand,” explains Dopp. “If you’ve got rising inventory, meaning more homes available and fewer buyers, then it’s going to take longer to sell your home.”

2. Most listed properties have high, double-digit “days on market”

Walk into any retail store and you’ll find two very distinct sections: new arrivals and clearance. Each section attracts a specific type of buyer.

All the flashy “just in” and “new release” signs attract the big spenders willing to pay full price to have what’s exciting and new, now.

The clearance section attracts the bargain hunters, who’ll ask for deeper discounts on already marked-down products that most buyers considered too defective, outdated, or uninteresting to pay full price.

This same shoppers’ mentality holds true in the real estate world where a home’s “new arrival” or “clearance” status is determined by days on market.

Days on market means exactly that—the number of days your home has been available for sale starting with the date your home was first listed in the MLS.

It’s not uncommon for homes to hit double digits in their days on market—after all 14 days is only two weeks. It’s when those weeks turn to months that you need to start worrying.

“After listing in the MLS, your first 30 days on the market are the most important days,” advises Dopp. “If it takes a higher number of days on market until we have an offer, it probably won’t be a great offer.”

So if the market not only has an overabundance of inventory, but it’s taking longer than 30 days for most of those homes to sell, that’s a clear sign that the market is trending down.

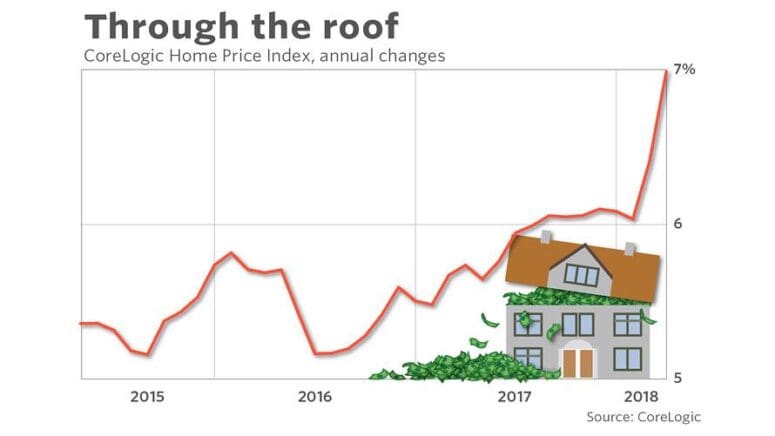

3. Home price gains are chilling year-over-year

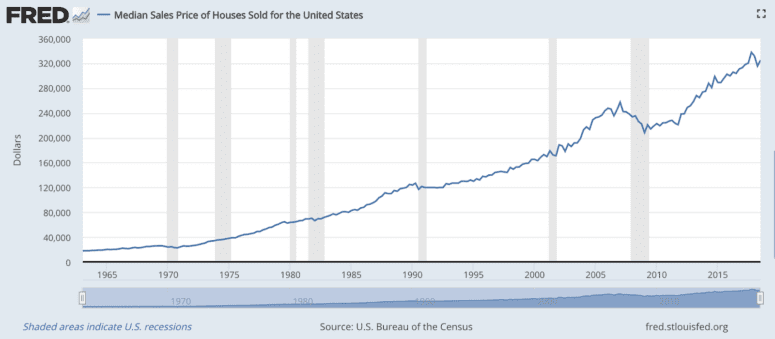

On the surface, home price gains sound great—after all, that means your home’s value is trending upward. In fact, this historically-reliable upward trajectory is why real estate is considered a safe, low-risk investment.

Historically, home prices do drop or “correct” from time to time, they rarely take any lasting toll on the expected appreciation of home values.

The problem comes in when that appreciation happens at an accelerated rate—eventually homes become too expensive for most buyers.

“In one year, our market saw over a 17% increase in market appreciation,” says Dopp. “So some buyers just went, ‘Whoa, what just happened? All of a sudden can’t afford to buy my first home.’”

If home values have been skyrocketing fast for an extended period, they’ll eventually hit a wall and start to fall. And when home price gains start to plateau that’s a sign they’ll soon start falling—which means the real estate market is about to slow down.

4. Increase in price reductions

What do shoppers do when a product they want is too expensive? Wait for it to go on sale.

And that’s exactly what home buyers are forced to do when home values appreciate at such an accelerated rate. When they can no longer afford to purchase even the most modest starter home, buyers simply stop house hunting.

It all goes back to supply and demand: when skyrocketing home values price too many buyers out of the market, demand goes down. And when too few people are interested in what you’re selling, the only way to get it sold is to reduce the price.

Unlike other investment markets, real estate is slow to react to shifting market trends—often because inexperienced sellers fail to read the signs.

Even when the signs point to a downturn in the market, some stubborn sellers insist on pricing at or above the comps—but expert agents pay attention to market trends and slowdown signs.

If a slowdown is coming, they know that a modest price reduction is a surefire way to get a home sold fast—before home prices start cliff-diving. This ensures that their clients will sell at a modest reduction rather than at a major markdown.

Now some agents use price reduction as a sales strategy: they first list all their properties at the top market value and then automatically reduce if there aren’t any offers after two weeks. When agents using this sales strategy are the only ones reducing their prices, there’s no need to worry.

But if a significant number of agents who typically price at, just above, or slightly below the comps are suddenly reducing their list prices—especially before hitting 30 days on market—they’ve read the signs and know a housing slowdown is imminent.

5. Mortgage interest rates are on the rise

Don’t make the mistake of assuming mortgage interest rates only matter to buyers making the payments—increasing rates can actually change the entire housing market landscape.

“When interest rates go up, that can change the whole picture for people,” says Dopp. “It could cost buyers an extra $50, or $100, or more each month on their mortgage payments.”

Rising interest rates reduce the amount of house buyers can afford—because the more a buyer has to pay the bank in interest, the less they’ll have to pay you for your house.

For example, let’s say a potential buyer can afford $1,200 a month for a mortgage payment.

With a 30-year fixed mortgage at a 4% interest rate, that buyer can afford to take out $250,000 mortgage with a monthly payment of $1,194—$6 under budget. But bump that interest rate up to 5%, and the monthly payments jump to $1,342—$142 over budget.

Unless that buyer can come up with an extra $150 a month, they’ll have to buy a less expensive house. In order to get under that $1,200 a month budget, they can now only afford a house priced at $223,000.

So by interest rates rising by just 1%, that buyer lost $27,000 in purchasing power—and that has a domino effect.

When rising interest rates reduce the purchase power of buyers, it prices them out of the market. As priced-out buyers leave, demand drops. When demand drops, houses stay on the market for longer. As homes stay listed for longer, that drives up inventory. And when inventory rises beyond the 6-month supply, prices begin to fall.

So when mortgage interest rates begin to rise with no sign of falling, you can expect that will domino into a market slowdown.

3 pro tips for selling the house in a real estate market slowdown

People always need a place to live, so houses will continue to sell no matter what if the market is warming up or cooling off. The real questions are: “How fast will it sell?” and “How much will it sell for?”

When the real estate market starts trending downward you need to take steps to ensure that your home sells fast—because your house is worth less every single day that it lingers on the market.

“There are three things will affect a home selling: location, condition, and price,” advises Dopp. “There’s nothing you can do about your location, but a home that is in great condition for the right price will sell even if the market shifts.”

1. Double check local market conditions with your agent

Unless you’re selling a mobile home, it’s true that you can’t change your location. But you can find out how houses are selling in your area from an expert.

So, the first and most important tip is simple: Don’t assume you know more than your real estate agent just because you follow national housing trends.

“Even though you hear of national real estate market statistics, every local market has its own story,” explains Dopp. “And that’s what matters most to your personal home sale.”

National housing trends are important to the national economy and they even impact consumer confidence in your area, but they can’t tell you what’s happening in your local real estate market.

Double checking the local market trends with your agent should always be step one, because even if the rest of the nation’s real estate markets have cooled, some markets may still be red hot.

If houses are selling like hotcakes in your neighborhood, the last thing you want to do is insist on pricing your home low to help it sell—just because you heard national reports of a market slowdown.

But if the currently hot local market is showing signs of an impending slowdown, your agent will know that, too. And if you’ve hired a savvy agent, they can help you strategize on how best to sell fast before home prices drop—by improving its condition and dropping its price.

2. Get your house in tip-top condition

When you’re selling in a seller’s market, where there’s tons of buyers and little competition, you can list your home in almost any as-is condition and expect to get pretty close to top dollar for your property.

But when sellers are all vying to attract the same few buyers during a market slowdown, listing your home as-is can cost you.

“Deferred maintenance in a down market is not a good idea,” advises Dopp. “Buyers ask you to discount your price when things aren’t done. So if it’s going to take $100 and a lot of elbow grease to remove your old wallpaper, it’s worth it. Otherwise a buyer may reduce their offer by $5,000.”

Not only will you have to settle for less money, you may not be able to sell your fixer-upper home at all.

However, this doesn’t mean you need to invest big bucks in major renovations to get your home back to brand new condition. You simply need to spend a little money and a lot of elbow grease on cleaning, decluttering and making all minor repairs.

3. Price it right

Any agent worth their salt will tell you that the most important part of selling a home fast and for the most money possible is to make sure you price it appropriately for the market.

When the market’s on an upswing, you can get away with listing at or just above the most recent comps (though some agents advise listing just below comps in a red hot market to increase your chances for a bidding war).

But during a market slowdown, savvy agents will recommend that you list your home for lower than your competition—to put your property at the top of a buyer’s list.

However, even with that expert advice, some sellers still insist on listing at the highest possible price “just to see” if they can get an offer that high.

That’s a bad strategy in a red hot market, but in a down market it’ll sabotage your shot at eventually selling at an even halfway decent price.

“In a market with declining prices, you can’t just try a higher price and see how it goes. Then you’re chasing the market, and you’re going to sell for less than if you would’ve priced it right in the beginning,” advises Dopp. “Even in a down market, homes have multiple offers on them if they’re priced right. So trust your agent.”

Interpreting the real estate tea leaves for signs of a slowdown

If you’re planning to sell your house in the next year or two—but you’re undecided as to the best time to list your home—looking at real estate market trends can help you decide.

But if the signs say a market slowdown is on the horizon, don’t interpret them to say: wait until the market recovers before listing.

While the downturn may just be short-term correction in the grand scheme of the national market trends, that “blip” could actually last for months or year—long after you want to have your home sold.

Instead, those signs are telling you to pull the trigger and list your home with a top-notch agent who can help you sell fast. After all, if you read the signs and play your cards right, you can get your home sold at a great price—before the market goes into full decline-mode.

Article Image Source: (Rawpixel/ Pexels)