What Is the 70% Rule in House Flipping?

- Published on

- 7 min read

-

Richard Haddad Executive EditorClose

Richard Haddad Executive EditorClose Richard Haddad Executive Editor

Richard Haddad Executive EditorRichard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

You need a fast home sale. Perhaps you’ve inherited an out-of-state property, or you’re facing a life change that demands quick relocation. You may be wondering how much a house flipper or “We Buy Houses” company will pay. One method investors use is the 70% rule — but what is the 70% rule in house flipping? Does it always apply?

In this brief post, we explain this investor offer-price guideline and provide helpful insights before you commit to a flipper or house-buying company.

What is the 70% rule in house flipping?

The 70% rule is a formula that many house flippers use to determine the maximum price they should pay for a property. The calculation is:

(After-repair value × 70%) – Estimated repair costs = Maximum offer price

- After-repair value (ARV): The price the home could sell for after renovations.

- 70% factor: This accounts for the investor’s profit margin and other expenses.

- Estimated repair costs: The cost to fix up the property before reselling it.

70% rule example:

Let’s say a house flipper estimates that your home will be worth $300,000 after repairs. They also calculate that it will take $50,000 to renovate the home.

($300,000 × 70%) – $50,000 = $160,000

In this scenario, the flipper or We Buy Houses company would likely offer no more than $160,000 to ensure they make a profit while covering their costs.

Seeing the dramatic difference between an after-repair value of $300,000 and a cash offer price of only $160,000 may be hard to swallow. You might think, “If I could come up with the $50,000 and time to repair the home, I could sell it for $140,000 more.” But there’s the rub when you need to sell quickly.

After investing $50,000 and putting your plans on hold, you may only receive $90,000 more, and then you must weigh that amount against all other expenses related to your situation:

- Time and money to travel to and from the location of an inherited house

- The cost of not being where you need to be (e.g., job, family, care facility)

- Maintaining mortgage payments and other home-related expenses

- The risk of foreclosure and possibly losing the home

For some, the convenience of a fast, all-cash sale outweighs the difference in final proceeds.

»Learn more: Read This Before You Sell Your House for Cash

Do all house-buying companies use the 70% rule?

When asking the question, What is the 70% Rule in house flipping? it’s important to note that not every house-buying company strictly follows this as a “rule.” While it’s a common guideline, there are some key factors that can influence a cash buyer’s offer:

- Market conditions: In a competitive market, investors may be willing to pay more than 70% of a home’s after-repair value (ARV) to secure a deal.

- Investor strategy: Some investors focus on long-term rentals or selling to institutional buyers, which may lead them to adjust their pricing models.

- Holding costs: Expenses such as property taxes, utilities, and insurance can impact how much a buyer is willing to pay.

- Buyer competition: If multiple investors are interested in a property in a coveted location, you might receive offers that exceed the 70% guideline.

- The house-buying company: Because offers can vary between investors, it’s wise to get quotes from multiple house-buying companies before making a decision.

»Learn more: How Much Do House-Buying Companies Pay

iBuyer vs. We Buy Houses: House flippers and We Buy Houses companies specialize in buying homes in need of repair. Larger iBuyer groups like Opendoor and Offerpad purchase homes in good condition, often paying 85% to 95% of market value before deducting service fees.

When is selling to a house flipper a good option?

Selling your home to a house flipper can be a good option in challenging situations, particularly when speed and convenience outweigh a higher selling price. Requesting a cash offer might be the right move if:

- Your home needs major repairs. If your house requires extensive, costly work and you don’t have the time, money (or mental capacity) to get everything fixed.

- You need to sell quickly. If you’re facing foreclosure, relocating for a job, or dealing with an inherited property, a cash sale can provide a fast exit.

- You want to avoid the listing process. Selling on the open market can involve showings, staging, and waiting for the right buyer. A direct sale to a flipper eliminates these steps. It can also provide privacy.

- You’re okay with a lower sale price in exchange for convenience. Cash buyers typically offer below market value, but in return, you get a fast, hassle-free transaction that lets you move on to the next chapter in your life.

»Learn more: We Buy Houses Pros and Cons

How does selling to a house flipper work?

Selling to a house flipper or a cash-buying company is typically a straightforward process. Here’s what to expect:

1. Request an offer. Contact a house-buying company and provide basic details about your home. Some companies might assess your property remotely, but most will schedule an in-person visit.

2. Receive a cash offer. The investor will evaluate your home’s condition and market value, and estimate their repair costs. Some companies provide a preliminary instant offer, followed by a final offer after the on-site assessment.

3. Review the terms. Unlike traditional sales, cash offers usually come with no contingencies (such as financing or home inspections). However, it’s still important to read the contract carefully. Watch for any hidden or unexpected fees.

4. Close on your timeline. If you accept the offer, you can often close within a week or two — sometimes even faster. The buyer typically covers closing costs.

»Learn more: Process of Selling a House for Cash in 9 Steps

How can you find a trusted cash homebuyer?

One of the best — and easiest — ways to find a reputable cash homebuyer is through HomeLight’s Simple Sale platform, a modern service that connects you with the largest network of trusted cash buyers in the country.

Unlike other house-buying platforms, Simple Sale shows you all your options in one place. You’ll receive a no-obligation cash offer in 24 hours and can close in as few as 10 days. In addition, Simple Sale compares your cash offer with an expert estimate of what you might receive if you sell your home with a top-rated real estate agent.

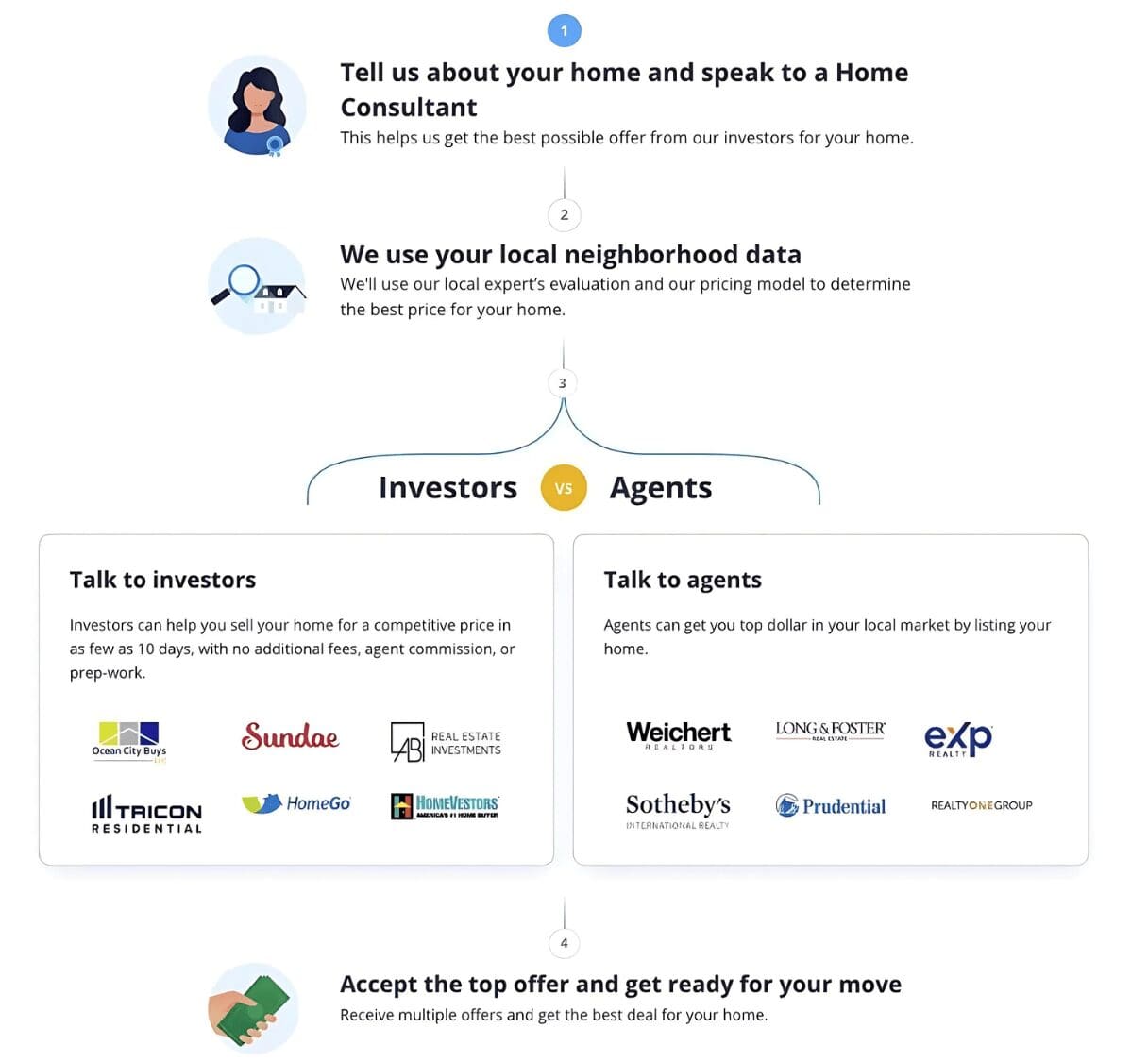

Here is the 4-step Simple Sale process:

HomeLight’s Simple Sale can provide cash offers for homes in almost any condition nationwide. To get started, fill out this short questionnaire about your home and selling timeline.

»Learn more: 9 Top Companies that Buy Houses for Cash

Will you make more money using an agent?

In most cases, selling your home with a real estate agent will result in a higher sale price than selling to a house flipper or cash buyer. An experienced agent will know how to effectively price and market your home, increasing your chances of attracting multiple buyers who may bid against each other. They can also provide expert guidance on how to prepare your home for sale for the highest proceeds.

Even after paying an agent’s commission (3%–6%), you’ll likely walk away with more money than you would in a direct sale to an investor. If you’re interested in selling with a performance-proven agent in your area, HomeLight’s free Agent Match tool can connect you with experienced agents who specialize in selling homes like yours.

»Learn more: Should I Sell to a Home Investor or List With an Agent?

Compare your options to sell a house fast

If you’re planning a home sale, it’s important to weigh your options against your current life needs. Here’s a quick comparison of selling to a house flipper versus listing with an agent:

| Selling to a house flipper | Selling with a real estate agent |

| Fast closing (often in a week or two) | Takes longer (often 30–60+ days) |

| No repairs needed | May require repairs or staging |

| Cash offer, no financing issues | Buyer financing can delay closing |

| Lower price (investors need a profit margin) | Higher sale price (competitive market pricing) |

| Minimal effort for the seller (fast and simple) | More steps involved (showings, negotiations) |

If you need to sell quickly and don’t want to deal with repairs, a cash offer from a house-buying company may be a good fit. However, if your goal is to get the highest possible price for your home, selling with a real estate agent is likely the better financial choice.

Want to compare offers and explore your options?

- Check your cash offer with HomeLight’s Simple Sale

- Find a top real estate agent with HomeLight’s Agent Match

Header Image Source: (Sheila Marie/ Unsplash)