What is a Fixer-Upper Home, and Is It Right For You?

- Published on

- 9 min read

-

Richard Haddad Executive EditorCloseRichard Haddad Executive Editor

Richard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

If you’ve spent any time scrolling home listings, you’ve likely seen the term fixer-upper. These homes tend to be priced lower than move-in-ready properties because they need repairs, updates, or a full renovation. For some buyers, that lower price tag opens the door to homeownership. For others, it’s a red flag signaling time, money, and risk.

So, what is a fixer-upper exactly, and how do you know if one is worth your time, money, or effort?

In this post, we’ll shine some light on fixer-uppers and share buying tips from top real estate agents throughout the country.

What is a fixer-upper?

While it’s not necessarily a technical or formal real estate term, the phrase fixer-upper has come to represent a house that requires repairs, cosmetic updates, or major renovations before it can reach its full potential. These homes often:

- Show signs of age or neglect, like outdated kitchens and bathrooms

- Have deferred maintenance issues, such as roof or HVAC problems

- May not meet modern buyer expectations in terms of style or finishes

Because of these drawbacks, fixer-uppers usually list at lower prices than comparable move-in-ready homes. That lower entry point can make them appealing, but it also means extra planning, budgeting, and decision-making.

“Don’t get caught chasing perfection — focus on the location and big-picture features you can’t change, and remember that cosmetic upgrades can always be done later,” advises Braden Johnson, a top agent serving the Mesa, Arizona area. “Most importantly, work with an agent who knows how to navigate negotiations and uncover opportunities in a competitive market.”

Typical buyers bypass fixer-uppers: According to a recent HomeLight survey, 76% of top agents throughout the country say the biggest selling point for buyers in today’s market is a home in move-in ready condition.

Why do buyers choose fixer-uppers?

While they may not be the most popular — even with their flaws — fixer-uppers attract plenty of interest. Here’s why some buyers actively seek them out:

- Lower purchase price: Fixer-uppers are typically discounted compared to updated homes in the same neighborhood, making them an entry point for first-time buyers or budget-conscious shoppers.

- Equity growth potential: Renovating a fixer-upper can increase the home’s value significantly, offering the chance for strong returns if you sell down the road.

- Personalization opportunities: Instead of settling for someone else’s style, buyers can design spaces that fit their taste — from the paint color to the floor plan.

- Investment strategy: For investors, fixer-uppers represent opportunities to flip or rent for profit. Most We Buy Houses companies look for fixer-uppers.

“Don’t look for your perfect home, get in the game with a home you can afford,” says Adam Pearce, a top-rated agent in Boise, Idaho. “The home should appreciate in 3-5 years, so you can step up with the additional equity to be used as a down payment for the home you would like to be in for the foreseeable future.”

What are the risks of buying a fixer-upper?

Buying a fixer-upper can be rewarding, but it’s not for everyone. Here are some of the challenges that come with these properties:

- Renovation surprises: Even with an inspection, you may uncover hidden issues like faulty wiring, water damage, or structural problems that add thousands to your budget.

- Financing hurdles: Some fixer-uppers may not qualify for traditional loans if the property’s condition is too poor. Buyers may need renovation loans, which can be more complicated.

- Time commitment: Renovations can take months or even years in some cases, delaying when you can fully enjoy the home.

- Living conditions: If you move in before renovations are complete, you may face disruptions, dust, and limited usable space.

Buying your first house can be scary, but the rewards often outweigh the risks.

“The only way to start creating equity is to start investing in yourself, by buying your own home,” says Adam Reynolds, a top agent serving the Beachwood, New Jersey area. “A home is a tangible asset that shelters you, both physically and financially, from the storms of life.”

Chuck Marquardt, a top-rated Los Angeles agent, says you can reduce risks by putting an expert in your corner. “Hire an experienced agent who understands the micromarkets that you are looking in, one who can help you set realistic expectations for what it will actually cost to buy a home that’s going to serve you well over time.”

Should you sell a fixer-upper as-is or renovate first?

If you’re the one selling a fixer-upper, you have two main options: put it on the market in its current condition, or make updates before listing.

- Selling as-is: The as-is option saves time and avoids renovation costs, but buyers will expect a discount. The pool of interested buyers might also be smaller since many shoppers prefer move-in-ready homes. If you sell the home as-is to an investor or cash house-buying company, expect an offer under market value.

- Making repairs or updates: Even a modest investment in painting, landscaping, or fixing obvious issues can boost your sale price and attract more buyers. Larger projects — like kitchen or bathroom remodels — can deliver value too, but you’ll need to weigh the upfront expense against potential returns.

If you’re not sure which strategy is best for you, request an offer through HomeLight’s Simple Sale platform and see both options. Answer a few questions about your home and you’ll receive a no-obligation cash offer in 24 hours. If you accept, you can close in as little as 7 days. You’ll also see an estimate of how much your home might sell for using a top local agent.

How to evaluate a fixer-upper’s potential

Whether you’re buying or selling, the value of a fixer-upper often comes down to the numbers. A few key steps can help you assess whether a property is worth the effort:

- Schedule a thorough inspection: Look beyond cosmetic flaws and identify structural, electrical, or plumbing issues that could be costly to fix.

- Get repair estimates: Meet with contractors to understand how much renovations might cost and how long they’ll take.

- Consider location: A fixer-upper in a desirable neighborhood with strong resale demand often makes more sense than one in a declining area.

- Do the math: Compare your total purchase price and renovation costs against what the home could realistically sell for once updated.

While potential can be a powerful draw in a home purchase, buyers must still be prudent.

“Be sure to do thorough inspections to learn all you can about the house and all the systems, utilities, appliances, etc.,” advises Chris Crystal, a seasoned agent in Miami-Dade County with 37 years of experience.

Want to crunch the numbers on your own property? Use HomeLight’s free Home Value Estimator to see a ballpark estimate of what your home might be worth right now.

Who should consider a fixer-upper?

As you can tell by now, a fixer-upper home isn’t the right fit for everyone, but they can be a smart choice in certain situations.

- First-time buyers who are willing to put in sweat equity and stretch their dollars further.

- Investors seeking properties they can flip for profit or convert into rentals.

- Homeowners who want to customize a house to their style instead of paying a premium for updates someone else chose.

If you fall into one of these categories, having the right partner is key. Connect with a top local agent through HomeLight’s free Agent Match tool. We analyze thousands of local transactions to match you with agents who know how to price, market, and negotiate fixer-uppers in your area.

If repairs or high interest rates give you pause, experienced agents often remind buyers that a home is a long-term purchase that comes with options for the future.

“Find the right home that works with a location and budget that fits,” recommends Daniel Heim, a top agent in Hoboken, New Jersey. “You can make enhancements and improvements to the home over time, and you can always refinance the home when rates improve to your benefit.”

Deena Carvajal, an Orlando, Florida agent, agrees. “Get in where you fit in. You are paying 100% interest in rent right now, so you are not gaining anything by waiting.”

Key takeaways: Is a fixer-upper right for you?

Fixer-uppers can open doors to opportunity, but they aren’t without challenges. If you’re a buyer, the draw is often the lower purchase price and potential for equity. If you’re a seller, the question is whether to invest in updates or sell as-is.

Either way, success with a fixer-upper depends on running the numbers, understanding your timeline, and having the right support.

“Don’t get lost chasing perfect — focus on what truly fits your needs,” says Andre Amini, a top agent in McLean, Virginia. “Every market has opportunity, and with preparation and patience, the right home will find you.”

Whether you’re buying or selling — or just want an expert opinion, HomeLight is here to help. Since 2012, HomeLight has helped over 2,000,000 people get a better outcome when buying or selling their home.

More tools from HomeLight to help plan your next move:

- Home Affordability Calculator

- Mortgage Payment Calculator

- Down Payment Calculator

- Earnest Money Calculator

- Closing Costs Calculator

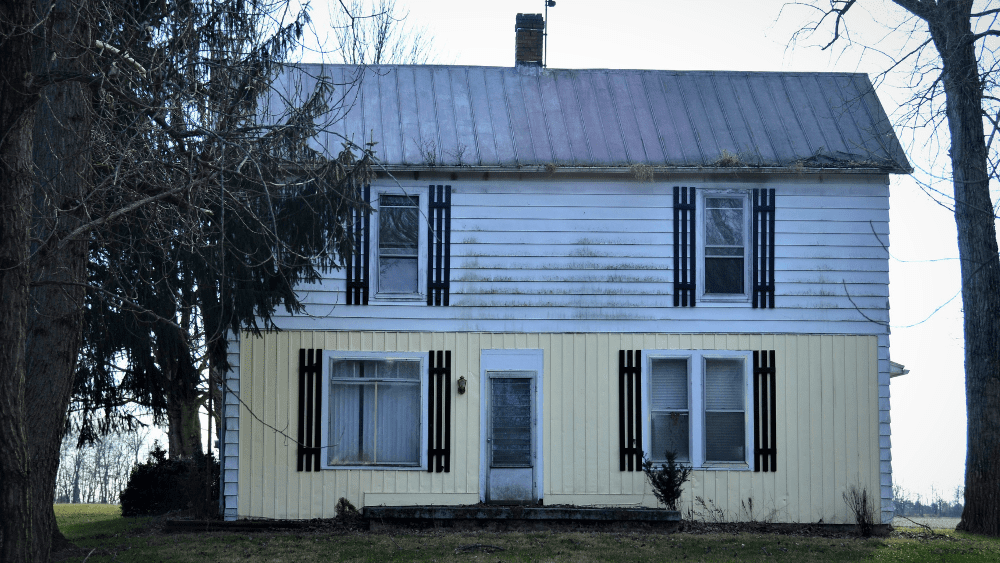

Header Image Source: (Roger Starnes Sr/Unsplash)