Can I Sell My House to Avoid Foreclosure in Tampa?

- Published on

- 9 min read

-

Richard Haddad Executive EditorCloseRichard Haddad Executive Editor

Richard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

If you’re a Tampa homeowner facing foreclosure, your situation may feel frightening and even overwhelming, especially if hard deadlines are looming. In your search for a solution, you may be asking, “Can I sell my house in foreclosure in Tampa?” The short answer is often yes.

In many cases, Tampa homeowners can still sell their property before the foreclosure process is finalized. The key is understanding how Florida’s foreclosure rules work, how much time you may have, and which selling option best fits your situation.

Below, we’ll break down what foreclosure looks like in Tampa, how long the process typically takes, and whether selling before the auction date could help you avoid long-term financial damage. We’ll also share expert insights about the positive steps you can take right now.

According to data from ATTOM, approximately 300,000 foreclosures occur in the U.S. each year, and that number is on the rise in some areas. Based on an end-of-year report, the statewide foreclosure rate in Florida is 1 in every 2,119 housing units. In the Tampa-St. Petersburg-Clearwater metropolitan area, the rate is 1 in every 1,373.

Can you sell a house in foreclosure in Tampa?

In most situations, you can sell your Tampa home while it is in foreclosure, as long as the foreclosure sale has not yet taken place.

Many homeowners are surprised to learn that they retain ownership of the property throughout most of the foreclosure process. That means you generally have the right to sell the home, pay off the loan, and stop the foreclosure before the final auction date.

“There are a lot of people who are underwater on their mortgage — maybe they don’t have a lot of equity, or they’ve lost a job,” says Maria Hoffman, a HomeLight Elite agent in Tampa with 24 years of experience. “The foreclosure process takes a while to unfold. The minute you know you can’t make your payments, that’s when you need to consult with a professional, seasoned, experienced real estate agent.”

She adds that the earlier you explore selling, the more flexibility you typically have in terms of price, buyers, and outcomes. “It’s often not too late. You can still take action even once you’ve received the foreclosure notice.”

How foreclosure works in Tampa

Florida is a judicial foreclosure state, which means lenders must go through the court system to foreclose on a home. This legal requirement to file a lawsuit in court often makes the process longer than in states that allow non-judicial foreclosures.

In Tampa, foreclosure generally follows these steps:

- The homeowner falls behind on mortgage payments.

- The lender files a foreclosure lawsuit in court.

- The homeowner is served notice and given time to respond.

- If the case proceeds, the court issues a final judgment.

- The property is scheduled for a public foreclosure auction.

In Tampa, Florida, a lender typically cannot start the formal foreclosure process until a homeowner is more than 120 days delinquent on their mortgage payments. This 120-day rule is a federal requirement designed to allow time for loss mitigation, such as loan modification or repayment plans, before the foreclosure process begins.

Because the process runs through the courts, timelines can vary depending on the lender, the court’s schedule, and whether the homeowner contests the foreclosure.

How long does foreclosure take in Tampa

Foreclosure timelines in Tampa can vary widely, but the process often takes several months to more than a year from the first missed payment to the foreclosure sale. On average, it takes 180 days for a foreclosure to be completed in Florida.

While this may sound like plenty of time, it’s important to remember that key deadlines — such as the auction date — can arrive quickly once the case moves forward.

“Don’t wait for the foreclosure auction date to be set,” Hoffman advises. “Once a sale date is set, your options narrow fast. Selling earlier almost always gives you more control.”

If you’re already behind on payments or have received legal notices, speaking with a local expert as soon as possible can help clarify how much time you realistically have and what steps could still help you avoid foreclosure, including listing your home for sale.

What happens if you sell before foreclosure is finalized?

Selling your Tampa home before the foreclosure sale can stop the process and help you move forward with fewer long-term financial consequences. In a successful sale, the proceeds first go toward paying off the remaining mortgage balance, along with any interest, fees, or legal costs tied to the foreclosure. Once the loan is satisfied, the foreclosure action is typically dismissed.

Acting early can also reduce the impact on your credit compared with a completed foreclosure, which may remain on your credit history for years. And if your home sells for more than what you owe, you may be able to keep the remaining equity to support your next move.

“When we’re able to list and sell before the auction, it can completely change a homeowner’s financial path,” Hoffman says. “Even in challenging situations, preserving credit and equity can make a huge difference in what comes next.”

If the expected sale price won’t fully cover the loan balance, a short sale may still be possible with lender approval, which is another reason to explore your options as soon as possible.

Option 1: Selling with a top Tampa real estate agent

In many cases, working with an experienced Tampa real estate agent is the best path for homeowners who still have enough time before foreclosure. This option gives you the best chance to maximize your sale price.

A knowledgeable local agent can:

- Set a competitive price based on current Tampa market conditions

- Market the property widely to attract qualified buyers

- Negotiate with buyers and, if needed, coordinate with the lender on a short sale

- Keep the transaction moving to meet foreclosure-related deadlines

Hoffman notes that urgency changes how these sales are handled. “When foreclosure is part of the picture, every step has to move with purpose — from pricing to negotiations to closing,” she says. “That’s where local experience really matters.”

Because timing is critical, connecting with a proven agent quickly can make all the difference. HomeLight’s free Agent Match platform analyzes over 27 million transactions and thousands of reviews to determine which Tampa area agent is best for your situation. To get started right away, enter a few details about your home and selling timeline.

A top Tampa agent will help you make informed decisions and avoid added delays.

How fast can you sell with an agent in Tampa?

The timeline for an agent-assisted sale in Tampa depends on pricing, property condition, location, and buyer demand. In Tampa, the average days on market (DOM) — the time from listing to signed contract — is about 62 days. However, a well-priced, skillfully-marketed home may attract strong interest within days.

In urgent situations, Hoffman says an experienced agent can streamline the process and help sellers move as quickly as the market allows.

“Homes that are priced correctly and marketed well can sell fast in Tampa,” Hoffman explains. “About a third of the homes on the market are selling in about 30 days. In most cases, if you’ve hired a good agent right away, you can beat the foreclosure deadline.”

If your timeline is especially tight, you may also want to compare this traditional path with faster alternatives, such as selling for cash to a house-buying company or investor.

Option 2: Selling for cash to avoid foreclosure in Tampa

If your foreclosure timeline is especially tight, selling your Tampa home for cash may provide a faster, more predictable path forward. Cash buyers — which can include individual investors or Tampa area house-buying companies — typically purchase homes in as-is condition and can often close in a matter of days or weeks rather than months.

The main advantage of a cash sale is speed and certainty. Because there’s no buyer financing, inspections may be limited, and the process usually involves few or no contingencies, the transaction can move quickly enough to stop a foreclosure before the auction date. The trade-off is that cash offers are often lower than what you might achieve through a traditional listing.

“For homeowners who are very close to a foreclosure deadline, certainty can matter more than squeezing out the highest possible price,” Hoffman says. “The right solution really depends on how much time you have and what outcome protects you best long term.”

She adds, “Just keep in mind, selling with an agent will typically net the most proceeds.”

How much will a Tampa house-buying company pay?

Use the Cash Offer Comparison Calculator below to get rough estimates of how a cash offer in Tampa might compare to an agent-assisted sale, depending on your selling method and whether you hire a top agent or an average agent.

As you can see, your cash offer amount will be considerably higher if your Tampa home is in good condition, but in a foreclosure situation, you may not have the time or money to make major repairs. If you’re facing an imminent financial need, the speed and convenience of a near-instant all-cash offer can’t be beat.

Examples of cash home buyers in Tampa

Homeowners researching a fast sale will often encounter local or regional “We Buy Houses”-style companies. These buyers generally focus on quick closings and minimal preparation from the seller. A few examples in the Tampa area include:

- Cash House Buyers Tampa (see customer reviews)

- Tampa Fast Home Buyer (see customer reviews)

- Emperor House Buyers LLC (see customer reviews)

- Revival Homebuyer (see customer reviews)

- Home Buyer Tampa (see customer reviews)

- A+ Home Buyers (see customer reviews)

Because each cash homebuyer company in Tampa uses its own pricing model, timelines, and contract terms, it’s wise to review multiple options and compare offers carefully before making a decision.

You’ll also want to carefully vet cash-for-home companies before making a commitment. However, there is a way to move forward quickly and know you’re working with a legitimate and established cash buyer.

Selling your house through HomeLight Simple Sale

HomeLight’s Simple Sale platform connects you with the largest network of vetted cash buyers in the country, including trusted buyers in Tampa. With Simple Sale, you can receive a no-obligation cash offer in 24 hours and close in days, not months.

Through Simple Sale, Tampa homeowners can:

- Request a no-obligation all-cash offer

- Sell the home in its current condition, without repairs or showings

- Choose a flexible closing timeline that fits their situation

- Compare the cash offer with an agent-assisted sale

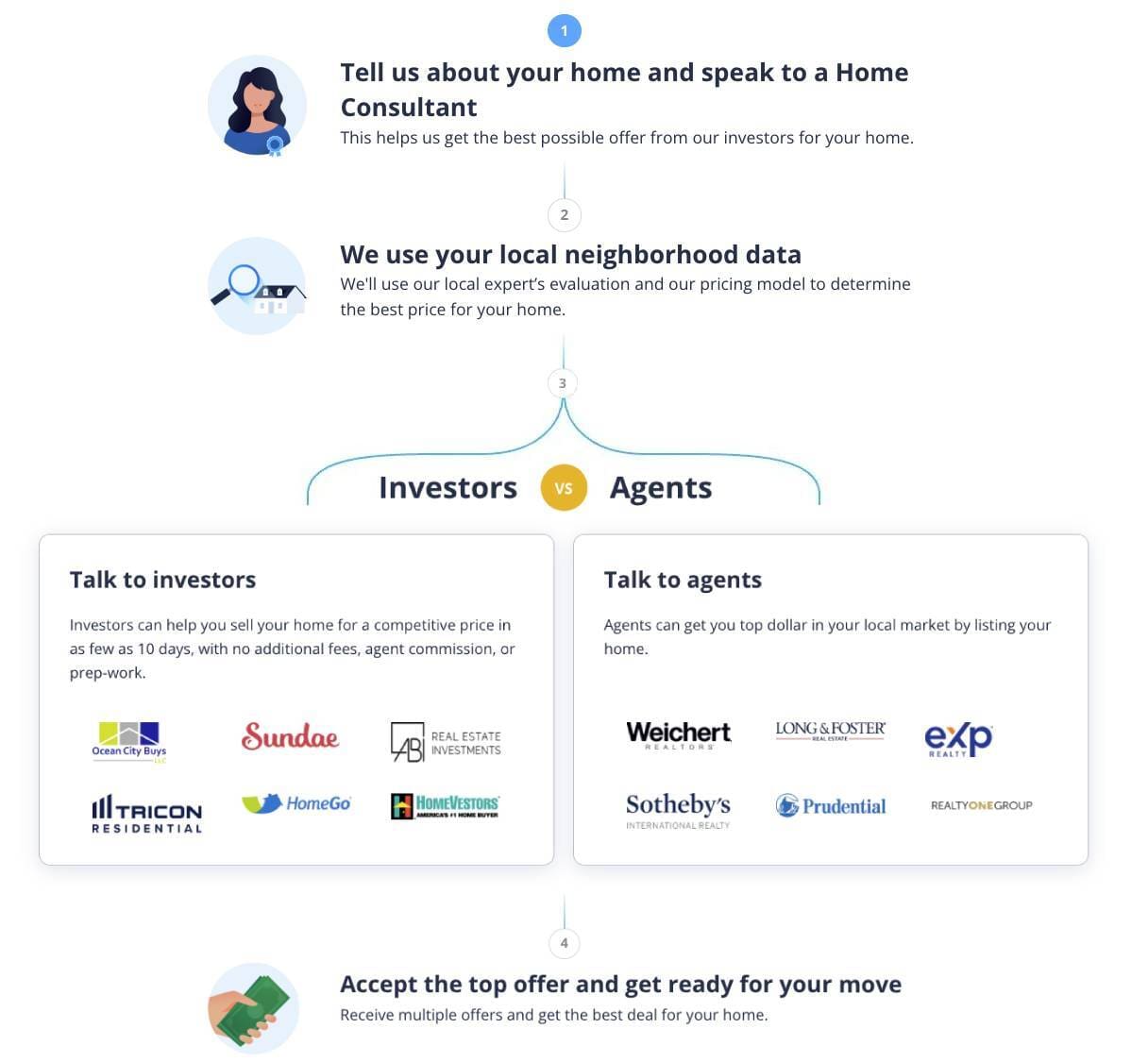

Here is the 4-step Simple Sale process:

HomeLight’s Simple Sale can provide cash offers for Tampa homes in almost any condition. To get started, fill out this short questionnaire.

Here are a few examples of what HomeLight customers are saying about Simple Sale:

Baohan Wu needed to sell his home fast. With HomeLight’s Simple Sale platform, Wu requested an all-cash offer and sold his home in about 24 days — from start to finish. See the video below.

A fast, all-cash purchase offer isn’t right for everyone or every situation, but if you’re facing foreclosure and would like a no-obligation cash offer, consider Simple Sale. You’ll also learn what a top agent might be able to get for your home.

HomeLight maintains an A+ rating with the Better Business Bureau and has a 4.8-star customer review ranking on Google. You can read these and other HomeLight customer reviews at homelight.com/testimonials.

Which selling option is right for your situation in Tampa?

The best way to sell a home in foreclosure depends on your timeline, equity position, and financial priorities.

In general:

- Working with an agent may make sense if you still have time before foreclosure and want the strongest chance at a higher sale price.

- Pursuing a cash sale may be the better fit if speed, certainty, and avoiding the foreclosure auction are your top concerns.

“There’s no single answer that fits every homeowner,” Hoffman says. “What matters most is understanding your timeline early so you can choose the path that gives you the best possible outcome.”

Comparing both approaches side by side can help you move forward with clarity rather than urgency alone.

Talk to a Tampa expert before the foreclosure clock runs out

If you’re facing foreclosure in Tampa, exploring your selling options sooner rather than later can expand what’s still possible. Even a short conversation with a knowledgeable local professional can clarify your timeline, potential sale price, and next steps.

HomeLight can connect you with a trusted Tampa agent through Agent Match or help you explore a fast cash offer through Simple Sale. With Simple Sale, you’ll also learn what a top agent might be able to get for your home, so you can compare both options and decide what direction feels right.

Foreclosure is a difficult situation, but with the right guidance and timely action, many Tampa homeowners are still able to sell, protect their financial future, and move on to what comes next.

Hoffman provides this final note of encouragement: “If you’re facing foreclosure, there’s no need to give up or bury your head in the sand. Consult with an experienced agent and learn about your options. I’ve helped a good number of people find solutions they didn’t know were available.”

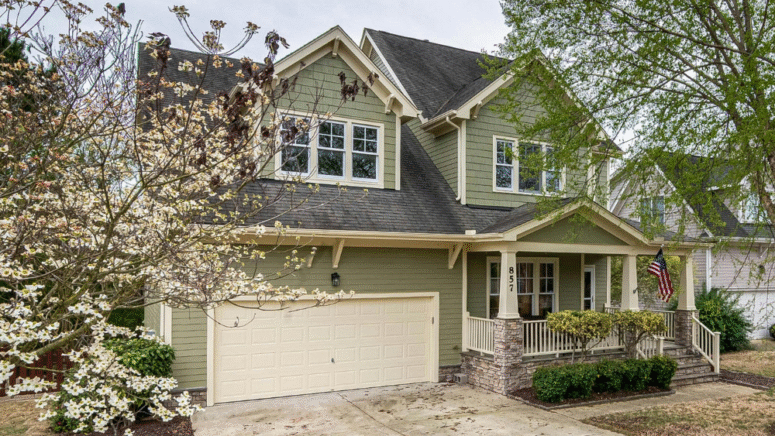

Header Image Source: (Gene Samit/ Pexels)

- "How Can a Lawyer Help Me Defend Against Foreclosure?", Boatman Ricci (March 2025)

- "Tampa becomes foreclosure epicenter as Florida tops nation in housing distress", Fox 13 News (November 2025)

- "U.S. Foreclosure Activity Increases in 2025", ATTOM (January 2026)

- "U.S. Foreclosure Rates by State – December 2025", ATTOM (January 2026)