How to Use Divorce Buyout and Home Value Calculators

- Published on

- 9 min read

-

Richard Haddad Executive EditorCloseRichard Haddad Executive Editor

Richard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

Deciding what to do with your home during a divorce can tug on your heart and your wallet. You’re not just dividing real estate; you’re also untangling memories and financial commitments. To help navigate these tough decisions, you can use two tools that can provide first-step insights: a divorce buyout calculator and a home value estimator.

This guide will explain how to use these calculators to make informed decisions about your shared home. We’ll also provide a list of these and other free online tools that can help you plan your next move.

What are my options with a house in a divorce?

When you’re dealing with a house during a divorce, you generally have three options:

- Sell the house and split the proceeds: Selling the house in a divorce is often the simplest solution, ensuring both parties walk away with their share of the equity.

- Buy out your spouse’s equity: This option allows one partner to keep the home by paying the other their share of the home’s value.

- Keep the house and sell at a later time: Sometimes, couples choose to keep the home temporarily, often to provide a stable environment for the children or wait for better market conditions.

For this post, we’ll focus on online tools that can provide helpful information in the early stages of decision-making. We’ll start by explaining how a divorce buyout calculator can assist with your planning.

What is a divorce buyout calculator?

A divorce buyout calculator is an online tool designed to help divorcing couples determine how much one spouse would need to pay to buy out the other’s share of their joint home. This tool takes into account various financial factors to provide a preliminary estimate for planning purposes.

How does a divorce buyout calculator work?

Using a divorce buyout calculator involves inputting several key pieces of information:

- Home value: The current market value of your home

- Outstanding mortgage: The amount you still owe on the mortgage

- Equity: The amount of equity that has been built up in the home

The calculator then uses these figures to compute an estimated buyout amount, roughly how much one spouse would need to pay the other to take over full ownership of the house. This simplifies what can be a complex financial assessment, giving you a clearer path forward as you decide the best course of action for your family’s future.

Example buyout calculator scenario

Here is a simplified example of how a buyout calculator might estimate the amount one spouse would need to pay to buy out the other’s equity.

| Value of property | $500,000 |

| Mortgage balance | $250,000 |

| Net value of property | $250,000 |

| Relinquishing spouse’s percentage | 50% |

| Relinquishing spouse’s share | $125,000 |

Without closing costs, the buyout estimate remains at $125,000. If closing costs are being considered, then most buyout calculators will provide additional input fields similar to the following table.

| Closing cost percentage | Typically, 9% of the home’s sale price (including Realtor fees) |

| Closing costs | $45,000 |

| Relinquishing spouse’s percentage | 50% |

| Relinquishing spouse’s share of closing costs | $22,500 |

| Relinquishing spouse’s share after costs | $102,500 |

Popular online divorce buyout calculators

There are a number of free divorce buyout calculators available online. Some calculators provide estimates for how much equity you have to divide based on three scenarios: a home sale, a traditional buyout, and a cash-out refinance. Others are more simplified but can still give you a first look at what you might expect.

Here are some examples:

- Calculator Academy Divorce Buyout Calculator

- Survive Divorce House Buyout Divorce Calculator

- Amortization Schedule Divorce Buyout Calculator

- The Gifford Group Divorce Buyout Calculator

- Steven A. Leitman Law Firm Divorce Buyout Calculator

- Divorce Mortgage Advisors Mortgage Payment Calculator

- Forbes Cash Out Refinance Calculator

These free tools can give you a preliminary understanding or starting point in your planning.

Other factors to consider in a divorce buyout

While a divorce buyout calculator is a good tool, it’s important to remember that the math is just one part of the picture in this complex process. Real-life buyouts can get more complicated depending on finances and taxes, state laws, and emotional factors. Before making any decisions, here are a few other key things to keep in mind.

Determine how much the house is worth

Knowing your home’s market value helps make sure the split of assets is fair and accurate. The buyout amount comes down to your home’s equity, which is tied to its current market value. If that value isn’t up to date, one spouse could easily pay more or get less than they should, and that can cause money issues or tension later on.

Determining how much the house is worth often involves getting a professional appraisal to ensure fairness. But to get a ballpark estimate, see our upcoming section about free online home value estimator tools.

Decide if you can afford to keep the home

Review your personal finances closely. Can you afford the mortgage, maintenance, and property taxes on a single income? This will be a key factor in deciding whether a buyout is feasible.

Remove the exiting spouse from the mortgage

To fully assume the property, the staying spouse must usually refinance the mortgage solely in their name. This not only affects the buyout amount but also impacts credit and long-term financial commitments. Some lenders will also have processes in place to allow one spouse to assume the mortgage loan in a divorce.

Review your state’s property division laws

Property division in a divorce can vary significantly from state to state. Understand your local laws to ensure the buyout is conducted legally and in a fair manner. Some states follow community property rules, meaning everything acquired during the marriage is split 50/50, while others use equitable distribution, which focuses on what’s fair rather than equal.

Knowing which system your state follows can help you and your ex set realistic expectations and avoid surprises during the buyout process.

Consider the tax implications of the buyout

There may be tax consequences for both parties in a divorce buyout, such as capital gains taxes if the property has appreciated significantly. Consult a tax advisor to understand how these might impact your decision.

What is a home value estimate calculator?

A home value estimate calculator is an online tool that provides a quick assessment of your property’s market value based on public records and recent real estate data. This tool is particularly useful for homeowners who need a preliminary estimate of their home’s worth, whether for selling, refinancing, or determining buyout prices in situations like divorce.

How does a home value estimator work?

Home value estimators use automated valuation models (AVMs) to analyze data from various sources, including recent property transactions, tax assessments, and market trends. By inputting basic information about your home, such as its location, size, and condition, the tool uses algorithms to compare your property against similar listings and sales in the area to provide an estimated market value.

Many online home value estimators are free to use, but you will likely be asked to provide an email address to receive and view your estimate.

Example questions asked by a home value estimator

To generate an accurate initial estimate, a home value estimator might ask you to provide or confirm some details about your home. These might include:

- Full address of your property

- Number of bedrooms and bathrooms

- Square footage of the home

- Unique features, upgrades, or renovations

- Overall condition of your home

- Your selling timeline

Popular online home value estimators

Below is a list of trusted online platforms that offer free home value estimates:

- HomeLight Home Value Estimator

- Zillow Zestimate

- RE/MAX Home Value Estimates

- Redfin Home Value Estimator

- Realtor.com RealValue™ Tool

- Chase Home Value Estimator

- Bank of America Home Value Estimator

Other factors to consider when using a value estimator

Online value estimators are a great starting point, but they don’t always capture the full picture. It’s a good idea to compare multiple estimates and, if possible, talk to a real estate professional for a more accurate read on your home’s value.

Here are some factors to keep in mind when using a value estimator:

A value estimate is not an appraisal

These calculators provide a general idea of value, but they do not replace a professional appraisal, which is more thorough and accepted by lenders. Value estimators often rely on public data that may be outdated or incomplete, so they can miss important details like recent upgrades or neighborhood changes. Think of them as a rough snapshot, helpful for getting started, but not enough for major financial decisions like a divorce buyout.

Information can be incorrect or outdated

The accuracy of an online estimator depends on the quality and recency of the data it uses. Always check when the estimate was last updated.

A competitive market analysis is more accurate

For a more detailed evaluation, consider asking a real estate agent for a competitive market analysis (CMA). This will provide a more tailored assessment based on current market conditions and comparable properties.

A pre-listing appraisal is another option

If you need a highly accurate value assessment for legal or negotiation purposes, consider getting a pre-listing appraisal from a certified professional. This is especially useful in high-stakes situations like divorce settlements.

Other helpful online real estate calculators

- Best Time to Sell Calculator: This uses real estate sales data from across the country to help you time your sale.

- Agent Commissions Calculator: This tool helps you estimate your real estate agent’s commission and compare average rates in cities across the country.

- Net Proceeds Calculator: This estimates the cost of selling your home and the proceeds you could earn from the sale.

- Home Affordability Calculator: This tool allows you to understand the costs associated with buying a house and learn what safe budgeting looks like for you before you start shopping for your next home.

- Down Payment Calculator: This helps you estimate how much you will need to put down on a home and provides insights about loan options that might work best for you.

- Closing Costs Calculator: This tool estimates how much cash you might need to bring to the closing table, including mortgage lender and third-party fees.

How to fund the divorce buyout

If one spouse is buying out the other in a divorce, figuring out how to fund the buyout is key. Here are some common financing options to consider:

- Home equity loan or line of credit: A home equity loan or line of credit allows you to borrow against the equity in your home. It can provide the cash needed for a buyout without selling the property.

- Cash-out refinance: A cash-out refinance replaces the existing mortgage with a new, larger loan and gives you the difference in cash. This can be a good way to access equity for a buyout while keeping the mortgage in one name.

- Offsetting with retirement or other marital assets: Instead of using cash or loans, some couples agree to balance the buyout by adjusting other marital assets, like retirement accounts or investments. This can reduce debt or borrowing needs while keeping the property transfer fair.

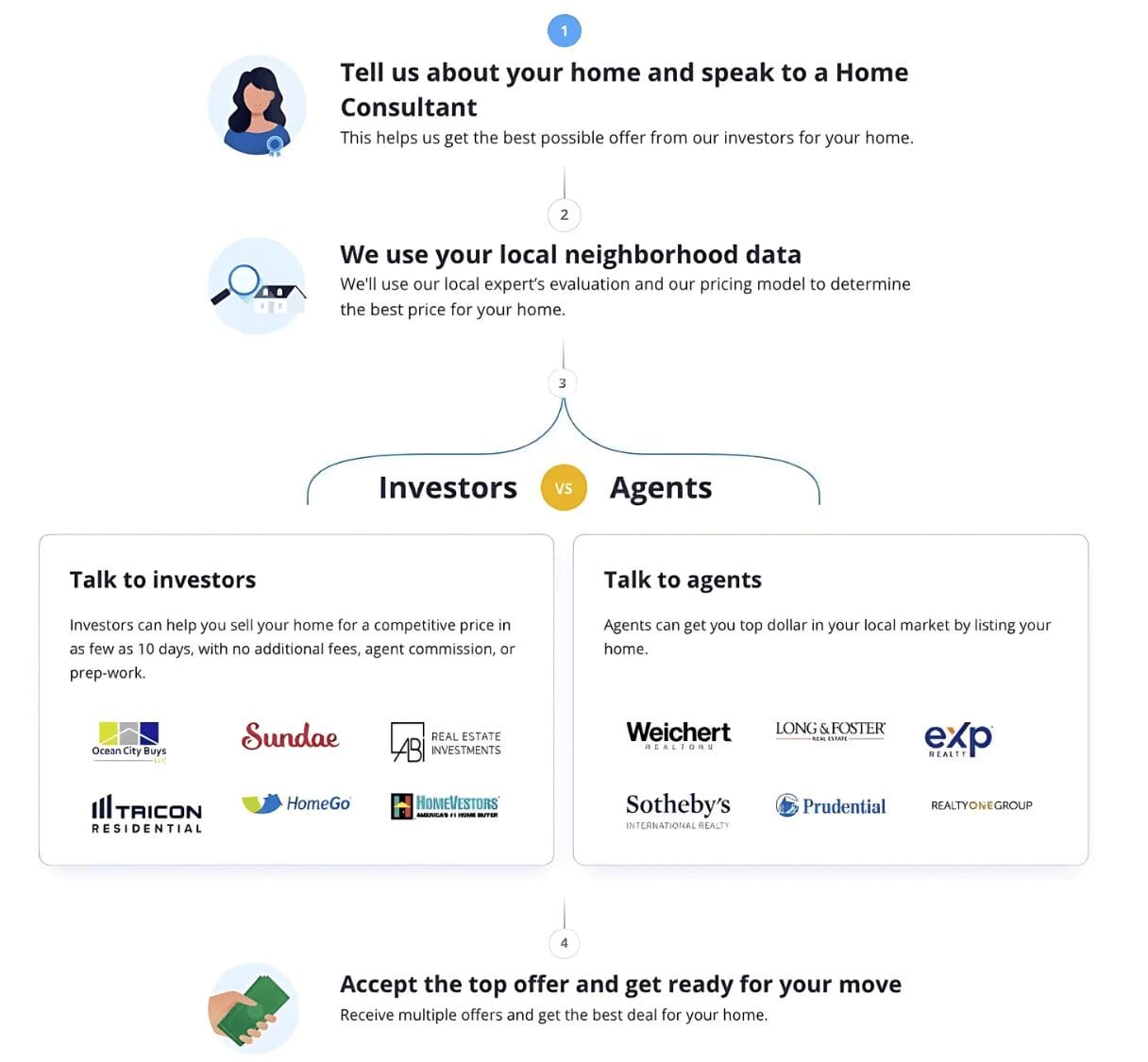

What if we need to sell the house fast for cash?

If you decide the best divorce solution for the house is to sell it for cash and split the proceeds, consider HomeLight’s Simple Sale platform. Simple Sale connects you to the largest network of cash home buyers in the country.

Simply answer a few questions about your home and selling timeline, and you’ll receive a no-obligation all-cash offer in 24 hours. If you accept the offer, you can close the sale in as few as 7 days. You’ll also see an estimate of what a top agent might be able to get for your home, so you can compare options.

Here’s how HomeLight Simple Sale works in four easy steps:

Decide what’s best for you and your family

Divorce buyout calculators and home value estimators can be helpful tools as you make decisions about your home and family during a divorce. But remember, these resources can only provide preliminary information and shouldn’t be relied on as the final word in your decision-making.

For expert insights about what to do with your home in a divorce, HomeLight can connect you with top agents in your area who specialize in working with divorced or divorcing clients.

We analyze over 27 million transactions and thousands of reviews to determine which agent is best for you based on your needs. Simply answer a few questions on HomeLight’s Agent Match platform, and we’ll recommend the most experienced agents in your market within minutes.

Editor’s note: This blog post is meant for educational purposes, not legal advice. If you need assistance navigating a home buyout in a divorce, HomeLight encourages you to contact your own advisor.

Header Image Source: (BruceEmmerling/ Pixabay)