How a Free Home Appraisal Works

- Published on

- 12 min read

-

Valerie Kalfrin, Contributing AuthorClose

Valerie Kalfrin, Contributing AuthorClose Valerie Kalfrin Contributing Author

Valerie Kalfrin Contributing AuthorValerie Kalfrin is a multiple award-winning journalist, film and fiction fan, and creative storyteller with a knack for detailed, engaging stories.

-

Sam Dadofalza, Associate EditorClose

Sam Dadofalza, Associate EditorClose Sam Dadofalza Associate Editor

Sam Dadofalza Associate EditorSam Dadofalza is an associate editor at HomeLight, where she crafts insightful stories to guide homebuyers and sellers through the intricacies of real estate transactions. She has previously contributed to digital marketing firms and online business publications, honing her skills in creating engaging and informative content.

Looking to get a free online home appraisal? Whether you’re thinking about selling soon, considering a home equity line of credit, or just plain curious, your home value is an important part of your overall financial picture.

Many banks, lenders, and real estate websites provide online home value estimator tools (also known as automated valuation models or AVMs), which are convenient to use. While the results of these tools can be limited in accuracy, you don’t want (or need) to pay up to $500 for a professional appraisal when you’re just in planning mode or satisfying curiosity.

Whether you plan to remodel the kitchen, are on the fence about selling your house now or waiting, or are simply interested in getting an estimate of value, you can benefit from a free home appraisal. Let’s take a look at where you can get these services and the degree to which these tools are helpful.

Why home value matters

For many, a home is not only a place to live but also the most valuable asset on their household balance sheet.

Understanding your home’s value when you’re selling will help you set a list price, assess offers, and ultimately achieve a successful sale. With an accurate valuation, you can confidently counter or accept offers, knowing that you’re making an informed decision that aligns with your property’s worth.

Similarly, home value may impact a buyer’s financing options. Lenders use appraisals to assess the risk associated with providing a mortgage for the property.

Knowing your home’s worth helps you plan for your future, as it often represents a significant portion of your net worth. The proceeds from your home sale may fund your next home purchase, retirement, or other financial goals.

Reasons to get a free home appraisal

A free home appraisal — which is not actually an appraisal but an online home value estimate — can’t replace the opinion of a professional appraiser and is unlikely to be as accurate as a real estate agent’s comparative market analysis (CMA). However, checking your home value online can be helpful in a variety of scenarios:

You’re looking to sell soon

People thinking about listing their homes in the near future may use a home value estimator as a starting point. If it’s been five, 10, or 15 years since you purchased, you may be unfamiliar with current trends and need to get re-oriented with the market.

An estimate of value can also help you run some back-of-the-napkin math on your potential net proceeds from the sale after accounting for your outstanding mortgage balance and the fees associated with selling.

You’re on the brink of 20% equity

Generally, you can request to cancel private mortgage insurance (PMI) when you reach at least 20% equity in your home. An online estimate can give you an idea of whether you’re within striking distance and if it’s time to contact your loan servicer about whether you qualify.

Keep in mind that your eligibility will also depend on factors like how much you still owe on the loan and your payment history.

You have plans to remodel

Dying to rip out your 1970s kitchen or redo the bathrooms? A home value estimate can provide an idea of what your home is currently worth. From there, you can ballpark the amount of value a certain type of renovation would add and whether the total cost of the project makes sense.

You’re considering a home equity loan

A home value estimate can give you an idea of how much money you might be able to access through a home equity line of credit, for instance.

“Some people will use them because they want to remodel and are curious how much equity they may have or what their home may be worth after the work,” says Joshua Cooley, a top-selling real estate agent in Eugene, Oregon.

You’re going through a life change

Another common reason people use online home value estimators is a divorce or death in the family. Any official legal proceeding will likely need an appraiser’s report, but heirs or estranged spouses often like to get a general idea of a property’s worth.

How free home appraisals work

Many online real estate sites provide free home valuations — including HomeLight. Each one arrives at their valuations using their own formula. Generally speaking, AVMs use some combination of the following data, in addition to proprietary software, to determine the value of a property:

- Data from a county auditor and tax assessor’s records. This includes a home’s property tax assessment and the auditor’s assessment of the gross living area for a particular property.

- Multiple listing service (MLS) listings and sales. Free home appraisal tools use recently sold comparable homes to determine property value.

- User-submitted data. On certain platforms, users can update the facts of their property for a more accurate reading, adding information that might boost value, like additional bathrooms, a new roof, or a kitchen renovation.

AVMs process this data using mathematical modeling and estimate your home’s worth based largely on the prices of recently sold homes nearby.

How to get a free home appraisal

Consider HomeLight’s Home Value Estimator to begin with. Input your address, and the software analyzes millions of real estate transactions, collects property details, and pulls in the most important elements of a CMA. You’ll receive a preliminary estimate of value in under two minutes.

We’ll also support our estimate with a cash offer from Simple Sale, a platform for selling your house fast.

Today, your options to get a free home value estimate are extensive. We put together a list of home value estimators compared, featuring tools from Chase Bank, Bank of America, RE/MAX, Eppraisal, and others to review. You can always use more than one and see what you get. But do note that while these are the best free home appraisal calculators, they don’t constitute an actual appraisal. It’s an estimate to be used as a first pass or starting point.

In a nutshell, these are the steps on how to get a home appraisal for free using online home value estimators:

- Enter your property details: Input basic information, such as your home’s address, square footage, number of bedrooms and bathrooms, and features.

- Review estimates: The tool will provide a home value estimate based on market data and recent sales.

- Refine with additional data: Some platforms allow you to adjust the estimate by adding unique features or recent upgrades.

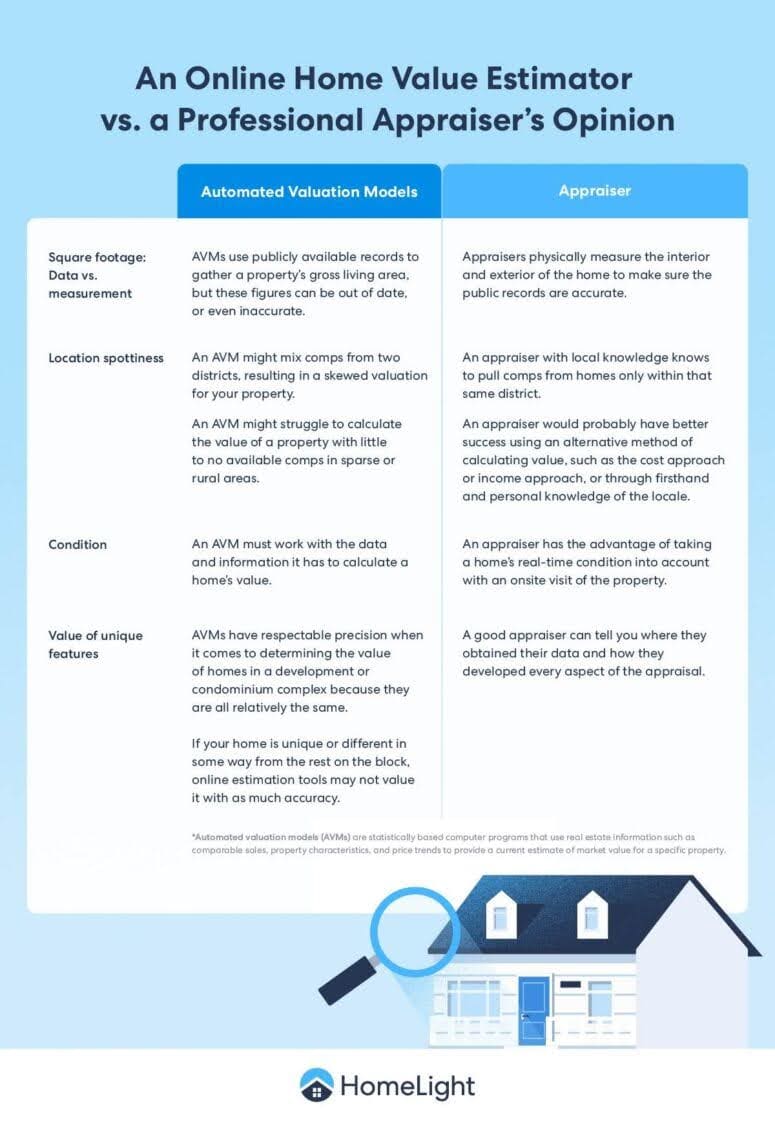

Free appraisals vs. professional appraisals

Licensed appraisers are still an integral part of the housing industry.

“Online tools set the initial benchmark,” says Cooley. “But these tools don’t walk through your home. They don’t engage with the five senses.”

Here’s how an appraiser’s process will differ from an online estimate:

Square footage: Data vs. measurement

An AVM uses publicly available records from places like the county auditor’s office to gather a property’s gross living area, but these figures can be out of date or even inaccurate, explains Jamie Owen, a Northeastern Ohio appraiser with over two decades of experience in the field.

Appraisers instead will physically measure the interior and exterior of the home to make sure the public records are accurate. “Gross living area is probably the number one factor for the value of that land,” Owen explains, “but pulling it off of the public record can be flawed.”

Location spottiness

“AVMs can be weak in specific areas,” says Owen. For example, a neighborhood under a certain ZIP code might be split into two different school districts, a major property value differentiator.

An appraiser with that local knowledge would know to pull comps from homes only within that same school district, while an AVM might mix comps from the two districts. Even the most accurate home value estimators may have these slip-ups, giving you a skewed valuation for your property.

In addition, an AVM might struggle to calculate the value of a property with little to no available comps in sparse or rural areas. In that case, an appraiser would likely achieve better results by using alternative methods to calculate value, such as the cost approach or the income approach, rather than relying solely on the sales comparison approach.

Moreover, an appraiser has firsthand and personal knowledge of the locale, which strengthens the accuracy of their valuation. The latest National Association of Realtors (NAR) Appraisal Survey shows that appraisers in rural areas have a median radius of 60 miles.

Condition

An AVM must work with the data and information it has to calculate a home’s value. These tools will not know that you completely renovated the second-floor bathroom unless you input those details. An appraiser has the advantage of taking a home’s real-time condition into account with an onsite visit of the property.

Value of unique features

AVMs have respectable precision when determining the value of homes in a development or condominium complex, says Owen, because they are all relatively the same. However, if your home is unique or different in some way from the rest on the block, online home appraisal tools may not value it with as much accuracy.

In contrast, professional appraisers consider your property’s distinct features, particularly for lakefront properties or homes with views, where the exact location significantly impacts both appeal and value.

Where AVMs lose in accuracy points, however, they gain in speed. They’re able to comb through millions of pieces of data almost instantly to estimate a home’s value, making it a fast and easy starting point for many home sellers, says Owen.

However, you won’t always understand where the estimate comes from. “A good appraiser can tell you where they obtained their data and how they developed every aspect of the appraisal,” Owen says. “You can’t ask a computer that.”

User error

In addition to rapid market changes, the user data can also be flawed because “it’s so subjective,” says Lorraine Danielson, a top real estate agent in the Atlanta area.

People might be able to answer specific questions clearly, such as, “Have you finished your basement?” but asking a homeowner to rate their home’s condition as “good” or “fair” is tricky. “There’s that human element to it… What some people think is messy is other people’s best day ever.”

Next up: Get a comparative market analysis

If you thought the only way to get a free home appraisal was on the internet, you’d be wrong. Somewhere between AVMs and a licensed appraiser, a top local real estate agent can help you find out how much your house would sell for through a CMA.

Danielson says her office always asks people why they want to know their home value, and then works with them to connect with a lender or provide the information they need. “We work with great lenders if they’re looking to refinance or cash out,” she says. “We try to be a resource there. As automated as you are, you still need people.”

CMA pulls in characteristics an AVM might miss

Like appraisers, real estate agents use comps as a reference point for the subject home and then make dollar adjustments based on competitive differences. The analysis takes into account significant features that drive or reduce value.

An agent can pull comps from their local MLS, giving them greater insights into the area. They can also offer to walk through your home if you’re thinking about listing it.

The CMA, which takes a more in-depth look at the unique characteristics of your home and property, will be more accurate than an online estimate and can actually help guide your pricing strategy before your home hits the market. If your agent has done their homework, the CMA should be close to the home’s appraisal price.

How to get a CMA

An agent’s CMA will be free as part of their listing services, but keep in mind that if an agent goes through the work of putting together a CMA for you, they may expect to at least be in the running to represent the home on the market.

While an agent’s CMA can be trusted as a pricing tool, listing your home based on an AVM alone is risky. Real estate experts advise using these tools as a starting point rather than the final word.

What to do if your home’s online estimate looks off

If you’re a homeowner who doesn’t check their home’s value online obsessively, you may be surprised to find that the estimates being presented on various sites look off. This can be a problem because when the time comes to sell.

Buyers are going to look up your address, and if the internet says your home is worth way less than you’re asking for, it could weaken your negotiating position. So, start owning your home’s history and value online. Claiming your property on sites like Zillow, Redfin, and Realtor, and updating your home’s online value, can change the perception of the property to better align with its current value.

In addition, check your records with the local county assessor’s office to determine if the information they have on file is the most accurate report of your property. If it isn’t, contact your assessor to request the record be updated. When the public record is updated, the estimation on the AVMs should change the next time it combs public data.

Free home estimates: A great starting point

Everyone needs a starting point, and when it comes to finding the value of your home, a free online home estimate is a great one. You’ll be able to figure out a ballpark estimate of your home’s value within seconds, giving you a general idea of how much your home may be worth.

But, an AVM is not the end-all-be-all when figuring out the price of your home. The figure won’t hold up under the scrutiny of a formal appraisal, and it’s just not tailored enough to help you determine a pricing strategy.

Start with an online estimate, but as you decide to sell your home soon, follow it up with the opinion of a trusted agent.

Free home appraisal FAQ

A free home appraisal is not actually an appraisal, but an online home value estimate. You can get a free home assessment from an online tool, known as an automated valuation model (AVM). AVMs use their own formulas and software, along with information collected from county auditor and tax assessor’s records, MLS listing, and sales, as well as data submitted by the homeowner to calculate a home value estimate.

Free home appraisals can provide a general estimate of your home’s value, but they may not be as precise as a professional appraisal conducted by a licensed appraiser. Still, they are a helpful starting point in the home selling process.

While a free home appraisal can be useful for setting your list price, many lenders require a professional appraisal as part of the mortgage approval process for buyers. A professional appraisal may provide a more accurate assessment of your home’s value

You can check free online home value estimators, look at recent sales of similar homes in your area, or use a CMA from a real estate agent. While these methods give you a good estimate, a professional appraisal will provide the most accurate valuation.

To get a rough estimate, consider factors like your home’s size, condition, location, and recent sales of similar properties. Online valuation tools and real estate agents’ CMAs can help, but an official appraisal is the most precise way to determine your home’s worth.

Many real estate agents offer free CMA as part of their services, so consult a local professional especially if you’re thinking about selling. You can also check with local banks, mortgage lenders, or appraisal websites that provide free property value estimates. Run a quick Google search of home appraisal + location to find appraisers in your area.

You can use online tools like HomeLight’s Home Value Estimator, or your county’s property tax assessor website to look up a home’s estimated value by address. These sources pull data from recent sales and market trends to give you a general idea of what a home is worth.

Header Image Source: (Pixasquare / Unsplash)