How Much Does a Home Appraisal Cost in Texas?

- Published on

- 12 min read

-

Dena Landon, Contributing AuthorClose

Dena Landon, Contributing AuthorClose Dena Landon Contributing Author

Dena Landon Contributing AuthorDena Landon is a writer with over 10 years of experience and has had bylines appear in The Washington Post, Salon, Good Housekeeping and more. A homeowner and real estate investor herself, Dena's bought and sold four homes, worked in property management for other investors, and has written over 200 articles on real estate.

-

Richard Haddad, Executive EditorClose

Richard Haddad, Executive EditorClose Richard Haddad Executive Editor

Richard Haddad Executive EditorRichard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

Whether you’re new to the housing market or buying a second home, it’s easy to get confused with all the lingo. A home inspection and a home appraisal both happen after an offer has been made and accepted. Both involve a professional looking at your prospective home, but they have some key differences.

Think of it this way — the home inspection is for you, the home appraisal is for the bank.

As Richard Stives, a real estate agent in El Paso, Texas, who specializes in first-time homebuyers and relocations, explains, “Most buyers are relying on financing in order to buy a house; their lender is going to require an appraisal to determine the value of the home in relation to what that buyer is willing to pay for it.” In other words, the appraisal helps you secure the mortgage.

Whether you’re buying, selling, or refinancing a home, here’s how much a home appraisal will cost in Texas, and what factors influence the price. We’ll also share expert insights about the appraisal process.

What is a home appraisal?

A home appraisal is an independent valuation of a home’s worth. Common reasons for needing a home appraised include selling or buying a property, refinancing a home loan, a divorce where the couple is splitting their assets, or an inheritance. Whenever you need to know a home’s true value, you’ll need a home appraisal.

How much does a home appraisal cost in Texas?

The average cost of a home appraisal in Texas will range between $425 and $650.

The cost varies depending on the property’s features and size, such as the number of rooms, square footage, and unique items, like a pool or acreage. All of these factors influence how much time the appraiser spends at the property and the research time needed to determine its value. The cost can also depend on the home’s location.

In the Houston area, for example, you can expect to pay around $425 for a typical 2,000-square-foot single-family home. But in Round Rock, a suburb of Austin, a single-family home appraisal can cost $650.

As you can see, home appraisal prices can vary. To help you determine where your home might fall in this estimate range, let’s take a closer look at the factors that influence the cost of a home appraisal in Texas.

Property type and features

Are you buying a single-family home, a condominium, or a multi-family? Generally, the more bedrooms and bathrooms, the more you’ll pay for an appraisal. It’ll be harder and take longer for an appraiser to find comparable homes (called comps) for a multi-family property.

Mike Lay, an experienced independent home appraiser at Appraisal House Texas in Travis County, says, “The fee for a 1,500-square-foot house in a tract development in a major city is going to be less expensive than an 8,000-square-foot waterfront mansion on 10 acres, or a 40-acre gentleman’s ranch with a main house, guest house, a barn, and two working pump jacks in the middle of West Texas.”

Buying acreage? The bank won’t just use any old appraiser, but one with specialized experience. This will cost you more.

Location (rural vs. urban)

If an appraiser has to drive two hours to reach your ranch, you’ll pay for that time on the road. There’s going to be a difference in price point to get an appraisal on homes in a rural vs. urban setting. It also can be harder for them to find comparable sales outside of a densely populated city.

Seasonal factors

The appraiser examines every part of the property to ensure an accurate valuation. There are times of the year when it’s harder to access areas — like a septic tank covered by snow, or a well they can’t find. If they have to take any special measures to locate and examine a property’s features, the cost will rise.

Extensive damage

Structural damage, storm damage, and any major damage that hasn’t been repaired take longer to assess. The appraiser might have to consider potential repair costs and how they impact the home’s value. They won’t do a full home inspection, but they will look for obvious issues like a cracked foundation, missing roof shingles, and water damage.

Appraiser availability

It takes time to perform an appraisal, sometimes a half day to a day. There are only so many days in the month, or appraisers in your area. Depending on demand — and in a hot market, they’re booked and busy — it can take a while to get an appraiser out to the property.

More demand, lower supply = higher prices. If you need an appraisal in a rush, Stives says that in his area you could pay between $800 to $900.

Loan type

Borrowing over $806,500? That’s the jumbo loan limit in Texas. If you borrow above that limit, the federal government won’t insure the loan. Without a guarantee or insurance, the lender has more risk.

Appraisal fees will likely be higher for a jumbo loan, as the appraiser has to take more time, could struggle to find comparables, and the bank may require a more in-depth look at the property. Expect to see this additional work in your final price tag.

Government-backed loans, such as VA loans or FHA loans, require appraisers to evaluate the property in comparison to their minimum structural and safety items. The VA caps how much an appraiser can charge. While the FHA doesn’t set a limit on fees, they do state that fees must be “customary and reasonable.”

A mortgage lender is not going to approve the property for financing if the sales price is far in excess of the home’s actual value based on appraisal.

Richard Stives Real Estate AgentClose

Richard Stives Real Estate AgentClose Richard Stives Real Estate Agent at BorderView Realty Currently accepting new clients

Richard Stives Real Estate Agent at BorderView Realty Currently accepting new clients

- Years of Experience 8

- Transactions 127

- Average Price Point $260k

- Single Family Homes 118

Why is a home appraisal needed?

Your new home serves as collateral for the mortgage loan. If you defaulted on your loan, the bank can repossess it and try to sell it to recoup their losses. Therefore, they want to ensure that your home is worth enough to cover the loan.

“A mortgage lender is not going to approve the property for financing if the sales price is far in excess of the home’s actual value based on appraisal,” says Stives.

In more active real estate markets like Austin and Dallas, with rapidly appreciating prices, this is even more important. Austin’s home values jumped 6% between April 2024 and 2023, and while growth is slowing, it’s still a strong market. Banks worry that rapid price appreciation could lead to a bubble, their loan could be underwater, and the asset securing the loan is now worth less. They order home appraisals to protect themselves from losing money.

An appraiser also assures buyers that they’re not overpaying for a house. If you’re making an all-cash offer, you don’t want to end up owning a home that’s worth less than what you paid. Couples that are getting divorced might need an appraisal when dividing assets and one party wants to keep the house. And if you’re selling to — or buying from — a friend or relative, it ensures fairness.

How does a home appraisal work?

There is more than one type of home appraisal. The desk appraisal — where the appraiser researches comparable properties at their desk and never visits the property — became more common during the pandemic. But the sales comparison approach is most common in the industry.

With the sales comparison approach, the appraiser reviews recently sold properties that are similar to the home you’re buying. They’ll adjust the home’s value based on competitive differences — for example, subtracting from the home’s value if it only has one bathroom and comparable properties have two. Essentially, they are attempting to get to a dollar figure that most closely approximates the value that buyers and sellers place on different features.

Appraisers also typically conduct an on-site visit. They’ll bring a tape measure and camera to check square footage, document its curb appeal, evaluate upgrades, and note the home’s overall condition. Any physical deficiencies, such as a cracked foundation, or detractors, like a lack of central air, subtract from the home’s value.

Everything they find goes into the Uniform Residential Appraisal Report. Appraisers must substantiate their opinion with research and reasoning.

In addition, neither the borrower nor the chosen lender decides who the appraiser will be. The lender must work through an appraisal management company (AMC) to have an independent, third-party appraiser assigned to the property. This ensures an unbiased opinion for both parties.

A typical home appraisal takes several hours to a day.

What do home appraisers look for in Texas?

Home appraisers have a general list of items that they consider before getting into specifics for your state. “Generally, features, amenities, and property condition play an important role in an appraiser’s valuation of a property,” Stives says.

This is true no matter where you live, but then they’ll evaluate state-specific items.

- Exterior. Home inspectors will look for cracked and flaking stucco, particularly around windows and doors.

- Foundation. Texan homes most commonly sit on concrete slabs, which can have issues with cracks, sagging, and leaks. In fact, six of the top 15 metro areas with foundation issues are cities in Texas.

- Age and condition. 74% of homes in Texas were built between 1970 and 2009. The state’s relatively new housing stock — particularly when compared to other states — and the age of the home they’re inspecting will influence a home appraiser’s conclusions.

- Home improvements. Improvements can add to, or sometimes subtract from, the home’s value. Removing two bedrooms to make a great room for your kids may have worked for your family, but not for the buyer who needs a four-bedroom. Appraisers also look at the quality of remodeling work and compare it to other homes in the area.

- Location and neighborhood. Appraisers consider the condition of other homes and whether it’s a growing or declining neighborhood.

Worried that the home appraisal will return a lower value than the offer price? Be honest with yourself about the home’s potential negatives.

Lay says that it’s hard to be specific about what would lower a home’s value, “If all of the homes in the area are generally well-maintained and have some updating completed over time, and your house has been a rental for the past 20 years and you never do anything to it, it is not going to be worth as much as the neighboring homes.”

If development is shifting away from the neighborhood, or the home was remodeled and it’s now completely different from the norm for the area, this could all lower the appraised value. An experienced agent, who guided you in setting the list price or making your offer, will help you in determining a fair market price that should appraise.

Can a current homeowner get a free home appraisal?

Current homeowners cannot get a free home appraisal. Appraisers are experienced, credentialed professionals who charge for their time. But that doesn’t mean you’re out of luck if you want to know your home’s current value.

You can request a comparative market analysis (CMA) from an experienced agent, often for free. Agents analyze much of the same data as an appraiser, and they also visit your home to draw a conclusion on its value. Most agents view a CMA as a marketing tool and a chance to win your business.

HomeLight’s Home Value Estimator is also a great tool to determine a home’s general value. After you answer a few short questions, the online estimator compares your home to housing market data for your area. Then, it returns a ballpark estimated worth.

Who pays for a home appraisal?

Who pays for a home appraisal depends on the reason for the valuation. Here’s a simple layout of who typically covers the costs:

| Purpose of the appraisal | Who generally pays for the appraisal |

| Refinance | Homeowner/borrower |

| Home purchase | Buyer/borrower |

| Pre-listing determination of value | Owner who is planning to sell |

| Settling an estate | Family or estate assets |

If you’re refinancing your current home or buying a new one, it’s on your dime. Sellers who want to get a pre-listing appraisal will pay for it out-of-pocket. For an estate sale, the cost comes from the family or estate’s assets.

When there’s a mortgage or loan involved, the bank will order the appraisal from a group of approved appraisal management companies. These companies provide third-party, outsourced appraisal contractors who are not affiliated with the lender or borrower. The lender arranges for the appraisal but you’ll still pay the appraiser’s fees.

Is a seller pre-listing appraisal worth it in Texas?

Though it’s typically the buyer’s lender who orders the home appraisal, there are times when a seller might want a pre-listing appraisal. An appraisal for selling house gives a seller a realistic idea of their home’s worth — and a possible list price. It’s a good idea in these situations:

- Your home has unique features

- It’s in a rural location without a lot of comps

- Your property is a ranch, farm, or has commercial uses

- You inherited the home

How do you find an appraiser in Texas?

Your bank typically finds and supplies the home appraiser if you’re taking out a mortgage. For other purposes, such as a divorce or settling an estate, organizations such as Houston Realtors, the Association of Texas Appraisers, and the Appraisal Institute provide online appraiser directories.

One surefire way to find a trusted agent who knows the market is to ask your agent. Real estate agents have built contacts and a network of professionals in your area. In addition to their expert pricing advice, they can recommend a home appraiser. If you’re looking for a great agent, HomeLight can connect you with the names and contact info of several in your area.

A home appraiser isn’t just a requirement, in many cases. Their work benefits you. “You get a disinterested third-party opinion from someone doing an in-depth dive on values in your area,” Lay says. “An appraiser doesn’t care if the value of your house is $500,000 or $900,000; it is what the math says it is.”

You can sleep easier in your new home knowing that you paid a fair price for it.

FAQs about home appraisals in Texas

What factors influence the cost of a home appraisal in Texas?

The cost of a home appraisal varies based on factors such as the size of the property, location, property type (single-family, condo, rural land, etc.), and the complexity of the appraisal. Urban areas may have higher fees than rural locations due to demand and accessibility.

How long does a home appraisal take in Texas?

A standard home appraisal typically takes between 30 minutes to a few hours for the on-site inspection. The full appraisal report can take anywhere from a few days to a week, depending on the appraiser’s workload and the complexity of the evaluation.

Can I choose my own home appraiser?

If you are refinancing or purchasing a home with a mortgage, the lender usually selects the appraiser to ensure an unbiased valuation. However, if you need an independent appraisal (for estate planning, divorce settlements, or cash sales), you can hire a licensed appraiser of your choice.

Are home appraisal fees negotiable?

In some cases, appraisal fees may be negotiable, especially if you are working with a local independent appraiser. However, for lender-ordered appraisals, the fees are generally set and non-negotiable.

What happens if my home appraisal comes in lower than expected?

If an appraisal is lower than the agreed-upon purchase price, the buyer may need to negotiate with the seller for a price reduction, cover the difference out of pocket, or challenge the appraisal by providing additional comparable sales data. In some cases, a second appraisal may be requested.

Do different types of loans require different appraisal fees?

Yes, appraisal costs can vary depending on the type of loan. FHA, VA, and USDA loans often have specific appraisal requirements, which may increase the cost compared to conventional loan appraisals. VA appraisals, for example, typically have fixed fees based on state guidelines.

Is an appraisal the same as a home inspection?

No, a home appraisal determines the fair market value of a property, while a home inspection assesses the condition of the home, identifying potential issues such as structural problems, plumbing, and electrical concerns. Both are important but serve different purposes.

How often should I get my home appraised?

If you are refinancing, selling, or need an updated home valuation for tax or estate purposes, an appraisal may be necessary. However, if you’re just curious about your home’s value, free online home value estimators or a comparative market analysis (CMA) from a real estate agent may be sufficient.

What can I do to prepare my home for an appraisal?

To maximize your home’s appraised value, ensure your property is well-maintained, make necessary repairs, improve curb appeal, and provide the appraiser with a list of recent upgrades or renovations.

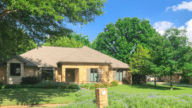

Header Image Source: (trongnguyen / Depositphotos)