How to Focus on the Right Fixes Before Selling Your House

- Published on

- 10 minute read

-

Dorothy O'Donnell, Contributing AuthorCloseDorothy O'Donnell Contributing Author

Dorothy O’Donnell is a writer based in San Francisco. She covers lifestyle, travel, real estate and other topics for publications such as the Los Angeles Times and 7x7.

-

Fran Metz, Contributing EditorCloseFran Metz Contributing Editor

Fran Metz is a freelance content writer, editor, blogger and traveler based in Las Vegas, Nevada. She has seven years of experience in print journalism, working at newspapers from coast to coast. She has a BA in Mass Communications from Fort Lewis College in Durango, Colorado, and lived in Arvada for 15 years, where she gained her experience with the ever-changing real estate market. In her free time, she enjoys 4-wheeling, fishing, and creating digital art.

You’ve lived with your home’s quirks for years: The toilet handle that needs jiggling after every flush. The electrical outlets that haven’t worked in a decade. That red accent wall in the living room that’s more dated than dramatic. Now that you’re putting it on the market, you see these imperfections through the eyes of potential buyers, thinking about what to fix before selling a house.

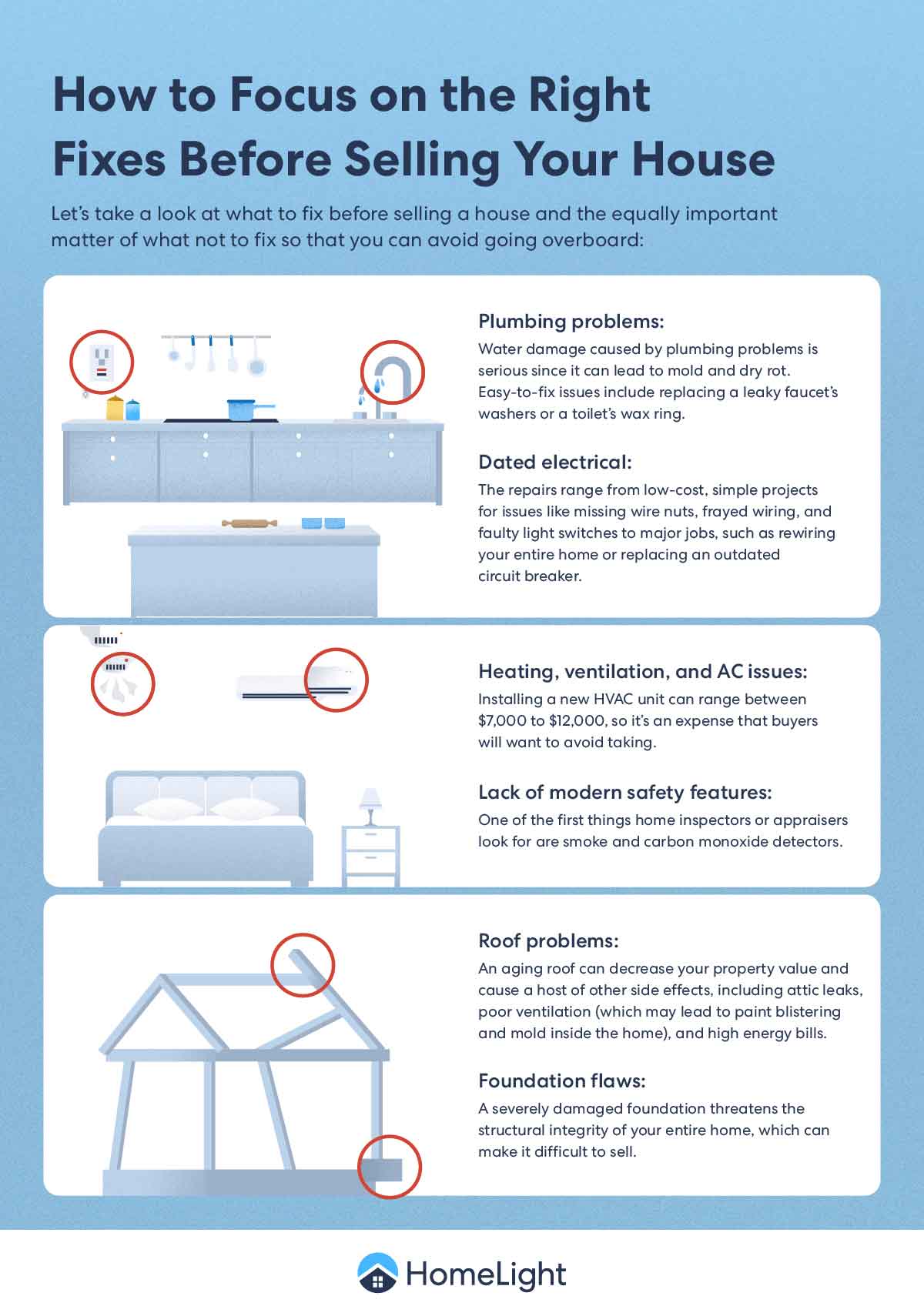

You wonder what they’ll overlook — and what might be deal breakers if you ignore them. Let’s take a look at what to fix before selling a house, and the equally important matter of what not to fix so you can avoid going overboard.

Common major repairs to fix before selling a house

No two houses are alike, which means your home is going to have its own unique set of repair issues. Invest in a pre-sale inspection to identify significant problems in your home that could scare buyers away or result in a lower appraisal if they’re not resolved. Your real estate agent can go over the inspection report with you and help you prioritize essential repairs.

“If we’re back on the market because we have these repair issues, every other buyer that comes in to buy our property will want these issues addressed,” says Nathan Dart, an Elite agent in Gaithersburg, Maryland.

Below are some common issues that are found during inspections:

Plumbing problems

Water damage caused by plumbing problems is serious since it can lead to mold and dry rot. The cost to repair it depends on a variety of factors, such as the source of the water, the size of the damaged area, and how long the problem has existed.

Plumber fees can range from as little as $99 to as much as $974, though a typical homeowner spends about $338. Easy-to-fix issues include replacing a leaky faucet’s washers or a toilet’s wax ring.

Dated electrical

Electrical problems are no laughing matter — they’re responsible for 51,000 fires every year. The repairs range from low-cost, simple projects for issues like missing wire nuts, frayed wiring, and faulty light switches, to major jobs such as rewiring your entire home or replacing an outdated circuit breaker. If you’re hiring a pro to handle these repairs, electrician fees typically run around $349, but can vary from $163 to $536 based on location and experience level.

Heating, ventilation, and AC issues

Installing a new HVAC unit can range between $7,000 to $16,000, so buyers will want to steer clear of this expense. Fortunately, just because your system isn’t working or running efficiently doesn’t necessarily mean you need a new one. A qualified technician may be able to repair it for $350.

You’ll just need to budget for a service call and any extra fees for repairs and parts. However, an older HVAC at the end of its estimated lifespan can also lower the appraised value of your home if other houses in the area have newer units.

Is it always worth fixing everything before you list your home? Some repairs cost more than they’re worth and won’t meaningfully change how buyers view your property. That’s why understanding what not to fix before selling can help you save money and protect your bottom line.

Roof problems

An aging roof can decrease your property value and cause a host of other side effects, including attic leaks and poor ventilation, which may lead to paint blistering and mold inside the home — and high energy bills.

A roof costs an average of $5,870 to $46,000 to replace. Consider investing in a new roof before selling if yours is significantly older or in disrepair compared to neighboring roofs.

Foundation flaws

A severely damaged foundation threatens the structural integrity of your entire home, which can make it difficult to sell. In worst-case scenarios, major foundation repairs can cost $2,224 to $8,129. Even basic fixes can be pricey.

Filling in a single crack, for example, runs between $250 and $800. But you may spend more for extras like slab jacking or hiring a structural engineer to assess the damage.

Lack of modern safety features

One of the first things home inspectors or appraisers look for is detectors for smoke and carbon monoxide. Every state requires in-home smoke detectors. Meanwhile, all states mandate carbon monoxide detectors in homes except Hawaii, and in Kansas and Missouri, the requirement applies only to child and adult care facilities.

Make sure you know your state and local laws — or check with your real estate agent — when it comes to how and where detectors must be installed. GFCI outlets and receptacles are must-haves for rooms with a water source, such as kitchens and bathrooms.

Beyond major repairs: What else should you fix?

Once your critical repairs are squared away, turn to additional fixes and upgrades that will make buyers take note. And yield the biggest bang for your buck.

1. Kitchens

If there’s one room in your home that needs to impress buyers, it’s the kitchen. It’s the hub of the home, bringing the family together over great food and creating unforgettable memories at the heart of the home.

Your kitchen doesn’t have to be a state-of-the-art affair. But it does need to be clean, functional, and not an eyesore. If your kitchen is begging for some TLC, for a few hundred dollars or less, you can amp up its appeal with a few strategic repairs and cosmetic updates.

“It doesn’t make sense to start a major kitchen remodel when you’re selling, so I would stick with quick, affordable updates, like lightening and brightening with neutral paint and changing hardware,” Maria Hoffman, an Elite agent in Tampa, Florida, advises.

She also suggests replacing dark, heavy window treatments with blinds that let in more light. Painting your cabinets will instantly perk up any kitchen. And don’t forget simple updates like swapping out old light switches and fixtures for new ones.

“Installing a new light fixture over a kitchen table isn’t super expensive, but it can really update the space and add a bit of a ‘wow’ factor,” Hoffman says.

2. Bathrooms

Home shoppers also scrutinize bathrooms, so make sure yours is spotless. Replace chipped shower or tub tiles and deep clean grout to remove mildew. If your caulk is looking funky, replace it. And be sure to fix pesky problems like dripping faucets, clogged drains, or a toilet that runs 24/7.

For an affordable mini-makeover, start with a coat of neutral paint. Then focus on your lighting and mirrors.

“The least expensive thing to do in a bathroom is update your light fixtures,” Hoffman says. “If you’ve got original builder-grade lights over your vanity, that’s a simple thing to replace. Changing a sheet mirror for a pretty framed one is inexpensive but can really change the look of the room.”

3. Home exterior and yard

Now that your home interior has been refreshed, head outside. First impressions are huge, so don’t let eyesores like damaged roof eaves, a weed-infested yard, or peeling paint greet buyers when they pull up to your home.

According to Hoffman, the value of stellar curb appeal can’t be overstated.

“I think one of the key fixes that people can overlook is tending to their landscaping,” she says. “Just making sure that things are clean and presentable is so important.”

Mow your lawn, tidy overgrown flower beds, prune trees, and power-wash your walkways, she advises. Then take a close look at your front door.

“It’s the first thing that buyers see, so make sure it’s nicely painted and has new hardware if needed,” Hoffman says. “These are simple things to update and some of the least expensive things you can do to increase the value of your home.”

4. Discretionary upgrades

Still have some money left in your fix-it budget? Consider these optional upgrades to give your place some extra oomph:

Paint where needed

Among easy, affordable updates, paint reigns supreme. Whether your entire house is screaming for it, or just a room or hallway, fresh paint will instantly make any space feel fresh and clean.

Brighten dark areas

Next to paint, new lighting tops the list of quick fixes that don’t cost a fortune. With the flick of a switch, stylish light fixtures or lamps can transform a gloomy, cramped room into a bright, welcoming spot with a more spacious feel.

Replace old kitchen countertops

Installing new countertops isn’t cheap. According to Angi, the cost to install new countertops is between $1,850 and $4,456.

But if you can swing it, this investment can take your kitchen from ho-hum to showstopper. “Replacing countertops is a little [pricier], but it’s certainly something I’ve seen pay off,” Hoffman says.

Refinish hardwood floors

Beautiful hardwood floors are among homebuyers’ most coveted features. If yours are dull or scuffed up, it’s worth the expense to refinish them. The average cost of the project is between $1,107 and $2,680. Yet you’ll recoup the full amount, or more, when you sell.

Invest in shiny new appliances

Buyers expect your home’s appliances to work properly, and having them brand new only adds to the appeal. If you’ve got the budget to replace that noisy refrigerator or ancient dishwasher, you’ll likely get stronger offers on your home — and more of them.

If your appliances are older yet still work well, you may want to skip replacing them. The average cost of an appliance package, which includes a refrigerator, range, microwave, and dishwasher, is $2,100 to $5,400.

Repairs that matter more for FHA, VA, and USDA buyers

If your buyer is using a VA, USDA, or FHA loan, certain repairs suddenly become a bigger deal. These programs have stricter safety and habitability standards, so skipping them can slow down or even derail your sale. Knowing what to prioritize can save you stress, time, and last-minute surprises.

- Roof and structural integrity: Lenders want a home that won’t cave in on them literally. Fix any leaks, missing shingles, or wobbly structures so buyers feel confident the house is safe and solid.

- Electrical and plumbing systems: Exposed wiring or a dripping pipe can be a dealbreaker for these loan types. Make sure everything runs smoothly so inspections don’t turn into a headache.

- Heating and cooling systems: A working heater (and sometimes air conditioning) isn’t just nice to have—it’s often a requirement. Buyers want to know they won’t be shivering or sweating their first night in the house.

- Water damage and mold: Mold and water damage scream “hidden problems.” Take care of leaks and clean up mold to keep both buyers and their lenders happy.

- Windows and doors: Windows and doors need to open, close, and lock properly to pass inspection. It’s about safety, energy efficiency, and making sure your home feels secure.

- Safety features: Smoke detectors, carbon monoxide alarms, and secure railings aren’t optional in the eyes of lenders. Installing them shows you care about your buyers’ safety and keeps the inspection smooth.

Consult with a real estate agent

Luckily, you don’t have to figure it out on your own. Ask a top local real estate agent for their perspective. Allowing them to do a quick walkthrough could save you a ton of money.

“The advice of a professional Realtor® is indispensable,” says Hoffman. “Sometimes, people undertake costly repairs or improvements that just are not going to net any return when they sell.”

For example, she had a client who was about to sign a contract to install solar panels in his home for $30,000. While solar panels are a fantastic way to cut energy costs, her client was planning to sell the house in a few months. Hoffman advised him to skip the panels.

“He would not be able to get that $30,000 back on top of his sale price,” she explains. “That’s an item that pays off over the long term. Agents know what buyers are looking for and can help you do a cost-benefit analysis for potential repairs and upgrades.”

Get smart about your to-do list

Once you know exactly which issues came up in your home inspection and the major repairs are behind you, it’s easier to plan how to spend what’s left on cosmetic improvements. Many sellers find they have a modest budget, often around $5,000, and while it’s tempting to pour it all into one big upgrade like a kitchen overhaul, that money goes fast.

A smarter approach is to invest in several smaller, high-impact updates that make the entire home feel more polished to buyers, such as the following:

Kitchen

Paint your dated kitchen cabinets a crisp white ($938, on average), replace all the hardware ($30 per piece), and add chic pendant lights (as low as $50 per piece) above the table in the previously dark breakfast nook.

Living room

After decluttering the living room, spend one weekend painting it yourself with a soft, warm bisque to further accentuate its inviting new look ($900). Remove the heavy curtains from the windows to make the room brighter. Put in a large ceiling fan (as low as $50) to provide heat relief and a striking decorative detail.

Primary bath

Moving on to the en suite bathroom, ditch the sheet mirror for a modern and contemporary mirror ($130), swap ugly builder-grade lighting for a pair of contemporary sconces ($90), and paint the walls a soothing sage green for a serene spa-like vibe ($200).

Curb appeal

Don’t overlook your home’s exterior. Simple updates like cleaning the front entry, adding potted plants ($40), or repainting the front door ($190) can instantly improve curb appeal. Rent a pressure washer for a day ($79) to clean the driveway and exterior walls and make the home look well cared for.

Basic landscaping, like mowing, trimming, and weeding, can make a noticeable difference. These outdoor improvements are often affordable and can pay off by helping your home attract more interest from buyers.

Fix smart, not everything

Fixing the right things before selling your house isn’t about turning it into a showroom. It’s about making buyers feel comfortable saying yes. By tackling essential repairs, safety concerns, and a few high-impact cosmetic updates, you can boost appeal without blowing your budget. Taking care of issues upfront also reduces the chance of inspection surprises popping up at the worst possible moment.

Think of it as removing distractions, so buyers focus on the home itself, not the leaky faucet or flickering light switch. When the little things are handled, your home feels move-in ready, well cared for, and much easier to fall in love with.

Header Image Source: Pxhere