Pros and Cons of Low Commission Real Estate Agents: Are They Right for You?

- Published on

- 15 min read

-

Dena Landon, Contributing AuthorClose

Dena Landon, Contributing AuthorClose Dena Landon Contributing Author

Dena Landon Contributing AuthorDena Landon is a writer with over 10 years of experience and has had bylines appear in The Washington Post, Salon, Good Housekeeping and more. A homeowner and real estate investor herself, Dena's bought and sold four homes, worked in property management for other investors, and has written over 200 articles on real estate.

-

Sam Dadofalza, Associate EditorClose

Sam Dadofalza, Associate EditorClose Sam Dadofalza Associate Editor

Sam Dadofalza Associate EditorSam Dadofalza is an associate editor at HomeLight, where she crafts insightful stories to guide homebuyers and sellers through the intricacies of real estate transactions. She has previously contributed to digital marketing firms and online business publications, honing her skills in creating engaging and informative content.

When it’s time to sell your home, it’s only natural to think of your bottom line. A home, after all, is most people’s largest financial asset. To maximize profit and lower home selling costs, you might have considered contacting low commission real estate agents to help with your sale.

Maybe you remodeled the kitchen and want to get that money back in the sale, or you’re planning on funding part of your retirement with your sale proceeds. Since agent commissions take a cut of your final sale price, you want to explore ways to reduce this expense and maximize your profit.

Low commission real estate agents offer to sell your home for a commission a few percentage points lower than what’s typical. Historically, the average commission rate has been 5.8% of the home price. However, with new agent commission rules in place, the average percentage and who pays have been evolving.

Nonetheless, low commission agents claim that because they’re paid less, you make more on the sale. But will that savings on commission cost you in other ways, potentially in a much lower sale price?

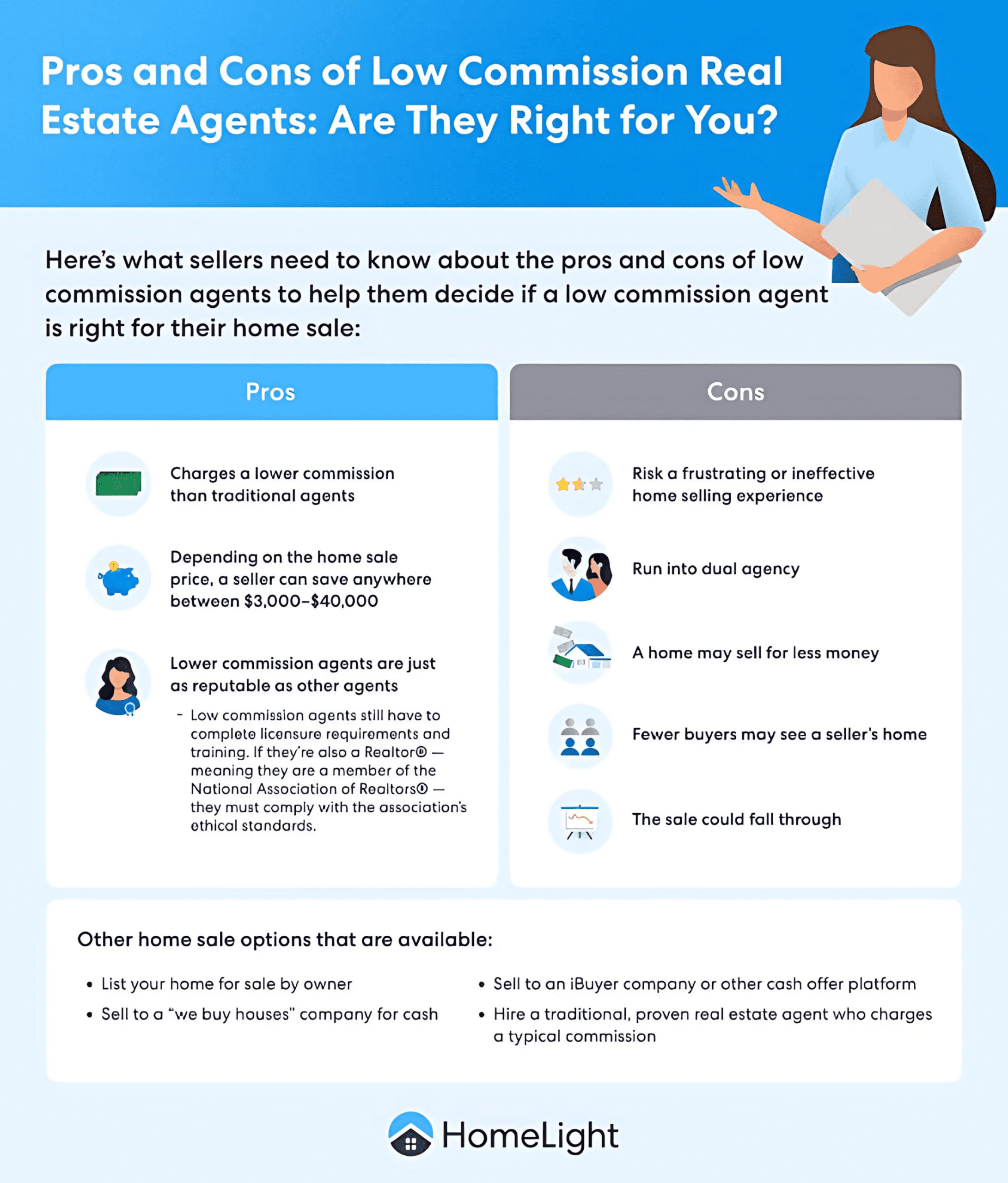

In this post, we’ll break down the pros and cons of low commission real estate agents to help you determine if hiring one is right for your home sale and financial future.

What’s the average real estate commission?

For decades, the average commission rate has been 5% to 6% of the home’s sale price, typically paid by the seller and split between the listing agent and the buyer’s agent. Further splits are made between the agent and their brokerage. Agents would usually stick to the average for their area because asking for more would mean fewer clients listing with them.

Following the landmark lawsuit settlement of the National Association of Realtors (NAR), the agent commission structure has changed, decoupling the fees for the buyer’s agent and the seller’s agent.

Under the new model, buyers are expected to negotiate commissions directly with their agents. This lowers seller-paid fees to 2% to 3% of the sale price. However, despite this change, some sellers may still feel the need to cover their buyer’s agent’s fees to attract more offers, especially in sluggish markets. Ultimately, the new average commission rate remains to be determined.

Nonetheless, some real estate agents choose to charge a lower commission rate than the traditional one, as low as 1% to 1.5% of the home’s sale price. A quick Google search of “1 percent commission realtor near me” can provide several suggestions for local agents offering these reduced rates.

What are low commission real estate agents?

A low commission agent, as the name implies, charges a lower commission than a traditional agent. For example, if the standard in your area is 3%, they might charge 2%.

Keep in mind that this will only affect the commission your agent gets, not other fees associated with selling a house. The agent who represents your home doesn’t dictate the buyer’s agent’s commission.

Are low commission real estate agents reputable?

Low commission agents still have to complete licensure requirements and training, making them just as reputable as other agents. If they’re also a Realtor — meaning they are a member of the NAR — they must comply with the association’s ethical standards. Some markets have more discount commission agents than others.

Zach WalkerLieb is an agent who sells homes 56% faster than average agents in Las Vegas, Nevada. He says that low commission agents can become more common when the housing supply is low, and demand is high.

“It’s actually advantageous for the seller, depending on the price range and condition of the home, to be aware of what commission can be offered,” he says. “If you’re offering it to the public and you can get away with offering 2.5% instead of 3%, it can save thousands of dollars.”

In a more balanced market in which each home gets fewer offers, who you work with could end up making a big difference in maximizing your home sale. In other words, the value added by working with a top agent can more than cover the savings of the lower commission.

How much can I save with a low cost real estate agent?

Wondering how much a low cost agent can save you? The chart below compares different commission rates for various scenarios: paying both the listing and buyer’s agent’s fees, only the listing agent’s fee, and a low commission agent’s fee.

| Home Sale Price | Combined Listing & Buyer Agent Fees (6%) | Listing Agent Fee Only (3%) | Low Commission Agent Fee (2%) | Savings |

| $150,000 | $9,000 | $4,500 | $3,000 | $6,000 / $1,500 |

| $200,000 | $12,000 | $6,000 | $4,000 | $8,000 / $2,000 |

| $250,000 | $15,000 | $7,500 | $5,000 | $10,000 / $2,500 |

| $300,000 | $18,000 | $9,000 | $6,000 | $12,000 / $3,000 |

| $350,000 | $21,000 | $10,500 | $7,000 | $14,000 / $3,500 |

| $400,000 | $24,000 | $12,000 | $8,000 | $16,000 / $4,000 |

| $450,000 | $27,000 | $13,500 | $9,000 | $18,000 / $4,500 |

| $500,000 | $30,000 | $15,000 | $10,000 | $20,000 / $5,000 |

| $1,000,000 | $60,000 | $30,000 | $20,000 | $40,000 / $10,000 |

| $1,500,000 | $90,000 | $45,000 | $30,000 | $60,000 / $15,000 |

| $2,000,000 | $120,000 | $60,000 | $40,000 | $80,000 / 20,000 |

What are the risks of using a low commission real estate agent?

You can tell from the chart above that you’ll save money if you’re paying a lower commission. But you could also lose money at other points of the home sale, and have an overall frustrating experience. Here are some of the downsides to using a low commission agent.

Risking a frustrating or ineffective home selling experience

Low commission agents typically make their living on volume. When they’re making less on a home sale, they need to sell more. Often, this means that they have less time to devote to each sale. They might not be available to answer your questions or do much beyond listing and showing the house.

“Low commission to me really means ‘no service,’” says Chiquita Pittman, a top-selling agent in New Brunswick, New Jersey. “As full commission agents, we have a network of inspectors, attorneys, contractors — we can help when there’s a problem. We have the solutions, and that goes a long way in navigating and managing the transaction.”

WalkerLieb’s team includes an operations manager who handles important documents, coordinates all the repairs, and deals with escrow. For home sellers, he says “it’s a stress-free transaction because we pride ourselves on being one of the teams that would earn that commission.” If you’re working with a low commission agent, you may not have a full and experienced team backing you up.

Running into dual agency

With low commission agents, you have to watch out for a situation where the real estate agent represents both the seller and buyer, called a dual agency. It’s illegal in eight states because of the risk that an agent won’t represent each side of the transaction fairly.

How can this work against you? If you list your $300,000 property with an agent who charges a 1.5% commission, you’d pay $4,500 when the home sells. But if they also represent the buyer, they’ll also receive the buyer’s agent commission. If the buyer’s agent is set to receive a 2.5% to 3% commission on the sale, that raises the dual agent’s potential earnings to $13,500.

On the surface, this might actually look good. After all, wouldn’t the agent try to get your home’s sale price higher to maximize their commission? But when you think of all the negotiations in a home sale — from needed repairs to closing dates — it’s clear that there are times when an agent might not look out for your best interests just to get the deal done.

Selling for less money

Another risk of working with a discount agent is that your house might sell for less than you could have received with a top agent’s expertise. Making strategic improvements, pricing it in the sweet spot, and leveraging a well-connected agent’s network can all drive a home’s sale price higher.

Agents also help with negotiations during the sales process — particularly after the home inspection if the buyer requests repairs.

In real estate, “You have to be able to negotiate and give guidance to keep the deal moving forward,” says Pittman. “Every deal today is paper thin, and if you don’t have the skill set to make sure everybody’s happy and create that win-win situation, you’re not going to get top dollar, and you’re going to leave money on the table.”

HomeLight internal data shows that partnering with the top 5% of real estate agents sells homes for an average of 10% more compared to average agents. That’s a significant amount of potential earnings you’re missing out with a discount agent.

Limiting your home’s exposure

When you offer buyer’s agents lower commissions, there’s the risk that they may not show their clients your house. In WalkerLieb’s area, he’s seen that once commission drops below 2.5%, there’s a significant drop-off in showings.

Since it will be the same amount of work for the buyer’s agent as a home with a higher commission, they might not want to accept a pay cut.

“Even though it may be unethical for them to not show a home that has a low commission offered, there are agents out there who make the decision whether or not to promote the home to their clients based on commission,” he says.

Sale potentially falling through

Because low commission agents are typically trying to do a large number of transactions, they might not care if one falls through. After the paperwork has been signed for your house, they’re already moving on to the next sale. But there’s a lot that happens after the purchase agreement.

In one instance, WalkerLieb’s buyer had an offer accepted on a home being sold by a low commission agent. “We couldn’t reach the agent for negotiations of repair at all,” he says.

“We had submitted the requests and reached back out multiple times, due diligence was ending, and we had to cancel the deal because we couldn’t even reach them,” he adds. He thinks the deal would have been easily saved if the agent had communicated.

What other home sale options are available?

Sell as For Sale By Owner (FSBO)

Hands-on sellers who have the time and resources available can list for sale by owner (FSBO). When you choose this path, you’re doing the work of an agent — from prepping your home, setting the list price, taking photos, listing your home online, hosting showings, and negotiating with buyers.

While a viable option, FSBO isn’t a popular route. In 2024, only 6% of home sales were FSBO, according to the NAR. Moreover, these homes typically sell for less. In 2023, they had a median sale price of $380,000, which is significantly lower than the $435,000 median for agent-assisted homes.

Sell to a We Buy Houses company for cash

We Buy Houses companies make all-cash offers on homes. Since they flip houses for profit, offers from cash buyers are likely to be lower. But if you’re looking for a quick sale, they can often close in less than a month.

While they don’t charge a commission, some companies charge fees on top of offering less for your home. We Buy Houses companies specialize in working with sellers who are selling a house in poor condition or who are about to go into foreclosure.

Sell to an iBuyer company or other cash offer platform

An iBuyer, or “instant buyer,” uses automated valuation models (AVM) and web platforms to determine your home’s value. These property tech companies offer a simplified sale process for sellers whose homes are typically in sellable condition.

HomeLight’s Simple Sale platform is another option sellers can leverage to sell their homes quickly and with less hassle. Just plug in your address and answer a few questions about your home to get a cash offer fast.

With a large network of cash buyers nationwide, HomeLight provides an all-cash offer in 24 hours and closes on properties in as little as 10 days.

Sell with a proven real estate agent who charges a typical commission

A traditional agent lists your home, markets it, and negotiates on your behalf to sell it. They provide a full range of services, including conducting a comparative market analysis (CMA) to determine your home’s value, developing pricing strategies, sharing tips for staging the space, hosting open houses, and providing meaningful insights into market trends and local neighborhoods.

What can I expect from a traditional real estate agent?

Traditional real estate agents handle every aspect of your home sale — from prepping and marketing to negotiating on your behalf.

Here’s what you can expect when you work with a top agent:

- Works closely with the seller and maintains responsiveness all throughout the transaction

- Specializes in home selling situations like yours

- Offers advice to save time and money, and removes frustration

- Prints and distributes brochures and flyers

- Schedules professional photography

- Arranges for a lockbox on property

- Lists your home on the multiple listing service (MLS)

- Markets your home in the most effective online spaces and to their network

- Places a “For Sale” sign on your property

- Handles all open houses and showings

- Schedules all required inspections

- Connects with local contractors and professional services

- Works with the buyer’s agent

- Negotiates repairs and concessions

- Reviews transaction documents thoroughly

- Addresses any surprises on the road to closing

- Handles the closing

So many things pop up in every single real estate transaction that’s new — especially if you’ve only done one or two sales — a low commission agent is not going to be experienced enough to navigate the transaction properly.

Zach WalkerLieb Real Estate AgentClose

Zach WalkerLieb Real Estate AgentClose Zach WalkerLieb Real Estate Agent at Keller Williams MP1 Currently accepting new clients

Zach WalkerLieb Real Estate Agent at Keller Williams MP1 Currently accepting new clients

- Years of Experience 14

- Transactions 476

- Average Price Point $568k

- Single Family Homes 444

How can I check to see if a low commission agent is reputable?

Before signing the listing contract, do your research to ensure you’ll be working with the best low commission realtor, highly qualified and the right fit for your selling situation.

Ask to review the listing agreement in detail

Reputable agents will be upfront about their commissions and contracts. Even if they’re taking a lower commission, they’ll be transparent.

Check your would-be agent’s track record

When they’re already offering less service, you want an agent who can get the job done. Lack of experience is a warning sign. “So many things pop up in every single real estate transaction that’s new — especially if you’ve only done one or two sales,” says WalkerLieb. “A low commission agent is not going to be experienced enough to navigate the transaction properly.”

Search the internet to check out their online presence and reviews

While even the most reputable offices will have the occasional grumpy commenter, if there are multiple complaints, heed the warning signs and look elsewhere. Also, check any reviews on the Better Business Bureau (BBB) website, and verify whether or not they’re a member.

Can you easily find them on the web? Reputable agents have professional websites and an active online presence.

Ask for a list detailing the exact services you will receive

Since you’re paying less, it’s important to be clear on what you’ll receive for the commission. If they don’t have a list, look again at their contract.

Value your investment through the end

For many Americans, their home is their biggest investment. Getting top dollar can significantly impact your financial future, which is why it’s important to look at the big picture.

The best low commission real estate agents offer valuable, legitimate services, but there can be truth in the adage that “you get what you pay for.” When you’re working with a really good agent, the difference is in the list-to-sales price ratio. You may pay more for their services, but your net could be higher.

“A lot of the strong, good agents may charge a 6% commission, but at the end of the day they’re going to sell your home and make you more than that initial 1 to 2% savings in commission might be,” WalkerLieb points out.

Partnering with a results-driven real estate agent pays off. When you’re ready to sell, just enter your home’s address, and we’ll connect you with top-performing agents in your neighborhood. While you might pay higher commissions when working with them, it increases your chances of a smooth and profitable home sale.

Low commission real estate agent FAQ

Low commission real estate agents are agents who offer their services at a lower commission rate than the traditional 5% to 6% of the home’s sale price. They may provide full service or limited services depending on their business model.

Low commission agents typically make money by handling a higher volume of transactions or by offering à la carte services. They may also work for brokerages with lower overhead costs or adopt technology-driven approaches to reduce expenses.

Real estate agents are free to pick the commission they’ll take — so, in theory, they could go as low as 1% or below. However, most stick within industry-accepted norms.

Yes, there are flat fee real estate agents who let clients pay a set amount regardless of the home’s sale price. This can be a great option if you’re looking to save on commission costs. However, be sure to understand the services included to ensure you’re getting the support you need.

The effectiveness of a low commission agent depends on their experience, market knowledge, and offered services. Some professionals provide full service and can be just as effective as traditional agents, while others may offer limited services, which could impact their success rate.

The services offered by low commission agents vary widely. Some offer full service, including marketing, negotiation, and transaction management, while others may only provide listing services. It’s essential to understand the services included before choosing a low commission agent.

Some potential drawbacks of using a low commission agent include limited services, less personalized attention, and potentially lower final sale prices due to less aggressive negotiation. However, some sellers find that the cost savings outweigh the potential downsides.

To find low commission real estate agents near you, try Googling “low commission agents in [state or city name].” Check real estate websites and local agent directories, or ask for recommendations from friends, family, or local real estate groups to find the best options in your area.

Before hiring one, take the time to read low commission real estate agents’ reviews or ask them for references from previous clients. This can help you gauge their experience and reputation in your local market.

Header Image Source: (Point3D Commercial Imaging Ltd. / Unsplash)

- "Average commission rate for real estate agents in the United States between 1992 and 2023," Statista (June 2023)

- "2025 Code of Ethics & Standards of Practice," National Association of Realtors

- "Dual Agency Legal States 2024," World Population Review (2024)

- "Highlights From the Profile of Home Buyers and Sellers," NAR (November 2024)