How Cash Buyers Change Your Selling Strategy: A Guide to Fast Offers

- Published on

- 11 min read

-

Richard Haddad Executive EditorCloseRichard Haddad Executive Editor

Richard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

As a home seller, when an offer lands on your table, the dollar amount is usually the first thing you look at. But if that offer is all-cash, it can quickly change your thinking about what qualifies as your “best” offer. Even if it’s lower than you expected, you can find yourself asking, “Should I accept a cash offer for my house?”

That’s because a cash offer isn’t just about the money; it’s about speed, certainty, and a streamlined process. The trade-offs in convenience and reduced risk can often lead to a better net outcome, especially when time is of the essence.

This guide will give you a data-driven look at how to evaluate a sell-your-house-fast cash offer. We’ll also provide a cash offer comparison calculator to help you decide if it’s the right move for you.

How does a cash offer change the selling process?

A cash offer is a proposal from a buyer who has enough funds on hand to purchase your home outright, without needing to secure a mortgage from a lender. This changes your selling strategy by removing the financing contingency — one of the most common hurdles that can cause a traditional sale to fall apart. The result is a much faster, simpler, and more certain path to the closing table.

Unlike a financed sale, which can take 30 to 60 days to close, a cash transaction can often be completed in as little as 7 to 14 days — sometimes even sooner. This accelerated timeline is possible because you bypass several time-consuming steps:

- No financing contingency: You don’t have to wait for the buyer’s loan to be underwritten and approved. This eliminates the risk of the buyer’s financing falling through at the last minute, a major point of uncertainty in traditional sales.

- No lender-required appraisal: While a cash buyer may still opt for an appraisal to ensure they aren’t overpaying, it isn’t required by a lender. This removes another potential obstacle, as a low appraisal can often derail a financed deal or force price renegotiations.

- Fewer hurdles: The entire process involves less paperwork and fewer parties, typically leading to a much smoother and more predictable closing.

Who are the typical cash buyers for homes?

Cash buyers come in many forms, from individuals using their savings to large-scale house-buying companies and investment groups. Each type has different motivations that influence their offers and terms. The best fit depends on your home’s condition and your selling priorities. Here’s a snapshot of the four main types of buyers who use cash.

Individual homebuyers

These are everyday buyers who happen to have the cash on hand to purchase a home. They might be retirees downsizing, wealthy individuals, or people who have recently sold another property or stocks. There is also a growing number of buyers using innovative programs like HomeLight’s Buy Before You Sell to unlock the equity from their current home, allowing them to make a compelling, non-contingent cash offer on their next one.

Real estate investors and house flippers

Investors and house flippers purchase properties as a business venture. Their primary goal is to generate a return on investment, either by renovating and reselling the property for a profit (flipping) or by turning it into a long-term rental. Their strategy depends on buying low, so their offers are usually below market value. However, they purchase homes quickly and “as-is,” saving you the time and expense of making repairs.

We Buy Houses companies

We Buy Houses companies are essentially large real estate investor groups that buy homes for flipping or as rental properties. They frequently target properties that are distressed or in need of significant repairs. One company’s marketing slogan, “We Buy Ugly Houses,” says it all. While they offer a fast solution for sellers who have a property that would be difficult to sell on the open market, their offers are lower than what you could get from other types of buyers.

iBuyers (Instant Buyers)

iBuyers are large, technology-driven companies like Opendoor or Offerpad that offer speed but charge service fees. They use algorithms to make near-instant cash offers on homes. Unlike investors and flippers, traditional iBuyers purchase homes that are in relatively good condition, make light repairs, and then resell them. An iBuyer offer provides speed and convenience but usually comes with a 5%-6% service fee, similar to a real estate agent’s commission.

A top agent can often get you more: Even if you decide to sell as-is, or you’re looking for a cash offer, HomeLight data shows that the top 5% of agents sell homes for up to 10% more than average agents. It’s wise to consult with an expert local real estate agent before you sign a purchase offer from a We Buy Houses company or investor.

Try our cash offer comparison calculator

Use our cash offer comparison calculator below to see how these cash buyers might differ in their offer prices. Enter different home values and repair costs to create example scenarios. While this tool can give you rough estimates, your results will depend on the condition of your home, its location, and the buyer you work with. Learn more on our post: How Much Do House-Buying Companies Pay.

Should I accept a cash offer for my house? Pros and cons

Deciding if you should accept a cash offer depends on balancing your financial goals with your personal needs for speed and convenience. The right choice ultimately comes down to weighing the trade-offs between potentially higher prices on the open market and the guaranteed certainty of a cash sale.

| Pros | Cons |

| Speed and a defined timeline: With no lender involved, you can close in a matter of days or weeks. This is a significant advantage if you need to sell your house fast for a job relocation or to coordinate the purchase of your next home. | Lower sale price: The biggest drawback is that cash offers, particularly from investors and house-buying companies, often come in below the home’s full market value. You are paying for the convenience and speed they offer you. |

| Certainty of closing: The risk of a deal falling through is substantially lower. Financing issues are among the most common reasons sales are delayed or terminated. A cash offer eliminates this worry. | Less market exposure: Accepting an off-market cash offer means you bypass the open market. You won’t know if you could have received a higher price or sparked a bidding war among multiple buyers. |

| Convenience and fewer hassles: Many cash offers are for the property in its current condition, meaning you can skip the stress of making repairs, staging your home, and accommodating repeated showings. | Little or no room to negotiate: Unless you’re selling your home on the MLS through an individual cash buyer, cash offers from investors and We Buy Houses groups are usually “take it or leave it.” |

| Simplified process: With less paperwork and fewer contingencies, the path from offer to closing is much more straightforward. You can also avoid ongoing carrying costs, like property taxes, insurance, and utilities. | Risk of scams: Not all cash buyers are legitimate. House-buying scams are common. Unscrupulous individuals use cash offers as bait to draw you in. Be certain you’re working with a trusted, established cash buyer. |

To learn more about the benefits and drawbacks, see our post: We Buy Houses Pros and Cons for an Informed Decision.

How to find a trusted cash buyer

If you’d like to see a no-obligation, all-cash offer from a trusted and vetted cash buyer, try HomeLight’s Simple Sale platform. You can receive a cash offer in 24 hours and close in as few as 7 days. You’ll also see an estimate of what a top agent could sell your home for, so you can see both options in one place.

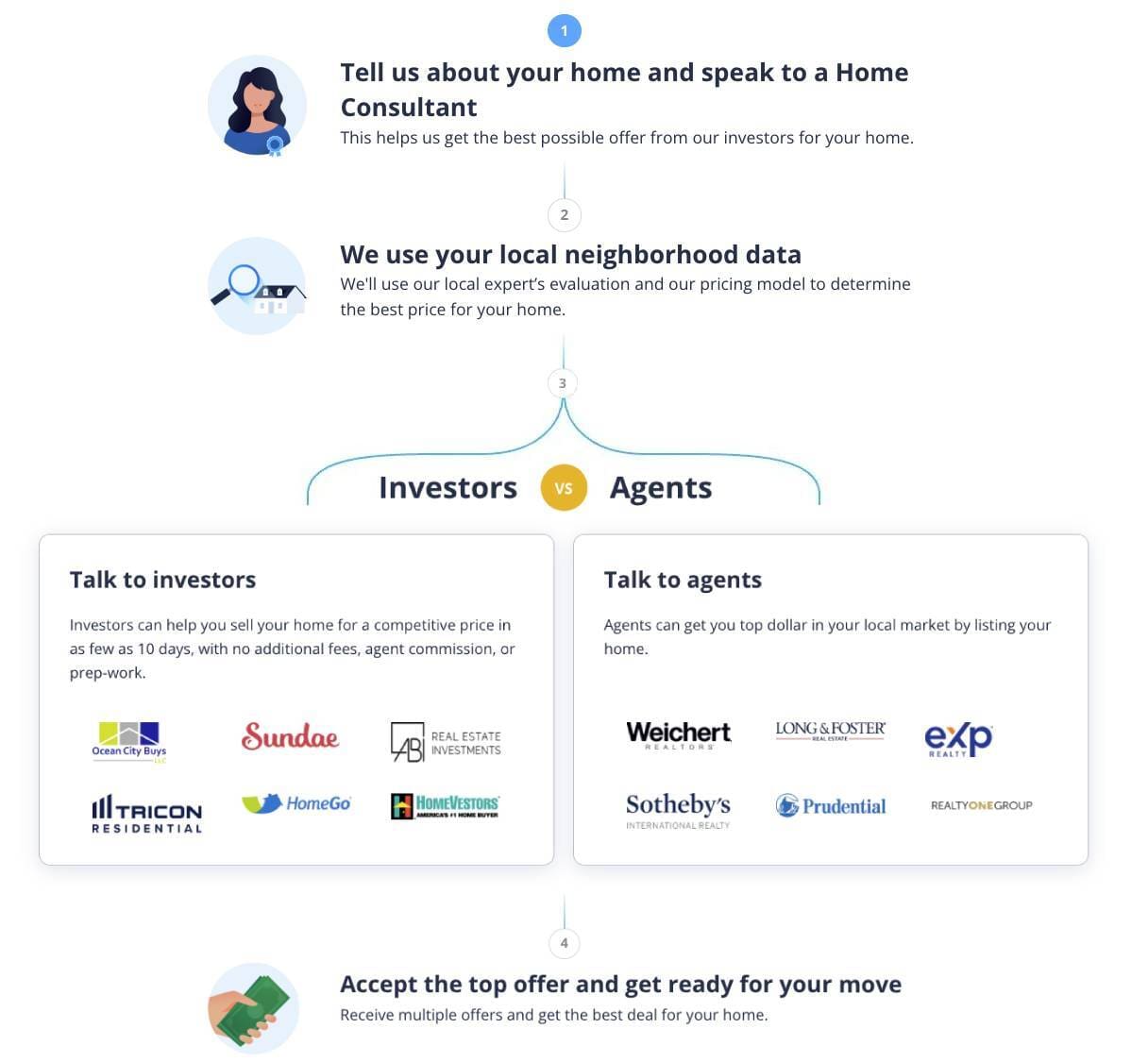

The 4-step Simple Sale process starts with entering a few details about your home:

When does accepting a fast cash offer make sense?

Accepting a fast cash offer can be the right choice depending on your needs and circumstances. It’s often the best path forward when speed, convenience, and certainty are more valuable to you than achieving the absolute highest possible price.

Here are some common situations where a fast cash offer is the ideal solution:

- You’re on a tight timeline: If you’re relocating for a new job, need the equity for your next home purchase, or you simply want to move on quickly, a cash offer provides a definite closing date you can plan around.

- You’ve inherited a property: Managing an inherited home, especially from a distance, can be emotionally and financially draining. A cash sale allows you to liquidate the house quickly without having to manage repairs, cleanouts, or a lengthy sales process.

- The home needs extensive repairs: If your property has significant structural issues, a dated interior, or other major problems, selling it as-is to a cash buyer can be far easier than investing tens of thousands of dollars in renovations with no guarantee of return.

- You’re facing financial hardship: For homeowners at risk of foreclosure or needing to liquidate assets due to divorce or other financial pressures, a fast cash sale can provide immediate relief and a way to move forward with certainty.

- You want to avoid the stress of a traditional sale: Some sellers simply prefer to avoid the hassles of staging, showings, open houses, and negotiations. A cash offer provides a private, simple, and predictable transaction.

How to evaluate a cash offer and protect yourself

While a cash offer can be very appealing, it’s important to approach it with a clear head and a healthy dose of skepticism. To be certain you’re getting a fair deal and protecting yourself from potential pitfalls (and scams), here are four steps to help you evaluate an offer.

1. Verify proof of funds (POF): Ask for a recent bank statement or letter confirming the buyer has the cash. A legitimate cash buyer will have no problem providing this.

2. Scrutinize the purchase agreement: Review the inspection period, closing date, and any contingencies. Some investors include lengthy inspection periods or clauses that allow them to sell the contract to another buyer (a practice known as wholesaling).

3. Compare the offer to your home’s market value: Even with an as-is sale, the offer should be reasonable. A top real estate agent can prepare a comparative market analysis (CMA) to give you a data-backed estimate of your home’s current value.

4. Get multiple offers if possible: Don’t feel pressured to accept the first cash offer that comes your way. Even if you need a fast sale, when possible, take an extra day or two to get more than one cash offer, and then compare your options.

Find your best path forward with HomeLight

Ultimately, how cash buyers change your selling strategy depends on your priorities. The key is to have a clear understanding of all your options. HomeLight is uniquely positioned to help you do just that.

- Get a cash offer from a trusted buyer: Our Simple Sale platform connects you to the largest network of pre-vetted cash buyers in the U.S.

- Partner with a top-performing agent: If maximizing your sale price is the goal, our free Agent Match tool can connect you with a top real estate agent in your area. We analyze millions of transactions to find agents who sell homes faster and for more money.

If you are unsure of your next step, consult with a top agent who can provide expert pricing strategy, marketing, and negotiation to get you the best possible outcome. Many top agents also have a network of local cash buyers.

Whether you need the speed and certainty of a cash sale or the top-dollar potential of an agent-led listing, HomeLight provides the tools and data you need to make the smartest decision for your home and your future.

You’ll find more helpful tips and resources in HomeLight’s Seller Resource Center.

Header Image Source: (Lisa Anna/ Unsplash)