How Can I Sell My House for Cash in Alabama?

- Published on

- 11 min read

-

Cheyenne Wiseman Associate EditorCloseCheyenne Wiseman Associate Editor

Cheyenne Wiseman is an Associate Editor at HomeLight.com. Previously, she worked as a writer for Static Media (Mashed.com and Chowhound.com) and as an editor for CBR.com. Cheyenne holds a bachelor’s degree in English from UC Davis, where she also founded and led a literary magazine called Open Ceilings. She has four years of experience writing and editing on topics including real estate, financial advising, and pharmaceuticals.

If you’re asking, “How can I sell my house for cash in Alabama?” you may be looking for a straightforward way to move on without dealing with repairs, showings, or a long sales process.

From fast-growing cities like Huntsville and Birmingham to college towns such as Auburn and Tuscaloosa — and quieter rural communities in between — seller needs can vary widely across the state. Some homeowners want a quick, certain closing, while others are deciding whether fixing up a home could bring a higher payoff.

This post walks through the two most common ways to receive an all-cash offer in Alabama, explains how pricing can differ based on condition and location, and helps you decide which option best fits your timeline and goals.

Options to sell my house for cash in Alabama

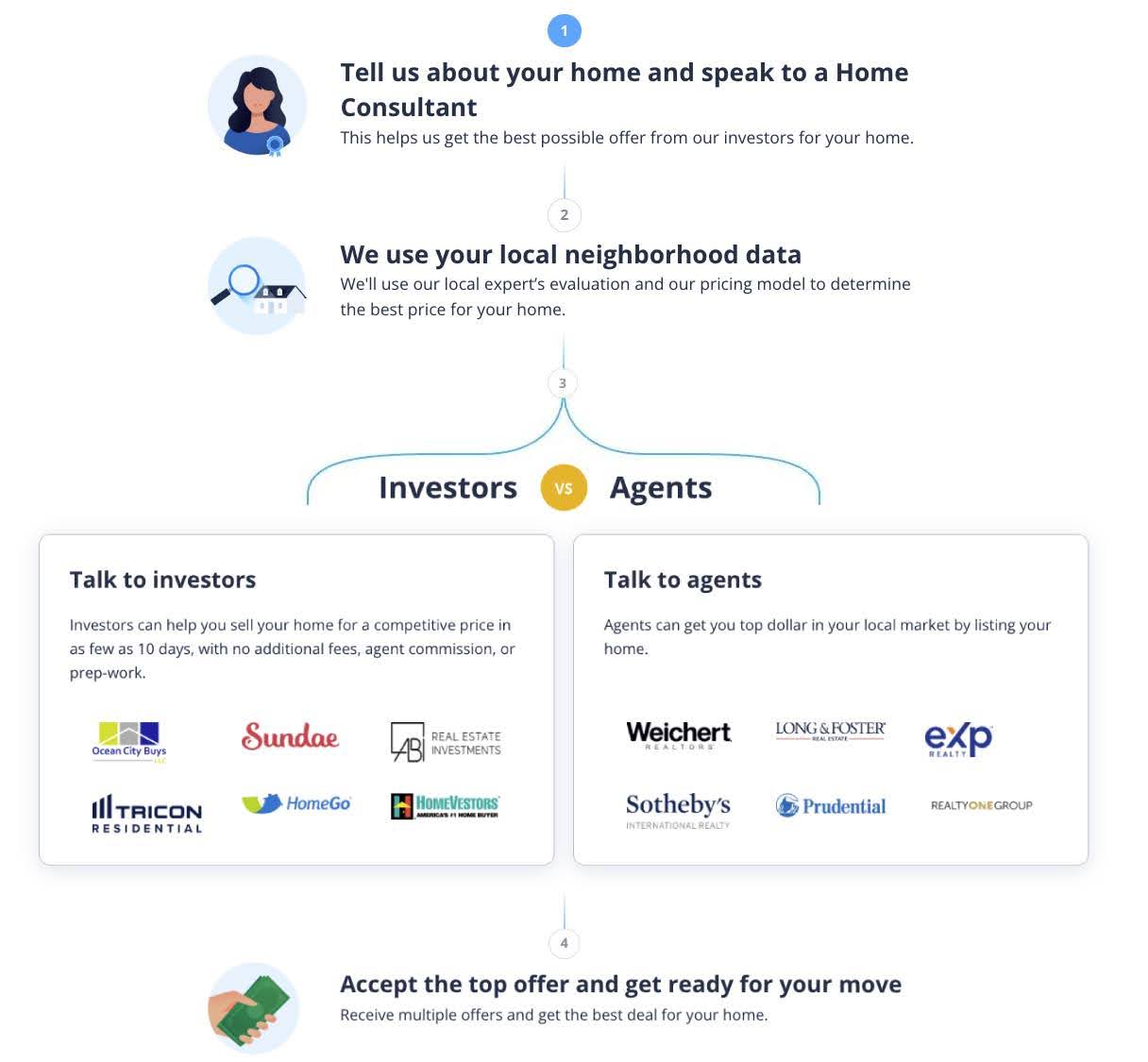

If you’re wondering, “How can I sell my house for cash in Alabama?” there are two main paths to consider. You can sell directly to a house-buying company or investor, or work with a real estate agent who can help bring in a cash buyer from the open market. Each approach offers its own balance of speed, effort, and potential proceeds.

Before we get into the details, use the calculator below to see how a cash offer in Alabama could compare based on the route you choose.

As the estimates show, cash offers tend to be higher when an Alabama home is in good condition. Still, many sellers don’t have the time, budget, or interest to take on repairs — especially with older homes common across the state. For homeowners facing a job relocation, financial pressure, or an inherited property located out of state, the speed and certainty of an all-cash sale can be a worthwhile tradeoff.

Here’s what you can expect from each option for selling a house for cash in Alabama.

Option 1: Sell to a cash buyer company in Alabama

House-buying companies and investor groups focus on purchasing homes for cash. Many of them buy properties in as-is condition, which means you don’t need to clean, make repairs, or stage your Alabama home. These are often known as “We Buy Houses” companies.

Other house-buying companies that serve Alabama, known as iBuyers, only consider homes in good condition or move-in-ready “turnkey properties.” Most iBuyers, including companies like Opendoor and Offerpad, pay higher cash offers but charge a fee of around 5% of the home’s price.

We Buy Houses companies in Alabama usually follow a process that looks like this:

- You submit information about your Alabama property online or by phone.

- They evaluate the home using local market data and often an in-person visit.

- You receive a no-obligation cash offer, often within 24 to 48 hours.

- If you accept, closing can happen in as little as 7 to 14 days.

Some Alabama cash buyers renovate and resell homes, while others hold them as rentals or long-term investments. In most cases, they aim to buy below market value to leave room for profit.

Many investors rely on the 70% rule, meaning they typically won’t pay more than 70% of a home’s after-repair value minus renovation costs. The calculator above reflects both this rule and a looser 80% guideline used by some rental investors.

These are general benchmarks, not guarantees. Actual offers in Alabama can vary based on the home’s condition, location, and local demand.

»Learn more: 6 Top We Buy Houses for Cash Companies in Alabama

Pros and cons of selling to an Alabama cash buyer company

| Pros | Cons |

| Speed: Close and get paid in days rather than months | Lower sale price: Offers are usually below full market value |

| No repairs required: Sell your Alabama home exactly as it sits | Limited negotiation: Most offers are take-it-or-leave-it |

| Convenience: No showings, open houses, or negotiations | Less competition: The home isn’t exposed to multiple buyers |

| No fees or commissions: Many companies cover closing costs | Not right for everyone: An agent-guided sale can benefit some |

| Certainty: Fewer financing issues that could delay closing | Risk of scams: Not every cash investor is reputable |

While many legitimate investors operate throughout the Yellowhammer State, it’s important to watch for red flags. Be cautious of companies that pressure you to sign quickly, lack verified reviews, or don’t show local market knowledge. Transparency and a proven track record matter.

»Learn more: We Buy Houses Pros and Cons: Make an Informed Decision

A better way to find trusted cash buyers in Alabama

HomeLight’s Simple Sale platform can connect you with the largest network of pre-vetted cash buyers in Alabama and throughout the country, helping you review offers without navigating the investor market on your own.

Here’s what to expect from the Simple Sale process:

You’ll enter some information about your Alabama home and receive a no-obligation offer within 24 hours. If you choose to move forward, you can close in as few as 7 days or select your own closing date. You’ll also receive an expert estimate of what your home could sell for with a top Alabama real estate agent, making it easier to compare options.

Option 2: Attract a cash buyer with a top Alabama agent

Not all cash offers come from investors. In Alabama’s housing market, many individual buyers come prepared with cash — including downsizers and buyers relocating from states like California or New York to enjoy more space and lower costs. A top Alabama real estate agent can help position your home to appeal to these buyers.

»Learn more: Why Hire a Real Estate Agent When You’re Selling or Buying

Pros and cons of selling with a top Alabama agent

| Pros | Cons |

| Higher sale price: Agents can help your home attract multiple offers | Slower timeline: A conventional listing can take weeks or months to close |

| Expert help: Pricing, marketing, and negotiations taken care of | Prep work required: You may need to clean, stage, or make repairs before listing |

| Broad market access: Reach more cash buyers through the MLS and agent networks | Multiple showings: The process involves showings and open houses |

| Less stress: Agents manage complex tasks for you | Commission fees: You’ll need to budget for agent fees (a percentage of the sale price) |

| Legal protection: Guidance on disclosures and federal fair housing laws | Uncertainty: There’s no guarantee of a speedy sale, and offers can fall through |

»Learn more: Should I Sell to a Home Investor or List With an Agent?

The easy way to find top-rated Alabama agents

If you’re leaning toward working with an agent, HomeLight’s free Agent Match platform can connect you with Alabama’s top performers based on real transaction data. We analyze more than 27 million sales and thousands of reviews to find the right fit for your needs.

Whether you’re trying to attract a cash buyer or simply want to understand all your options, the right Alabama agent can help you maximize your sale. Share a few details about your goals and timeline to get a no-obligation consultation.

What can affect your cash offer price in Alabama?

In Alabama, cash offer prices often depend on location, condition, and current market activity. Homes in higher-demand areas like Huntsville, Birmingham, Mobile, and college towns such as Auburn or Tuscaloosa tend to draw stronger interest than properties in more rural parts of the state.

Alabama’s mix of older housing and newer builds means homes needing repairs may see lower investor offers, while well-kept properties can attract higher-paying cash buyers. Market trends also play a role: median prices have risen sharply year over year, even as inventory has grown, making buyers more selective.

Want a clearer sense of where your home stands? HomeLight’s free Home Value Estimator can help you gauge value before comparing your best cash-sale options below.

Which cash sale option is right for you?

If speed and simplicity matter most, selling to a vetted Alabama cash buyer through HomeLight’s Simple Sale platform may be the better fit — whether your home is in Birmingham, Mobile, Huntsville, Montgomery, or a smaller town in between.

If you have more flexibility and want to aim for a higher price, taking the time to list with a top Alabama agent could pay off, especially in higher-demand areas like Huntsville’s tech corridors or near Auburn and Tuscaloosa.

When you request a Simple Sale offer, you’ll also receive an expert estimate of what your Alabama home could sell for with a leading local agent, making it easier to compare both paths.

Still asking, “How can I sell my house for cash in Alabama?” Use the Home Cash Offer Comparison Calculator above, then request a no-obligation offer or speak with a trusted Alabama expert to move forward with confidence.

Header Image Source: (Seiji Seiji/Unsplash)