How to Sell My House for Cash in Cary

- Published on

- 8 min read

-

Alexandra Lee Associate EditorClose

Alexandra Lee Associate EditorClose Alexandra Lee Associate Editor

Alexandra Lee Associate EditorAlexandra is an associate editor of HomeLight.com. Previously, she served as a writer and social media manager at Santa Barbara Life & Style Magazine, in addition to interning at the nonprofit honors society Phi Beta Kappa. Alexandra holds a bachelor's degree in communication and global studies from UC Santa Barbara, and she has three years of experience reporting on topics including international travel, luxury properties, celebrity interviews, fine dining, and more.

If you’re looking to sell a house for cash in Cary, you’re likely prioritizing a fast and straightforward sale. Whether you’re dealing with a home that needs major updates in established neighborhoods like MacGregor Downs or Lochmere or managing an inherited property near downtown Cary, a cash sale can help you skip prep work, avoid repairs and showings, and close on a timeline that works for you.

The three big questions on your mind might be:

- How do I sell a house for cash in Cary?

- What does this convenience cost?

- How much more can I get for my Cary house if I make repairs?

Cary and what your offer might look like depending on the buyer, your home’s condition, and whether you choose to make repairs or sell as-is.

Options to sell my house for cash in Cary

Homeowners in Cary typically have two ways to sell for cash: by working directly with a house-buying company or investor, or by hiring a real estate agent who can attract a traditional buyer who prefers to pay cash. Your proceeds will likely vary depending on which approach you take.

Before we dive into the details, use the calculator below to see how a cash offer in Cary might stack up depending on your selling method.

As you can see, a cash offer will likely be significantly higher for Cary homes that have been well-maintained; however, not every seller has the time, resources, or desire to undertake major repairs before moving. For homeowners who are dealing with a sudden life or job change, financial pressure, or the need to sell an inherited property from out of state, a cash offer may be the most speedy and convenient solution.

Below, we’ll take a closer look at what you can expect from each option to sell a house for cash in Cary.

Option 1: Sell to a cash buyer company in Cary

House-buying companies and investor groups specialize in purchasing homes for cash. Many of them accept properties in “as-is” condition, meaning you don’t need to clean, stage, or make repairs to your Cary home. These are commonly known as “We Buy Houses” companies.

Other house-buying companies that serve Cary, or iBuyers, only purchase homes in good condition or move-in-ready “turnkey properties.” The most well-known iBuyers are Opendoor and Offerpad, which usually pay higher cash offers but charge service fees of around 5% of the home’s sale price.

We Buy Houses companies in Cary typically follow a similar streamlined process:

- You submit information about your Cary property online or by phone.

- They assess the home’s value using local market data and an on-site visit.

- You receive a no-obligation cash offer, often within 24 to 48 hours.

- If you accept, they can close in as little as 7 to 14 days.

While some Cary cash buyers focus on fixing and flipping homes, others rent them out or hold them as long-term investments. In general, their goal is usually to purchase homes below market value in order to generate a profit.

Most We Buy Houses investors in Cary follow the 70% rule of house flipping, which suggests that the purchase price should not exceed 70% of a home’s after-repair value (ARV) minus the estimated cost of the repairs. The comparison calculator above demonstrates a range of the 70% rule, as well as an 80% guideline used by many rental property investors.

Keep in mind that these are only general rules, and some Cary cash-for-homes companies may offer more or less depending on the property’s condition and location.

»Learn more: 5 Top We Buy Houses for Cash Companies in Cary

Pros and cons of selling to a Cary cash buyer company

| Pros | Cons |

| Speed: Close the deal and get paid in a matter of days, not months | Lower sale price: Offers typically fall below market value |

| No repairs required: Sell your Cary home exactly as it stands | No negotiation: Most companies present a take-it-or-leave-it cash offer |

| Convenience: Skip the showings, open houses, and drawn-out negotiations | Less competition: You won’t exposing the home to a pool of potential buyers |

| No fees or commissions: Most cash buyers will cover closing costs in full | Not suitable for all situations: An agent-led sale can make more sense for some |

| Certainty: Low risk of a deal falling through due to financing issues | Unscrupulous buyers and scams: Not every cash buyer is trustworthy |

Although there are many legitimate investors in Cary, it’s still important to keep an eye out for potential scams, such as a company that pressures you into making quick decisions or lacks an established track record or online presence. Instead, search for companies with verified reviews, strong market expertise, and clear, direct communication.

»Learn more: We Buy Houses Pros and Cons: Make an Informed Decision

A better way to find trusted cash buyers in Cary

HomeLight’s Simple Sale platform can connect you with the largest network of pre-vetted cash buyers in throughout Cary and the U.S., helping you review offers without having to sort through investors on your own.

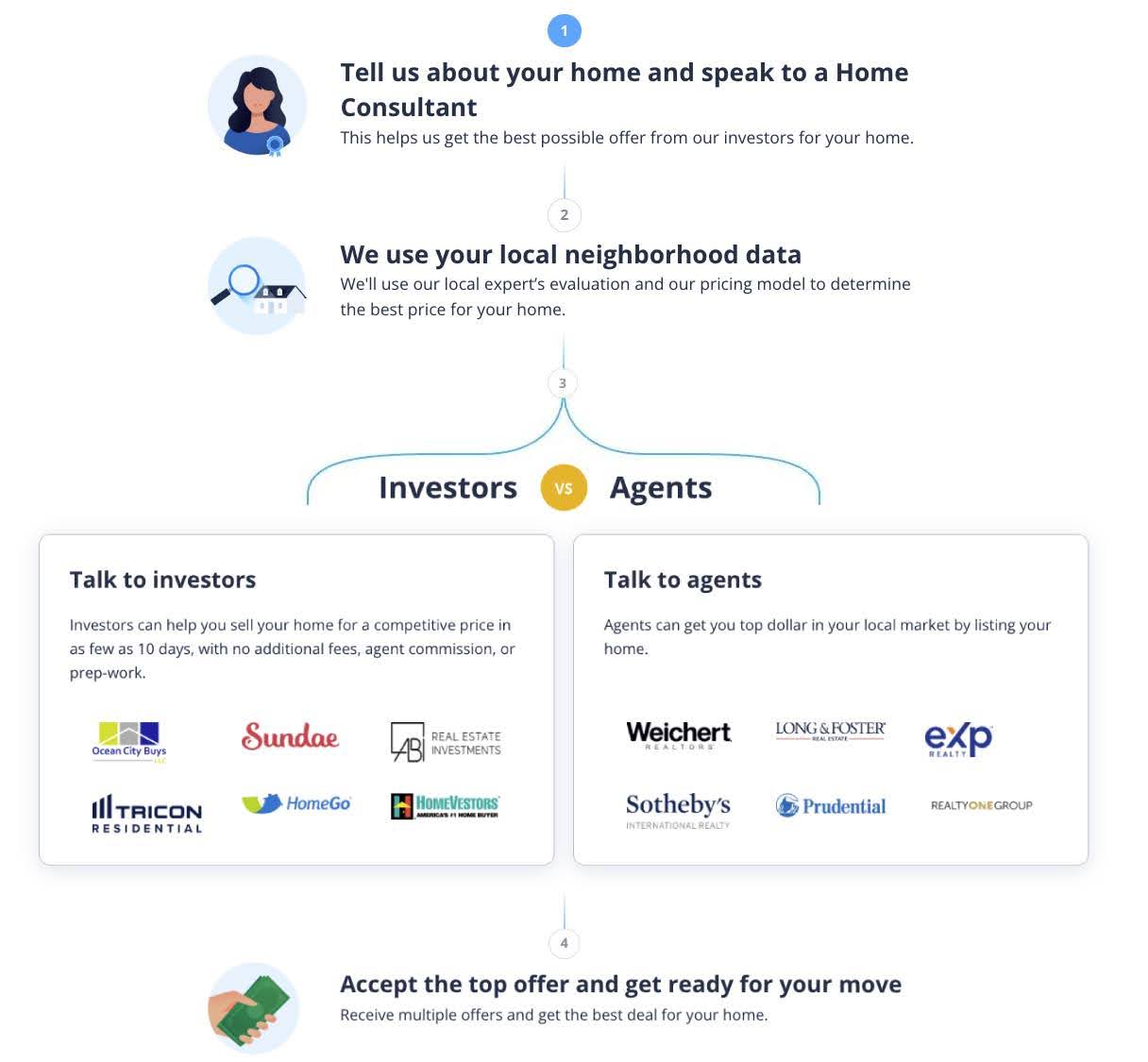

Here is the 4-step Simple Sale process:

To get started, you’ll enter a few details about your Cary home and receive a no-obligation offer within 24 hours. If you decide to move forward, you can close in as little as 7 days or choose your ideal move-out date. In addition, you’ll also receive an expert estimate of what your home could sell for with a top-rated Cary real estate agent, so you can compare both options side-by-side.

Option 2: Attract a cash buyer with a top Cary agent

Not all cash offers come from investors or companies. In Cary’s active housing market, many individual buyers come prepared with cash, whether they’re downsizing to a smaller home, relocating after selling a home in California, or looking for a second home within the Research Triangle. An experienced Cary real estate agent can help you market your home to attract these types of buyers.

»Learn more: Why Hire a Real Estate Agent When You’re Selling or Buying

Pros and cons of selling with a top Cary agent

| Pros | Cons |

| A higher sale price: Agents can boost your listing’s exposure to attract multiple offers | Longer timeline: A traditional listing in Cary can take weeks or even months to close |

| Professional guidance: Pricing, marketing, and negotiations are managed for you | Prep work required: You’ll likely need to clean, stage, or make upgrades before listing |

| Broad market access: Reach more cash buyers through the MLS and agent networks | Showings and disruptions: Selling with an agent typically involves multiple walkthroughs |

| Reduced stress: Agents handle complex tasks, saving you time and reducing uncertainty | Commission fees: Agent comissions will be a percentage of the final sale price |

| Legal protection: You’ll get guidance on disclosures and federal fair housing laws | Uncertainty of sale: There is no guarantee of a quick sale, and offers can still fall through |

»Learn more: Should I Sell to a Home Investor or List With an Agent?

The easy way to find top-rated Cary agents

If you’re considering partnering with a real estate professional, HomeLight’s free Agent Match platform can connect you with Cary’s top-performing agents based on real transaction data. We analyze data from over 27 million transactions and thousands of client reviews to determine which agent is the right fit for your specific situation.

Whether you want to attract a quick cash offer or prefer to explore all your options first, the right Cary agent will help you get the most from your sale. For a no-obligation consultation with a trusted agent, share a little about your selling goals and timeline.

What can affect your cash offer price in Cary?

Several local factors can influence how much cash buyers are willing to pay for a home in Cary. Location and neighborhood planning play a major role, with properties in established communities like MacGregor Downs, Lochmere, or Preston often attracting stronger interest thanks to their proximity to Research Triangle employers. Homes near downtown Cary or with easy access to major corridors like US-1 and I-40 may also appeal to cash buyers seeking convenience and long-term demand.

Home condition and age are also key considerations, as many Cary homes were built in the 1990s and early 2000s and may need updates to kitchens, baths, or major systems. Cash buyers typically factor those upgrade costs directly into their offers, while well-maintained homes can command more competitive pricing.

Before weighing any cash offers, use HomeLight’s free Home Value Estimator to understand what your Cary home might be worth in today’s market.

Which cash sale option is right for you?

If speed, convenience, and a no-fuss experience top your priority list, selling to a vetted Cary cash buyer through HomeLight’s Simple Sale platform may be the right fit — especially if you’re juggling a move tied to the Research Triangle, managing a dated home, or working around a tight timeline.

If you’re willing to take more time to potentially earn a higher price — and don’t mind preparing your home for the market — working with a top Cary agent could make the most sense. In established communities like Lochmere, Preston, or MacGregor Downs, well-prepared homes can sometimes attract strong buyer interest, including competitive cash offers.

When you request an offer from Simple Sale, you’ll also receive an expert estimate of what your Cary home could sell for with a top agent, so you can confidently compare both options.

Still undecided about selling a house for cash in Cary? Use the Home Cash Offer Comparison Calculator above for an idea of what your home could sell for, depending on your preferred method. From there, you can request a no-obligation offer or consult with a trusted Cary expert for personalized advice.

While there’s no one-size-fits-all answer, with the right tools and expert support you can make a confident, well-educated decision.

Header Image Source: (Meri Vasilevski / Unsplash)