How to Sell My House for Cash in Omaha

- Published on

- 8 min read

-

Cheyenne Wiseman Associate EditorClose

Cheyenne Wiseman Associate EditorClose Cheyenne Wiseman Associate Editor

Cheyenne Wiseman Associate EditorCheyenne Wiseman is an Associate Editor at HomeLight.com. Previously, she worked as a writer for Static Media (Mashed.com and Chowhound.com) and as an editor for CBR.com. Cheyenne holds a bachelor’s degree in English from UC Davis, where she also founded and led a literary magazine called Open Ceilings. She has four years of experience writing and editing on topics including real estate, financial advising, and pharmaceuticals.

If you’re asking, “Should I sell my house for cash in Omaha, NE?” chances are you’re looking for a quick, straightforward transaction. With this type of sale, you can skip the prep work, avoid making repairs, bypass showings, and close on a schedule that works for you.

The three big questions on your mind might be:

- How do I sell a house for cash in Omaha?

- What does this convenience cost?

- How much more can I get for my Omaha house if I make repairs?

In this post, we’ll walk through the two most common ways to secure an all-cash offer in Omaha — and what your payout might look like depending on who you sell to and whether you make repairs or sell the home “as is.”

Options to sell my house for cash in Omaha

Omaha homeowners generally have two main paths to sell for cash: working with a house-buying company or investor, or enlisting a real estate agent who can help attract a cash offer from a traditional buyer. Each option can yield different net proceeds.

Before we get into the details, try the calculator below to see how a cash offer in Omaha might compare based on your selling approach.

As you can see, if your Omaha home is in great shape, you’ll typically see a higher cash offer. But not every seller has the time, budget, or motivation to tackle major upgrades before listing. For those facing a sudden job relocation, financial pressure, or the need to sell an inherited property from out of state, the speed and simplicity of an all-cash deal can be a huge advantage.

Here’s what you can expect from the main options to sell a house for cash in Omaha.

Option 1: Sell to a cash buyer company in Omaha

Cash buyer companies and investor groups purchase homes directly for cash. Many buy properties in as-is condition — meaning no repairs, staging, or even a deep clean are required. These are often referred to as We Buy Houses companies.

Some cash buyers in Omaha operate as iBuyers, which generally focus on homes that are move-in ready or in excellent condition (i.e., “turnkey properties”). Popular iBuyer companies like Opendoor and Offerpad tend to offer higher purchase prices than traditional investors, but they also charge service fees of around 5% of the home’s value.

We Buy Houses companies in Omaha typically follow a similar approach:

- You provide details about your Omaha property online or over the phone.

- They assess the home’s value using local market data and an on-site visit.

- You receive a no-obligation cash offer, often within 24 to 48 hours.

- If you accept, closing can happen in as little as 7 to 14 days.

Some Omaha investors focus on flipping properties, while others purchase them to rent or hold long-term. Their goal is usually to buy at a price below market value, creating a margin for profit.

Many Omaha cash buyers use the 70% rule in house flipping, which means they won’t pay more than 70% of the property’s after-repair value (ARV) minus repair costs. Our calculator above also factors in an 80% guideline that’s common for rental property investors.

Of course, these are only general benchmarks — offers can vary based on location, demand, and the home’s condition.

»Learn more: 5 Top We Buy Houses for Cash Companies in Omaha

Pros and cons of selling to an Omaha cash buyer company

| Pros | Cons |

| Fast closings: Close and get paid in a matter of days, not months | Lower sale price: Offers are typically below market value |

| No repairs necessary: Sell your Omaha home in its current condition | Firm offers: There’s typically no negotiating with a cash offer |

| Convenience: No showings, open houses, or negotiations required | Less competition: You’re not exposing the home to multiple buyers |

| No fees or commissions: Most companies absorb closing costs | Not ideal for all sellers: An agent-assisted sale can be more profitable for some |

| Certainty: There’s less risk of a deal falling through due to financing | Unscrupulous buyers and scams: Not every cash investor is reputable |

While there are many reputable investors in Omaha, be cautious. Watch for red flags such as high-pressure tactics, a lack of verifiable reviews, or no clear business presence. The safest route is working with buyers with proven local expertise and transparent communication.

»Learn more: We Buy Houses Pros and Cons: Make an Informed Decision

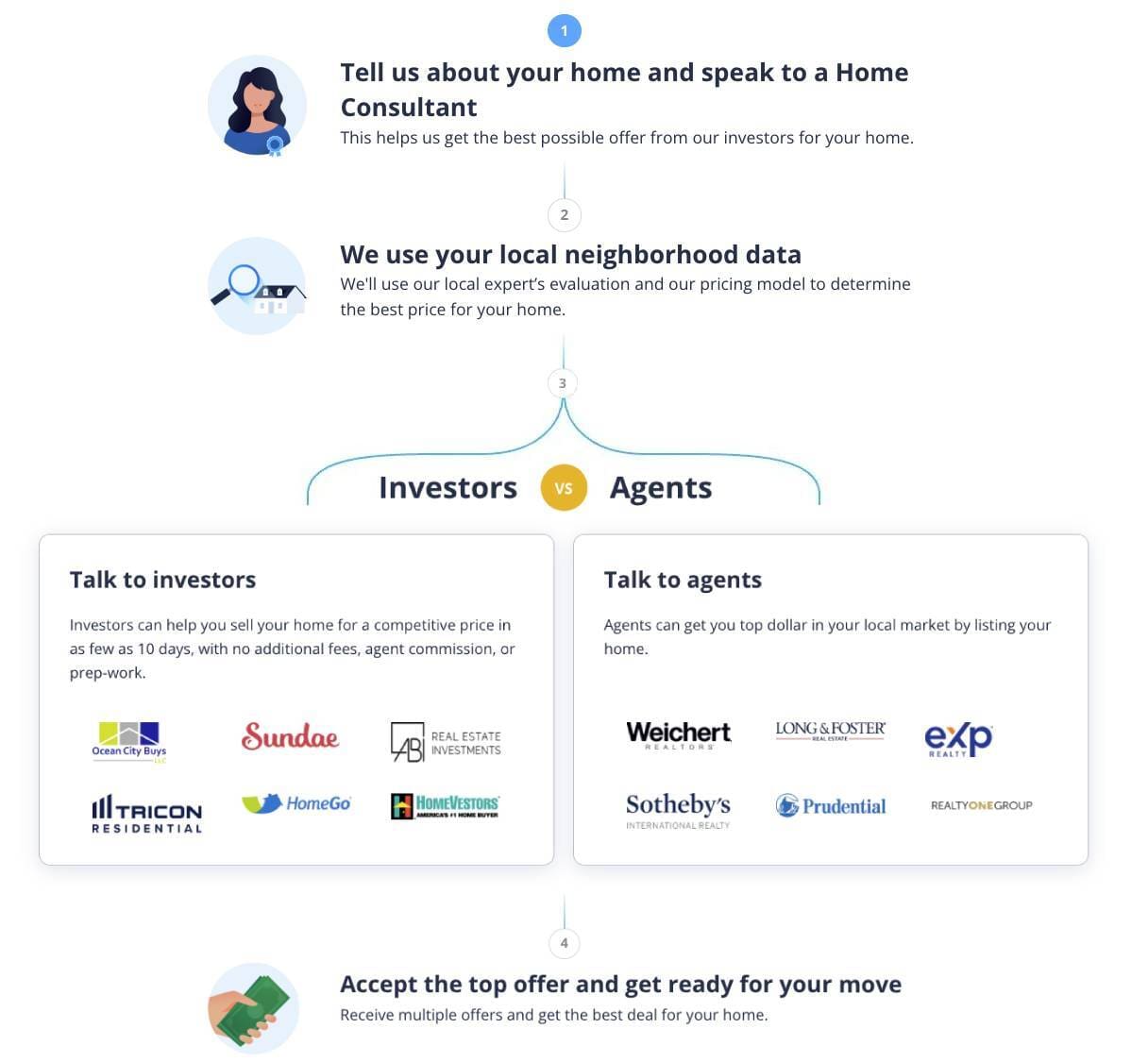

A better way to find trusted cash buyers in Omaha

HomeLight’s Simple Sale platform gives you access to one of the largest networks of pre-vetted cash buyers in Omaha and across the country. This makes it easier to compare offers without having to approach investors on your own.

Here’s the four-step Simple Sale process:

Just enter a few basic details about your Omaha home and receive a no-obligation offer within 24 hours. If you accept, you can close in as few as 7 days or choose your closing date. You’ll also receive an expert estimate of what your house might sell for using a leading Omaha real estate agent, so you can compare each option.

Option 2: Attract a cash buyer with a top Omaha agent

Not all cash offers come from investors or companies. In Omaha’s competitive housing market, many individuals pay with cash, whether they’re downsizing, relocating after selling a home in Iowa, or looking for a second home to take advantage of the city’s affordable housing market. A top Omaha real estate agent can help position your home to attract these buyers.

»Learn more: Why Hire a Real Estate Agent When You’re Selling or Buying

Pros and cons of selling with a top Omaha agent

| Pros | Cons |

| A better sale price: Agents can increase exposure to attract multiple offers | Longer timeline: A traditional listing can take weeks or months to close |

| Professional expertise: Pricing, marketing, and negotiations are handled for you | Home prep work: You may need to clean, stage, or complete repairs before you list |

| Broad market reach: Access more cash buyers through the MLS and agent networks | Showings and disruptions: Selling this way typically involves multiple walkthroughs |

| Peace of mind: Agents manage complex tasks, leaving you with less stress | Commission fees: You’ll need to budget for agent fees (a percentage of the sale price) |

| Legal guidance: Help with disclosures and federal fair housing laws | Uncertainty: There’s no guarantee of a speedy sale, and offers can fall through |

»Learn more: Should I Sell to a Home Investor or List With an Agent?

The easy way to find top-rated Omaha agents

Want to work with an agent? HomeLight’s free Agent Match platform can connect you with Omaha’s best-performing agents based on real transaction data. We analyze over 27 million transactions and thousands of reviews to pair you with the best agent for your needs.

Whether you’re planning to get a cash offer or simply exploring your options, the right Omaha agent can help you maximize your sale. For a no-obligation consultation with a trusted agent, tell us a little about your selling goals and timeline.

Which cash sale option is right for you?

If speed, convenience, and a smooth process are your top priorities, selling to a vetted Omaha cash buyer through HomeLight’s Simple Sale platform could be the right fit.

If you have the time to prepare your home and try for a higher sale price, working with a top Omaha real estate agent could be the better choice. Skilled agents understand how to highlight local draws — from the city’s affordable cost of living to its growing arts and dining scene — to attract serious buyers.

When you request a Simple Sale offer, you’ll also get a professional estimate of what your Omaha home could sell for on the open market with a top agent, so you can weigh both options.

Still asking, “What’s the best way to sell my house for cash in Omaha?” Use our Home Cash Offer Comparison Calculator above to see how your home’s value might vary depending on your selling approach. Then, request a no-obligation offer or consult with a trusted Omaha expert who knows the city’s market.

There’s no one-size-fits-all answer, but with the right tools and guidance, you can make a confident, well-informed choice.

Header Image Source: (Lawcain/DepositPhotos)