When Does It Make Sense to Rent vs. Own Your House?

- Published on

- 7-8 min read

-

Christine Bartsch, Contributing AuthorClose

Christine Bartsch, Contributing AuthorClose Christine Bartsch Contributing Author

Christine Bartsch Contributing AuthorFormer art and design instructor Christine Bartsch holds an MFA in creative writing from Spalding University. Launching her writing career in 2007, Christine has crafted interior design content for companies including USA Today and Houzz.

-

Jedda Fernandez, Associate EditorClose

Jedda Fernandez, Associate EditorClose Jedda Fernandez Associate Editor

Jedda Fernandez Associate EditorJedda Fernandez is an associate editor for HomeLight's Resource Centers with more than five years of editorial experience in the real estate industry.

When it comes to paying for a place to live and choosing between renting vs owning your home, which is better?

While there’s a strong argument for both positions, the truth is — there’s no right answer to this question.

However, there is a right answer for you.

Renting vs Owning a Home: The 7 factors that matter

With a swarm of opinions attempting to sway you into a decision, it can be difficult to determine if renting or owning a home is in your best interest.

Instead of telling you what to do, we’ve combed the data and consulted the experts to give you the facts on renting a home vs owning a home, so you’ll be well-equipped to figure out which living arrangement is right for your lifestyle and finances.

1. Analyze monthly housing costs

The first and most important factor to consider is pretty much a no-brainer — pick whichever option is cheaper for you month-by-month.

“When people are trying to decide whether to rent or buy, they should look at the rental rates in the neighborhood where they’re considering buying and compare it to how much the mortgage would cost on a similar property in the same area,” says Myra Beams, a top-selling agent in Hobe Sound, Florida.

“If you’re in an area with a high cost of living, sometimes it really is less expensive to buy a property as opposed to renting. So, if you’ve got some job stability, then you should start looking for a place to buy.”

Of course, figuring out your monthly housing expenses isn’t as simple as just looking at your potential monthly rent or mortgage payment amounts.

For example, if you’re paying $1,600 a month to rent a two-bedroom apartment — but you qualify to buy a two-bedroom home with a monthly mortgage payment of $1,500 — buying might sound like the smarter financial decision.

But not so fast.

That home may be in a neighborhood with a homeowners association (HOA) that requires an additional $350 a month in association fees.

Then, you’ll need to pay anywhere from $700 to $10,000 in annual property taxes depending on your state’s property tax rate. That averages out to an extra $60 to $850 a month.

Plus, your rent may cover other housing expenses, like utilities and maintenance costs, that you must pay for on your own when you’re the homeowner.

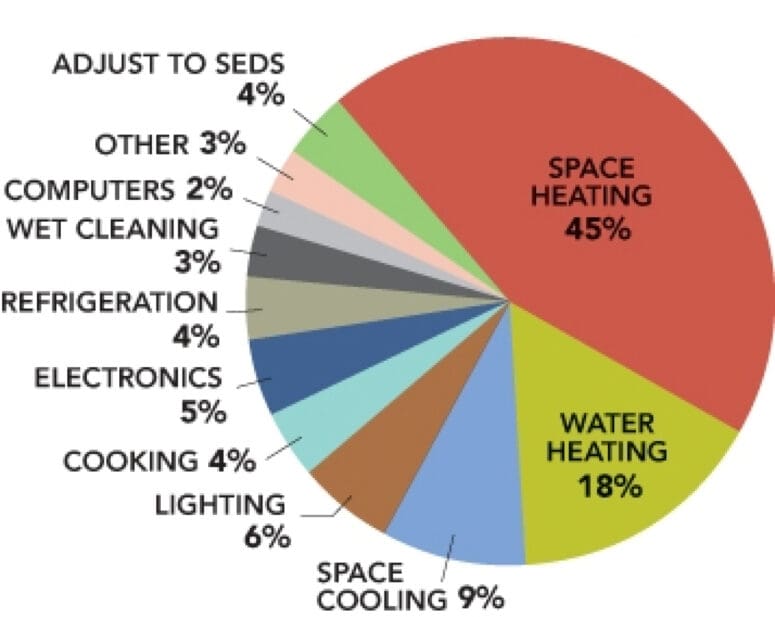

Location plays a big role in how expensive your utilities will be. However, the average household spends just over $2,000 on energy alone. That averages out to $167 a month just for electricity. You’ll still need to cover water, sewage, garbage, and gas.

- Source: Energy.gov

Add all those expenses onto that lower $1,500 mortgage payment and suddenly, you’re paying anywhere around $2,000 to $3,000 a month in housing costs.

Renting is sounding better and better, right?

Maybe not.

Homeownership comes with some big benefits that offset the money you might save by renting.

For starters, buying guarantees you a stable monthly payment. Even if a mortgage is more expensive than rent to start, your landlord will probably raise your rent annually — so you’ll have to either pay more and more every year, or move.

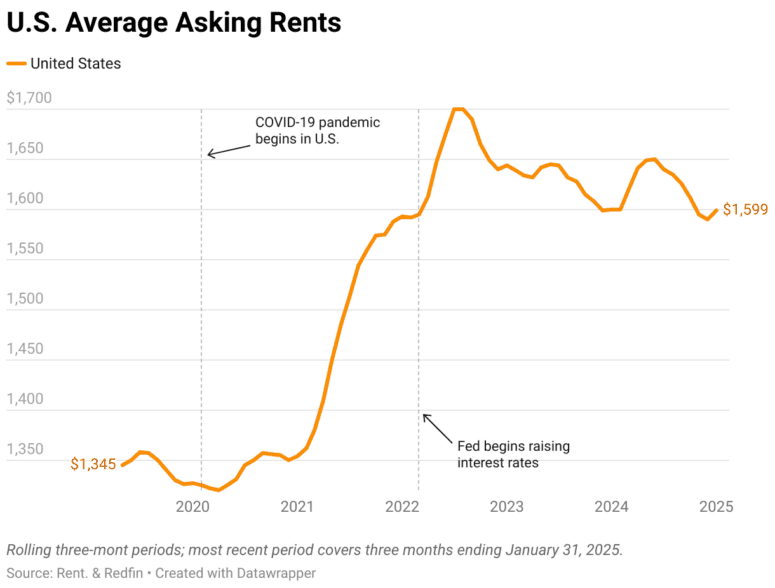

In fact, a recent report by Rent.com found that since the Fed raised interest rates in March 2022, rents have been elevated. Prices are currently holding steady, with a month-on-month growth of 0.5%, which could further increase once renters feel the effects of lower levels of new apartment construction.

When you buy, your monthly mortgage payment is guaranteed to stay at that same amount, unless you refinance five years down the road — which would likely save you money — because you’ll now owe less on a home that’s worth more.

That’s thanks to the next big benefit that comes with homeownership: building home equity.

When you rent, a big chunk of your monthly income is going straight into your landlord’s wallet with no other benefit beyond a place to live…temporarily.

When you buy a house, you’re not only getting a permanent place to live; you’re making an investment in an asset that will likely increase in value over time.

“If you look at the historical numbers overall, homes tend to appreciate at a rate of around 5% per year,” explains Beams.

“So if you own a home for five years and then sell, you’re going to have a good bit of equity built up in your home. Whereas the person who’s just continued to rent for those five years has nothing except some canceled checks.”

As an example, let’s say you buy a home for $290,000. If it appreciates 5% (or $14,500) each year, it could be worth $362,500 in five years.

Add that $72,500 to the equity you’ve built up by paying down your mortgage debt and you’ll get significantly more in net proceeds than you paid out of your savings for a down payment.

The verdict:

Rent: When rent is cheaper than a mortgage payment

Buy: When a mortgage payment (and other housing expenses) are cheaper than renting in the long run

2. Estimate how long you intend to stay put

While the opportunity to build equity is a strong argument for homeownership, it only makes financial sense if you intend to own the house for the long term — say five to seven years. This allows plenty of time for your home to increase in value and for you to pay down your mortgage.

But if you intend to move within a year or two, renting rather than owning a home is the wiser choice — because building equity takes time.

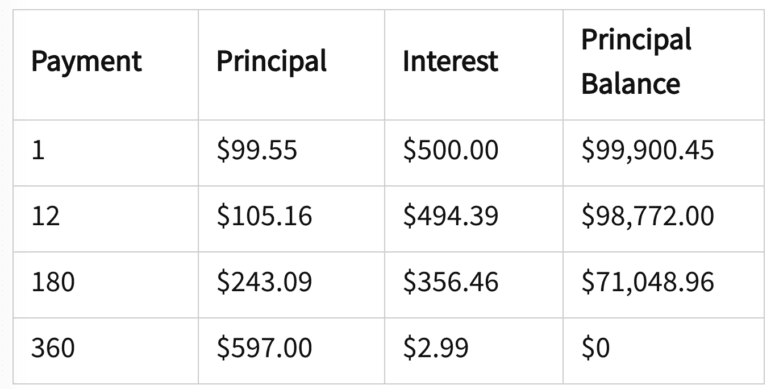

For starters, in the beginning, the majority of your monthly mortgage payment is going toward the interest rather than paying down the principal loan balance.

Let’s say you buy a $290,000 house by taking out a $232,000 mortgage with a $1,500 monthly payment. Only around $230 a month is going toward paying down the principal balance in the beginning. So, in one year, you’ll only have paid off $2,760 of your principal loan balance.

Let’s also imagine that your home does manage to appreciate by 5% that first year to a value of $304,500. If you sell for $304,500 after that first year, you’ll only net $17,260 in equity proceeds — after paying off the $232,000 mortgage and recouping the $58,000 you paid out on the down payment. And you’ll still owe a chunk of that $17,260 to the government.

You see, in most cases the IRS offers tax breaks on home sale proceeds if the property is your primary residence — but only if you’ve been living there for at least two consecutive years.

But if you sell within one year of owning your home, you’ll have to pay a capital gains tax on any proceeds from the sale. For that income of $17,260, you will need to pay a 12% capital gains tax rate — so in the end, you’ll only get $15,189 in equity proceeds.

That’s assuming your home rose in value by 5% in the first place — which is unlikely.

You see, while home values do trend upward in the long term, the real estate market typically fluctuates like a roller coaster in the short term.

“If you’re planning on moving within a few years, you’d have to buy in a neighborhood that has high turnover,” says Beams.

“Plus, if you only plan to own for the short term, the property needs to have some existing equity in case the prices go down. Otherwise, you’ll become upside down in the mortgage.”

The verdict:

Rent: When you’re planning to relocate within a few years

Buy: When you’re settled in an area for the foreseeable future

3. Assess how local market conditions affect your decision

Your personal readiness isn’t the only area you need to assess when you’re considering buying a house. You also need to look at whether or not your local real estate market is ready for you.

While home values trend upward in the long term, in the short term, real estate markets fluctuate between buyer’s, seller’s, and balanced market conditions.

In a seller’s market, there are a lot of buyers and few homes listed for sale — leading to higher home prices and bidding wars over even the most undesirable homes. In a buyer’s market, there are lots of homes available for sale but few buyers — so there are many good homes to choose from at great prices. A balanced market falls somewhere in between, with reasonable home prices and healthy competition.

While it seems straightforward that it’s best to buy in a buyer’s or balanced market, remember that real estate markets are fluid and always changing — so it’s not only current conditions you need to consider but also the trends.

“If home prices are on a downward trend, then it might make sense to continue renting until that market bottoms out. Then you can buy at a great price,” explains Beams. “But if home prices are on an upward trend, then it might make sense to buy now before prices reach the top of the market.”

And remember, researching national real estate trends can’t tell you what your local market is doing. While the majority of the country may be experiencing a sluggish buyer’s market, your local area could be experiencing a red-hot seller’s market.

The same holds true for different neighborhoods in the same city.

The only way to know for sure if it’s the right time to buy in your desired neighborhood is to consult a top-notch real estate agent.

The verdict:

Rent: When it’s a strong seller’s market with limited inventory

Buy: When it’s a buyer’s market and there’s lots of inventory

4. Research current mortgage interest rate trends

It’s true that the majority of your monthly payment goes toward the mortgage interest rather than the principal balance for the first few years — which is why the rate you get is so important.

Current rates — and the duration of the loan — directly impact exactly how much you’ll pay each month. Let’s look at that $232,000 mortgage loan again.

If you take out a 30-year mortgage for $232,000 at a fixed interest rate of 6.625%, you’ll pay around $1,750 a month (not including taxes and insurance) — depending on other factors, like your credit score and your down payment amount.

Take out that same $232,000 as a 20-year mortgage with a fixed interest rate of 6.625%, and you’ll pay around $2,000 a month.

Of course, interest rates are what they are, so you need to take what you can get, right?

Not exactly.

The process that determines mortgage interest rates is commonly misunderstood. While mortgage-backed securities and the federal reserve rate impact mortgage rates, each lender actually sets its own interest rates.

That’s why it’s important to shop around to find the lenders who’ll give you the best interest rates.

Did you catch that? You’re not looking for lenders that advertise the best rates, but lenders who will give the best rates specifically to you.

It’s easy to mock up a few numbers to get a broad-stroke look at what your mortgage payment might look like compared to rent. However, you need hard figures to really determine if it’s smarter to rent or own a home.

In order to find those solid numbers, you need to look at the factors that influence the interest rate you’ll get that are unique to you — including your credit score, the location of the house, your down payment amount, and the loan types you qualify for.

“As long as interest rates are on the low side, buying instead of renting makes sense,” says Beams.

“But if the interest rates are on an upward swing, buying becomes cost prohibitive for a lot of people because they can’t qualify for a rising interest rate mortgage.”

So, if you see that the interest rates have just started on an upward swing, then it might be motivation to buy now instead of rent — because in the future, you might not be able to afford it. Interest rates fluctuate between 6% and 7% in the current market.

The verdict:

Rent: When mortgage interest rates are too high (but trending downward)

Buy: When mortgage interest rates are low (and starting to trend upward)

5. Evaluate your financial stability

In one regard, the question you need to ask yourself isn’t whether it’s better to buy a house but whether you can actually afford to buy one.

Many people mistakenly believe that you need a close-to-perfect credit score and a 20% down payment saved up before buying a home is even a possibility. Luckily, that’s not true.

“The mortgage process when buying a house can be daunting for some people. One reason that renters put off becoming first-time buyers is because it’s so difficult to come up with the money for a sizable down payment in addition to the closing costs,” explains Beams.

“However, there are financing programs available that will help first-time buyers buy a house with a very low down payment, such as FHA loans that only require 3.5% down. There are also some conventional loan programs that have low down payment options, as long as you pay a mortgage insurance premium.”

But just because you can get a loan with significantly less than a 20% down payment doesn’t mean you should.

When you get a mortgage, your lender is taking a risk and betting that you’ll honor your debt by paying it back in a timely manner. Lenders are more comfortable taking this risk when the buyer has something to lose, too — namely their down payment.

The less money that buyers put down, the less they have to lose. So naturally, lenders require buyers with less of a down payment to lose to buy mortgage insurance.

Your monthly payment is destined to increase when your lender requires you to purchase private mortgage insurance, which will typically cost you between 0.5% to 1% of the entire loan amount annually. That’s an extra $193 a month on that $232,000 loan.

But in some cases, buying a home before you’ve saved up a 20% down payment does make sense, especially when interest rates are low and you’re house shopping in a buyer’s market.

While you may not get quite as good a deal, you’re still building equity instead of losing those monthly payments to your landlord.

Plus, you can always refinance into a better deal in a few years when you’ve improved your credit, established a record of on-time mortgage payments, and built up equity in the house.

The verdict:

Rent: When you’re building (or rebuilding) your financial standing — or you don’t have enough savings for a decent down payment

Buy: When you’re financially stable enough to negotiate a good deal on a home — or market conditions are too good to pass up

6. Weigh the hidden costs of homeownership

With all the financial aspects to worry about, people often overlook the responsibilities that come with homeownership.

“When you rent, you’re not responsible for maintenance or repairs, and you don’t have to worry about home values declining,” says Beams.

“However, when you buy instead of rent, you can make any changes that you want to the house. You don’t have to worry about what the landlord might say if you paint the walls or hang up pictures.”

The good news is that when you own your own home, you can do whatever you want when it comes to upgrades and maintenance. The bad news is, what you do (or don’t do) to your home can actually hurt its value if you’re not careful.

Let’s say you let your yard die and the foliage grow wild, or install a kitschy backsplash in the kitchen that only a select few could love. You won’t be able to sell your home for the most possible money unless you invest time and money into fixing those issues.

When you rent, your landlord is the one responsible for keeping up the place — and repairing any issues that arise.

If the bathroom plumbing springs a leak, you just need to put in a repair request if you’re a renter. When that happens in your own home, you’re on the hook to cover the cost of a plumber yourself.

In fact, it’s recommended that you put away 2% of your home’s value for maintenance every year. On a $300,000 house, that’s $6,000. So you don’t want to start your homeownership journey without any money in the bank.

The verdict:

Rent: When you don’t have the time or money for maintenance

Buy: When you’re excited to maintain and improve a property you own

7. Find a neighborhood to meet your long-term lifestyle needs

While financial stability plays a critical role in the decision to rent vs own a home, lifestyle factors can be just as influential. Your personal preferences, career aspirations, and long-term plans should align with your housing choice.

Renting lets you try out all a neighborhood has to offer before settling on the best one to meet your long-term needs — or allows you to postpone purchasing a property until you know what your long-term needs will be.

Flexibility vs. Stability

Renting offers greater mobility, making it ideal for those who anticipate career moves, lifestyle changes, or simply enjoy exploring different neighborhoods. Homeownership, on the other hand, provides long-term stability and the ability to personalize your living space to suit your needs.

Community and Lifestyle Preferences

If you’re not sure where you want to live, it’s best to rent until you decide. Or you’ll wind up stuck owning a house in a place that you hate.

For example, let’s say you love a neighborhood, even though it’s a bit farther from your workplace than you’d like. So you buy a place, and within the year, you find that you can’t handle the distance in backed-up traffic.

Now you’re either stuck with the sucky commute, or you’ll have to sell and pay capital gains on any potential proceeds.

Some people value the sense of permanence and community that comes with homeownership, while others appreciate the low-maintenance lifestyle of renting, especially in urban areas where amenities like gyms, pools, and concierge services are included.

“Renting provides the freedom to try out neighborhoods and move on if you don’t like the area. You only have to live in a rental for as long as the term of the lease,” advises Beams. “There are also fewer upfront costs and less paperwork when you rent.”

If you’d rented for six months or a year first, you’d know whether or not the location works for you — before you make a hefty investment in a home.

Future Plans and Family Considerations

If you’re planning to start a family or need extra space, homeownership might be more appealing. You’ll want to buy a home in a family-friendly neighborhood with good schools, nearby parks, and accessible parking to get you through those diaper-bag, car seat days. However, if you prioritize travel, remote work flexibility, or avoiding the commitment of a mortgage, renting could be the better fit.

While financial factors often drive the rent vs. own debate, considering how each option aligns with your personal and professional goals is just as important. Balancing both financial readiness and lifestyle preferences will help you make the right choice for your future.

The verdict:

Rent: When you prefer work flexibility, traveling, and avoiding huge financial commitments

Buy: When you are looking for permanence and establishing your family in a community

Renting a Home vs. Owning a Home: Which one is right for you?

“If you’re looking to build personal wealth, then you should really be looking at buying real estate,” advises Beams.

But that doesn’t always mean that buying a house is a smart financial choice for everyone. You need to be financially ready and mentally prepared before you take the big leap of putting an offer on a house.

Remember…If you do decide to own property, the biggest benefit you get from it financially is when the time comes to sell. Until then, you’re just pouring money into it via repairs and upkeep. You’ll build up equity, but unless you get a home equity loan or line of credit, the ultimate payoff comes when you get to reap the reward of your hard-earned investment.

So, make sure you put just as much intent into the decision to sell your house as you did to buy it. To maximize your investment at resale, you can:

- Time the sale right at your market’s peak.

- Show the house in its best light with the proper home prep and staging.

- Set the right price to attract a strong offer right away.

And lastly, partner with a top real estate agent to guide you through the complexities of the process. They’ll be able to objectively prepare your house for sale, see you through tough negotiations, and make sure you get the most possible money for your property.

Article Image Source: (Rob Christian Crosby/ Death to the Stock Photo)

- "Why Energy Efficiency Matters," US Department of Energy

- "January 2025 Average Rent Report: Rents Stay Flat, but Change Could be Coming," Rent (January 2025)

- "Average monthly mortgage payment," Bankrate (February 2025)

- "Median Sales Price of Houses Sold for the United States," Federal Reserve Bank of St. Louis (February 2025)