How to Sell a House for Cash in Tennessee

- Published on

- 8 min read

-

Cheyenne Wiseman Associate EditorClose

Cheyenne Wiseman Associate EditorClose Cheyenne Wiseman Associate Editor

Cheyenne Wiseman Associate EditorCheyenne Wiseman is an Associate Editor at HomeLight.com. Previously, she worked as a writer for Static Media (Mashed.com and Chowhound.com) and as an editor for CBR.com. Cheyenne holds a bachelor’s degree in English from UC Davis, where she also founded and led a literary magazine called Open Ceilings. She has four years of experience writing and editing on topics including real estate, financial advising, and pharmaceuticals.

If you’re planning to sell a house for cash in Tennessee, chances are you’re looking for a quick, straightforward sale. This approach allows you to skip the hassle of home prep, sidestep repairs and showings, and choose a closing date that works for you.

You might be wondering:

- How do I sell a house for cash in Tennessee?

- What does this convenience cost?

- Could I make more if I invested in repairs first?

In this guide, we’ll break down the two main ways to secure an all-cash offer in Tennessee and how the numbers might look depending on who you sell to — and whether you list your home “as is” or make improvements before selling.

Options to sell a house for cash in Tennessee

Tennessee homeowners typically have two ways to sell for cash: work directly with a house-buying company or investor, or partner with a real estate agent who can help attract a cash-ready traditional buyer. Each route comes with its own level of proceeds.

Before we get into the details, try the calculator below to see a quick comparison of what a cash offer in Tennessee might look like for your situation.

As shown, your cash offer amount will be considerably higher if your Tennessee home is in good shape. However, not everyone has the time, money, or capacity to take on repairs. For homeowners facing a major life or job change, financial strain, or the need to sell an inherited property from out of state, the convenience of an all-cash offer is hard to match.

If you plan to sell a house for cash in Tennessee, here’s what you can expect from each path.

Option 1: Sell to a cash buyer company in Tennessee

Cash buyer companies and investor groups focus on purchasing homes outright with cash. Many will buy properties in as-is condition, meaning there’s no need to deep clean, make repairs, or stage your Tennessee home before the sale. These businesses are often referred to as “We Buy Houses” companies.

We Buy Houses companies in Tennessee typically follow a similar, straightforward process:

- You provide some basic info about your Tennessee property online or by phone.

- They assess the home’s value using local market data and an in-person visit.

- You receive a no-obligation cash offer, often within 24 to 48 hours.

- If you accept, closing can happen in as few as 7 to 14 days.

While some Tennessee cash buyers focus on fixing and flipping homes, others hold properties as rentals or long-term investments. In either case, they typically aim to purchase below market value to leave room for profit.

Many investors use the 70% rule — a common house-flipping formula stating that a purchase price should be no more than 70% of the home’s after-repair value (ARV), minus repair costs. Our calculator above provides estimates using both this rule and an 80% benchmark sometimes applied by rental property investors.

Still, these are general guidelines, and actual offers can vary depending on a home’s location, condition, and demand in the Tennessee market.

»Learn more: 6 Top We Buy Houses for Cash Companies in Tennessee

Pros and cons of selling to a Tennessee cash buyer company

| Pros | Cons |

| Quick closing: Close and get paid in a matter of days, not months | Lower sale price: Offers are often below market value |

| No repairs necessary: Sell your Tennessee home in its current condition | Firm offers: It’s usually a take-it-or-leave-it cash offer |

| Convenience: No showings, open houses, or negotiating required | Fewer eyes on your home: Limited competition from other buyers |

| No fees or commissions: Most companies cover closing costs | Not always the best fit: Some sellers benefit more from listing with an agent |

| Certainty: Less chance of a deal falling apart due to financing | Unscrupulous buyers and scams: Not every cash buyer is reputable |

Although many reputable investors work in Tennessee, it’s smart to vet any buyer carefully. Avoid those who apply pressure, lack a verifiable history, or have no online presence. Prioritize companies with positive, verified reviews, clear communication, and proven experience in the local market.

»Learn more: We Buy Houses Pros and Cons: Make an Informed Decision

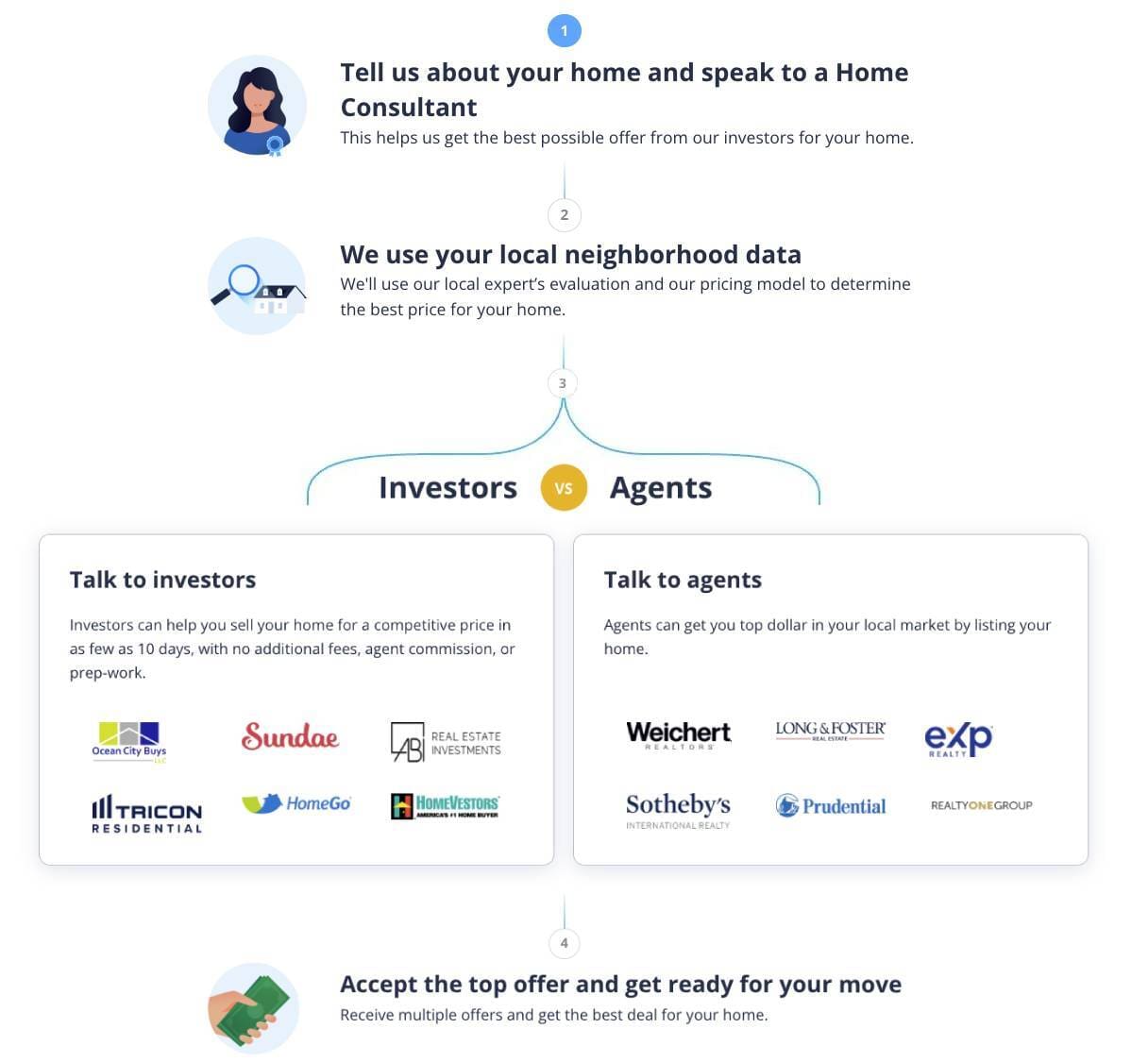

A better way to find trusted cash buyers in Tennessee

HomeLight’s Simple Sale platform gives you access to the largest network of pre-vetted cash buyers in Tennessee and nationwide, helping you review offers without having to approach investors on your own.

Here’s how the Simple Sale process works:

Just input a few details about your Tennessee home, and you’ll receive a no-obligation offer within 24 hours. If you accept, you can close in as few as 7 days or choose your closing date. You’ll also receive an expert estimate of what your house might sell for using a top Tennessee real estate agent, so you can weigh each option.

Option 2: Attract a cash buyer with a top Tennessee agent

Not all cash offers come from investors or companies. In Tennessee’s competitive housing market, many individual buyers pay with cash — whether they’re downsizing, relocating after selling a home in California, or seeking a second home to enjoy the state’s mild seasons. A skilled Tennessee real estate agent can help position your home to attract these buyers.

»Learn more: Why Hire a Real Estate Agent When You’re Selling or Buying

Pros and cons of selling with a top Tennessee agent

| Pros | Cons |

| A higher sale price: Agents can boost exposure to attract multiple offers | Takes longer: A traditional listing can take weeks or months to close |

| Professional guidance: They handle pricing, marketing, and negotiations | Prep work: You may need to clean, stage, or complete repairs before listing |

| Broad market access: Reach more cash investors through the MLS and agent networks | Showings and disruptions: Expect multiple buyer walkthroughs |

| Peace of mind: Agents manage complex tasks, alleviating your stress | Commission fees: You’ll need to budget for agent fees (a percentage of the sale price) |

| Legal protection: Provides help with disclosures and federal fair housing laws | Uncertainty of sale: There’s no guarantee of a quick sale, and offers can fall through |

»Learn more: Should I Sell to a Home Investor or List With an Agent?

The easy way to find top-rated Tennessee agents

If you’re considering working with an agent, HomeLight’s free Agent Match platform can connect you with some of Tennessee’s top-performing real estate professionals, based on real transaction data. We sift through more than 27 million transactions and thousands of verified reviews to find an agent whose experience aligns with your needs.

The right Tennessee agent doesn’t just list your home — they understand how to highlight what makes your property stand out. For a no-obligation consultation with a trusted agent, simply share your selling goals and timeline.

Which cash sale option is right for you?

If speed, convenience, and a low-stress experience are most important, selling to a vetted Tennessee cash buyer through HomeLight’s Simple Sale platform could be the better fit.

If you’re willing to take more time to potentially achieve a higher sale price and don’t mind preparing your home to be market-ready, partnering with a top Tennessee agent may be the way to go — whether that means selling a historic home in Franklin, a downtown Nashville condo, or a quiet cabin retreat in the Smokies.

When you request a Simple Sale offer, you’ll also receive a professional estimate of what your home could fetch on the open market with a top agent, so you can compare both paths side by side.

Still on the fence about whether you should sell a house for cash in Tennessee? Use our Home Cash Offer Comparison Calculator above to see what your home might sell for, depending on your chosen route. Then, request a no-obligation offer or connect with a trusted local expert to talk through your options.

There’s no universal answer — but with the right tools, insights, and a partner who knows Tennessee’s real estate landscape, you can make a confident, informed choice.

Header Image Source: (trongnguyen/DepositPhotos)